Competitive Personal Loan Rates: Unlock the Best Deals Today!

Personal loans can be a great financial tool. They help cover unexpected expenses or fund significant purchases.

But getting the best rates is essential. Understanding competitive personal loan rates can save you money and reduce stress. Many lenders offer various rates, and it’s crucial to know what to look for. This guide will help you navigate the landscape of personal loans. We will explore how to find the most competitive rates and what factors affect these rates. By the end, you’ll be better prepared to make an informed decision. Ready to find the best personal loan rates? Let’s get started. Upstart Personal Loans offer great options to consider.

Introduction To Competitive Personal Loan Rates

Personal loans offer a flexible way to meet various financial needs. They help with debt consolidation, home improvements, or major purchases. Finding competitive personal loan rates is crucial. It can save you money and make repayment easier.

Understanding Personal Loans

Personal loans are unsecured loans. Lenders do not require collateral. They offer a lump sum of money to the borrower. The borrower repays the loan in fixed monthly installments. The loan term ranges from one to seven years, depending on the lender.

Interest rates on personal loans vary. They depend on factors such as credit score, income, and loan amount. Borrowers with higher credit scores often receive lower interest rates. This makes their loans more affordable.

Importance Of Competitive Rates

Competitive personal loan rates are important. They reduce the overall cost of the loan. Lower interest rates mean smaller monthly payments. This can make it easier to manage your finances.

Here is a comparison table highlighting the benefits of competitive rates:

| Loan Amount | High Rate (15%) | Competitive Rate (8%) |

|---|---|---|

| $10,000 | $1,500 | $800 |

| $20,000 | $3,000 | $1,600 |

| $30,000 | $4,500 | $2,400 |

The table shows the cost difference between high and competitive rates. Borrowers can save significantly with lower interest rates.

Upstart Personal Loans offer competitive rates. They are known for their user-friendly process. Their platform ensures secure access to your loan details. Visit Upstart to learn more.

Key Features Of Competitive Personal Loan Rates

Understanding the key features of competitive personal loan rates can help you make informed decisions. This section highlights the essential aspects that make personal loans attractive. These features include low interest rates, flexible repayment terms, no hidden fees, a quick approval process, and customizable loan amounts. Let’s explore each of these features in detail.

Low Interest Rates

Competitive personal loan rates often come with low interest rates. Lower interest rates mean you pay less over the life of the loan. This can save you a significant amount of money, making it easier to manage your finances.

Flexible Repayment Terms

Another key feature is flexible repayment terms. You can choose a repayment plan that fits your budget. Whether you need a shorter or longer term, flexibility ensures you can meet your financial goals without undue stress.

No Hidden Fees

Transparency is crucial with competitive personal loans. They typically have no hidden fees. This means you won’t encounter unexpected costs, and you can budget more effectively.

Quick Approval Process

A quick approval process is a standout feature. You can get access to funds swiftly, which is beneficial in emergencies. This feature ensures you can address your financial needs without long waiting periods.

Customizable Loan Amounts

Finally, competitive personal loans offer customizable loan amounts. You can borrow the exact amount you need, avoiding the pitfalls of over-borrowing. This customization allows for better financial planning and management.

Benefits Of Securing The Best Personal Loan Rates

Securing the best personal loan rates can greatly impact your financial health. Lower interest rates mean less money spent on debt. Here are some key benefits of getting the best rates for your personal loan.

Saving Money On Interest

One major benefit of securing a good rate is saving on interest. Lower interest rates mean you pay less over the loan’s life. This can result in significant savings, especially on large loans. For example, a 1% difference in interest rates can save you hundreds or even thousands of dollars.

Easier Debt Management

Lower interest rates make debt management easier. With lower monthly payments, you can pay off your loan faster. This helps in reducing financial stress and makes budgeting simpler. You can also avoid falling behind on payments, which improves your credit score over time.

Increased Financial Flexibility

Securing the best personal loan rates provides increased financial flexibility. Lower interest payments free up more money for other expenses. This allows you to invest in other areas or save for future needs. Having extra funds can also help in emergencies or unexpected situations.

By focusing on securing the best personal loan rates, you can enjoy these benefits and improve your overall financial well-being. Consider Upstart Personal Loans for competitive rates and excellent service. Visit Upstart Personal Loans for more information.

How To Find The Best Personal Loan Rates

Finding the best personal loan rates can save you a lot of money. To ensure you get the most competitive rates, you need to do some research. Here are several methods to help you find the best personal loan rates.

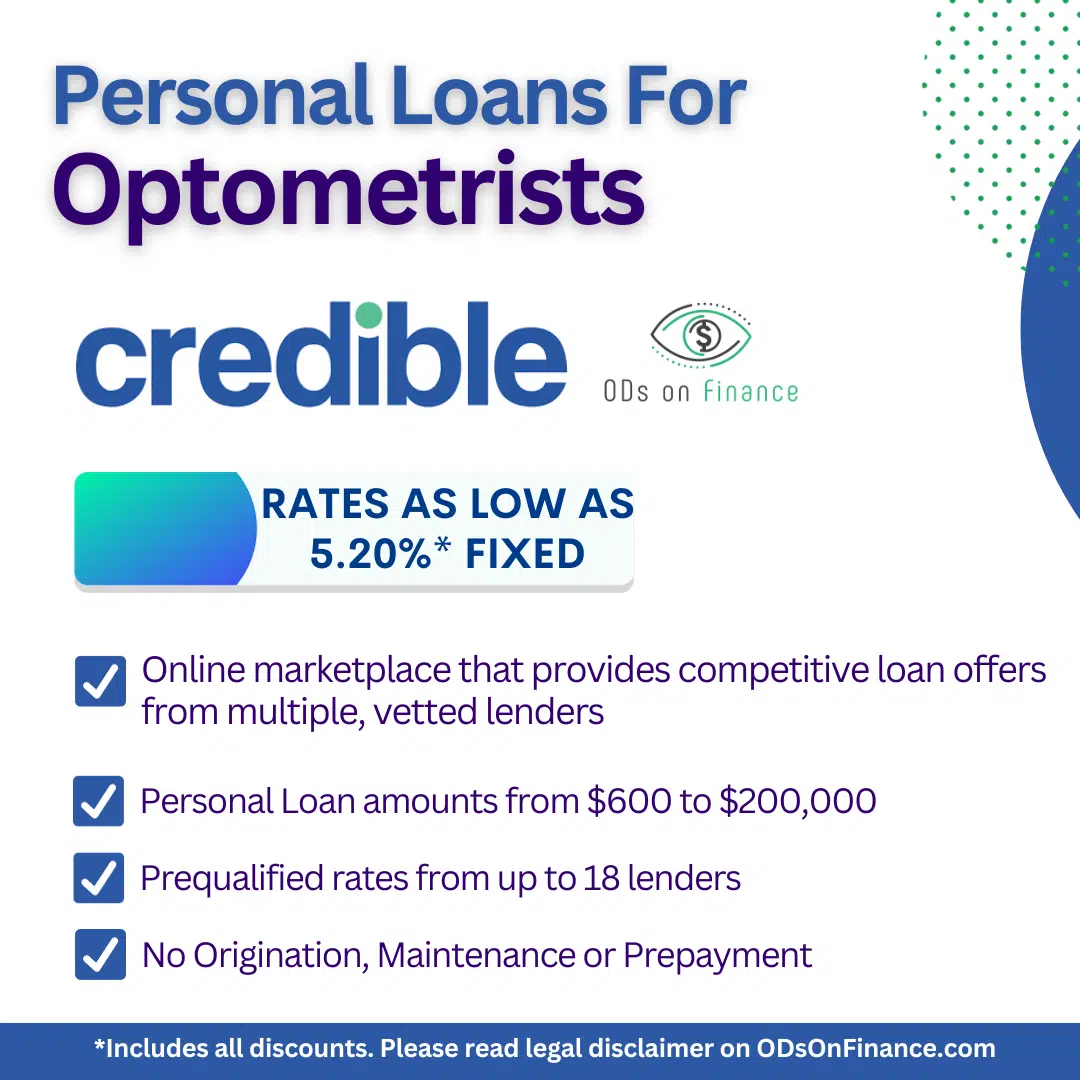

Comparing Different Lenders

One of the first steps is to compare different lenders. Each lender offers different rates and terms. Look at banks, credit unions, and online lenders. Make a list of their interest rates, fees, and repayment terms. This way, you can easily compare and choose the best option.

Using Online Loan Comparison Tools

Online loan comparison tools are very useful. They allow you to compare multiple lenders at once. Simply enter your loan amount and term. The tool will show you different offers from various lenders. This saves time and helps you find the best rates quickly.

Checking Your Credit Score

Your credit score plays a significant role in determining your loan rate. Lenders use it to assess your creditworthiness. Check your credit score before applying for a loan. If your score is low, take steps to improve it. A higher score can get you better rates.

Negotiating With Lenders

Do not hesitate to negotiate with lenders. Sometimes, they are willing to offer lower rates to secure your business. Explain your financial situation and ask for a better rate. You might be surprised at how flexible they can be.

Reading Reviews And Testimonials

Reading reviews and testimonials can give you insight into a lender’s reputation. Look for feedback from other borrowers. Pay attention to comments about customer service, loan terms, and overall experience. This information can help you choose a reliable lender.

Pricing And Affordability Breakdown

Competitive personal loan rates can save you money. Understanding the pricing and affordability of Upstart Personal Loans is essential. This breakdown will help you make informed decisions.

Interest Rates Breakdown

Interest rates are crucial in determining your loan cost. Upstart Personal Loans offer competitive rates based on your credit profile and other factors. Here’s a simple table to illustrate the range:

| Credit Score Range | Interest Rate (APR) |

|---|---|

| Excellent (720+) | 5% – 10% |

| Good (680-719) | 10% – 15% |

| Fair (640-679) | 15% – 20% |

| Poor (Below 640) | 20% – 35% |

Understanding Apr

Annual Percentage Rate (APR) is not just the interest rate. It includes fees and other costs. Knowing APR helps you compare different loans. Upstart Personal Loans’ APR varies based on your creditworthiness and loan terms.

- APR includes interest rate and fees.

- Helps in comparing different loan offers.

- Reflects the true cost of borrowing.

Fees And Charges To Consider

Fees can impact the affordability of your loan. Upstart Personal Loans may include:

- Origination Fee: Typically ranges from 1% to 8% of the loan amount.

- Late Payment Fee: A charge for missing a payment deadline.

- Prepayment Penalty: Some loans may charge for early repayment.

Understanding these charges helps you budget better. Always read the fine print.

Pros And Cons Of Competitive Personal Loan Rates

Competitive personal loan rates can provide many benefits. However, there are some drawbacks to consider. Understanding both sides will help you make an informed decision. Below are the pros and cons of competitive personal loan rates.

Pros: Lower Monthly Payments

One significant advantage of competitive personal loan rates is lower monthly payments. With a reduced interest rate, your monthly financial burden decreases. This makes it easier to manage your budget and meet other financial goals.

Pros: Faster Loan Approval

Another benefit is faster loan approval. Competitive rates often come from lenders with streamlined processes. This means you can access funds quickly, which is helpful in urgent situations.

Cons: Potential For Overborrowing

One downside is the potential for overborrowing. Lower rates might tempt you to borrow more than needed. This can lead to financial strain if you cannot repay the loan on time.

Cons: Possible Variable Rates

Some competitive loans come with possible variable rates. This means your interest rate could change over time. If rates increase, your monthly payments might become unaffordable.

| Pros | Cons |

|---|---|

| Lower Monthly Payments | Potential for Overborrowing |

| Faster Loan Approval | Possible Variable Rates |

Who Can Benefit The Most From Competitive Personal Loan Rates?

Competitive personal loan rates offer significant advantages. Understanding who benefits the most helps in making informed financial decisions. Here, we explore ideal candidates and scenarios where personal loans are most beneficial.

Ideal Candidates For Personal Loans

Not everyone should apply for a personal loan. Identifying the right candidates ensures that the loan serves its purpose effectively.

- Individuals with Good Credit Scores: They often secure the lowest rates.

- People Consolidating Debt: Combining multiple debts into one loan simplifies payments.

- Home Improvement Enthusiasts: Funding renovations without dipping into savings.

- Medical Emergencies: Quick access to funds during unexpected health issues.

Scenarios Where Personal Loans Are Beneficial

Personal loans can be a lifeline in various situations. Here are key scenarios where they prove beneficial:

- Debt Consolidation: Merging high-interest debts into one manageable payment.

- Major Purchases: Funding significant expenses like weddings or travel.

- Business Ventures: Starting or expanding a small business.

- Unexpected Expenses: Handling emergencies without financial strain.

Understanding these factors helps in leveraging competitive personal loan rates effectively. Always evaluate your financial situation and loan terms before proceeding.

Conclusion: Unlocking The Best Personal Loan Deals Today

Finding the best personal loan rates can greatly benefit your financial health. Understanding the key factors and tips can help you secure competitive rates.

Recap Of Key Points

- Compare rates from different lenders to find the best deal.

- Check your credit score regularly. A good score can lower your interest rates.

- Understand the terms of the loan before signing any agreement.

- Consider the total cost of the loan, not just the interest rate.

Final Tips For Securing Competitive Rates

To ensure you get the best personal loan rates, follow these tips:

- Improve your credit score. Pay bills on time and reduce debt.

- Shop around. Use online tools to compare loan offers.

- Read the fine print. Understand fees and penalties associated with the loan.

- Negotiate. Ask lenders if they can offer better terms.

By following these steps, you can unlock the best personal loan deals available today. This will help you manage your finances more effectively.

Frequently Asked Questions

What Are Personal Loan Rates?

Personal loan rates are the interest rates charged by lenders on borrowed funds. They vary based on credit score and loan terms.

How To Get Competitive Loan Rates?

To get competitive loan rates, maintain a good credit score, compare offers from different lenders, and negotiate terms.

Why Compare Personal Loan Rates?

Comparing personal loan rates helps you find the lowest interest rates and best loan terms, saving you money.

Does Credit Score Affect Loan Rates?

Yes, a higher credit score usually results in lower personal loan rates, making borrowing more affordable.

Conclusion

Finding the right personal loan can be challenging. Competitive rates make a difference. Upstart Personal Loans offers attractive options. Their process is simple and straightforward. Secure your financial future today. Explore their offerings by clicking here. Take control of your finances. Make informed decisions for better financial health.