Comparison of Student Credit Cards With Low Apr

Student credit cards with low APR offer lower interest rates, making them affordable for students. They help build credit responsibly.

Student credit cards are essential financial tools for young adults. They offer manageable interest rates, which can significantly reduce the cost of borrowing. These cards are designed to help students establish and build their credit histories early. A low APR makes it easier to pay off balances without accumulating high interest.

This can lead to better financial habits and improved credit scores. Most student credit cards also come with added benefits like rewards programs and no annual fees. Choosing the right card involves comparing APRs, fees, and rewards to find the best fit for your financial needs.

Introduction To Student Credit Cards

Student credit cards are designed for college students. They help students build credit history. These cards often have lower interest rates and unique benefits. They are a great way to learn financial responsibility.

Purpose And Benefits

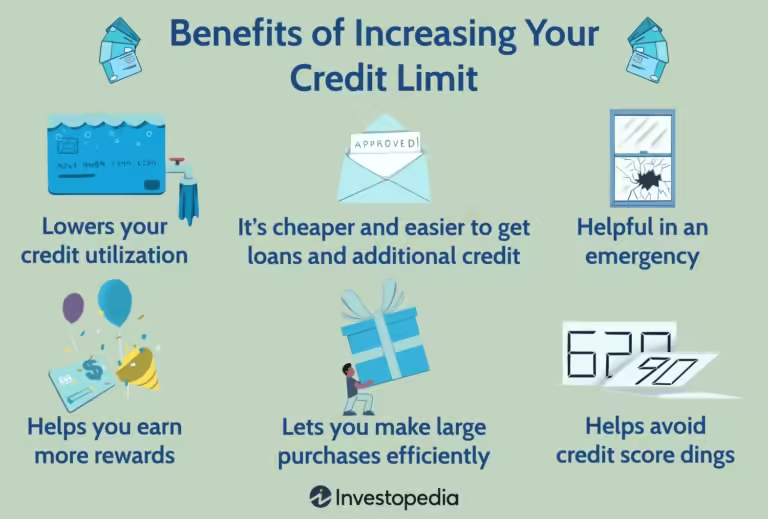

Student credit cards offer many benefits. They help students build a credit history. This is crucial for future loans and mortgages.

- Lower APR: Student credit cards often come with lower APRs.

- Rewards: Many cards offer cashback or points on purchases.

- Financial Education: Managing a credit card teaches budgeting and responsibility.

- Credit Score: A good credit score helps in the future.

Eligibility Criteria

To get a student credit card, certain criteria must be met. These criteria are generally lenient for students.

| Criteria | Description |

|---|---|

| Age | Applicants must be at least 18 years old. |

| Student Status | Applicants must be enrolled in a college or university. |

| Income | Some form of income or a co-signer may be required. |

| Credit History | Minimal or no credit history is usually acceptable. |

Understanding Apr

Choosing the right student credit card can be tough. One key factor to consider is the APR. Understanding APR is essential for making informed financial decisions. Here, we break down what APR is and why a low APR is important.

What Is Apr?

APR stands for Annual Percentage Rate. It is the yearly interest rate charged on borrowed money. This rate includes fees and other costs. APR helps you understand the true cost of borrowing.

APR can be fixed or variable. A fixed APR stays the same over time. A variable APR can change based on market rates. Most student credit cards have variable APRs.

To compare APRs, look at the APR range. This range shows the lowest and highest rates you may be charged. A lower APR means you pay less interest on your balance.

Importance Of Low Apr

A low APR is crucial for students. It reduces the cost of borrowing. If you carry a balance, a lower APR saves you money.

Here are the key benefits of a low APR:

- Less interest on unpaid balances

- Lower monthly payments

- More savings over time

Consider these factors when selecting a student credit card. Student credit cards with low APRs can make a big difference in your financial health.

| Credit Card | APR Range | Benefits |

|---|---|---|

| Card A | 12% – 24% | Cashback, No Annual Fee |

| Card B | 15% – 22% | Rewards Points, Low Late Fee |

| Card C | 14% – 20% | Travel Rewards, 0% Intro APR |

Choosing the right credit card involves comparing APRs. Look for cards with the best rates. This will help you save money.

Top Student Credit Cards

Finding the right student credit card can be tricky. Students need cards with low APR and useful features. Here’s a look at the top student credit cards available.

Card Features

Student credit cards come with various features. These features help students build credit and manage finances.

- Low APR: Cards with a low Annual Percentage Rate reduce interest costs.

- Rewards Programs: Earn points or cash back on purchases.

- No Annual Fee: Avoid extra charges with no yearly fee.

- Credit Building: Helps build a strong credit history.

Pros And Cons

Each credit card has its benefits and drawbacks. Understanding these can help make a better choice.

| Credit Card | Pros | Cons |

|---|---|---|

| Card A |

|

|

| Card B |

|

|

| Card C |

|

|

Low Apr Vs. Other Benefits

Student credit cards often come with varied features. Low APR is a prime feature. It helps students save on interest. Other benefits also make these cards attractive. Let’s compare low APR with other perks.

Cashback And Rewards

Cashback and rewards are popular features. They give back a percentage of spending. This can be in cash or points. Points can be used for travel, shopping, or gift cards.

- Cashback: Earn a percentage on purchases.

- Rewards Points: Accumulate points for every dollar spent.

- Redeem Options: Use points for travel, shopping, or gift cards.

| Card | Cashback Rate | Rewards Rate |

|---|---|---|

| Card A | 1.5% | 2 points/dollar |

| Card B | 2% | 1.5 points/dollar |

Sign-up Bonuses

Sign-up bonuses are one-time offers. They reward new cardholders. Meeting spending requirements within a set time earns these bonuses.

- Bonus Points: Earn extra points after spending a certain amount.

- Cash Bonus: Get a cash reward for meeting spend criteria.

- Introductory Offers: Enjoy benefits like 0% APR for a limited time.

| Card | Sign-Up Bonus | Requirement |

|---|---|---|

| Card C | 20,000 points | $500 in 3 months |

| Card D | $100 cash | $300 in 3 months |

Tips For Choosing A Card

Choosing a student credit card can be tough. You want a card with a low APR. It’s important to know what to look for. Here are some tips to help you choose the best card. These tips will make the process easier and help you find the right card for your needs.

Evaluating Your Needs

First, evaluate your needs. Make a list of what you need in a credit card. Do you need a low APR? Do you want rewards or cashback? Think about your spending habits. Will you carry a balance or pay in full each month?

- Low APR: Helps save on interest if you carry a balance.

- Rewards: Look for cards that offer points or cashback.

- Fees: Check for annual fees, late fees, and foreign transaction fees.

- Credit Limit: Ensure the limit suits your spending habits.

Once you know your needs, it’s easier to find a card that fits.

Comparing Offers

Next, compare different credit card offers. Look at the features of each card. Pay attention to the APR, fees, and rewards.

| Card | APR | Annual Fee | Rewards |

|---|---|---|---|

| Card A | 12.99% | $0 | 1% cashback |

| Card B | 14.99% | $25 | 2% on groceries |

| Card C | 11.99% | $0 | 1.5% on all purchases |

Use this table to compare the features. Choose the card that best meets your needs.

Also, read reviews from other students. Their experiences can provide valuable insights. Check the customer service ratings too. Good customer service is important.

By evaluating your needs and comparing offers, you can find the best student credit card with a low APR. This will help you manage your finances better and save money in the long run.

Managing Your Credit Card

Student credit cards with low APR can be very helpful. But managing your credit card is very important. Good management helps build your credit history and avoid debt. Let’s dive into how you can do this.

Building Credit History

Building a good credit history is crucial. A good credit history helps with future loans. Always pay your bills on time. Late payments hurt your credit score.

Use your credit card for small purchases. Keep your credit utilization low. Aim to use less than 30% of your limit. This shows you are responsible with credit. Check your credit report regularly.

Make sure there are no errors. Errors can lower your credit score. Correct any mistakes as soon as possible. This keeps your credit report accurate.

Avoiding Debt

Avoiding debt is very important for students. Debt can be stressful and hurt your future. Create a monthly budget. This helps you know how much you can spend. Stick to your budget to avoid overspending.

Pay off your balance each month. Carrying a balance can lead to high interest charges. If you can’t pay in full, pay as much as you can.

Don’t use your credit card for cash advances. They come with high fees and interest rates. Avoid impulse purchases. Think before you buy to avoid unnecessary debt.

| Tip | Action |

|---|---|

| Pay on time | Set reminders to avoid late fees |

| Use less credit | Keep usage below 30% |

| Check reports | Fix errors quickly |

| Follow budget | Track spending and stick to limits |

| Avoid cash advances | Use only for purchases |

By following these tips, you can manage your student credit card well. This helps build a solid credit history and avoid debt.

Case Studies

In this section, we will explore real-life case studies of students using credit cards with low APR. These stories highlight the benefits and long-term impacts of choosing the right credit card. Through these examples, we aim to provide insights into the practical use of student credit cards.

Student Experiences

Meet Sarah, a university student who chose a credit card with a low APR. She uses her card for monthly expenses and pays off the balance regularly. Sarah’s low APR card helps her save on interest fees. She also enjoys cash-back rewards on her purchases. This responsible use builds her credit score over time.

John, another student, opted for a low APR card with a higher credit limit. He uses it for emergency expenses and manages to keep his balance low. John’s disciplined approach ensures he benefits from the low APR, saving money on interest payments. He is also able to build a solid credit history.

Long-term Impact

Sarah’s experience with a low APR card has long-term benefits. She graduated with a good credit score, making it easier to secure loans and better interest rates in the future. Her early financial discipline pays off, providing her with financial freedom.

John’s strategic use of his low APR card leads to significant savings. He avoids high-interest debt and maintains a healthy credit score. This financial stability opens doors to opportunities like renting an apartment or buying a car at a lower interest rate.

| Student | Card Benefits | Long-Term Impact |

|---|---|---|

| Sarah | Low APR, Cash-Back Rewards | Good Credit Score, Financial Freedom |

| John | Low APR, Higher Credit Limit | Significant Savings, Financial Stability |

Final Thoughts

Choosing the right student credit card with a low APR is crucial. It affects your financial future. This final section provides a summary of key points.

Making An Informed Choice

Making an informed choice ensures you get the best value. Here are some factors to consider:

- APR: Lower APR means less interest.

- Rewards: Look for cash back or points.

- Fees: Avoid cards with high fees.

- Credit Limit: A higher limit is better for emergencies.

- Customer Service: Good support can make a difference.

Future Financial Health

Choosing the right credit card impacts your future financial health. Here’s why:

- Lower Debt: Low APR helps keep debt manageable.

- Better Credit Score: Responsible use boosts your credit score.

- Financial Habits: Good habits start with smart choices.

Remember, your credit card is a financial tool. Use it wisely to build a strong financial future.

Frequently Asked Questions

What Is A Student Credit Card?

A student credit card is designed for college students. It offers rewards and helps build credit. These cards often have lower fees.

How Does A Low Apr Benefit Students?

A low APR reduces the interest on unpaid balances. This makes it easier for students to manage debt. It’s ideal for those new to credit.

What Are The Best Features Of Student Credit Cards?

Best features include low APR, rewards, and no annual fees. These cards also offer credit-building opportunities. Some provide cashback or points.

Can Students Get Approved Easily?

Yes, students can get approved with limited credit history. Many student cards are designed for beginners. A co-signer can also help.

Conclusion

Selecting a student credit card with low APR can save you money. It helps build your credit responsibly. Compare different options to find the best fit. Look for added benefits like rewards and no annual fees. Making an informed choice now can set you up for financial success in the future.