Compare Checking Accounts: Find the Best Option for You

Choosing the right checking account can be a daunting task. Different banks offer various features and benefits.

Comparing checking accounts helps you find the best options for your needs. It allows you to make informed decisions based on fees, rewards, and features. Understanding the differences can save you money and provide peace of mind. In this guide, we will explore the key aspects to consider when comparing checking accounts, including the Truist One Checking Account. This account offers attractive features like automatic upgrades and no overdraft fees. Learn how you can benefit from these features and why it might be the right choice for you. Click here to learn more about Truist One Checking Account.

Introduction To Checking Accounts

Checking accounts are essential financial tools for managing daily transactions. Understanding their purpose and benefits is crucial for effective financial management. Below, we delve into what checking accounts are and their advantages.

What Is A Checking Account?

A checking account is a type of bank account designed for frequent use. It allows individuals to deposit and withdraw money with ease. Unlike savings accounts, checking accounts often come with features such as checks, debit cards, and online banking.

Checking accounts are ideal for everyday transactions. They help in paying bills, making purchases, and transferring money. Banks offer various types of checking accounts to cater to different needs.

Purpose And Benefits Of Checking Accounts

Checking accounts serve as the primary tool for managing daily financial activities. They offer several benefits, making them indispensable for most people.

- Convenience: Checking accounts provide easy access to your funds through checks, debit cards, and online banking.

- Safety: Funds in checking accounts are insured by the FDIC up to $250,000, ensuring your money is protected.

- Automatic Upgrades: Some checking accounts, like the Truist One Checking Account, offer automatic upgrades based on account activity.

- No Overdraft Fees: Certain accounts, including the Truist One Checking Account, waive overdraft fees, providing peace of mind.

Additionally, many banks offer rewards for new customers. For instance, the Truist One Checking Account allows new customers to earn up to $400 with qualifying activities. This can be a significant incentive for those opening a new account.

To qualify for these rewards, new customers must:

- Open the account online using promo code DC2425TR1400.

- Receive at least two direct deposits totaling $1,000 or more within 120 days.

Checking accounts are more than just a place to store money. They are tools for managing finances efficiently, providing access, security, and potential rewards.

Key Features To Consider

Choosing the right checking account can be challenging. Understanding the key features helps you make an informed decision. Below are crucial aspects to consider when comparing checking accounts.

Minimum Balance Requirements

Many checking accounts require a minimum balance. For instance, the Truist One Checking Account needs a minimum opening deposit of $50. It’s essential to know these requirements to avoid potential fees.

Monthly Fees And Maintenance Costs

Monthly fees can significantly impact your finances. The Truist One Checking Account highlights no overdraft fees. Always check for any hidden costs or maintenance fees.

Atm Access And Fees

Access to ATMs is crucial. Check if the bank offers fee-free ATM usage or reimburses ATM fees. Truist may offer convenient ATM access, reducing your out-of-pocket expenses.

Overdraft Protection

Overdraft protection is a vital feature. Truist One Checking Account ensures no overdraft fees, which can save you money and provide peace of mind.

Interest Rates And Apy

Interest rates and Annual Percentage Yield (APY) affect your earnings. While checking accounts typically have lower rates, it’s still important to compare.

Online And Mobile Banking Services

Online and mobile banking services offer convenience. Truist provides online account opening, making it easier to manage your finances on the go.

Customer Service And Support

Customer support is crucial for resolving issues. Truist offers assistance through their contact number, 800.709.8700, ensuring you have access to help when needed.

Comparing these key features helps you choose the best checking account for your needs.

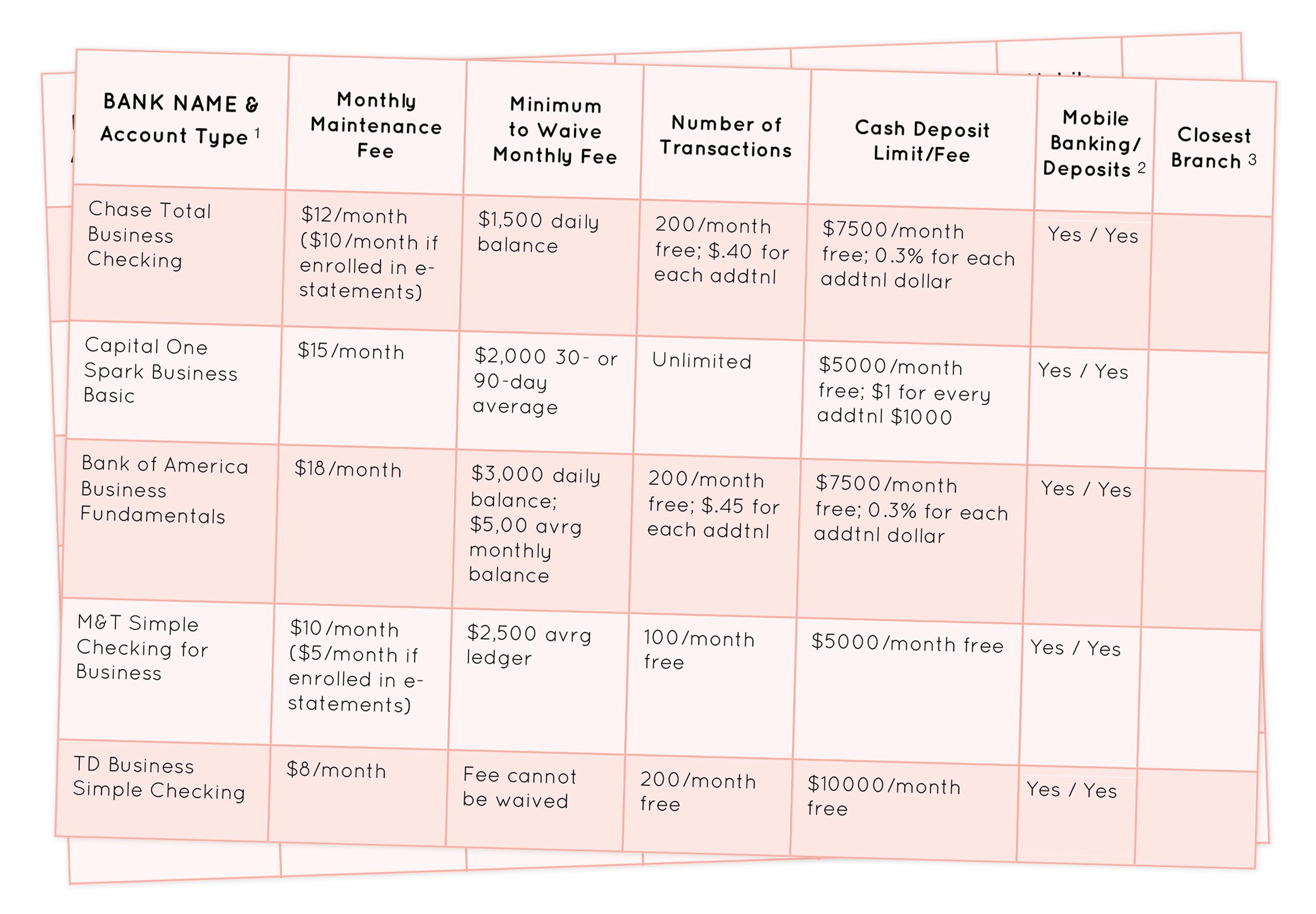

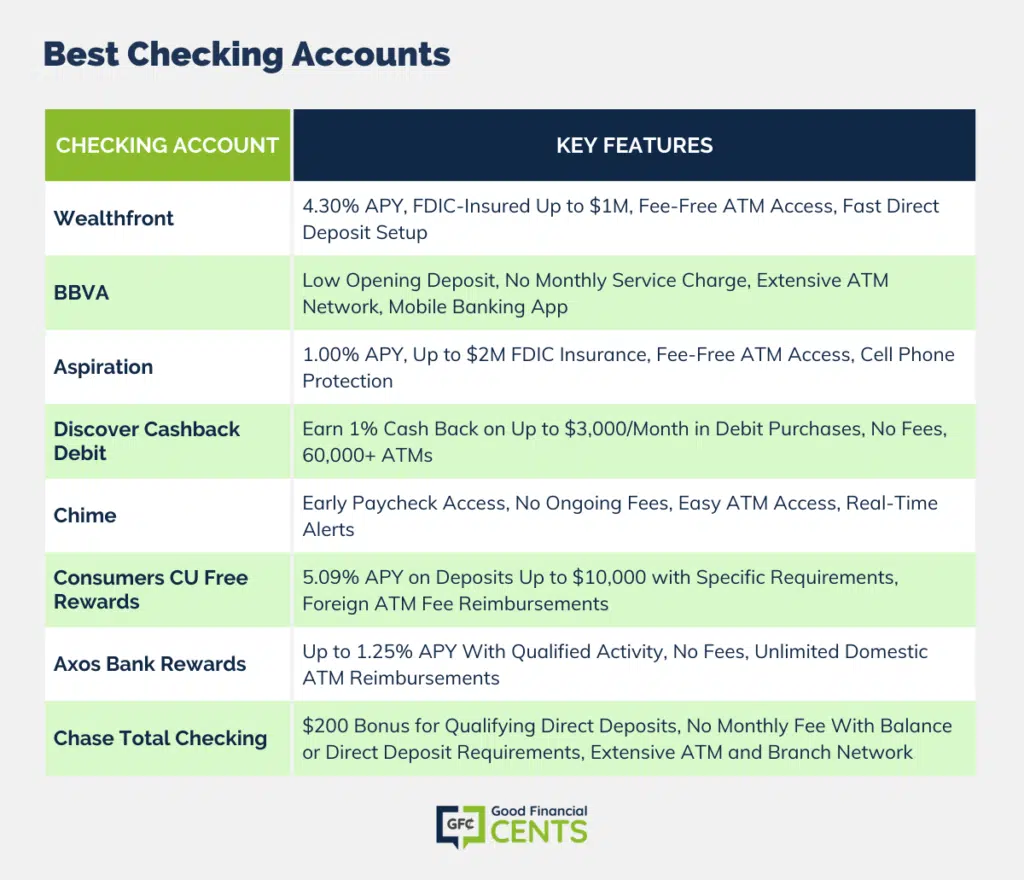

Comparing Popular Checking Accounts

Choosing the right checking account can be a daunting task. With so many options available, it’s essential to understand the various types of accounts. This guide will help you compare popular checking accounts based on different banking institutions and specific needs.

Traditional Bank Checking Accounts

Traditional bank checking accounts are offered by large, well-established banks. They provide a wide range of services and physical branch access.

- Convenience: Access to a vast network of ATMs and branches

- Services: Comprehensive services including loans, credit cards, and investment options

- Fees: May include monthly maintenance fees, overdraft fees, and ATM fees

| Bank | Features | Fees |

|---|---|---|

| Bank of America | 24/7 Customer Support, Mobile Banking | $12 Monthly Fee |

| Wells Fargo | Overdraft Protection, Online Bill Pay | $10 Monthly Fee |

Credit Union Checking Accounts

Credit unions are member-owned financial cooperatives. They often offer lower fees and higher interest rates than traditional banks.

- Membership: Must meet certain eligibility criteria to join

- Fees: Generally lower fees and better terms

- Community Focus: Often support local communities and causes

| Credit Union | Features | Fees |

|---|---|---|

| Navy Federal | Free Checking, High Interest Rates | No Monthly Fee |

| PenFed | ATM Reimbursements, Mobile Deposits | No Monthly Fee |

Online Bank Checking Accounts

Online banks operate entirely online, providing convenience and often lower fees.

- Access: No physical branches, online and mobile banking only

- Fees: Typically lower or no fees

- Interest Rates: Often offer higher interest rates on deposits

| Online Bank | Features | Fees |

|---|---|---|

| Ally Bank | No Monthly Fees, High Yield Savings | No Monthly Fee |

| Chime | Automatic Savings, Early Direct Deposit | No Monthly Fee |

Student Checking Accounts

Student checking accounts are designed specifically for students, offering unique benefits and lower fees.

- Eligibility: Typically available to students aged 17-24

- Fees: Often no monthly maintenance fees

- Features: May include perks like ATM fee reimbursements and budgeting tools

| Bank | Features | Fees |

|---|---|---|

| Chase | No Monthly Fees, Mobile Banking | No Monthly Fee |

| US Bank | Free First Order of Checks, Online Banking | No Monthly Fee |

Senior Checking Accounts

Senior checking accounts cater to the needs of older adults, offering benefits like reduced fees and special services.

- Age Requirement: Typically available to individuals aged 60 and above

- Fees: Lower or no monthly maintenance fees

- Services: May include free checks and higher interest rates on deposits

| Bank | Features | Fees |

|---|---|---|

| TD Bank | No Monthly Fees, Free Checks | No Monthly Fee |

| PNC Bank | ATM Fee Rebates, Online Banking | No Monthly Fee |

One account worth considering is the Truist One Checking Account. This account offers automatic upgrades and no overdraft fees. As a new customer, you can earn up to $400. The minimum opening deposit is $50. Check out more details here.

Pricing And Affordability

Understanding the pricing and affordability of checking accounts is crucial for managing your finances effectively. In this section, we will explore the key aspects that influence the cost of maintaining a checking account.

Fee Structures And Charges

Different checking accounts have varied fee structures. The Truist One Checking Account offers some unique benefits:

- No overdraft fees: This eliminates the worry of incurring extra charges due to insufficient funds.

- Minimum opening deposit: A minimum deposit of $50 is required to open the account.

Other fees to consider include:

- Monthly maintenance fees

- ATM withdrawal fees

- Transaction fees

Reviewing these fees can help you choose the most affordable option.

Comparing Interest Rates

Interest rates on checking accounts can vary. While the Truist One Checking Account focuses on eliminating fees, other accounts might offer interest on your balance. Compare rates to find the best return on your money.

| Account Type | Interest Rate |

|---|---|

| Truist One Checking Account | No interest |

| High-Interest Checking | Up to 1.5% |

Hidden Costs To Watch Out For

Some checking accounts may have hidden costs that aren’t immediately obvious:

- Minimum balance requirements: Failing to maintain a minimum balance can result in fees.

- Foreign transaction fees: Charges for transactions made in foreign currencies.

- Inactive account fees: Fees for accounts with little or no activity.

By understanding these hidden costs, you can avoid unexpected charges and choose an account that aligns with your financial habits.

Pros And Cons Of Different Checking Accounts

Choosing the right checking account can be confusing with many options available. Each type of checking account has its own set of pros and cons. Understanding these can help you make an informed decision. Let’s explore the advantages and disadvantages of different checking accounts.

Pros And Cons Of Traditional Bank Checking Accounts

Traditional bank checking accounts are offered by well-established banks with physical branches.

| Pros | Cons |

|---|---|

|

|

Pros And Cons Of Credit Union Checking Accounts

Credit union checking accounts are provided by member-owned financial cooperatives.

| Pros | Cons |

|---|---|

|

|

Pros And Cons Of Online Bank Checking Accounts

Online bank checking accounts are managed entirely online without physical branches.

| Pros | Cons |

|---|---|

|

|

Pros And Cons Of Student Checking Accounts

Student checking accounts are designed specifically for students.

| Pros | Cons |

|---|---|

|

|

Pros And Cons Of Senior Checking Accounts

Senior checking accounts are tailored for older adults, usually 55 and older.

| Pros | Cons |

|---|---|

|

|

Recommendations For Ideal Users

Choosing the right checking account depends on your unique needs. Different accounts cater to different users. Let’s explore the best options for various groups.

Best Checking Accounts For Students

For students, low fees and easy online access are essential. The Truist One Checking Account offers no overdraft fees and a minimum opening deposit of $50. It’s an excellent choice for students with limited funds. Plus, the opportunity to earn $400 as a new customer is a huge perk.

Best Checking Accounts For Seniors

Seniors often seek accounts with low fees and easy access to funds. The Truist One Checking Account is beneficial due to its no overdraft fees policy. Automatic upgrades ensure that the account evolves with the user’s needs, making it an excellent choice for seniors.

Best Checking Accounts For Frequent Travelers

Frequent travelers need accounts with robust online services and minimal international fees. The Truist One Checking Account offers convenient online account opening and management. This feature is perfect for those who are often on the move and need to access their account from anywhere.

Best Checking Accounts For High-balance Holders

High-balance holders benefit from accounts that reward large deposits. The Truist One Checking Account stands out with its potential for rewards. By maintaining a high balance, users can take advantage of the $400 reward for new customers.

Best Checking Accounts For Fee-averse Customers

For those who want to avoid fees, the Truist One Checking Account is ideal. It has no overdraft fees and a low minimum opening deposit of $50. This makes it a great choice for fee-averse customers looking for a hassle-free banking experience.

| Ideal User | Key Benefits | Truist One Checking Account Features |

|---|---|---|

| Students | Low fees, online access, $400 reward | No overdraft fees, $50 opening deposit |

| Seniors | Low fees, automatic upgrades | No overdraft fees |

| Frequent Travelers | Online services, minimal international fees | Convenient online account opening |

| High-Balance Holders | Rewards for large deposits | $400 reward for new customers |

| Fee-Averse Customers | Low fees, no overdraft fees | $50 opening deposit |

Frequently Asked Questions

What Is A Checking Account?

A checking account is a bank account for daily transactions. It allows deposits, withdrawals, and bill payments easily.

How To Choose A Checking Account?

Compare fees, minimum balance requirements, and features. Consider ATM access, online banking, and customer service quality.

Do Checking Accounts Earn Interest?

Some checking accounts offer interest. However, the interest rate is usually lower compared to savings accounts.

Are There Fees For Checking Accounts?

Many banks charge monthly fees. Some accounts waive fees if you meet specific criteria, like maintaining a minimum balance.

Conclusion

Choosing the right checking account can simplify your financial life. Truist One Checking Account offers great benefits. No overdraft fees mean peace of mind. Automatic upgrades keep your account current. Plus, new customers can earn up to $400. Open your account online with ease. For more details, visit Truist Retail Checking today. Make a smart choice for your finances.