Cloud-Based Expense Management: Streamline Your Finances Today

Managing expenses can be a daunting task for businesses. Cloud-based expense management offers a modern solution.

In today’s fast-paced business world, tracking and controlling expenses efficiently is crucial. Cloud-based expense management systems like Emburse offer innovative solutions to streamline this process. They provide flexible, mobile-friendly tools designed to improve compliance, enhance convenience, and offer real-time insights. With Emburse, businesses can automate accounts payable, simplify travel management, and gain actionable data insights. This helps organizations save money, plan proactively, and manage cash flow effectively. Curious to learn more? Discover how Emburse can transform your expense management by visiting their website. Click here to explore Emburse’s offerings and see how they can benefit your business.

Introduction To Cloud-based Expense Management

Managing expenses can be challenging for any business. Cloud-based expense management offers a modern solution. It simplifies tracking and controlling expenses. This method also ensures better financial planning and compliance.

What Is Cloud-based Expense Management?

Cloud-based expense management uses online tools to handle expenses. This approach leverages cloud technology to streamline processes. Businesses can access and manage expenses from anywhere with an internet connection.

| Feature | Description |

|---|---|

| Expense Management | Flexible solutions with proactive controls and insights. Tailored to meet unique organizational needs. |

| Travel Management | Mobile-friendly solutions for better policy adherence. Customizable app for travel management. |

| Payments & Invoice | Automates accounts payable. Improves cash flow visibility and streamlines payment processes. |

| Insights & Analytics | Provides data-driven insights. Helps uncover savings and manage cash flow efficiently. |

The Importance Of Streamlining Finances

Streamlining finances is crucial for any business. It helps in reducing errors and saving time. With cloud-based solutions, companies can ensure real-time expense tracking and reporting.

- Enhances Compliance: Ensures adherence to financial policies.

- Convenience: Access data anytime, anywhere.

- Proactive Planning: Supports future-proofing and financial planning.

- Secure Payments: Ensures timely and secure reimbursements.

Emburse offers innovative travel and expense management solutions. These solutions help businesses streamline their processes. They also provide actionable insights and enhance compliance.

To learn more about Emburse, visit their official website.

Key Features Of Cloud-based Expense Management Tools

Cloud-based expense management tools like Emburse offer a range of features that streamline financial processes. These tools provide businesses with the efficiency and insights needed to manage expenses effectively.

Automated Expense Tracking

One of the most important features is automated expense tracking. This functionality eliminates the need for manual entry, reducing errors and saving time. Emburse captures and categorizes expenses automatically, ensuring that all transactions are recorded accurately.

- Reduces manual data entry

- Minimizes errors

- Saves time

Real-time Data Access

With real-time data access, businesses can monitor expenses as they occur. Emburse provides up-to-the-minute information, allowing for better decision-making and financial planning. This feature ensures that all stakeholders have access to the latest data.

- Provides up-to-date information

- Enhances decision-making

- Supports financial planning

Integration With Other Financial Tools

Emburse integrates seamlessly with other financial tools, providing a unified platform for managing expenses. This integration with other financial tools simplifies processes and ensures data consistency. Whether it’s accounting software or payroll systems, Emburse connects effortlessly.

- Ensures data consistency

- Simplifies financial processes

- Supports various integrations

Customizable Reporting And Analytics

Emburse offers customizable reporting and analytics to meet unique business needs. These tools provide data-driven insights that help identify spending trends and areas for cost reduction. Users can tailor reports to their specific requirements, enhancing visibility and control.

- Provides data-driven insights

- Identifies spending trends

- Offers customizable reports

To learn more about how Emburse can transform your expense management, visit their website.

Pricing And Affordability Breakdown

Emburse offers a range of pricing options to suit various business needs. Understanding the pricing structure can help you decide if Emburse is the right choice for your organization. Let’s dive into the details.

Subscription Models

Emburse provides flexible subscription models to cater to different business sizes and needs. Here are some common subscription models:

- Monthly Subscriptions: Ideal for businesses with fluctuating needs.

- Annual Subscriptions: Offers a discount for long-term commitment.

- Pay-per-Use: Suitable for businesses with irregular expense management requirements.

Each model is designed to provide cost-effective solutions and ensure that you only pay for what you use. For specific pricing, contact Emburse at hi@emburse.com or call +1 877 EMBURSE.

Free Vs. Paid Plans

Emburse offers both free and paid plans, each with its own set of features. Here is a comparison:

| Plan Type | Features |

|---|---|

| Free Plan |

|

| Paid Plan |

|

The free plan is great for small businesses or startups. Larger organizations may benefit more from the paid plans due to their advanced features.

Cost-benefit Analysis

Investing in Emburse can lead to significant cost savings and increased operational efficiency. Here are some key benefits:

- Enhanced Compliance: Reduces the risk of financial errors and fraud.

- Real-Time Tracking: Provides up-to-date expense reports.

- Improved Cash Flow: Automates payments and invoicing.

- Customizable Solutions: Meets unique business needs.

While the initial cost may seem high, the long-term benefits outweigh the expenses. By reducing administrative work and improving compliance, Emburse helps you save time and money.

For a detailed cost-benefit analysis, contact Emburse at hi@emburse.com or call +1 877 EMBURSE.

Pros And Cons Of Cloud-based Expense Management

Cloud-based expense management systems, like Emburse, offer many advantages and some drawbacks. Understanding these can help businesses make informed decisions about managing their expenses online.

Pros: Ease Of Use

Cloud-based systems are designed to be intuitive and user-friendly. Emburse, for example, provides customizable solutions that adapt to the unique needs of any organization. This ensures that users can easily navigate and utilize the system without extensive training.

Pros: Accessibility

With cloud-based expense management, access is possible from anywhere with an internet connection. Emburse offers a mobile-friendly travel management app, allowing employees to manage expenses on the go. This increases adoption and policy adherence across the organization.

Pros: Scalability

As your business grows, so do your expense management needs. Cloud-based solutions like Emburse offer tailored vertical expense solutions that can scale with your organization. This ensures that the system remains effective and efficient, regardless of company size.

Cons: Security Concerns

Storing sensitive financial data in the cloud can raise security concerns. While Emburse ensures data security with a broad range of global security and data processing requirements, businesses must still be vigilant about data protection and privacy.

Cons: Dependence On Internet Connectivity

Cloud-based systems require a stable internet connection. If the internet goes down, access to the expense management system is lost. This can disrupt business operations and delay critical processes. Ensuring reliable internet access is crucial for seamless functioning.

Specific Recommendations For Ideal Users

Emburse’s cloud-based expense management software offers tailored solutions for various types of users. Here’s a closer look at the ideal users for Emburse, based on their unique needs and business structures.

Small Businesses

Small businesses benefit greatly from Emburse’s flexible solutions. They can automate accounts payable to control costs, improve cash flow visibility, and streamline payment processes. Here are specific advantages for small businesses:

- Real-time expense tracking helps in maintaining accurate records.

- Data-driven insights aid in uncovering savings opportunities.

- Customizable solutions adapt to their unique business needs.

Freelancers And Contractors

Freelancers and contractors need efficient ways to track and manage expenses. Emburse offers mobile-friendly solutions which are ideal for those constantly on the move. Benefits include:

- Mobile-friendly travel solutions increase policy adherence.

- Real-time reporting simplifies financial planning.

- Secure and timely reimbursements ensure cash flow stability.

Large Enterprises

Large enterprises require robust systems to handle vast amounts of data. Emburse provides comprehensive tools to manage this complexity. Key features for large enterprises include:

- Proactive controls and insights to ensure compliance.

- Tailored expense solutions for diverse organizational needs.

- Automation of accounts payable to streamline processes.

Remote Teams

Remote teams need seamless integration and user-friendly interfaces. Emburse’s cloud-based platform ensures everyone stays connected and compliant. Advantages for remote teams:

- Customizable travel management app for easy access.

- Real-time expense tracking for better financial oversight.

- Secure data handling to protect sensitive information.

For more details and to get started with Emburse, visit their website or contact their sales team.

Frequently Asked Questions

What Is Cloud-based Expense Management?

Cloud-based expense management is a system that helps businesses manage expenses online. It offers real-time tracking, reporting, and automation. This improves efficiency and reduces errors.

How Does Cloud-based Expense Management Work?

Cloud-based expense management works by storing data on remote servers. Users can access and update expense information online. This allows for real-time collaboration and reporting.

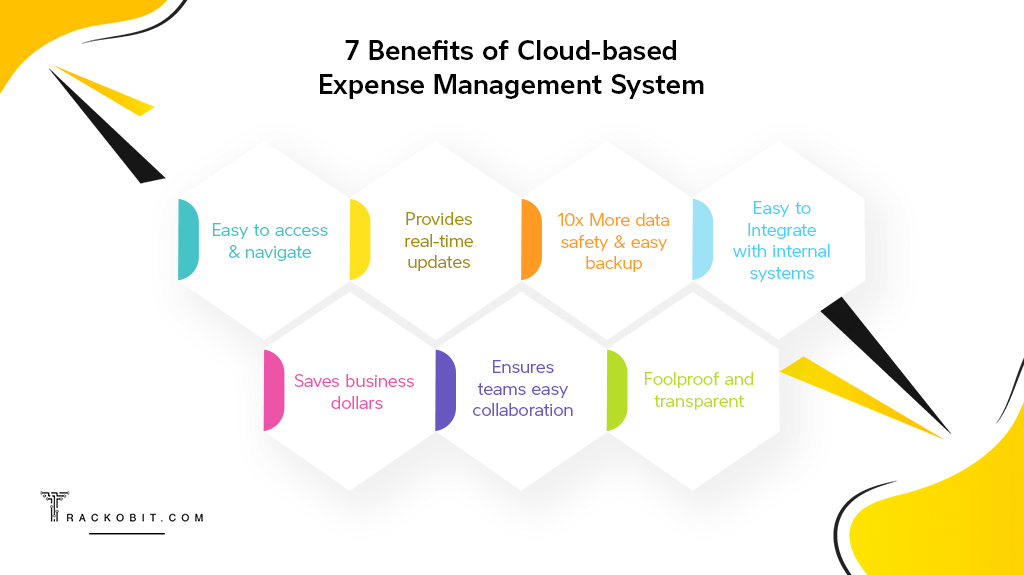

What Are The Benefits Of Cloud-based Expense Management?

The benefits include real-time tracking, automated reporting, and reduced errors. It also offers scalability, easy access, and cost savings. Overall, it enhances efficiency.

Is Cloud-based Expense Management Secure?

Yes, cloud-based expense management is secure. Most systems use encryption and regular security updates. They also have access controls to protect sensitive data.

Conclusion

Embracing cloud-based expense management with Emburse can transform your financial processes. This tool simplifies expense tracking and enhances compliance. With features like real-time reporting and mobile-friendly solutions, businesses can gain valuable insights and control costs efficiently. Tailored solutions meet unique needs, ensuring future-proof planning. Ready to streamline your expense management? Explore Emburse’s offerings here and elevate your financial operations today.