Cloud-Based Accounting: Streamline Your Financial Management Today

Cloud-based accounting has transformed how businesses manage their finances. It offers convenience, efficiency, and accuracy.

In today’s fast-paced digital world, managing finances can be overwhelming. Traditional accounting methods are often time-consuming and prone to errors. This is where cloud-based accounting steps in. It allows businesses to track expenses, calculate taxes, and manage cash flow seamlessly. With solutions like Found, small business owners can automate many of their financial tasks. Found provides tools for expense tracking, tax calculations, and invoicing, all within one app. It’s user-friendly and secure, ensuring your financial data is protected. Discover how cloud-based accounting can simplify your business operations and keep your finances in check.

Introduction To Cloud-based Accounting

Cloud-based accounting is transforming how businesses manage their finances. Accessible from anywhere, it offers flexibility and real-time updates. This guide will explore what cloud-based accounting is, the evolution of accounting software, and why businesses are moving to the cloud.

What Is Cloud-based Accounting?

Cloud-based accounting involves using online software to manage financial data. Unlike traditional accounting software, it stores information on remote servers. This means you can access your data from any device with an internet connection.

Key features include:

- Real-time access to financial data

- Automated updates and backups

- Collaboration with multiple users

- Scalability for growing businesses

The Evolution Of Accounting Software

Accounting software has come a long way. Initially, businesses used paper ledgers. Then came desktop software, which required manual updates and backups. Cloud-based solutions have revolutionized this process.

Here is a brief timeline:

| Era | Accounting Method |

|---|---|

| Pre-1980s | Paper Ledgers |

| 1980s-2000s | Desktop Software |

| 2000s-Present | Cloud-Based Accounting |

Why Businesses Are Moving To The Cloud

Many businesses are shifting to cloud-based accounting for various reasons. It offers convenience, security, and efficiency. Let’s look at some benefits:

- Accessibility: Access your financial data from anywhere, anytime.

- Cost-Effective: Reduces the need for expensive hardware and IT maintenance.

- Real-Time Updates: Provides up-to-date financial information.

- Scalability: Easily adapt to your business’s growing needs.

- Automation: Automates tasks like invoicing and expense tracking.

- Security: Ensures data protection with encryption and secure servers.

Products like Found exemplify these benefits. They offer tools to track expenses, calculate taxes, manage cash flow, and more. Found combines banking, invoicing, and bookkeeping in one app. It provides FDIC-insured funds, data encryption, and comprehensive fraud monitoring. This makes it a comprehensive solution for small business owners.

Cloud-based accounting is the future of financial management. It offers the tools and flexibility needed to thrive in today’s fast-paced business environment.

Key Features Of Cloud-based Accounting Tools

Cloud-based accounting tools offer numerous benefits for small business owners. They help manage finances efficiently and streamline various accounting tasks. Below are some key features of these tools that make them indispensable for modern businesses.

Automated Bookkeeping

Automated bookkeeping reduces manual data entry and minimizes errors. These tools automatically track expenses, categorize transactions, and update financial records. This ensures accurate and up-to-date bookkeeping without the need for constant manual intervention.

Real-time Financial Reporting

Real-time financial reporting provides instant access to your financial data. It allows business owners to make informed decisions based on current financial information. You can generate various reports, such as profit and loss statements, balance sheets, and cash flow reports, with just a few clicks.

Multi-user Access

Multi-user access enables different team members to work on the same accounting platform simultaneously. This feature promotes collaboration and ensures that everyone has access to the most recent financial data. Permissions can be set to control access levels, ensuring data security.

Integrations With Other Software

Cloud-based accounting tools integrate seamlessly with other business software. This includes CRM systems, payment processors, and project management tools. These integrations streamline operations and eliminate the need for manual data transfer between systems, saving time and reducing errors.

Secure Data Storage And Backup

Secure data storage and backup are critical features of cloud-based accounting tools. They use advanced encryption methods to protect your financial data. Additionally, regular backups ensure that your data is safe and can be restored in case of any unforeseen issues.

With these features, cloud-based accounting tools like Found provide small business owners with the tools to manage expenses, calculate taxes, and handle cash flow efficiently. The user-friendly interface, automation, and security make Found an ideal choice for modern businesses.

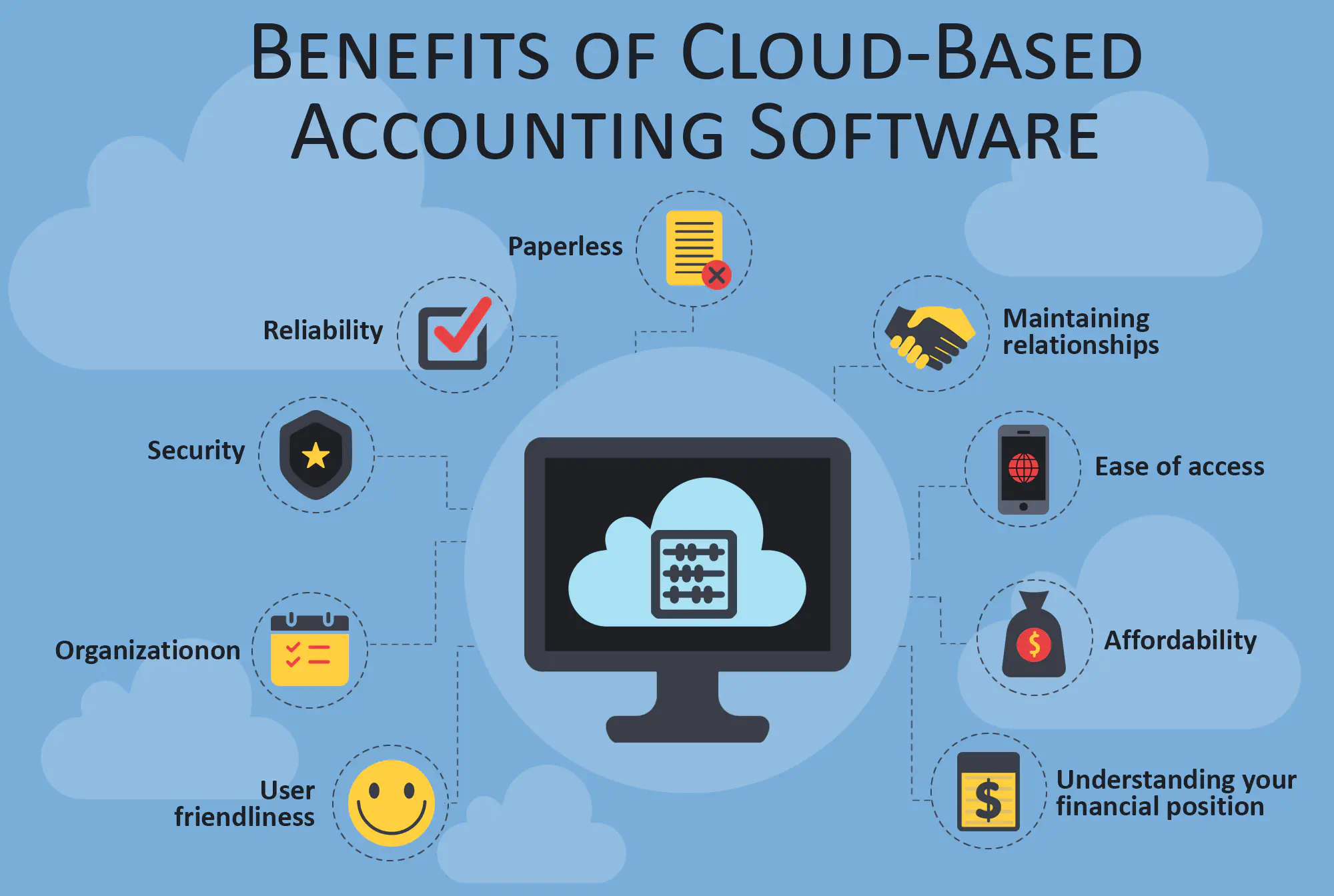

Benefits Of Cloud-based Accounting For Businesses

Cloud-based accounting systems have become essential for modern businesses. These platforms offer numerous advantages that improve efficiency, reduce costs, and enhance overall business operations. Below, we explore the primary benefits of adopting cloud-based accounting for your business.

Increased Efficiency And Productivity

Cloud-based accounting systems automate many manual tasks. This automation saves time and reduces errors. For example, Found offers features like automatic expense tracking and real-time tax calculations. These tools allow business owners to focus on growth rather than paperwork.

Cost Savings And Scalability

Cloud-based accounting systems are typically subscription-based. This model eliminates the need for expensive hardware and software purchases. Found provides a free sign-up with no hidden fees. This makes it a cost-effective solution for small businesses. Additionally, cloud-based systems can easily scale with your business needs. Whether you are a freelancer or a growing enterprise, you can adjust your plan as needed.

Enhanced Collaboration And Accessibility

Cloud-based accounting platforms provide real-time access to financial data. This feature enables seamless collaboration among team members. With Found, users can manage finances from any device, whether it’s iOS, Android, or desktop. This accessibility ensures that all stakeholders have up-to-date information at their fingertips.

Improved Accuracy And Compliance

Automated systems reduce the risk of human error. Cloud-based accounting platforms like Found offer auto-categorization for easy write-offs. This ensures accurate and compliant financial records. Additionally, Found’s smart tax tools provide real-time calculation of estimated tax bills. This helps businesses stay compliant with tax regulations.

Flexibility And Remote Work Capabilities

Cloud-based accounting platforms support remote work environments. This flexibility is crucial in today’s business landscape. Found allows business owners to manage all finances within a single app. This means you can access your financial data from anywhere, at any time. Such flexibility is vital for businesses that operate remotely or have team members in different locations.

In summary, the benefits of cloud-based accounting for businesses are numerous. Increased efficiency, cost savings, enhanced collaboration, improved accuracy, and flexibility make these systems indispensable tools for modern businesses.

Pricing And Affordability Of Cloud-based Accounting Solutions

Cloud-based accounting solutions offer a convenient way for businesses to manage their finances. Understanding the pricing and affordability of these solutions is crucial. This section will explore various pricing models, compare costs, assess value for money, and highlight hidden costs.

Subscription-based Pricing Models

Most cloud-based accounting solutions operate on a subscription-based model. This means users pay a monthly or annual fee to access the software. Found, for instance, offers a free sign-up with no hidden fees or account maintenance charges. They also provide a premium plan called Found Plus with additional features.

Comparing Costs Of Different Platforms

| Platform | Free Plan | Monthly Cost | Annual Cost |

|---|---|---|---|

| Found | Yes | Free / Found Plus (Price not specified) | N/A |

| Platform B | No | $20 | $200 |

| Platform C | Yes | $15 | $150 |

When comparing costs, consider what each platform offers. Found provides a comprehensive suite of banking, invoicing, and bookkeeping tools without a fee.

Value For Money: What To Consider

Value for money is not just about the price. It also involves the features and benefits offered. Found combines several essential business tools in one app, including:

- Business banking with no hidden fees

- Smart tax tools for real-time calculations

- Seamless finances with integrated invoicing and bookkeeping

These features save time and reduce manual effort, providing significant value to small business owners.

Hidden Costs To Watch Out For

While many cloud-based accounting solutions offer transparency, it’s important to watch out for potential hidden costs. These can include:

- Additional fees for premium features

- Costs for exceeding usage limits

- Charges for customer support

Found is upfront about its pricing, with no hidden fees or account maintenance charges. This transparency helps users avoid unexpected costs and budget more effectively.

Pros And Cons Of Using Cloud-based Accounting

Cloud-based accounting has become a popular choice for small business owners. It’s known for its convenience, automation, and the ability to access data from anywhere. In this section, we will delve into the pros and cons of using cloud-based accounting, helping you decide if it’s the right fit for your business.

Advantages: Accessibility, Automation, And Accuracy

Accessibility

One of the biggest advantages of cloud-based accounting is accessibility. You can access your financial data from anywhere, at any time, using any device with an internet connection. This is particularly beneficial for business owners who travel frequently or manage remote teams.

With tools like Found, you can manage your cash flow, send invoices, and track expenses seamlessly, all from one app. The ability to have real-time access to your financial data ensures that you can make informed decisions swiftly.

Automation

Cloud-based accounting solutions offer significant automation features. For instance, Found automates expense tracking, calculates estimated tax bills in real-time, and auto-categorizes transactions for easy write-offs. This automation saves you time and reduces manual effort, allowing you to focus on growing your business.

Accuracy

Automation also leads to greater accuracy. Manual data entry is prone to errors, but with cloud-based accounting, many processes are automated, reducing the risk of mistakes. Found’s automatic expense tracking and paper-free bookkeeping ensure your records are accurate and up-to-date.

Disadvantages: Security Concerns And Internet Dependence

Security Concerns

Security is a major concern for businesses using cloud-based accounting. Your financial data is stored online, making it a potential target for cyber-attacks. However, solutions like Found address these concerns by providing FDIC-insured funds, data encryption, secure infrastructure, and two-factor authentication.

While these measures significantly enhance security, it’s essential to stay vigilant and ensure that your service provider maintains high security standards.

Internet Dependence

Internet connectivity is crucial for using cloud-based accounting systems. If your internet connection is unstable or unavailable, you might face challenges in accessing your financial data. This can be particularly problematic in areas with poor internet infrastructure.

It’s important to have a reliable internet connection to ensure seamless access to your accounting system and avoid disruptions in managing your finances.

Balancing The Pros And Cons For Your Business

When considering cloud-based accounting, it’s crucial to weigh the pros and cons based on your business needs. Here’s a quick comparison table:

| Advantages | Disadvantages |

|---|---|

| Accessibility from any device | Security concerns |

| Automation of tasks | Dependence on internet |

| Increased accuracy |

Cloud-based accounting offers numerous benefits like accessibility, automation, and accuracy. However, it’s important to consider security and internet dependence. Solutions like Found provide robust features and security measures, making it a comprehensive choice for small business owners.

Specific Recommendations For Ideal Users

Found is a versatile financial tool designed for various types of users. From small businesses to freelancers, it offers a range of features tailored to meet different needs. Below are specific recommendations for ideal users of Found.

Small And Medium-sized Enterprises (smes)

SMEs can benefit greatly from Found’s comprehensive banking and financial management tools. Found provides:

- Business Banking: Manage cash flow easily with virtual cards and custom pockets.

- Smart Tax Tools: Real-time calculation of estimated tax bills and auto-save for taxes.

- Seamless Finances: Send professional invoices and track expenses automatically.

Startups And Growing Businesses

Startups and growing businesses need efficient financial management to scale effectively. Found offers:

- Easy Sign-Up: No hidden fees, no account maintenance fees, and no minimum balance.

- Automation: Automates tasks, saving time and reducing manual effort.

- Comprehensive Tools: Combines banking, invoicing, and bookkeeping in one app.

Freelancers And Independent Contractors

Freelancers and independent contractors often juggle multiple clients and projects. Found simplifies this with:

- User-Friendly Interface: Extremely easy to integrate and use.

- Expense Tracking: Automatic expense tracking and paper-free bookkeeping.

- Invoicing: Send professional, trackable, and free invoices easily.

Non-profit Organizations

Non-profits have unique financial needs and Found addresses them effectively. It provides:

- Secure Transactions: FDIC-insured funds up to $250,000 and data encryption.

- Efficient Management: Manage all finances within the Found app without toggling between apps.

- Tax Management: Simplifies tax calculations and savings.

Conclusion: Is Cloud-based Accounting Right For You?

Cloud-based accounting is revolutionizing how businesses manage finances. It offers flexibility, automation, and real-time access to financial data. But is it the right solution for your business? Here, we explore the considerations to help you decide.

Evaluating Your Business Needs

Assess your current accounting processes and tools. Identify gaps and inefficiencies. Consider the following:

- Scalability: Do you need a solution that grows with your business?

- Remote Access: Is accessing financial data from anywhere important?

- Automation: Will automated tasks save you time and reduce errors?

- Integration: Do you need seamless integration with other business tools?

Understanding these needs helps determine if cloud-based accounting aligns with your goals.

Making The Transition To Cloud-based Accounting

Switching to cloud-based accounting requires planning and execution. Here’s a step-by-step guide:

- Research: Explore different cloud-based accounting solutions.

- Trial: Use free trials to test features and compatibility.

- Data Migration: Plan and execute the transfer of your current data.

- Training: Train your team on the new system.

- Support: Ensure access to customer support for troubleshooting.

Following these steps ensures a smooth transition with minimal disruption to your operations.

Final Thoughts And Next Steps

Cloud-based accounting offers numerous benefits. Evaluate your business needs and consider the ease of transition. If you decide to proceed, start with a reliable solution like Found. Found provides tools for tracking expenses, calculating taxes, managing cash flow, and more, all in one app.

Take the next step by exploring Found’s features and benefits. Sign up for free, and see how cloud-based accounting can streamline your business operations.

Frequently Asked Questions

What Is Cloud-based Accounting?

Cloud-based accounting is using internet-based software to manage financial records. It allows access from anywhere, improving collaboration and efficiency.

How Secure Is Cloud-based Accounting?

Cloud-based accounting is secure with strong encryption and regular updates. Providers use advanced security measures to protect your data.

What Are The Benefits Of Cloud-based Accounting?

Cloud-based accounting offers real-time updates, accessibility, and cost savings. It streamlines financial management and enhances collaboration.

Can Small Businesses Use Cloud-based Accounting?

Yes, small businesses can use cloud-based accounting. It is cost-effective, scalable, and user-friendly, making it ideal for small enterprises.

Conclusion

Embracing cloud-based accounting can streamline your business processes. It offers convenience, security, and efficiency. Small business owners can benefit greatly. For managing expenses, taxes, and invoices, consider using tools like Found. It combines banking, invoicing, and bookkeeping in one app. Sign up easily and enjoy seamless financial management. To learn more, visit Found. Simplify your business today with cloud-based solutions.