Checking Account With Low Fees: Save More With These Tips

Finding a checking account with low fees can be challenging. High fees can eat into your savings quickly.

But don’t worry, there’s a solution that can save you money and provide great benefits. Introducing the Truist One Checking Account. This account offers a seamless banking experience with automatic upgrades and no overdraft fees. You can open it online and enjoy convenient access through the Truist Mobile app. New customers can even earn a $400 bonus by meeting certain requirements. With a minimum opening deposit of just $50, this account is designed to be accessible and beneficial. Say goodbye to high fees and hello to hassle-free banking. Learn more about the Truist One Checking Account today and see how it can make managing your money easier and more rewarding.

Introduction To Low-fee Checking Accounts

In today’s fast-paced world, managing finances efficiently is crucial. A low-fee checking account can be a game-changer for those looking to save money on banking fees. These accounts offer the same essential features as traditional checking accounts but with significantly lower costs.

What Is A Low-fee Checking Account?

A low-fee checking account is a type of bank account designed to minimize fees. These accounts often have lower monthly maintenance fees, reduced overdraft charges, and minimal transaction costs. They are ideal for individuals who want to manage their money without incurring hefty fees.

| Feature | Description |

|---|---|

| Lower Monthly Fees | Typically, these accounts have lower or no monthly maintenance fees. |

| Reduced Overdraft Charges | Overdraft fees are often lower or completely waived. |

| Minimal Transaction Costs | Transaction fees are kept to a minimum, allowing for cost-effective banking. |

Why Choose A Low-fee Checking Account?

There are several benefits to choosing a low-fee checking account. First, they help you save money by reducing or eliminating fees. Second, these accounts often come with user-friendly features like mobile banking and automatic upgrades.

- Save Money: Lower fees mean more money stays in your account.

- Convenient Features: Many low-fee accounts offer online banking and mobile app access.

- No Overdraft Fees: Some accounts, like the Truist One Checking Account, do not charge overdraft fees.

For example, the Truist One Checking Account offers automatic upgrades and no overdraft fees. New customers can earn a $400 bonus by opening the account online and making qualifying direct deposits. The minimum opening deposit is only $50, making it accessible to many.

The Truist One Checking Account is tailored for those seeking a straightforward and beneficial checking account. It provides seamless access through the Truist Mobile app, ensuring a smooth banking experience.

Key Features Of Low-fee Checking Accounts

Low-fee checking accounts are designed to provide cost-effective banking solutions. These accounts come with several key features that help you save money while managing your finances efficiently. Here are the essential features of low-fee checking accounts:

Minimal Monthly Maintenance Fees

One of the primary benefits of low-fee checking accounts is the minimal monthly maintenance fees. For example, the Truist One Checking Account requires a minimum opening deposit of just $50. These accounts often have lower fees compared to traditional checking accounts, making them budget-friendly.

No Overdraft Fees

Many low-fee checking accounts, including the Truist One Checking Account, offer no overdraft fees. This feature ensures you do not incur extra charges if you accidentally spend more than you have in your account. It provides peace of mind and helps you avoid unexpected expenses.

Free Atm Access

Free ATM access is another significant feature of low-fee checking accounts. Many banks offer nationwide access to ATMs without any fees. This means you can withdraw cash or check your balance without worrying about additional costs.

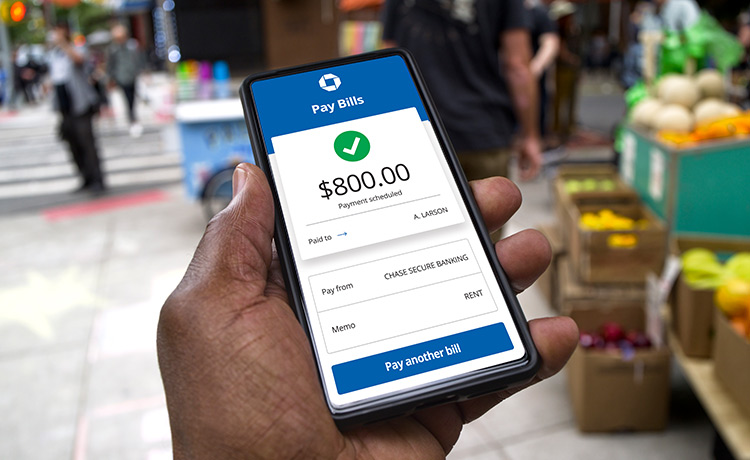

Online And Mobile Banking Capabilities

Low-fee checking accounts often come with robust online and mobile banking capabilities. The Truist One Checking Account, for instance, provides convenient access through the Truist Mobile app. You can manage your account, transfer funds, and pay bills from your phone or computer, making banking more accessible and convenient.

| Feature | Details |

|---|---|

| Minimal Monthly Maintenance Fees | Lower fees compared to traditional accounts |

| No Overdraft Fees | No extra charges for overdrafts |

| Free ATM Access | Nationwide access without fees |

| Online and Mobile Banking | Manage account via mobile app or online |

Low-fee checking accounts like the Truist One Checking Account offer several benefits. They help you manage your finances efficiently while keeping costs low. These accounts are ideal for those seeking affordable and convenient banking solutions.

Pricing And Affordability Breakdown

When choosing a checking account, understanding the pricing and affordability is key. The Truist One Checking Account offers several appealing features, but it’s important to break down the costs and conditions to ensure it fits your financial needs.

Comparing Monthly Fees

The Truist One Checking Account stands out with its no overdraft fees policy. This is a significant benefit for those who worry about unexpected charges. Here’s a quick comparison of the monthly fees:

| Bank | Monthly Fee | Overdraft Fee |

|---|---|---|

| Truist One Checking | $0 | $0 |

| Bank of America | $12 | $35 |

| Chase Total Checking | $12 | $34 |

As seen, Truist offers a clear advantage with no monthly or overdraft fees.

Hidden Costs To Watch Out For

While Truist One Checking Account advertises no overdraft fees, be aware of potential hidden costs:

- Minimum Opening Deposit: $50

- Direct Deposit Requirement: To qualify for the $400 bonus, you need two direct deposits totaling $1,000 within 120 days.

- Reward Forfeiture Conditions: Changing the account type or closing the account before the reward is deposited can lead to forfeiture.

These conditions are important to consider to avoid unexpected charges and to ensure you receive the advertised benefits.

Fee Waiver Conditions

Truist One Checking Account offers fee waiver conditions that can be beneficial:

- Automatic Upgrades: Your account upgrades based on your banking habits, potentially providing better features over time.

- No Overdraft Fees: A significant relief for users who might occasionally overspend.

To maximize the benefits, ensure you meet the direct deposit requirements and keep your account in good standing. These conditions help you enjoy the full range of perks without additional costs.

For further details or to open an account, visit the Truist website.

Pros And Cons Of Low-fee Checking Accounts

Exploring low-fee checking accounts can reveal a variety of benefits and drawbacks. It is essential to understand both sides before making a decision. Below, we will discuss the advantages and potential drawbacks of low-fee checking accounts.

Advantages Of Low-fee Accounts

Low-fee checking accounts, like the Truist One Checking Account, offer several key benefits:

- No Overdraft Fees: Avoid extra charges for overdrafts.

- Automatic Upgrades: Enjoy enhanced features based on banking habits.

- Convenient Access: Manage your account easily through a mobile app.

- $400 Bonus Offer: Earn a bonus by meeting specific conditions.

The Truist One Checking Account is specifically designed to provide a seamless banking experience. Features like no overdraft fees and automatic upgrades ensure a stress-free banking experience. The $400 bonus offer also adds a significant incentive for new customers.

Potential Drawbacks To Consider

While low-fee checking accounts offer many benefits, there are some potential drawbacks to consider:

- Direct Deposit Requirement: Qualifying direct deposits are necessary for promotional benefits.

- Minimum Opening Deposit: A $50 deposit is required to open the account.

- Eligibility Restrictions: Specific residency requirements and exclusions for existing account holders.

- Reward Forfeiture Conditions: Rewards may be forfeited if account conditions are not met.

The Truist One Checking Account requires a minimum opening deposit of $50 and qualifying direct deposits to receive the $400 bonus. Additionally, certain exclusions apply, such as existing account holders and recent account closures. It is important to consider these factors before deciding.

By understanding the pros and cons of low-fee checking accounts, you can make an informed decision that best suits your financial needs.

Tips For Maximizing Savings With Low-fee Checking Accounts

Opening a low-fee checking account like the Truist One Checking Account can help you save money. To maximize your savings, it’s important to use the features and benefits available to you. Let’s explore some effective strategies.

Automating Savings Transfers

Set up automatic transfers from your checking account to your savings account. This ensures you save consistently without having to think about it. With the Truist One Checking Account, you can easily manage these transfers through the Truist Mobile app.

Here’s how you can set up automatic transfers:

- Log in to your Truist account.

- Navigate to the transfers section.

- Set the amount and frequency of transfers to your savings account.

Automating savings helps you reach your financial goals faster and takes advantage of any interest your savings account might offer.

Utilizing Cashback Rewards

Look for opportunities to earn cashback on purchases. Some checking accounts offer cashback rewards for using their debit card. Though the Truist One Checking Account does not explicitly mention cashback rewards, using a connected credit card with rewards can be beneficial.

Consider these tips to maximize cashback:

- Use your rewards card for everyday purchases.

- Pay off your balance in full each month to avoid interest charges.

- Track your rewards and redeem them strategically.

Using rewards cards in conjunction with your checking account ensures you get the most out of every purchase.

Avoiding Common Banking Fees

One of the best ways to save money is by avoiding common banking fees. The Truist One Checking Account helps by offering no overdraft fees.

Other fees to watch out for include:

| Fee Type | How to Avoid |

|---|---|

| ATM Fees | Use in-network ATMs. |

| Monthly Maintenance Fees | Maintain the required minimum balance. |

| Foreign Transaction Fees | Avoid using your card abroad or find a card with no foreign fees. |

Understanding these fees and how to avoid them can save you a significant amount over time.

Maximizing savings with a low-fee checking account involves smart management of your finances. Use automation, leverage rewards, and stay informed about fees. The Truist One Checking Account offers great benefits to help you on your financial journey.

Who Should Consider A Low-fee Checking Account?

A low-fee checking account can be a perfect choice for many individuals. These accounts offer essential banking services without the burden of high fees, making them ideal for those seeking simplicity and cost-efficiency.

Ideal Users For Low-fee Checking Accounts

Several types of individuals can benefit from low-fee checking accounts like the Truist One Checking Account:

- Students: College students or young adults just starting their financial journey.

- Low-income earners: Individuals with limited income who need to minimize banking costs.

- Retirees: Seniors on fixed incomes looking to save on banking fees.

- Minimalists: People who prefer straightforward banking without extra frills.

Scenarios Where Low-fee Accounts Excel

Low-fee checking accounts shine in various scenarios, providing value and convenience:

| Scenario | Benefits |

|---|---|

| High Transaction Volume | No overdraft fees mean peace of mind for frequent transactions. |

| Online Banking | Access your account easily with the Truist Mobile app. |

| Direct Deposits | Qualify for a $400 bonus with direct deposits. |

| Automatic Upgrades | Enjoy enhanced features as your banking habits evolve. |

The Truist One Checking Account is particularly beneficial for those seeking a hassle-free and efficient banking experience. With no overdraft fees and automatic upgrades, it suits various financial needs.

Frequently Asked Questions

What Is A Low Fee Checking Account?

A low fee checking account has minimal or no monthly maintenance fees. It helps you save on banking costs.

How Do I Find A Low Fee Checking Account?

Research banks and credit unions. Compare their fee structures. Look for accounts with zero or low monthly fees.

Are There Hidden Fees In Low Fee Checking Accounts?

Read the account terms carefully. Some accounts may have fees for overdrafts or ATM usage.

Can Students Get Low Fee Checking Accounts?

Yes, many banks offer low fee or no fee checking accounts specifically designed for students.

Conclusion

Choosing a checking account with low fees can make banking easier. The Truist One Checking Account offers automatic upgrades and no overdraft fees. It’s a great option for those seeking simplicity and benefits. Opening an account online and meeting specific requirements could also earn you a $400 bonus. Ready to enjoy hassle-free banking? Click here to learn more about the Truist One Checking Account. Simplify your finances and save on unnecessary fees today.