Checking Account Rewards: Maximize Your Banking Benefits

Checking Account Rewards Checking accounts are essential for managing daily finances. But did you know they can also offer rewards?

Many banks now offer special perks with their checking accounts. These rewards can range from cash bonuses to fee waivers. One such option is the Truist One Checking account. It stands out with its automatic upgrades and no overdraft fees. Plus, it offers the chance to earn $400 with qualifying activities. With Truist One Checking, you can open an account online easily. Enjoy convenient online banking and the Truist mobile app for account management. Ready to explore these rewards? Check out the details on the Truist website here.

Introduction To Checking Account Rewards

Checking accounts are essential tools for managing finances. Many banks offer rewards for using these accounts. These rewards can be beneficial for account holders. In this post, we explore the concept of checking account rewards and how they can benefit you.

What Are Checking Account Rewards?

Checking account rewards are incentives offered by banks to attract customers. These rewards can come in various forms. Some common rewards include:

- Cash bonuses

- Interest earnings

- Fee waivers

- Discounts on other banking products

For example, Truist One Checking offers rewards like earning $400 with qualifying activities. This is a great way to get more value from your checking account.

Purpose And Benefits Of Checking Account Rewards

The main purpose of checking account rewards is to attract and retain customers. Banks use these incentives to stand out in a competitive market. Rewards provide multiple benefits for account holders:

| Benefits | Description |

|---|---|

| Cash Incentives | Earn extra money by meeting specific account requirements. |

| Fee Waivers | Avoid paying common fees such as overdraft or maintenance fees. |

| Convenience | Enjoy easy online and mobile banking options. |

| Account Upgrades | Receive automatic upgrades to better account features. |

For instance, Truist One Checking offers no overdraft fees and automatic upgrades. These features make managing your account easier and more cost-effective. Additionally, the Truist mobile app provides account management and spending insights, adding to the convenience.

Remember, checking account rewards are not just about cash bonuses. They include various perks that can save you money and time.

Key Features Of Checking Account Rewards Programs

Checking account rewards programs offer various benefits that can enhance your banking experience. These programs provide incentives for everyday banking activities. Below are key features to look for in checking account rewards programs:

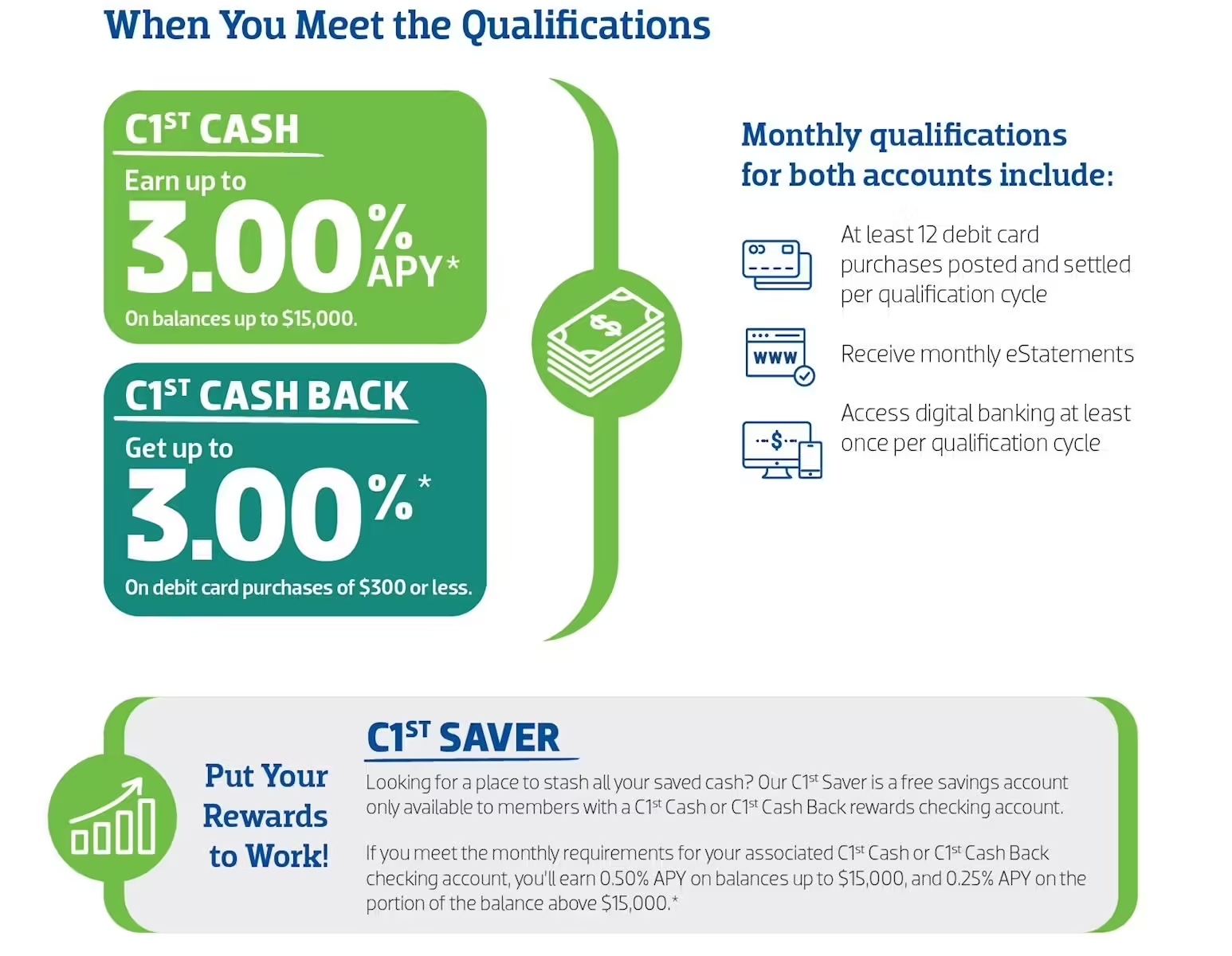

Cashback Offers

Many checking accounts offer cashback rewards on purchases. These rewards accumulate as you use your debit card for transactions. For instance, the Truist One Checking account may provide cashback on certain purchases, making everyday spending more rewarding.

Interest Earnings

Some checking accounts allow you to earn interest on your balance. This means your money grows while it’s in your account. The Truist One Checking account might offer interest earnings, adding value to your deposits.

Discounts On Products And Services

Checking account rewards programs often include discounts on various products and services. These discounts can range from reduced fees on financial products to special offers on partner services. Truist One Checking could provide access to such discounts, enhancing your savings.

Atm Fee Reimbursements

Access to ATM fee reimbursements is another valuable feature. Many rewards programs cover fees charged by out-of-network ATMs. This benefit can save you money when you need cash from an ATM that’s not part of your bank’s network.

Referral Bonuses

Some checking accounts offer referral bonuses for bringing in new customers. If you refer a friend and they open an account, you both could receive a bonus. The Truist One Checking account may provide such bonuses, encouraging you to share your positive banking experiences.

For more information about the Truist One Checking account and its features, visit the Truist website.

How To Maximize Your Checking Account Rewards

Maximizing your checking account rewards can significantly boost your financial benefits. With the right approach, you can make the most of your checking account features and promotions. Here’s how you can do it effectively.

Choosing The Right Account For Your Needs

Selecting the best checking account is the first step. Consider Truist One Checking, which offers automatic upgrades and no overdraft fees. This account also provides convenient online banking options.

- Automatic upgrades to enhance your account features over time.

- No overdraft fees, saving you money on penalties.

- Easy online account opening and management through the Truist mobile app.

Meeting Account Requirements

To earn rewards, you must meet certain requirements. With Truist One Checking, you need to:

- Open the account online using the promo code DC2425TR1400.

- Receive at least two qualifying direct deposits totaling $1,000 or more within 120 days.

Meeting these requirements can earn you up to $400 in rewards.

Taking Advantage Of Promotions

Promotions can offer substantial benefits. Truist’s current promotion requires new accounts to be opened between 10/31/24 and 4/30/25. Ensure your account remains in good standing to qualify for the reward.

Here’s a quick summary of the promotion details:

| Promotion | Details |

|---|---|

| Promo Code | DC2425TR1400 |

| Account Opening Period | 10/31/24 – 4/30/25 |

| Qualifying Direct Deposits | Two deposits totaling $1,000 or more |

Using Linked Accounts For Greater Benefits

Linking accounts can provide additional advantages. Truist offers access to their mobile app, which provides spending insights and account management tools. This can help you keep track of your finances and maximize your rewards.

By linking your checking account with other accounts, you can enjoy seamless transfers and better financial management. This integration can lead to greater benefits and rewards over time.

For more information, visit the Truist website or contact customer service.

Pricing And Affordability

Understanding the pricing and affordability of a checking account is crucial. Truist Retail Checking offers several features that make it an attractive option. Let’s dive into the details.

Monthly Maintenance Fees

Truist Retail Checking aims to keep costs low. The account does not have monthly maintenance fees, making it a cost-effective choice for many. This feature ensures that you can save more and worry less about hidden charges.

Minimum Balance Requirements

Another advantage is the minimal opening deposit. You need only $50 to open a Truist Retail Checking account. There are no ongoing minimum balance requirements to maintain the account, which helps in avoiding additional fees or penalties.

Additional Charges To Consider

While Truist Retail Checking has no overdraft fees, there are other potential charges to be aware of:

- Foreign transaction fees: Applicable when using your card abroad.

- ATM fees: Fees may apply when using non-Truist ATMs.

Understanding these charges can help you manage your finances better and avoid unexpected costs.

For more information, visit the Truist website or contact customer service.

Pros And Cons Of Checking Account Rewards

Checking accounts with rewards programs can offer great benefits. But, they also come with certain limitations. Understanding the advantages and drawbacks can help you decide if a rewards checking account is right for you.

Advantages Of Checking Account Rewards

There are several advantages to having a checking account with rewards:

- Earn Extra Money: With the Truist One Checking account, you can earn $400 with qualifying direct deposits.

- Convenient Online Banking: Manage your account easily with online banking options and the Truist mobile app.

- No Overdraft Fees: This account does not charge overdraft fees, offering peace of mind.

- Automatic Upgrades: The account automatically upgrades, offering better features over time.

Potential Drawbacks And Limitations

While the rewards can be enticing, there are some potential drawbacks:

- Qualification Requirements: To earn the $400 reward, you need to receive at least two qualifying direct deposits totaling $1,000 within 120 days.

- Reward Forfeiture: If the account balance is negative or the account is closed before the reward is deposited, you lose the reward.

- Account Maintenance: You must keep the account in good standing to receive and maintain rewards.

- Eligibility Restrictions: The promotion is not available to recent account holders or those with closed accounts after 10/31/23.

Overall, checking accounts with rewards can be beneficial if you meet the requirements and maintain the account properly.

Recommendations For Ideal Users

Choosing the right checking account rewards can be overwhelming. To simplify this process, we’ve identified the best options tailored for different user needs. Let’s explore the ideal checking account rewards for students, frequent travelers, high spenders, and savvy savers.

Best Checking Account Rewards For Students

Students often seek checking accounts with low fees and beneficial rewards. The Truist One Checking account is an excellent option. Here are the reasons:

- No overdraft fees: Ideal for students managing tight budgets.

- Automatic upgrades: Simplifies the banking experience.

- Earn $400 with qualifying activities: A significant bonus for new account holders.

- Easy online account opening: Convenient for busy student schedules.

- Minimum opening deposit: $50: Affordable for most students.

The Truist One Checking account ensures students can manage their finances efficiently without the stress of overdraft fees.

Ideal For Frequent Travelers

Frequent travelers need flexibility and accessibility. The Truist One Checking account offers:

- Access to the Truist mobile app: Manage your account from anywhere.

- Convenient online banking options: Handle transactions on the go.

- No overdraft fees: Avoid unexpected charges while traveling.

With these features, travelers can enjoy hassle-free banking, keeping their finances in check wherever they are.

Perfect For High Spenders

High spenders benefit from accounts that offer substantial rewards. The Truist One Checking account provides:

- Earn $400 with qualifying direct deposits: A lucrative reward for high volume transactions.

- Automatic upgrades: Ensures you receive the best possible account features.

This account is designed to maximize rewards, making it perfect for those who spend more.

Great For Savvy Savers

Savvy savers look for accounts with low fees and good rewards. The Truist One Checking account offers:

- No overdraft fees: Save money by avoiding unnecessary charges.

- Earn $400 with qualifying activities: Boost your savings with this generous reward.

- Minimum opening deposit: $50: Low entry requirement for initial savings.

These features make the Truist One Checking account a smart choice for those who prioritize savings.

Frequently Asked Questions

What Are Checking Account Rewards?

Checking account rewards are incentives offered by banks. These can include cashback, interest earnings, or discounts. They aim to attract and retain customers.

How Do I Earn Checking Account Rewards?

You earn rewards by meeting specific criteria. These may include maintaining a minimum balance, making frequent transactions, or using a linked debit card.

Are Checking Account Rewards Taxable?

Yes, checking account rewards can be taxable. The IRS considers them as interest income. Consult your tax advisor for detailed guidance.

Which Banks Offer The Best Checking Account Rewards?

Several banks offer competitive rewards. Popular options include Chase, Bank of America, and Discover. Compare their offerings to find the best fit for you.

Conclusion

Truist One Checking offers valuable rewards and benefits. No overdraft fees. Automatic upgrades. Open an account easily online. Earn $400 with qualifying activities. Manage your account with the Truist mobile app. Start your rewarding banking journey today by visiting Truist Retail Checking. Explore how Truist can make banking simple and beneficial for you. Remember, your financial well-being is just a few clicks away. Make the smart choice now!