Checking Account For Students: Unlock Financial Freedom Today

For students, managing finances can be overwhelming. A checking account simplifies this task.

The Truist One Checking account offers students a practical solution. Opening a checking account is a crucial step for students. It helps in managing daily expenses and developing financial responsibility. The Truist One Checking account stands out with its unique features tailored for students. It offers automatic upgrades, no overdraft fees, and easy online account opening. Plus, new customers can earn $400 by meeting specific requirements. This account not only simplifies banking but also provides tools for better financial management. Learn more about the Truist One Checking account here. Ready to take control of your finances? Read on to discover how this account can benefit you.

Introduction To Student Checking Accounts

Managing finances while in school can be challenging. A student checking account helps you stay on top of your money. It’s designed to meet the unique needs of students, making it easier to handle daily transactions.

What Is A Student Checking Account?

A student checking account is a type of bank account tailored for students. It typically offers lower fees and flexible requirements. These accounts often come with perks that cater specifically to the needs of students.

For instance, the Truist One Checking account offers features like automatic upgrades and no overdraft fees. This makes managing your money simpler and more efficient.

Why Students Need A Checking Account

Having a checking account is crucial for students for several reasons:

- Convenient Access: Easy management through mobile apps.

- Financial Independence: Helps in learning to manage money responsibly.

- No Overdraft Fees: Avoid unnecessary charges, like those provided by Truist One Checking.

Additionally, the Truist One Checking account allows students to earn $400 by opening an account and completing qualifying activities. This extra cash can be very useful for college expenses.

The Truist One Checking account also offers tools and insights to help manage spending and achieve financial goals. It’s perfect for students who want to start their financial journey on the right foot.

Key Features Of Student Checking Accounts

Student checking accounts offer unique features designed to meet the needs of students. They provide a flexible and cost-effective way to manage money while studying. Here are some key features that make student checking accounts an attractive option:

No Monthly Maintenance Fees

Many student checking accounts, like Truist One Checking, do not charge monthly maintenance fees. This feature ensures that students can save money each month, making it easier to manage their finances.

Low Minimum Balance Requirements

Student checking accounts often have low minimum balance requirements. For instance, the minimum opening deposit for Truist One Checking is just $50. This low barrier allows students to open an account with minimal financial stress.

Mobile And Online Banking

Modern student checking accounts offer mobile and online banking options. With Truist One Checking, students can manage their accounts through the Truist mobile app. This convenience allows students to monitor their finances, pay bills, and transfer money on the go.

Atm Access And Network

Access to a wide network of ATMs is crucial for students. Many student checking accounts provide extensive ATM access and may offer fee reimbursements for out-of-network ATM usage. Truist One Checking ensures students can access their money easily.

Overdraft Protection

Overdraft protection is a vital feature for students who may occasionally overdraw their accounts. Truist One Checking offers no overdraft fees, providing peace of mind and helping students avoid additional financial strain.

Pricing And Affordability

Understanding the pricing and affordability of a student checking account is vital. Students usually have limited funds, so finding an account with minimal fees and affordable features is essential. Let’s break down the key aspects.

Fee Structures

Many banks offer student checking accounts with different fee structures. Some accounts, like the Truist One Checking, have no overdraft fees, which is a significant advantage for students. Here’s a comparison of common fees:

| Bank | Monthly Fee | Overdraft Fee | Minimum Deposit |

|---|---|---|---|

| Truist One Checking | $0 | $0 | $50 |

| Bank A | $5 | $35 | $25 |

| Bank B | $3 | $30 | $100 |

Hidden Costs To Watch Out For

While many student accounts advertise low fees, it’s crucial to be aware of hidden costs. Some banks may charge for:

- ATM usage outside their network

- Paper statements

- Account maintenance if specific conditions are not met

The Truist One Checking account, for example, has no hidden overdraft fees, which can save students money. Always read the fine print to ensure there are no unexpected charges.

Comparing Different Banks’ Student Accounts

Comparing different banks’ student accounts can help you find the best fit. Here’s a quick comparison:

| Bank | Key Feature | Special Offer |

|---|---|---|

| Truist One Checking | No overdraft fees | Earn $400 with qualifying activities |

| Bank A | Low monthly fee | Free first order of checks |

| Bank B | High interest on balance | Free financial planning sessions |

By comparing features, fees, and special offers, students can find the most affordable and beneficial checking account.

Pros And Cons Of Student Checking Accounts

Student checking accounts offer unique benefits designed for young adults. However, they come with potential drawbacks. Understanding both sides can help you make an informed decision.

Advantages Of Student Checking Accounts

- No Overdraft Fees: Avoid penalties for overdrawing your account, offering peace of mind.

- Automatic Upgrades: Features automatically enhance over time, adapting to your changing needs.

- Convenient Access: Manage your account through the mobile app, making banking effortless.

- Earn $400: New customers can earn a reward by completing qualifying activities.

- Low Minimum Deposit: Only $50 required to open the account, making it accessible.

- Enhanced Financial Tools: Tools and insights help manage spending and reach financial goals.

Potential Drawbacks To Consider

- Geographic Restrictions: Account must be opened online and is limited to specific U.S. states.

- Age Requirement: Primary account holder must be 18 or older.

- Qualifying Activities: To earn the $400 reward, specific direct deposits must be completed within 120 days.

- Reward Forfeiture: The reward is forfeited if the account type is changed or closed before the reward is deposited.

- Limited to New Customers: Existing or recent Truist personal checking account holders are not eligible.

| Feature | Details |

|---|---|

| No Overdraft Fees | Avoid penalties for overdrawing your account. |

| Automatic Upgrades | Features enhance automatically over time. |

| Convenient Access | Manage your account through the mobile app. |

| Earn $400 | New customers can earn a reward by completing qualifying activities. |

| Low Minimum Deposit | Only $50 required to open the account. |

| Enhanced Financial Tools | Tools and insights help manage spending and reach financial goals. |

| Geographic Restrictions | Account must be opened online and is limited to specific U.S. states. |

| Age Requirement | Primary account holder must be 18 or older. |

| Qualifying Activities | Specific direct deposits must be completed within 120 days to earn the reward. |

| Reward Forfeiture | The reward is forfeited if the account type is changed or closed before the reward is deposited. |

| Limited to New Customers | Existing or recent Truist personal checking account holders are not eligible. |

Ideal Users And Scenarios For Student Checking Accounts

Student checking accounts offer distinct benefits tailored to meet the needs of young individuals. These accounts are beneficial for different stages of a student’s life and various scenarios.

Best For College Students

College students often deal with tight budgets and need accounts with no overdraft fees. The Truist One Checking account offers a perfect solution. It ensures students avoid costly fees even if their balance drops below zero.

Additionally, the account provides tools to help manage spending and reach financial goals. These features are essential for students who are learning to manage their finances independently.

Suitable For High School Students

High school students starting to handle their own money will benefit from a checking account like Truist One Checking. This account helps them understand banking basics and develop good financial habits.

With a minimum opening deposit of just $50, it is accessible and straightforward. The ability to manage the account through the Truist mobile app adds convenience for tech-savvy teenagers.

Perfect For Students Studying Abroad

Students studying abroad need easy access to their funds without worrying about overdraft fees. The Truist One Checking account is ideal for them. It eliminates fees and offers automatic upgrades over time, ensuring enhanced features as their needs grow.

Moreover, the online account opening process makes it easy for students to set up their accounts from anywhere. This feature is crucial for those preparing to move abroad.

Here’s a quick overview of the Truist One Checking account:

| Feature | Description |

|---|---|

| Automatic Upgrades | Account features improve automatically over time. |

| No Overdraft Fees | Avoid fees even if the balance drops below zero. |

| Online Account Opening | Open your account conveniently online. |

| Mobile App | Manage your account easily through the Truist mobile app. |

Considering these features, the Truist One Checking account stands out as a versatile and beneficial option for students at different stages of their education journey.

Conclusion: Empower Your Financial Future

Choosing the right checking account can empower students to take control of their financial future. Understanding the benefits and making informed decisions are key steps toward achieving financial independence.

Summary Of Benefits

- Automatic Upgrades: Account features enhance over time, providing better services and tools.

- No Overdraft Fees: Avoid penalties for overdrawing your account.

- Online Account Opening: Convenient online setup process saves time and effort.

- Earn $400: New customers can earn a $400 reward by meeting specific requirements.

- Convenient Access: Manage your account easily with the Truist mobile app.

- Enhanced Financial Management: Tools and insights to help manage spending and reach financial goals.

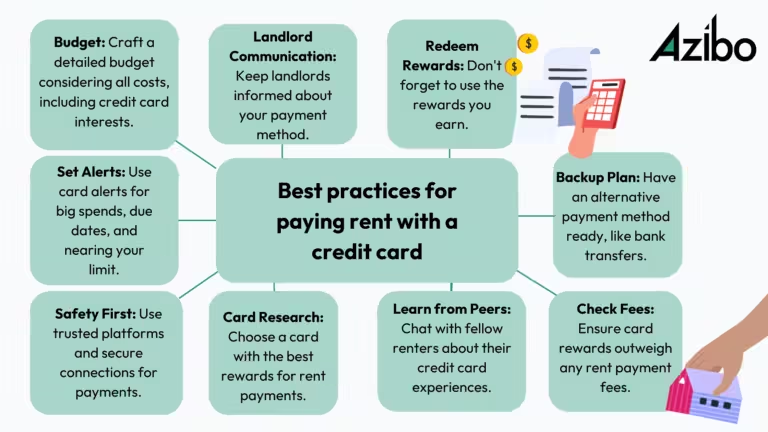

Tips For Choosing The Right Account

- Assess Your Needs: Determine what features are most important, such as no fees or easy access.

- Compare Options: Look at different accounts and compare their benefits and fees.

- Consider Accessibility: Ensure the account offers convenient online and mobile banking options.

- Check Eligibility: Make sure you meet the account’s requirements, such as age and residency.

- Understand Rewards: Know the criteria for earning rewards and any conditions that apply.

Final Thoughts On Financial Independence For Students

Achieving financial independence starts with the right checking account. With Truist One Checking, students benefit from features designed to support their financial growth. No overdraft fees, easy access, and the opportunity to earn rewards make it a smart choice for managing money effectively.

Take the first step towards a secure financial future by choosing an account that aligns with your needs and goals. Empower yourself with the right tools and resources, and watch your financial confidence grow.

Frequently Asked Questions

What Is A Student Checking Account?

A student checking account is a bank account designed for students. It offers low or no fees, making it budget-friendly. These accounts often have perks like no minimum balance and free online banking.

How To Open A Student Checking Account?

To open a student checking account, you typically need a government-issued ID. You may also need proof of enrollment in an educational institution. Some banks allow online applications, making it convenient.

Are There Fees For Student Checking Accounts?

Many student checking accounts have minimal or no fees. Banks often waive monthly maintenance fees for students. It’s important to check each bank’s fee schedule for specific details.

Can International Students Get A Checking Account?

Yes, international students can open a checking account. They may need additional documentation, such as a passport and student visa. Some banks have special accounts for international students.

Conclusion

Choosing a checking account as a student can be daunting. Truist One Checking offers many benefits, including no overdraft fees and easy online access. This account helps manage finances better and even provides a chance to earn $400. It’s a solid choice for students needing a reliable banking option. To learn more, visit the Truist website here. Start your financial journey confidently with Truist One Checking.