Checking Account For Families: Simplify Your Family’s Finances

Managing family finances can be challenging. A suitable checking account can make life easier.

Truist One Checking is an excellent choice for families. This account offers features like automatic upgrades and no overdraft fees, making it ideal for stress-free banking. Families need accounts that cater to their unique needs. Truist One Checking provides numerous benefits, including a $400 reward for new customers. By opening an account online and meeting specific requirements, families can enjoy this reward. The account also ensures no overdraft fees, which is crucial for managing a family budget. Moreover, automatic upgrades mean account benefits improve over time. Simplifying family finances is essential, and Truist One Checking is designed to help. Learn more about this account and its benefits here.

Introduction To Family Checking Accounts

Managing family finances can be challenging. A family checking account simplifies this task. It helps in organizing expenses, saving money, and budgeting effectively.

What Is A Family Checking Account?

A family checking account is a shared bank account. It allows multiple family members to access and manage funds. Each member can deposit and withdraw money, write checks, and monitor transactions. It is ideal for families wanting shared access to household funds.

The Purpose Of A Family Checking Account

The main purpose of a family checking account is to centralize financial management. It helps in tracking household expenses and ensures everyone is on the same page. This type of account also aids in budgeting and saving for common family goals.

Opening a family checking account like Truist One Checking offers numerous benefits:

- Automatic upgrades

- No overdraft fees

- Online account opening

- Earn $400 reward with qualifying activities

Here are some additional details for Truist One Checking:

| Minimum Opening Deposit | $50 |

|---|---|

| Eligibility | 18 or older, US residents, specified states |

| Reward Processing | $400 within 4 weeks after meeting requirements |

| Enrollment Instructions | Open account online with promo code DC2425TR1400 |

With a family checking account, managing joint finances becomes easier. It ensures transparency and accountability among family members. Choose a trusted bank like Truist to enjoy these benefits.

Key Features Of Family Checking Accounts

A family checking account offers various features to help manage finances efficiently. These accounts ensure that all family members have easy access while maintaining control over spending. Let’s explore the key features that make family checking accounts a smart choice for households.

Joint Account Access

Joint account access allows multiple family members to use the account. This feature is essential for households where both parents need to manage expenses. It ensures transparency and simplifies tracking of all transactions.

With Truist One Checking, joint account access ensures both parents can monitor spending, receive notifications, and manage the account together.

Allowance And Budgeting Tools

Family checking accounts often include allowance and budgeting tools. These tools help parents allocate funds for each child and track their spending. They can set up automatic transfers and monitor how allowances are spent.

Having these tools integrated into the account helps teach children financial responsibility and ensures that the family stays within budget.

Parental Controls And Spending Limits

Setting parental controls and spending limits is crucial for managing a family checking account. Parents can set spending limits for each child, ensuring they do not overspend.

These controls provide peace of mind, knowing that children can only access a certain amount of money, reducing the risk of financial mishaps.

Automated Savings Options

Automated savings options help families save money effortlessly. Parents can set up automatic transfers to a savings account, ensuring regular contributions without manual intervention.

For example, Truist One Checking offers automatic upgrades that enhance account benefits over time, including savings features.

Mobile Banking And Notifications

Mobile banking and notifications are essential for modern family checking accounts. They allow families to manage their account on-the-go, access real-time transaction details, and receive important alerts.

With the Truist One Checking account, mobile banking features provide easy access to account information, making it simple to stay informed and manage finances efficiently.

Pricing And Affordability Breakdown

Choosing the right checking account for your family involves understanding the costs. Let’s explore the pricing and affordability aspects of Truist One Checking. This will help you make an informed decision.

Monthly Fees And Minimum Balances

Truist One Checking offers a straightforward approach to monthly fees. Here’s what you need to know:

- Minimum Opening Deposit: $50

- Monthly Maintenance Fees: None mentioned

This account stands out with no monthly maintenance fees, making it an affordable option for families. The low minimum opening deposit of $50 makes it accessible.

Transaction And Overdraft Fees

Understanding transaction and overdraft fees is crucial for managing your finances. Truist One Checking offers significant benefits:

- Overdraft Fees: None

- Transaction Fees: No specific transaction fees mentioned

With no overdraft fees, families can enjoy stress-free banking. This feature is particularly beneficial during unexpected expenses.

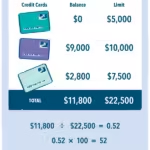

Comparing Different Providers

Comparing different checking account providers helps identify the best option. Here’s a quick comparison of Truist One Checking with typical features of other providers:

| Feature | Truist One Checking | Other Providers |

|---|---|---|

| Minimum Opening Deposit | $50 | $100 – $500 |

| Monthly Maintenance Fees | None | $10 – $25 |

| Overdraft Fees | None | $30 – $35 per instance |

| Reward for New Customers | $400 | Varies, often none |

Truist One Checking offers competitive advantages, especially with its no-fee structure and new customer reward. This makes it a strong contender for families seeking affordable banking solutions.

Pros And Cons Of Family Checking Accounts

Family checking accounts offer several benefits and some drawbacks. They can simplify financial management for families, but there are potential downsides to consider. Below, we’ll explore both sides of using a family checking account.

Advantages Of Using A Family Checking Account

Family checking accounts can provide significant advantages for households. These include:

- Convenient Monitoring: Easy tracking of all family expenses in one place.

- Shared Access: Multiple family members can access the account, simplifying bill payments.

- Cost-Efficient: Typically lower fees compared to having multiple individual accounts.

- Overdraft Protection: Features like no overdraft fees can reduce financial stress.

- Automatic Upgrades: Accounts like Truist One Checking offer automatic upgrades, enhancing benefits over time.

Potential Drawbacks And Considerations

There are also some potential drawbacks and considerations with family checking accounts, such as:

- Limited Privacy: All account holders can see each other’s transactions.

- Responsibility: Each family member must act responsibly to avoid misuse.

- Eligibility: Some accounts have specific eligibility requirements, like Truist One Checking, which requires US residency and excludes existing or recently closed account holders.

- Reward Forfeiture: Rewards like the $400 bonus from Truist One Checking can be forfeited if certain conditions are not met.

Specific Recommendations For Ideal Users

Choosing the right checking account can be challenging, especially with a family to consider. Truist One Checking offers unique benefits tailored for different family needs. Here are some specific recommendations for ideal users.

Families With Teenagers

Teenagers often need guidance on managing their finances. Truist One Checking provides automatic upgrades which can be useful for families teaching financial responsibility. The account has no overdraft fees, making it a safe choice for teens who are learning to manage their money.

Additionally, the option to open the account online simplifies the process for busy families. The $400 reward for new customers can also serve as an excellent financial lesson for teens, showing them the benefits of smart banking choices.

Busy Households With Multiple Incomes

For households with multiple income streams, managing finances can get complicated. Truist One Checking is designed to simplify banking with its automatic upgrades and no monthly maintenance fees. This makes it easier to keep track of multiple transactions without worrying about additional costs.

| Feature | Benefit |

|---|---|

| Automatic upgrades | Enhances account benefits over time |

| No overdraft fees | Stress-free banking |

| Online account opening | Convenient and quick |

| $400 reward | Extra financial boost |

Families Focused On Saving And Budgeting

Truist One Checking is ideal for families focused on saving and budgeting. The account offers no overdraft fees, which helps in avoiding unexpected costs. The $50 minimum opening deposit is manageable, and the $400 reward can be a significant addition to family savings.

The automatic upgrades feature enhances account benefits over time, making it easier to manage and grow your savings. By opening the account online and completing the qualifying activities, families can take advantage of these rewards and focus on building a strong financial future.

Frequently Asked Questions

What Is A Family Checking Account?

A family checking account is a joint account shared by family members. It allows multiple people to access and manage funds. This can help with household budgeting and expenses.

How Do Family Checking Accounts Work?

Family checking accounts work like regular checking accounts but allow multiple users. Each family member can deposit, withdraw, and manage money. It simplifies shared expenses and budgeting.

Are Family Checking Accounts Safe?

Yes, family checking accounts are safe with proper management. Banks offer security measures to protect your funds. Ensure all users understand account responsibilities and security protocols.

What Are The Benefits Of A Family Checking Account?

Family checking accounts offer convenience and easy money management. They simplify shared expenses, budgeting, and financial planning. They also provide transparency in family finances.

Conclusion

Truist One Checking offers a smart solution for family banking needs. Enjoy automatic upgrades and no overdraft fees. New customers can earn a $400 reward. Open your account online and start enjoying benefits today. Simple, stress-free banking awaits. Learn more about Truist One Checking here.