Credit Score Improvement Programs: Boost Your Financial Health

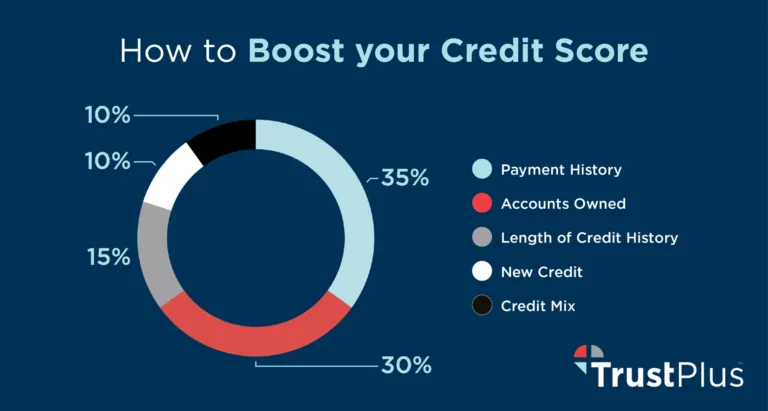

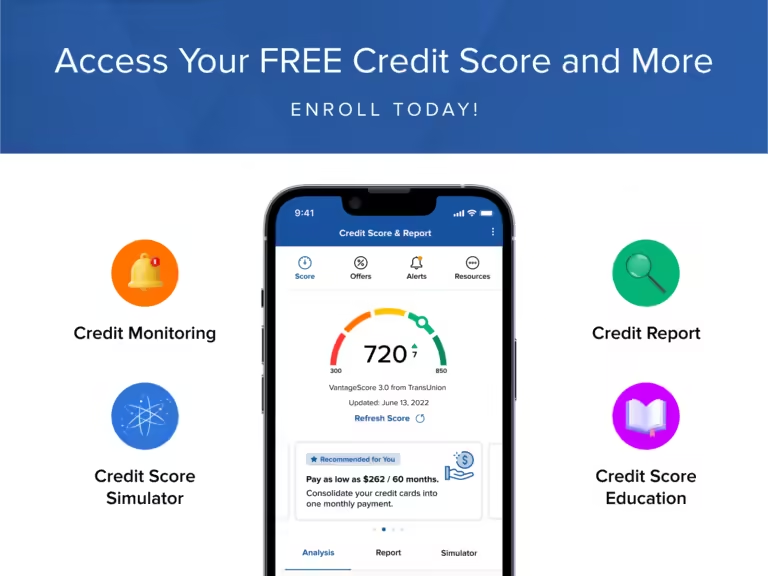

Improving your credit score can open doors to better financial opportunities. Credit score improvement programs can guide you on this path. Credit scores are vital for financial health. They affect loan approvals, interest rates, and even job prospects. Many people struggle to understand how to improve their scores. This is where credit score improvement programs…