Cashback Credit Card Comparison: Find the Best Rewards Today

Cashback credit cards can save you money. They give back a percentage of what you spend.

But, not all cashback cards are the same. Comparing them helps you choose the best one for your needs. When you shop with a cashback credit card, you earn rewards on your purchases. This is great for saving money and getting extra perks. But, with so many options available, how do you pick the right one? A good comparison will highlight the key differences in rewards, fees, and benefits. This way, you can find the card that fits your spending habits best. Ready to start saving? Check out our detailed cashback credit card comparison to make an informed choice. Visit Freecash: https://freecash.com/en for more details.

Introduction To Cashback Credit Cards

Cashback credit cards are a popular financial tool. They offer rewards in the form of cash for your spending. Understanding how they work can help you save money.

Understanding Cashback Credit Cards

A cashback credit card gives you a percentage of your spending back as cash. This is usually a small percentage, like 1% to 5%. The cashback amount depends on the card and your spending categories.

- For example, you might earn 1% on all purchases.

- Some cards offer higher rates for specific categories.

Each card has different rules and rates. It’s important to read the terms carefully.

Why Cashback Credit Cards Are Popular

Cashback credit cards are popular because they offer real money back. This can help reduce your expenses. Many people use them for everyday purchases. Common categories include:

- Groceries

- Gas

- Online shopping

Using these cards wisely can lead to significant savings over time.

Another reason for their popularity is the simplicity. You don’t need to worry about points or miles. The cashback is straightforward and easy to understand.

Key Features Of Top Cashback Credit Cards

Choosing the right cashback credit card can be challenging. Each card offers different features and benefits. To make an informed decision, it’s important to consider key aspects. This section breaks down the essential features of top cashback credit cards.

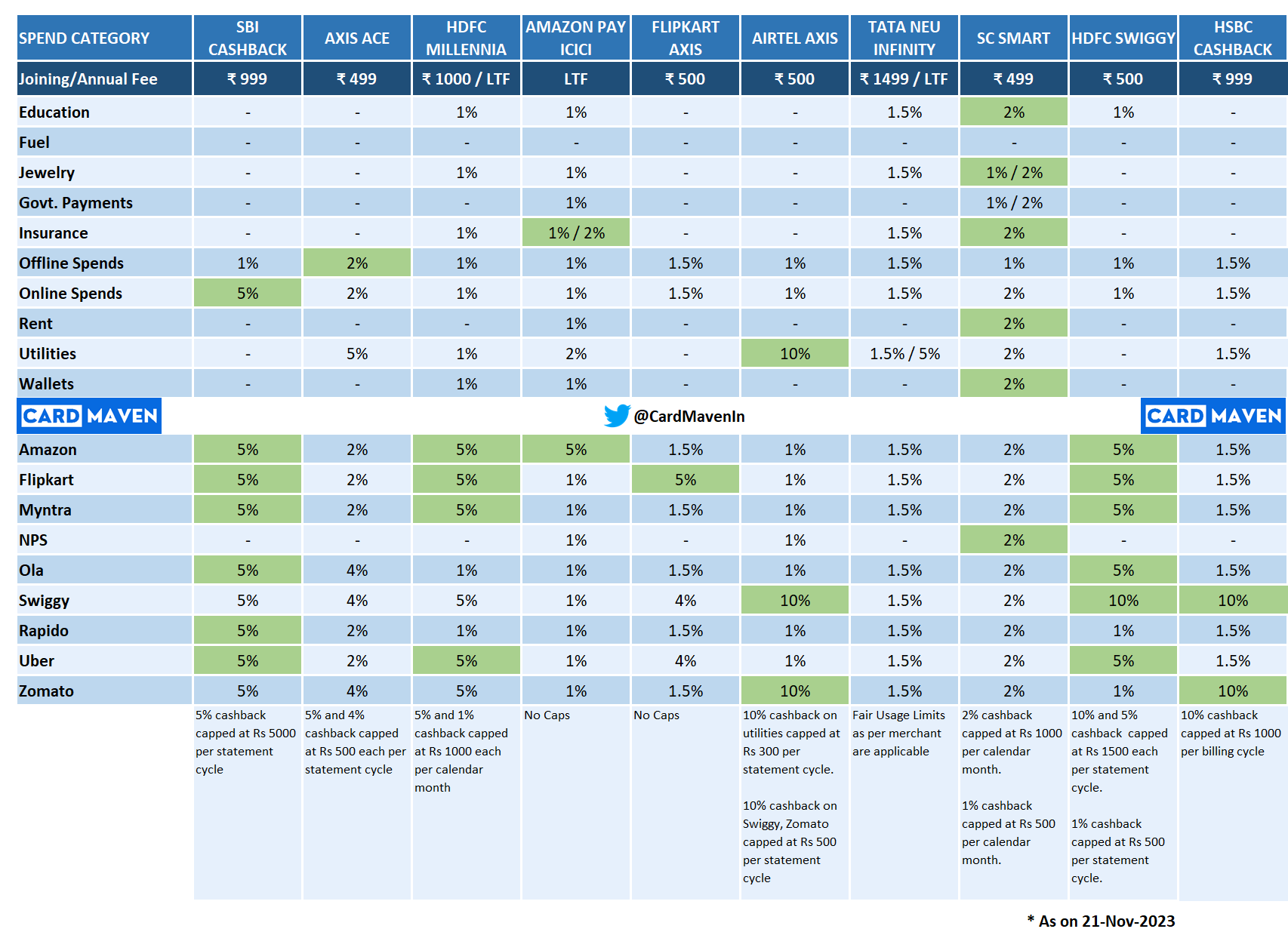

Cashback Rates And Categories

Cashback rates and categories vary by card. Some cards offer a flat rate on all purchases. Others provide higher rates in specific categories such as groceries, dining, or travel.

- Flat-rate cards: Earn a consistent percentage on all transactions.

- Category-specific cards: Higher cashback in select categories.

Understanding these rates helps you maximize your rewards based on your spending habits.

Introductory Offers And Sign-up Bonuses

Many cashback credit cards offer enticing introductory offers. These can include:

- Sign-up bonuses: Earn a bonus after spending a certain amount in the first few months.

- Introductory cashback rates: Higher cashback rates during the initial months.

These offers can provide significant value, especially if you plan to make large purchases soon after getting the card.

Annual Fees And Other Charges

Annual fees and other charges are crucial factors to consider. Some cards come with no annual fee, while others may charge a fee in exchange for better rewards.

| Card Type | Annual Fee | Benefits |

|---|---|---|

| No Annual Fee | $0 | Basic cashback rewards |

| Premium Cards | $50 – $100 | Enhanced rewards and perks |

Weigh the annual fee against the potential cashback earnings to determine value.

Additional Perks And Benefits

Additional perks can enhance the overall value of a cashback credit card. Look for benefits such as:

- Travel insurance and protection

- Purchase protection and extended warranties

- Exclusive access to events and experiences

These perks can add significant value beyond the cashback rewards, making your card more beneficial.

Comparing Cashback Credit Cards

Choosing the best cashback credit card can be tough. Each card offers different features, benefits, and drawbacks. This section will help you compare some of the popular cashback credit cards. Making an informed decision can save you money and earn rewards.

Card A: Features, Benefits, And Drawbacks

Features:

- 1.5% cashback on all purchases

- No annual fee

- 0% APR for the first 12 months

- Mobile app for easy tracking

Benefits:

- Simple rewards structure

- Great for everyday spending

- No fees to worry about

Drawbacks:

- No bonus categories for higher rewards

- Standard APR after the first year is high

Card B: Features, Benefits, And Drawbacks

Features:

- 5% cashback on rotating categories

- 1% cashback on all other purchases

- $200 signup bonus after spending $500 in the first 3 months

- Free credit score monitoring

Benefits:

- High rewards on bonus categories

- Generous signup bonus

- Helps track and improve your credit score

Drawbacks:

- Requires activation of bonus categories each quarter

- Annual fee after the first year

Card C: Features, Benefits, And Drawbacks

Features:

- 2% cashback on grocery and gas purchases

- 1% cashback on all other purchases

- No annual fee

- Extended warranty protection

Benefits:

- Higher rewards on grocery and gas

- No fee for card ownership

- Added protection on purchases

Drawbacks:

- Lower rewards on non-grocery or gas purchases

- No introductory APR offer

Pricing And Affordability Breakdown

Understanding the pricing and affordability of cashback credit cards is crucial. This includes annual fees, interest rates, APR, and hidden fees. Let’s break down each of these factors to help you make an informed decision.

Annual Fees Analysis

Annual fees can vary significantly among cashback credit cards. Some cards offer no annual fee, while others can charge up to $100 or more. Here is a comparison of common annual fees:

| Card Type | Annual Fee |

|---|---|

| No Annual Fee Cards | $0 |

| Low Annual Fee Cards | $20 – $50 |

| Premium Cards | $100+ |

Interest Rates And Apr

Interest rates and APR (Annual Percentage Rate) are critical to evaluate. A lower APR means less interest on unpaid balances. Here’s a general overview:

- Low APR Cards: 12% – 15%

- Average APR Cards: 16% – 20%

- High APR Cards: 21% and above

Tip: Pay off your balance monthly to avoid high interest charges.

Hidden Fees And Charges

Hidden fees can catch you by surprise. Be aware of these common charges:

- Late Payment Fees: Up to $40

- Foreign Transaction Fees: 2% – 3% of the transaction amount

- Balance Transfer Fees: 3% – 5% of the transferred amount

- Cash Advance Fees: $10 or 5% of the amount, whichever is higher

Always read the terms and conditions to understand all possible fees.

Pros And Cons Of Cashback Credit Cards

Cashback credit cards can be a great tool for earning rewards on your everyday purchases. They offer various benefits and potential drawbacks that are important to consider before applying. Understanding these pros and cons can help you make an informed decision.

Advantages Of Cashback Credit Cards

Cashback credit cards provide several advantages:

- Earn Rewards: Receive a percentage of your spending back as cash. This can be used on anything you like.

- Simple Rewards Structure: Many cashback cards offer straightforward rewards. No need to track points or miles.

- Flexible Redemption: Use the cashback for statement credits, gift cards, or direct deposits.

- Introductory Offers: Some cards come with sign-up bonuses. Spend a certain amount in the first few months and get extra cashback.

Potential Drawbacks And Risks

While cashback credit cards offer many benefits, they also have some drawbacks and risks:

- High Interest Rates: Carrying a balance can lead to high interest charges. This can negate the cashback benefits.

- Annual Fees: Some cards come with annual fees. Ensure the rewards outweigh these fees.

- Spending Temptation: The lure of cashback rewards can lead to overspending. This can result in debt.

- Limited Rewards Categories: Some cards offer higher cashback on specific categories. Ensure these categories match your spending habits.

By weighing these pros and cons, you can determine if a cashback credit card is right for your financial situation.

Specific Recommendations For Ideal Users

Choosing the right cashback credit card can be overwhelming. Understanding your spending habits helps. Below are specific recommendations for different types of users. Find the best cashback credit cards for everyday purchases, travel and dining, and online shopping.

Best Cashback Credit Cards For Everyday Purchases

For daily expenses, certain credit cards offer higher rewards on groceries, gas, and other common items. Here are some top picks:

| Credit Card | Cashback Rate | Categories | Annual Fee |

|---|---|---|---|

| Card A | 5% | Groceries, Gas | $0 |

| Card B | 3% | Dining, Pharmacy | $50 |

Choose a card that matches your daily spending needs. This maximizes your cashback.

Best Cashback Credit Cards For Travel And Dining

If you travel often or eat out a lot, look for cards that reward these activities. Here are some recommendations:

- Card C: 4% cashback on dining and travel, no foreign transaction fees, $95 annual fee.

- Card D: 3% cashback on all travel expenses, 2% on dining, $0 annual fee.

These cards help you save more on experiences rather than purchases.

Best Cashback Credit Cards For Online Shopping

Online shoppers can benefit from credit cards with higher cashback rates for online purchases. Here are some top cards:

- Card E: 5% cashback on all online transactions, $25 annual fee.

- Card F: 4% cashback on selected online retailers, $0 annual fee.

Maximize your savings by using these cards for online purchases.

Frequently Asked Questions

What Is A Cashback Credit Card?

A cashback credit card gives you a percentage back on purchases. This reward is usually credited back to your account. It can also be used for statement credits, gift cards, or other rewards.

How Do Cashback Credit Cards Work?

Cashback credit cards return a small percentage of your spending. This is usually between 1% to 5%. The cashback can be redeemed as statement credits, checks, or gift cards.

Are Cashback Credit Cards Worth It?

Yes, if you use them wisely. They offer rewards on purchases you would make anyway. Ensure you pay off the balance monthly to avoid interest charges.

What Are The Best Cashback Credit Cards?

The best cashback credit cards offer high rewards on everyday spending. They also have low fees and flexible redemption options. Research and compare cards to find the best fit for your needs.

Conclusion

Choosing the right cashback credit card can be challenging. Compare carefully. Each card offers unique benefits and rewards. Consider your spending habits and preferences. Visit Freecash for more information. Make an informed decision. Save money and earn rewards. Happy spending!