Buy Wirex Credit Card: Unlock Digital Payment Freedom

Are you searching for a versatile credit card that supports cryptocurrency? The Wirex Credit Card might be the solution you need.

This card is designed to offer high rewards and seamless crypto transactions. Wirex Card is not just any debit card; it’s a modern banking alternative for the Web3 era. It allows you to earn crypto rewards, avoid foreign exchange fees, and enjoy high-interest earnings. Imagine earning up to 8% back in crypto on every purchase and up to 16% interest on your savings. Trusted by millions worldwide, Wirex makes spending and managing digital assets easy and secure. Ready to explore the benefits of the Wirex Card? Visit Wirex to get started today.

Introduction To Wirex Credit Card

The Wirex Credit Card is a unique financial tool. It merges traditional banking with the power of cryptocurrencies. This card is designed for the modern, tech-savvy individual.

Overview Of Wirex

Wirex is a global leader in digital payments. Founded in 2014, it has over 6 million customers. Wirex has processed over $20 billion in transactions. The company offers a secure and user-friendly platform.

Wirex’s main office is located in Milan, Italy. It provides various financial services, including the Wirex Card. The card is a secure and free debit card for Web3 transactions.

Purpose And Benefits Of The Wirex Credit Card

The Wirex Credit Card offers numerous benefits:

- Cryptoback™ Rewards: Earn up to 8% crypto rewards on every transaction.

- No Foreign Exchange Fees: Enjoy 0% foreign exchange fees globally.

- X-Accounts: Earn up to 16% Variable AER on selected currencies.

- DUO Passive Earnings: Generate up to 360% APR.

- Institutional Asset Pricing: Buy digital assets at the same price as institutions.

- High Limits and No Fees: Free ATM withdrawals, unlimited spending, no monthly fee.

- Cross-Chain Bridge: Free and instant cross-chain bridge for stablecoins and crypto.

- Stablecoin Support: Supports top stablecoins like USDC and USDT on multiple blockchains.

- Crypto Borrowing: Borrow stablecoins starting at 0% APR without credit checks.

Wirex offers three pricing plans:

| Plan | Monthly Fee | Cryptoback™ Rewards | Annual Savings Bonus | APR on X-Accounts |

|---|---|---|---|---|

| Standard Plan | Free | Up to 1% | None | None |

| Premium Plan | $9.99/month | Up to 3% | Up to 6% | None |

| Elite Plan | $29.99/month | Up to 8% | Up to 16% | Up to 20% |

Wirex ensures high security with $30 million insurance on digital assets. The card is accessible with Google Pay™ in Australia. It is trusted globally for its reliable services.

Key Features Of The Wirex Credit Card

The Wirex Credit Card offers several unique features, making it a versatile tool for both crypto enthusiasts and everyday users. Let’s delve into the key aspects that set the Wirex Credit Card apart.

Multi-currency Support

The Wirex Card supports multiple currencies, including both fiat and cryptocurrencies. This feature allows you to hold and spend various currencies without the need for multiple cards.

| Type | Currencies Supported |

|---|---|

| Fiat | USD, EUR, GBP, and more |

| Crypto | Bitcoin, Ethereum, Litecoin, and stablecoins like USDC and USDT |

Crypto And Fiat Integration

Wirex seamlessly integrates crypto and fiat currencies. Users can easily convert between their crypto and fiat balances, simplifying transactions and making everyday spending easier.

Instant Exchange And Transactions

The Wirex Card offers instant exchange between supported currencies. Transactions are processed quickly, ensuring you can access your funds when you need them most.

- Instant conversion between crypto and fiat

- Fast transaction processing

- No delays in accessing funds

Rewards And Cashback Program

With the Wirex Card, you earn up to 8% Cryptoback™ rewards on every transaction. This rewards program is available across different tiers, catering to various user needs.

- Standard Plan: Free, up to 1% Cryptoback™ rewards

- Premium Plan: $9.99/month, up to 3% Cryptoback™ rewards

- Elite Plan: $29.99/month, up to 8% Cryptoback™ rewards

Global Acceptance And Usage

The Wirex Card is accepted worldwide, making it a reliable option for international travelers. Enjoy 0% foreign exchange fees and free ATM withdrawals globally.

- Accepted in over 200 countries

- No foreign exchange fees

- Free ATM withdrawals

Pricing And Affordability Breakdown

The Wirex Card offers a secure and cost-effective solution for managing crypto transactions. Understanding the various fees associated with the card is essential for maximizing its benefits. Below is a comprehensive breakdown of the Wirex Card’s pricing and affordability.

Card Issuance Fees

The Wirex Card provides a seamless experience with no issuance fees. Both new and existing users can obtain the card without any additional costs, making it an attractive option for crypto enthusiasts.

Transaction Fees

Wirex Card users benefit from 0% foreign exchange fees globally, allowing for worry-free international transactions. Additionally, the card supports free ATM withdrawals, ensuring you can access your funds conveniently.

Monthly Maintenance Fees

| Plan | Monthly Fee | Rewards | Additional Benefits |

|---|---|---|---|

| Standard Plan | Free | Up to 1% Cryptoback™ rewards | None |

| Premium Plan | $9.99/month | Up to 3% Cryptoback™ rewards | Up to 6% annual savings bonus |

| Elite Plan | $29.99/month | Up to 8% Cryptoback™ rewards | Up to 16% annual savings bonus, up to 20% APR on X-Accounts |

Currency Exchange Rates And Fees

The Wirex Card stands out with its 0% foreign exchange fees, offering a major advantage for users who frequently travel or make international purchases. This feature ensures that you get the best value for your money without any hidden charges.

Additionally, the card supports instant cross-chain bridge for stablecoins and crypto, enabling free and fast transactions across different blockchains.

Wirex also provides institutional asset pricing, allowing users to buy digital assets at the same rates as institutions. This can be a significant cost-saving feature for those involved in frequent crypto trading.

With the Wirex Card, you can enjoy high rewards and interest earnings, making it a versatile and affordable option for managing your finances in the digital age.

Pros And Cons Of The Wirex Credit Card

The Wirex Credit Card is a versatile financial tool designed for crypto enthusiasts. It offers numerous benefits but also has some limitations. Below, we will discuss the pros and cons of using the Wirex Credit Card.

Advantages Of Using Wirex Credit Card

- Cryptoback™ Rewards: Earn up to 8% crypto rewards on every transaction.

- No Foreign Exchange Fees: Enjoy 0% foreign exchange fees globally.

- X-Accounts: Earn up to 16% variable AER on selected currencies.

- DUO Passive Earnings: Generate up to 360% APR.

- Institutional Asset Pricing: Buy digital assets at the same price as institutions.

- High Limits and No Fees: Free ATM withdrawals, unlimited spending, no monthly fee.

- Cross-Chain Bridge: Free and instant cross-chain bridge for stablecoins and crypto.

- Stablecoin Support: Supports top stablecoins like USDC and USDT on multiple blockchains.

- Crypto Borrowing: Borrow stablecoins starting at 0% APR without credit checks.

- Security: $30 million insurance on digital assets.

Potential Drawbacks And Limitations

- Jurisdictional Limitations: Availability subject to regulatory restrictions in certain jurisdictions.

- Monthly Fees: Premium and Elite plans have monthly fees of $9.99 and $29.99, respectively.

- Dependence on Crypto: Rewards and features are primarily beneficial for crypto users.

- Limited Physical Presence: Mostly operates online, which may be a drawback for some users.

Specific Recommendations For Ideal Users

The Wirex Card offers a host of features that make it a versatile option for a variety of users. Below are specific recommendations for who should consider getting a Wirex Credit Card and the best use cases and scenarios.

Who Should Consider Getting A Wirex Credit Card

Crypto Enthusiasts:

- Those who actively engage in cryptocurrency transactions

- Individuals looking to earn up to 8% Cryptoback™ rewards

Frequent Travelers:

- People who travel internationally and want 0% foreign exchange fees

- Those who prefer free ATM withdrawals globally

Investors:

- Users interested in earning up to 16% annual interest with X-Accounts

- Individuals seeking high APR up to 360% with DUO Passive Earnings

Security-Conscious Users:

- People who prioritize the security of their digital assets

- Individuals who value $30 million insurance on their assets

Best Use Cases And Scenarios

Daily Purchases:

- Use the Wirex Card for everyday transactions to earn crypto rewards

- Make purchases both online and offline without foreign exchange fees

Investing in Digital Assets:

- Buy digital assets at institutional asset pricing

- Utilize stablecoin support for diversified investments

Savings and Earnings:

- Earn high interest with X-Accounts and DUO Passive Earnings

- Benefit from up to 16% annual savings bonus

Financial Flexibility:

- Borrow stablecoins with no credit checks starting at 0% APR

- Enjoy unlimited spending and no monthly fee

Global Usage:

- Use the card globally with no foreign exchange fees

- Access free and instant cross-chain bridge for stablecoins and crypto

Conclusion: Embrace Digital Payment Freedom With Wirex

The Wirex Card offers a secure and free debit card designed for Web3. It facilitates easy on and off-ramp for everyday crypto transactions. With its numerous features and benefits, the Wirex Card stands out as an alternative banking solution.

Summary Of Key Points

- Cryptoback™ Rewards: Earn up to 8% crypto rewards on every transaction.

- No Foreign Exchange Fees: 0% fees globally.

- X-Accounts: Earn up to 16% Variable AER on selected currencies.

- DUO Passive Earnings: Generate up to 360% APR.

- Institutional Asset Pricing: Buy digital assets at institutional prices.

- High Limits and No Fees: Free ATM withdrawals, unlimited spending, no monthly fees.

- Cross-Chain Bridge: Free and instant cross-chain bridge for stablecoins and crypto.

- Stablecoin Support: Supports USDC and USDT on multiple blockchains.

- Crypto Borrowing: Borrow stablecoins starting at 0% APR without credit checks.

Final Thoughts And Encouragement

The Wirex Card is more than just a payment method. It’s an innovative solution for those who embrace the digital currency revolution. Its benefits go beyond traditional banking, offering high rewards, interest earnings, and unparalleled security.

Whether you are a seasoned trader or new to crypto, Wirex provides tools and benefits to help you maximize your digital assets. With its global reach and trusted by millions, Wirex continues to lead in the crypto banking industry.

Start enjoying the freedom of digital payments today with the Wirex Card.

Frequently Asked Questions

What Are The Benefits Of Wirex Credit Card?

The Wirex Credit Card offers numerous benefits. It provides seamless cryptocurrency and fiat transactions. Users enjoy low fees, instant notifications, and cashback rewards. It’s highly secure with advanced encryption.

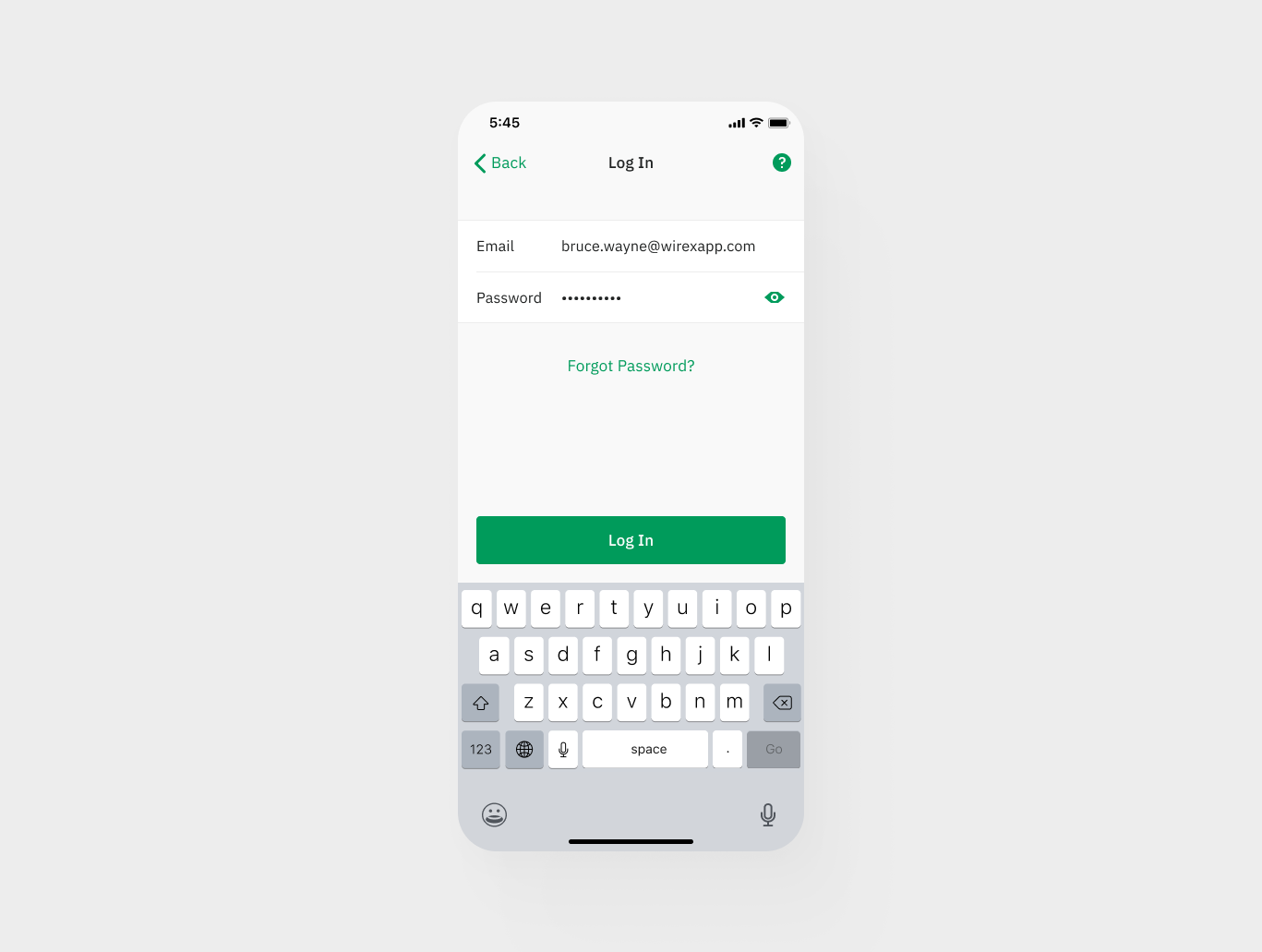

How To Apply For Wirex Credit Card?

Applying for a Wirex Credit Card is simple. Sign up on the Wirex website. Complete the required verification process. Once verified, you can order your card.

Is Wirex Credit Card Secure?

Yes, the Wirex Credit Card is secure. It uses advanced encryption technology. This ensures all transactions are safe. Additionally, it offers instant notifications for every transaction.

Can I Use Wirex Credit Card Internationally?

Yes, the Wirex Credit Card can be used internationally. It supports multiple currencies. This makes it convenient for global transactions. Enjoy seamless spending worldwide.

Conclusion

Choosing the Wirex Card offers numerous benefits. Enjoy high crypto rewards, no foreign exchange fees, and interest earnings. It’s secure, globally trusted, and user-friendly. Perfect for everyday crypto transactions. Click here to learn more and get started today.