Buy Now Pay Later: Unlock Financial Flexibility Today

Are you tired of paying interest on your credit card purchases? Meet Perpay, a service that lets you buy now and pay later without interest or fees.

Imagine shopping for top brands, building your credit, and managing payments effortlessly. Perpay offers a unique solution for those looking to improve their credit score while enjoying a wide range of products. It automatically deducts payments from your paycheck, ensuring you stay on track. With the Perpay Credit Card, you can shop anywhere Mastercard is accepted and earn rewards. This service is perfect for managing finances without incurring extra costs. Ready to learn more about how Perpay can benefit you? Click here to explore their offerings.

Introduction To ‘buy Now Pay Later’ (bnpl)

In today’s fast-paced world, financial flexibility is crucial. One service that offers such flexibility is Buy Now Pay Later (BNPL). This payment option allows consumers to purchase products immediately and pay for them over time. Let’s dive into the details of BNPL and understand its growing popularity.

What Is Buy Now Pay Later?

Buy Now Pay Later, often abbreviated as BNPL, is a financial service that allows users to buy products and pay for them in installments. This can be over a few weeks or months. The primary appeal of BNPL is that it provides immediate access to products without the need for upfront payment.

BNPL services typically come with no interest or fees, as long as payments are made on time. This makes it an attractive option for consumers who need flexibility in their spending. Many BNPL providers also offer additional benefits, such as rewards programs or credit-building opportunities.

The Rise Of Bnpl In The Financial World

In recent years, BNPL has seen significant growth. More consumers are opting for BNPL services due to their convenience and flexibility. This growth is reflected in the increasing number of companies offering BNPL options, including major retailers and financial institutions.

BNPL services like Perpay have gained popularity due to their unique features. Perpay offers a marketplace with top brands, a credit card for additional flexibility, and a credit-building service. These features make it a comprehensive solution for consumers looking to manage their finances effectively.

According to industry reports, the use of BNPL services has surged, especially among younger consumers. This trend is expected to continue as more people become aware of the benefits of BNPL and seek alternatives to traditional credit options.

| Feature | Benefit |

|---|---|

| Perpay Marketplace | Access to a variety of top brands |

| Perpay Credit Card | Earn 2% rewards |

| Credit Building | Automatic payments help build credit |

| Mobile Accessibility | Manage payments on the go |

Overall, the rise of BNPL in the financial world highlights a shift towards more consumer-friendly payment solutions. As more people embrace this model, it’s likely that BNPL will continue to evolve and offer even greater benefits to users.

Key Features Of Buy Now Pay Later

Buy Now Pay Later (BNPL) services have gained popularity due to their convenience and flexibility. These services offer a range of features that make them an attractive option for consumers. Here, we explore the key features of BNPL, focusing on Interest-Free Periods, Flexible Repayment Plans, Instant Approval Process, and Seamless Integration with Online Shopping.

Interest-free Periods

One of the standout features of BNPL services like Perpay is the interest-free periods. Users can spread their payments over a set period without incurring any additional interest. This means you can purchase items now and pay for them later without worrying about extra costs.

| Feature | Details |

|---|---|

| Interest-Free Period | No interest on payments spread over time |

| Cost | Zero additional fees |

Flexible Repayment Plans

BNPL services offer flexible repayment plans to suit different financial situations. Perpay, for example, allows users to pay with their paycheck, making it easier to manage payments. You can choose a plan that fits your budget and schedule, ensuring you don’t miss any payments.

- Multiple payment plans

- Pay with your paycheck

- Manageable payment schedules

Instant Approval Process

Another key feature of BNPL services is the instant approval process. With Perpay, you can get approved quickly and start shopping right away. This quick approval process makes it convenient for users to make purchases without waiting for long approval times.

- Quick approval

- Start shopping immediately

- No lengthy processes

Seamless Integration With Online Shopping

BNPL services integrate seamlessly with online shopping platforms. With Perpay, you can access a marketplace of top brands and make purchases directly through the app. This integration simplifies the shopping experience, making it easy to buy and pay later.

| Integration | Benefits |

|---|---|

| Perpay Marketplace | Access to various top brands |

| Mobile App | Shop and pay on the go |

How Buy Now Pay Later Benefits Consumers

Buy Now Pay Later (BNPL) services have surged in popularity, offering consumers a flexible way to manage their finances. Services like Perpay allow users to purchase products and pay over time without incurring interest or fees. Below are the key benefits that BNPL services provide to consumers.

Increased Purchasing Power

With BNPL, consumers can increase their purchasing power significantly. Perpay users unlock $1,000 to shop for a variety of products from top brands in electronics, home goods, apparel, and more. This increased purchasing power enables consumers to buy items they may not afford upfront, spreading the cost over manageable payments.

| Feature | Benefit |

|---|---|

| Perpay Marketplace | Access to top brands and high-end products |

| Credit Card Use | Use anywhere Mastercard is accepted |

Improved Cash Flow Management

BNPL services like Perpay help consumers manage their cash flow better. Automatic deductions from paychecks ensure that payments are made on time, reducing the risk of missed payments. This system helps consumers plan their monthly budgets more effectively.

- Automatic Payments: Reduces the burden of remembering due dates.

- No Interest or Fees: Payments are made without additional costs.

Convenience And Ease Of Use

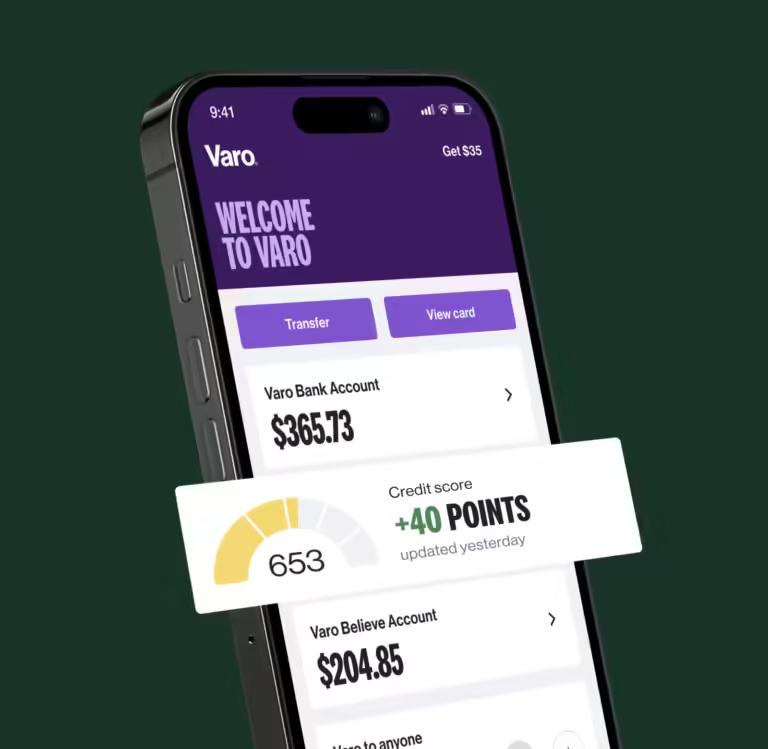

BNPL services offer unparalleled convenience. Perpay provides a mobile app, enabling consumers to manage their purchases and payments on the go. The service is designed to be user-friendly, making it easy for even non-tech-savvy individuals to navigate.

- Download the Perpay mobile app.

- Select products from the marketplace.

- Set up automatic payments directly from your paycheck.

Additionally, the Perpay Credit Card allows users to earn 2% rewards on payments, adding another layer of convenience and benefit. This card can be used anywhere Mastercard is accepted, broadening its utility.

Pricing And Affordability Breakdown

Buy Now Pay Later (BNPL) services offer a flexible payment option. Users can purchase items and pay over time without upfront costs. Understanding the pricing and affordability of BNPL services is crucial. This section breaks down the costs and fees associated with these services.

Comparing Bnpl Providers

Different BNPL providers offer varying terms and conditions. Here’s a comparison of some popular BNPL providers:

| Provider | Interest | Fees | Credit Impact |

|---|---|---|---|

| Perpay | None | None | Positive impact with timely payments |

| Afterpay | None | Late fees | No impact |

| Klarna | None for “Pay in 4” | Late fees | Negative impact for missed payments |

Hidden Fees And Charges

Many BNPL services promote interest-free payments. But, it’s essential to be aware of potential hidden fees. Some common hidden fees include:

- Late payment fees: Charged if you miss a payment.

- Service fees: Additional costs for using the service.

- Credit card fees: If linked to a credit card, interest may apply.

Perpay stands out by not charging any interest or hidden fees.

Understanding The True Cost Of Bnpl

It’s easy to get attracted to zero-interest offers. But the true cost of BNPL services goes beyond the sticker price. Consider these points:

- Payment schedule: Understand the frequency and amount of each installment.

- Potential impact on credit: Timely payments can boost your credit score. Delinquent payments might harm it.

- Rewards and benefits: With Perpay, you earn 2% rewards on payments made with their credit card.

Always read the fine print. Ensure you understand all terms and conditions before committing.

Pros And Cons Of Buy Now Pay Later

Buy Now Pay Later (BNPL) services have become popular among consumers. They offer a flexible way to purchase items without immediate payment. This section will explore the advantages and disadvantages of using BNPL services like Perpay.

Advantages Of Using Bnpl

BNPL services come with several benefits that make them appealing:

- Convenience: BNPL allows you to shop for everyday products and pay over time.

- No Interest or Fees: With Perpay, you can pay over time without additional costs.

- Credit Improvement: Automatic payments from your paycheck help build positive credit history.

- Rewards Program: Earn 2% rewards on payments made with the Perpay Credit Card.

- Wide Product Range: Access a variety of top brands in electronics, home goods, apparel, and more.

The table below summarizes these advantages:

| Advantage | Details |

|---|---|

| Convenience | Shop for products and pay over time. |

| No Interest or Fees | Pay over time without extra costs. |

| Credit Improvement | Build positive credit history with automatic payments. |

| Rewards Program | Earn 2% rewards with the Perpay Credit Card. |

| Wide Product Range | Shop from top brands in various categories. |

Potential Drawbacks And Risks

Despite the benefits, BNPL services also have potential drawbacks:

- Debt Accumulation: Easy access to credit can lead to overspending and debt.

- Credit Impact: Late payments can negatively affect your credit score.

- Limited Availability: Perpay is not available to residents of New Hampshire.

- Eligibility Criteria: Not all consumers may qualify for BNPL services.

The table below highlights these potential drawbacks:

| Drawback | Details |

|---|---|

| Debt Accumulation | Overspending can lead to debt. |

| Credit Impact | Late payments harm credit scores. |

| Limited Availability | Not available in New Hampshire. |

| Eligibility Criteria | Not all consumers qualify. |

Ideal Users And Scenarios For Buy Now Pay Later

Perpay is a financial service that allows users to shop for everyday products, build credit, and pay over time with their paycheck. It is ideal for those looking to manage their finances more effectively, especially when buying higher-priced items.

Best Situations To Use Bnpl

Buy Now Pay Later (BNPL) services like Perpay are best for specific scenarios. Here are the most suitable situations:

- Big Purchases: Buying high-cost items like electronics, home goods, or apparel from the Perpay Marketplace.

- Credit Building: Users aiming to improve their credit score. Perpay offers automatic payments from paychecks to build positive credit history.

- Interest-Free Payments: Those who prefer to avoid interest fees. Perpay allows payment over time without additional costs.

- Rewards Program: Users who want to earn rewards. The Perpay Credit Card offers 2% rewards on payments.

Who Should Avoid Bnpl?

While BNPL services offer many benefits, they may not be suitable for everyone. Here’s who should avoid using BNPL:

- Irregular Income: Individuals with unstable income may struggle with automatic payments deducted from their paycheck.

- Existing Debt: Those already managing significant debt should avoid adding more financial commitments.

- Poor Financial Discipline: Users who find it challenging to stick to a budget may overspend using BNPL services.

- Residing Outside the U.S.: Perpay is only available to eligible U.S. residents, excluding New Hampshire.

Understanding the ideal users and scenarios for Buy Now Pay Later helps make informed financial decisions. Perpay offers a flexible, interest-free payment solution with credit-building benefits.

:max_bytes(150000):strip_icc()/buy-now-pay-later-5182291-final-4dcaa9bea32a4aa398eb99e5ca5406bb.png)

Frequently Asked Questions

What Is Buy Now Pay Later?

Buy Now Pay Later (BNPL) is a payment method. It allows consumers to purchase items and pay for them later. Payments are often made in installments.

How Does Buy Now Pay Later Work?

With BNPL, you buy items now and pay later. Payments are typically divided into equal installments. Some providers may offer interest-free periods.

Is Buy Now Pay Later Safe?

Yes, BNPL is generally safe when used responsibly. It’s important to read terms and conditions. Make sure to pay installments on time.

Can I Use Buy Now Pay Later Online?

Yes, BNPL is widely available for online shopping. Many e-commerce websites offer this payment option at checkout. It provides convenience for online shoppers.

Conclusion

Perpay offers a practical way to buy now and pay later. It helps build credit while shopping for top brands without interest or fees. The service is accessible via a mobile app, making it user-friendly. With Perpay, you can improve your credit score and enjoy various rewards. Discover how Perpay can fit into your financial plan by visiting their website today. Start shopping smartly and manage your payments with ease.