Business Expense Management Credit Card: Streamline Your Finances

Managing business expenses can be challenging. A good solution is a business expense management credit card.

These cards streamline your financial operations, making tracking and managing expenses easier. Introducing the Flex Financial Platform, a comprehensive tool designed to boost business growth. Flex integrates banking, payments, and expense management into one easy-to-use app. With features like net-60 payment terms and 0% interest for 60 days, Flex helps manage cash flow effectively. Security is a priority, with robust encryption and multi-factor authentication. This platform ensures your financial data is safe. Flex Credit Card offers individual employee cards at no extra cost and credit limits that grow with your business. For more details, visit the official website.

Introduction To Business Expense Management Credit Card

In today’s fast-paced business world, managing expenses efficiently is crucial. A Business Expense Management Credit Card like Flex helps streamline financial operations. This card offers numerous features that enhance business growth and simplify financial management.

What Is A Business Expense Management Credit Card?

A Business Expense Management Credit Card is designed to manage and track business expenses. Flex Credit Card is an excellent example, providing net-60 payment terms and 0% interest for 60 days if the balance is paid on time. This allows businesses to maintain cash flow without incurring additional interest.

Purpose And Importance In Streamlining Finances

The main purpose of a Business Expense Management Credit Card is to help businesses manage their expenses efficiently. Flex provides:

- Individual employee cards at no extra cost.

- Simplified banking and payments through its integrated platform.

- Receipt capture and expense tracking.

- High APY rates on idle cash, up to 2.99%.

These features are designed to reduce complexity and improve financial management. The security measures provided by Flex, such as robust encryption and multi-factor authentication, ensure that financial data is protected. Additionally, Flex offers automated fraud monitoring, making it a reliable choice for businesses.

Here’s a quick overview of Flex’s key features:

| Feature | Description |

|---|---|

| Net-60 Payment Terms | 0% interest for 60 days if the balance is paid within the grace period. |

| Employee Cards | Individual cards for employees at no extra cost. |

| Expense Tracking | Simplified receipt capture and expense management. |

| High APY Rates | Earn up to 2.99% APY on idle cash. |

| Security | Robust encryption, multi-factor authentication, and automated fraud monitoring. |

By integrating all financial operations into a single platform, Flex reduces complexity and helps businesses manage their finances more effectively. The scalable services and credit limits grow with the business, making it a valuable tool for companies of all sizes.

Key Features Of Business Expense Management Credit Card

Managing business expenses efficiently is crucial for any company. A Business Expense Management Credit Card offers several key features that help streamline financial operations. Flex Financial Platform’s credit card is designed with various functionalities to support businesses in managing their expenditures. Let’s explore the essential features in detail.

Automated Expense Tracking

With automated expense tracking, businesses can easily monitor and record all transactions. This feature eliminates manual entry errors and saves time. Flex Credit Card provides an intuitive platform that captures and categorizes expenses in real-time.

| Feature | Benefit |

|---|---|

| Real-time transaction recording | Reduces manual errors |

| Automatic categorization | Simplifies expense management |

Enhanced Spending Controls

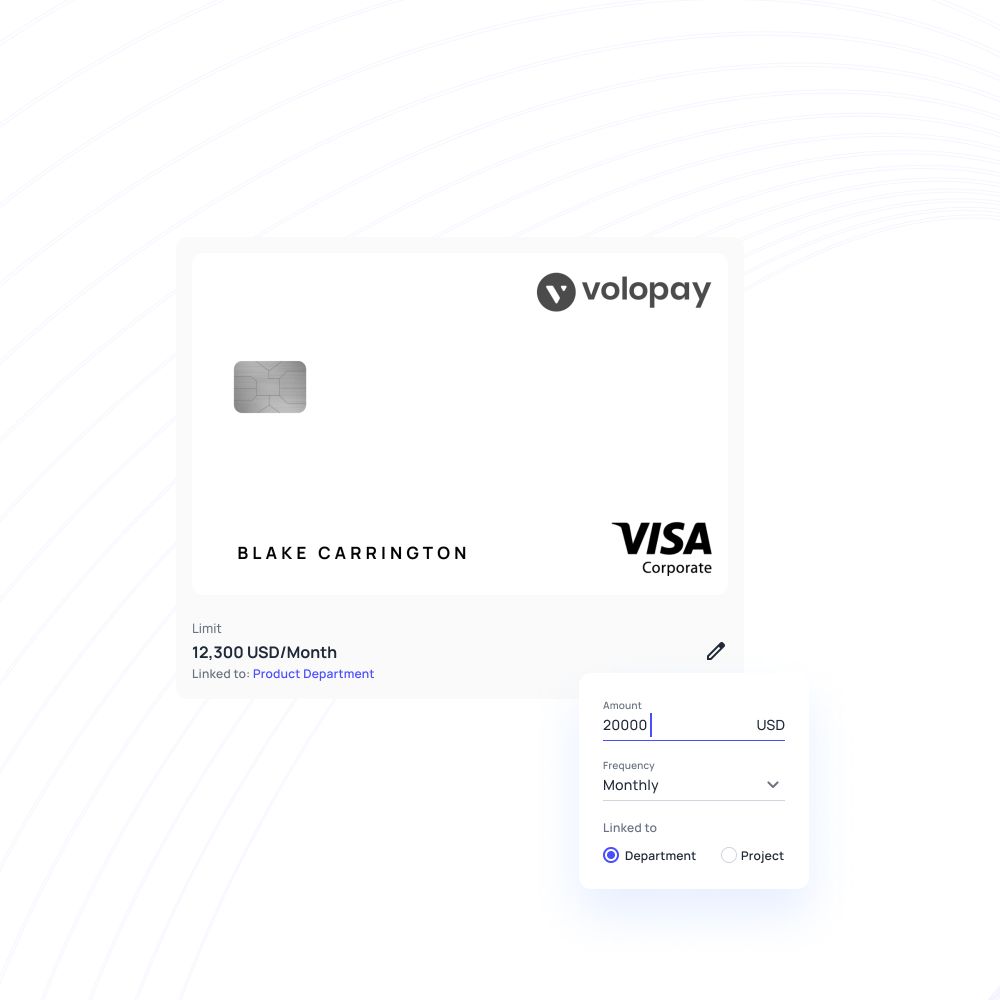

Flex Credit Card offers enhanced spending controls to manage employee expenditures. Businesses can set individual limits and monitor usage. This ensures that spending aligns with company policies.

- Set spending limits per employee

- Monitor transactions in real-time

- Restrict certain types of purchases

Real-time Reporting And Analytics

Real-time reporting and analytics provide insights into spending patterns. Flex Financial Platform offers detailed reports and analytics to help businesses make informed decisions. Accessing these reports is easy and helps in budgeting and forecasting.

Key Benefits:

- Identify spending trends

- Optimize budget allocation

- Improve financial planning

Integration With Accounting Software

Integration with accounting software is a valuable feature for businesses. Flex Credit Card seamlessly integrates with popular accounting tools. This ensures that all financial data is synchronized and easily accessible.

Advantages:

- Reduces data entry tasks

- Ensures accurate financial records

- Facilitates quick reconciliation

Reward Programs And Benefits

Flex Credit Card offers attractive reward programs and benefits. Businesses can earn rewards on their purchases, which can be redeemed for various perks. This includes cashback, travel rewards, and more.

Reward Highlights:

- Earn up to 2.99% APY on idle cash

- Net-60 payment terms on purchases

- 0% interest for 60 days with timely payments

In conclusion, the Flex Financial Platform’s Business Expense Management Credit Card offers robust features that aid in efficient financial management. These key features are designed to streamline operations, provide security, and offer valuable rewards.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of the Flex Business Expense Management Credit Card is crucial for any business. This section breaks down the costs associated with using Flex, including annual fees, interest rates, comparisons with other financial tools, and long-term cost savings.

Annual Fees And Interest Rates

The Flex Credit Card offers an attractive pricing structure:

- Annual Fees: No annual fees for using the Flex Credit Card.

- Interest Rates: 0% interest for 60 days if the balance is paid within the grace period. Interest will accrue if the balance is not settled by the end of the bi-monthly billing period.

This pricing model allows businesses to manage their expenses without worrying about additional annual costs or immediate interest charges.

Comparison With Other Financial Tools

Flex Credit Card stands out when compared to other financial tools:

| Feature | Flex Credit Card | Traditional Credit Cards |

|---|---|---|

| Annual Fees | None | Varies, often $95-$450 |

| Interest Rate | 0% for 60 days | 12%-29% |

| Employee Cards | No extra cost | Usually an additional fee |

Flex offers significant benefits over traditional credit cards, especially in terms of cost savings and flexibility.

Long-term Cost Savings

Using the Flex Credit Card can lead to long-term cost savings:

- Interest-Free Period: The 60-day interest-free period helps businesses manage cash flow effectively.

- No Annual Fees: Eliminating annual fees reduces recurring costs.

- High APY on Idle Cash: Earn up to 2.99% APY on idle cash with Flex Banking.

These features provide businesses with a cost-effective tool for managing expenses while maximizing financial resources.

Pros And Cons Of Business Expense Management Credit Card

Understanding the pros and cons of a business expense management credit card is crucial. It helps businesses make informed financial decisions. In this section, we will explore the advantages and potential drawbacks of using such cards.

Advantages Of Using The Card

The Flex Credit Card offers several benefits for businesses:

- Net-60 payment terms: Businesses have up to 60 days to pay off purchases, allowing for better cash flow management.

- 0% interest for 60 days: If the balance is paid within the grace period, businesses can avoid interest charges.

- Credit limits that grow: The credit limits increase as the business grows, providing flexibility.

- Individual employee cards: No extra cost for issuing cards to employees, simplifying expense tracking.

- Seamless integration: The card integrates with the Flex Financial Platform, consolidating all financial operations.

- High APY on idle cash: Earn up to 2.99% APY, maximizing returns on unused funds.

Potential Drawbacks And Limitations

Despite the many benefits, there are some potential drawbacks and limitations to consider:

- Interest accrual: If the balance is not paid within the 60-day period, interest will accrue.

- Variable APY rates: APY rates depend on the Federal Funds Rate and can change.

- Multi-Factor Authentication: While it enhances security, it may add an extra step to account access.

- Regulated partners: Payment services are provided by third-party regulated partners, which could involve additional terms.

By weighing these advantages and potential drawbacks, businesses can better determine if the Flex Credit Card aligns with their financial needs.

For more information about the Flex Financial Platform, visit the official website.

Specific Recommendations For Ideal Users

The Flex Financial Platform is designed to cater to various business needs. Here are specific recommendations for ideal users based on their unique requirements and usage patterns.

Small To Medium-sized Businesses

For small to medium-sized businesses, the Flex Credit Card offers a perfect blend of simplicity and functionality. These businesses can benefit from:

- Net-60 payment terms on all purchases, providing ample time to manage cash flow.

- 0% interest for 60 days if the balance is paid within the grace period.

- Credit limits that grow with the business, ensuring scalability.

Additionally, individual employee cards at no extra cost make it easier to manage and track expenses across the team.

Frequent Business Travelers

For frequent business travelers, the Flex Credit Card is a valuable tool. Benefits include:

- Seamless expense management with receipt capture and instant processing.

- Free ACH/wire payments, making international transactions hassle-free.

- High APY rates on idle cash, maximizing returns on funds not immediately in use.

The robust security features, including multi-factor authentication and automated fraud monitoring, ensure that all transactions are secure, even on the go.

Companies With High Volume Of Transactions

For companies with a high volume of transactions, the Flex Financial Platform offers unmatched efficiency. Key features include:

- Simplified banking and payments, streamlining financial operations.

- Comprehensive expense management tools to track and control spending.

- High credit limits, ensuring that the company’s purchasing power grows with its needs.

Moreover, the integration of all financial operations into a single platform reduces complexity and enhances operational efficiency.

Frequently Asked Questions

What Is A Business Expense Management Credit Card?

A business expense management credit card helps businesses track and control expenses. It offers detailed reporting and spending limits.

How Do Business Expense Cards Work?

Business expense cards allow employees to charge business expenses. They provide real-time monitoring and simplify expense tracking.

What Are The Benefits Of Using These Cards?

Benefits include improved expense tracking, easier budgeting, and potential rewards. They also enhance cash flow management.

Can Small Businesses Use Expense Management Credit Cards?

Yes, small businesses can use these cards. They help manage expenses efficiently and offer valuable financial insights.

Conclusion

Managing business expenses becomes simpler with the right credit card. Flex offers a comprehensive financial platform tailored to your needs. Enjoy streamlined banking, expense management, and exceptional security. Benefit from net-60 payment terms and 0% interest for 60 days. Flex grows with your business, providing scalable solutions. Simplify your financial operations and focus on growth. Explore more about Flex here.