Business Credit Card With No Fees: Maximize Savings and Benefits

Finding the right business credit card can be a challenge, especially with so many fees involved. Luckily, there are options available that cater to businesses looking for fee-free solutions.

When running a business, every dollar counts. Hidden fees can quickly add up and eat into your profits. That’s why a business credit card with no fees is a game-changer. It offers the financial flexibility you need without the burden of extra costs. Flex, a financial platform designed to accelerate business growth, provides a fee-free credit card with numerous benefits. With Flex, you can enjoy simplified banking, streamlined expense management, and enhanced cash flow, all while avoiding unnecessary fees. Interested in learning more about how Flex can help your business thrive? Check out their offerings here.

Introduction To Business Credit Cards With No Fees

Using a business credit card with no fees can simplify managing your business finances. It helps you save money and provides flexibility. Let’s explore what business credit cards are and their purpose.

What Are Business Credit Cards?

Business credit cards are specialized credit cards for business expenses. They help manage cash flow and track spending. These cards are issued to businesses rather than individuals.

With a business credit card, you can separate personal and business expenses. This is important for accounting and tax purposes. It also helps in building business credit.

Purpose Of No-fee Business Credit Cards

No-fee business credit cards eliminate annual fees. They save you money and offer various benefits. For example, Flex offers 0% interest for the first 60 days and net-60 terms on purchases.

These cards often come with additional features. Flex provides simplified expense management and free ACH/wire payments. You can also earn up to 2.99% APY on cash on hand.

No-fee cards are great for startups and small businesses. They provide the financial flexibility needed without extra costs. Flex also issues individual employee cards at no extra cost, making it easier to manage team expenses.

Using a no-fee business credit card like Flex can enhance your cash flow. It provides security with multi-factor authentication and robust encryption. Moreover, deposited funds are insured up to $3M through FDIC.

| Feature | Details |

|---|---|

| Interest Rate | 0% for the first 60 days |

| Credit Terms | Net-60 on purchases |

| Expense Management | Effortless and streamlined |

| Security | Multi-factor authentication, robust encryption |

| FDIC Insurance | Up to $3M |

Choosing a no-fee business credit card like Flex can be a smart financial decision. It helps manage expenses efficiently while saving on annual fees.

Key Features Of Business Credit Cards With No Fees

Business credit cards with no fees offer numerous benefits for entrepreneurs. These cards help save money and provide essential features to support business growth. Let’s explore the key features that make these cards a valuable tool for businesses.

No Annual Fees

One of the most attractive features of these business credit cards is the absence of annual fees. Flex Credit Card offers this benefit, making it an excellent choice for cost-conscious business owners. With no annual fees, businesses can allocate their resources to more critical areas, enhancing their financial flexibility.

Low Or No Foreign Transaction Fees

For businesses operating internationally, minimizing foreign transaction fees is crucial. Flex Credit Card provides low or no foreign transaction fees, making it easier for businesses to manage expenses abroad. This feature helps reduce costs associated with currency conversion and foreign transactions, leading to significant savings over time.

Introductory Apr Offers

Many business credit cards come with introductory APR offers, which are beneficial for managing cash flow. Flex Credit Card offers 0% interest for the first 60 days on all business purchases. This allows businesses to make necessary investments without worrying about immediate interest charges, providing a valuable grace period to manage finances effectively.

Rewards Programs And Cash Back

Business credit cards often include rewards programs and cash back incentives, adding value to everyday spending. Flex Credit Card offers a streamlined expense management system, allowing businesses to maximize their rewards. Here are some of the benefits:

- Earn up to 2.99% APY on cash on hand.

- Individual employee cards at no extra cost.

- Free ACH/wire payments.

- Enhanced cash flow with flexible credit terms.

These rewards programs help businesses save money and reinvest it into their growth strategies.

How No-fee Business Credit Cards Maximize Savings

A no-fee business credit card like Flex can significantly reduce your financial burdens. These cards eliminate annual fees, foreign transaction fees, and offer lucrative rewards. This results in substantial savings for your business. Let’s explore how no-fee business credit cards maximize your savings.

Reduction In Annual Costs

No annual fees mean you save hundreds of dollars each year. Flex offers a 0% interest rate for the first 60 days. This provides immediate cost savings. Your business can allocate these savings to other growth areas.

Savings On International Transactions

No-fee business credit cards often waive foreign transaction fees. Flex also provides free ACH/wire payments. This is beneficial for businesses with international dealings. It ensures you don’t pay extra for overseas transactions.

Managing Cash Flow With Introductory Apr

Flex offers 0% interest for the first 60 days. This introductory APR helps manage cash flow efficiently. You can make necessary purchases without immediate financial strain. This is especially useful during the initial business stages.

Earning Rewards And Cash Back On Purchases

Flex credit cards offer rewards on purchases. You can earn significant cash back, enhancing your savings. Additionally, Flex provides high APY on cash on hand. This ensures your money grows even when it’s not being spent.

Overall, choosing a no-fee business credit card like Flex optimizes savings. It supports financial stability and growth for your business.

Pricing And Affordability Breakdown

Choosing the right business credit card is crucial for managing expenses effectively. One of the key factors to consider is pricing and affordability. Let’s break down the costs associated with business credit cards that have no fees, focusing on the Flex Credit Card.

Comparison Of No-fee Business Credit Cards

When selecting a business credit card with no fees, it’s essential to compare the features and benefits. Here’s a comparison table highlighting the Flex Credit Card and its competitors:

| Card Name | Interest Rate | Annual Fee | Credit Limit | Special Features |

|---|---|---|---|---|

| Flex Credit Card | 0% for 60 days | None | Grows with business | Net-60 terms, individual employee cards |

| Card A | 15.99% | None | Up to $50,000 | Cashback on purchases |

| Card B | 19.99% | None | Up to $30,000 | Travel rewards |

Understanding Interest Rates And Fees

Understanding the interest rates and fees associated with your business credit card is vital. The Flex Credit Card offers unique benefits in this aspect:

- 0% interest for the first 60 days on all business purchases.

- Interest only accrues if the full balance is not paid within the grace period.

- No annual fees, making it an affordable option for businesses.

By paying the balance in full within the bi-monthly billing period, businesses can avoid interest charges, enhancing cash flow management. Additionally, the Flex Credit Card provides credit limits that grow with your business, ensuring you have access to the funds you need as your business expands.

Pros And Cons Of No-fee Business Credit Cards

Choosing a business credit card with no fees can be an attractive option for many entrepreneurs. While these cards offer significant benefits, there are also some drawbacks to consider. Below, we will explore the advantages and potential disadvantages of no-fee business credit cards.

Advantages Of No-fee Cards

One of the most compelling benefits of no-fee business credit cards is the lack of annual fees. This can save businesses substantial amounts of money, especially for startups and small enterprises.

- Cost Savings: No annual fees mean more funds available for other business expenses.

- Enhanced Cash Flow: The Flex Credit Card offers net-60 terms on all purchases, providing a generous window to manage cash flow.

- Interest-Free Period: With Flex, enjoy 0% interest for the first 60 days, provided the full balance is paid within the grace period.

- Expense Management: Simplified expense tracking and management, including the issuance of individual employee cards at no extra cost.

Potential Drawbacks To Consider

While no-fee business credit cards offer many perks, they may also come with some limitations that businesses need to be aware of.

- Limited Rewards: No-fee cards may offer fewer rewards compared to fee-based cards.

- Credit Limits: Although Flex provides credit limits that grow with your business, initial limits may be lower compared to fee-based options.

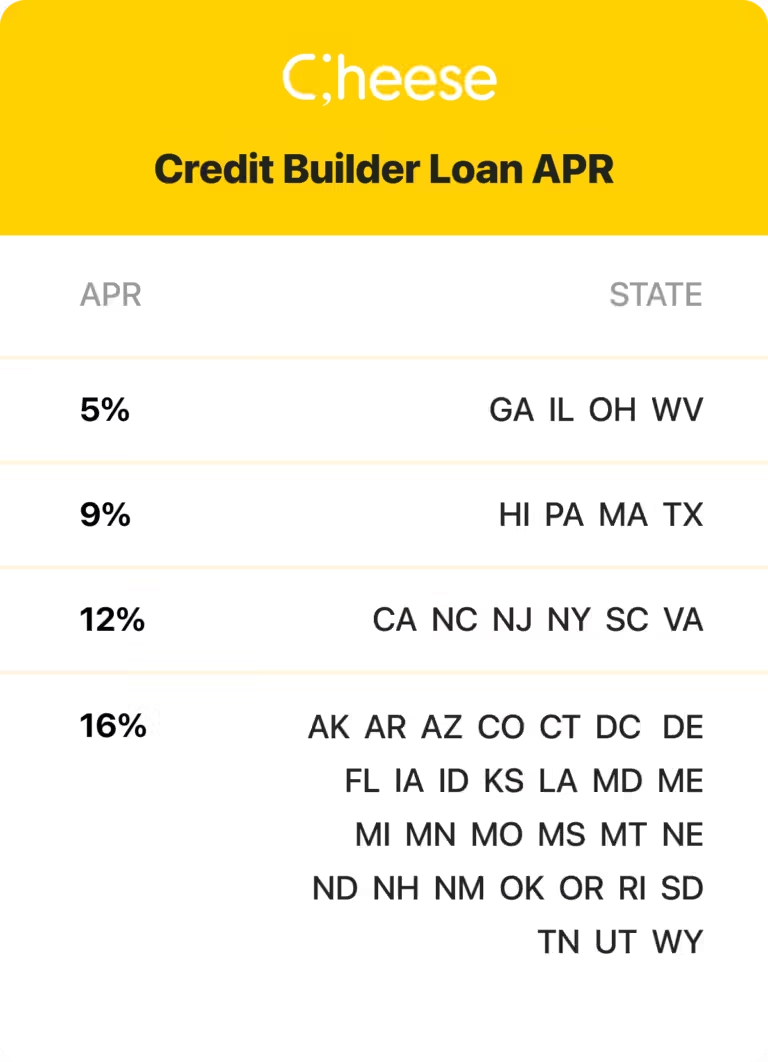

- Geographic Restrictions: The Flex Credit Card is not available in certain states, including CA, ND, SD, VT, and NV.

By weighing these advantages and potential drawbacks, businesses can make informed decisions about whether a no-fee business credit card like Flex is the right choice for their financial needs.

Ideal Users And Scenarios For No-fee Business Credit Cards

Choosing the right business credit card can be a strategic decision for any company. A no-fee business credit card offers multiple advantages without the burden of annual fees. Understanding who benefits the most from these cards helps in making informed decisions.

Best For Small Businesses And Startups

Small businesses and startups often operate with tight budgets and limited resources. A no-fee credit card like Flex can be especially beneficial for these entities. Flex offers 0% interest for the first 60 days, which can be crucial for managing initial expenses.

- Credit limits grow with your business.

- No impact on credit score upon application.

- Streamlined expense management with individual employee cards at no extra cost.

With Flex, small businesses can manage finances efficiently and allocate funds to critical areas without worrying about additional costs.

Ideal For Frequent Travelers

Frequent business travelers can gain significant benefits from a no-fee business credit card. The Flex Credit Card offers net-60 terms on all purchases, giving travelers the flexibility they need.

- No foreign transaction fees.

- Free ACH/wire payments.

- Enhanced cash flow with flexible credit terms.

With these features, businesses can manage travel expenses seamlessly and ensure that their cash flow remains unaffected.

Great For Businesses With High Monthly Expenses

Businesses with high monthly expenses need a card that can keep up with their spending. The Flex Credit Card is designed to support such businesses with its competitive features.

| Feature | Benefit |

|---|---|

| Net-60 terms | Extended payment period for better cash flow |

| High credit limits | Supports large purchases and high expenses |

| 2.99% APY on cash | Earn interest on idle cash |

For businesses that incur significant monthly expenses, Flex offers a robust solution that balances cash flow with growth opportunities.

Frequently Asked Questions

What Is A Business Credit Card With No Fees?

A business credit card with no fees means no annual, foreign transaction, or late payment fees. These cards are cost-effective. They help businesses manage expenses without additional costs.

Are There Benefits To No-fee Business Credit Cards?

Yes, they save money on fees and offer rewards. Businesses can earn cash back, points, or miles. Additionally, they often provide expense tracking tools.

How To Qualify For A No-fee Business Credit Card?

To qualify, you need a good credit score and business income. Lenders evaluate your credit history and financial stability. Applying is simple and can be done online.

Can Startups Get No-fee Business Credit Cards?

Yes, many no-fee business credit cards cater to startups. They provide essential financial tools. Startups can build credit history and manage expenses effectively with these cards.

Conclusion

Choosing a business credit card with no fees can boost your financial flexibility. Flex offers significant advantages, such as 0% interest for 60 days and a high APY on cash. Simplified expense management and robust security features are also key benefits. Interested in Flex? Learn more here. Make the right financial choice for your business today!