Business Credit Card Application Process: Simplified Steps for Approval

The business credit card application process can seem daunting. But it doesn’t have to be.

This guide will simplify it for you, step by step. Applying for a business credit card can offer numerous advantages. It can help manage expenses, build your business credit, and offer rewards. But knowing where to start and what to expect can make all the difference. Whether you’re a startup or an established business, understanding the process can save you time and effort. In this blog, we’ll break down the application process, from gathering necessary documents to choosing the right card. With the right approach, you can secure a card that meets your business needs and supports your growth. To explore options, check out the Flex Financial Platform’s business credit card.

Introduction To Business Credit Cards

Business credit cards offer a range of benefits tailored specifically for businesses. They are designed to help manage expenses, streamline operations, and provide financial flexibility.

What Is A Business Credit Card?

A business credit card is a financial tool issued to a company. It allows the company to make purchases and manage expenses. Business credit cards offer features and benefits that cater to business needs.

They come with higher credit limits compared to personal credit cards. Additionally, they often include expense management tools and rewards programs.

Purpose And Benefits Of Business Credit Cards

Business credit cards serve multiple purposes and offer several benefits:

- Expense Management: Track and categorize business expenses easily.

- Cash Flow Management: Improve cash flow with extended payment terms.

- Rewards and Cashback: Earn rewards or cashback on purchases.

- Employee Cards: Issue cards to employees to manage team expenses.

- Build Business Credit: Help build your company’s credit profile.

One excellent example of a business credit card is the Flex Credit Card. It provides a range of features tailored to business needs:

| Feature | Description |

|---|---|

| Net-60 on all purchases | 0% interest for 60 days if the full balance is paid within the grace period. |

| Flexible credit limits | Credit limits grow with your business. |

| Individual employee cards | Issue employee cards at no extra cost. |

| Effortless expense management | Streamline receipt capture and manage expenses easily. |

| High security | FDIC insurance up to $3M, automated fraud monitoring, and robust encryption. |

Using a business credit card like the Flex Credit Card can greatly benefit your business operations. From managing expenses to providing financial flexibility, it is a valuable tool for any business.

Understanding The Application Process

Applying for a business credit card like Flex can seem daunting. By understanding the steps involved, you can navigate the process smoothly and efficiently. Below, we break down the application process into manageable parts.

Initial Steps To Consider

Before you start the application, consider the following steps:

- Research different business credit cards to find the one that suits your needs. Flex offers features like net-60 on all purchases and 0% interest for 60 days.

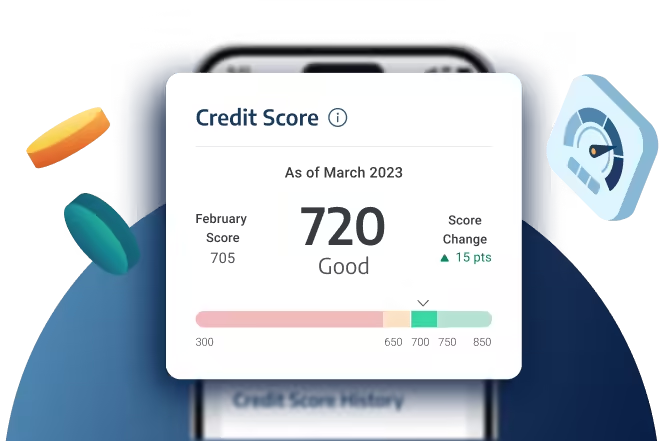

- Assess your business credit score. A higher score improves your chances of approval and better terms.

- Gather your business details. This includes your business name, address, and tax identification number.

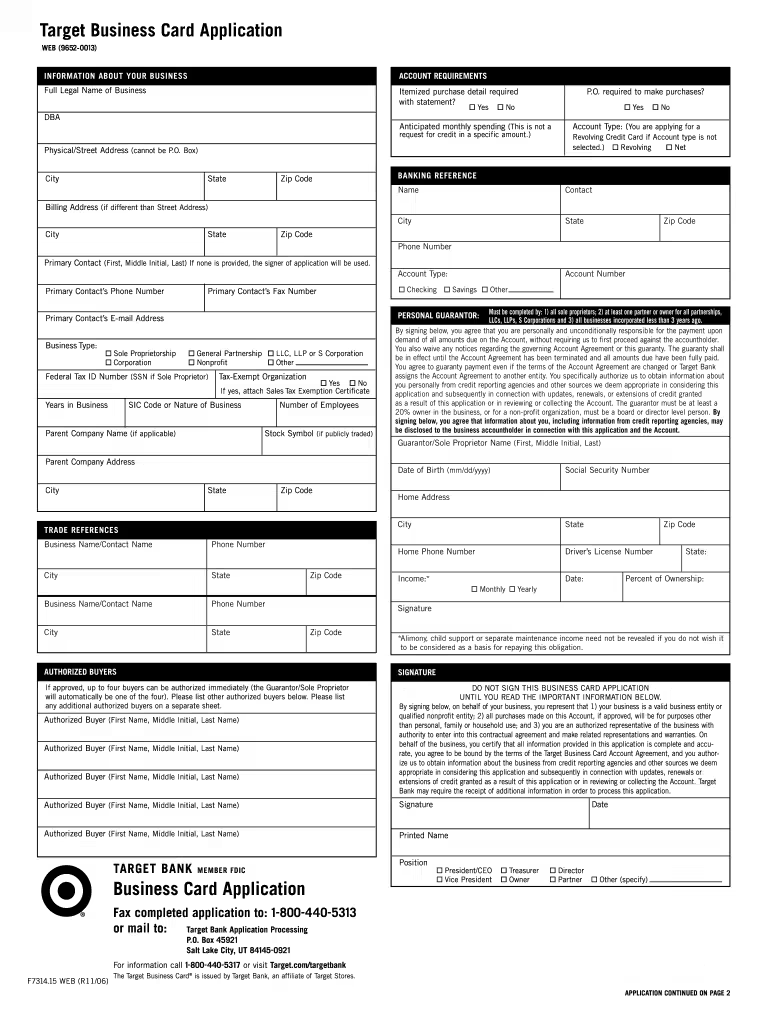

Necessary Documentation And Information

Having the right documentation ready will streamline the application process. Here’s what you’ll need:

| Documentation | Details |

|---|---|

| Business Information | Provide your business name, address, and tax ID number. |

| Financial Statements | Include income statements, balance sheets, and cash flow statements. |

| Personal Identification | Submit your personal ID, such as a driver’s license or passport. |

| Business Plan | Outline your business goals and how the credit card will help achieve them. |

Flex also requires additional information:

- Banking Details: Flex integrates banking, payments, and expense management into one platform.

- Employee Information: You can issue individual employee cards at no extra cost.

- Security Features: Flex provides FDIC insurance up to $3M and automated fraud monitoring.

Having these documents and information at hand will make the application process quicker and easier. Remember, the more prepared you are, the smoother the process will be.

Key Features Of Business Credit Cards

Business credit cards offer unique features tailored to meet the needs of companies. Below are the key features that can benefit your business.

Credit Limits And Terms

Business credit cards often provide higher credit limits compared to personal cards. This allows businesses to manage larger purchases and maintain cash flow. For instance, Flex Credit Card offers credit limits that grow with your business.

Moreover, the terms are flexible. The Flex Credit Card offers a net-60 payment term on all purchases. This means you have 60 days to pay off your balance without incurring interest, provided you pay the full amount within the grace period.

Rewards And Benefits Programs

Business credit cards often come with attractive rewards and benefits. These can include cashback, travel rewards, and discounts on business-related expenses. The Flex Financial Platform integrates various financial services to accelerate business growth, offering benefits such as:

- Up to 2.99% APY on idle cash.

- Individual employee cards at no extra cost.

- Free ACH/wire payments.

These rewards can help reduce overall business expenses and offer additional value.

Interest Rates And Fees

Understanding the interest rates and fees associated with business credit cards is crucial. The Flex Credit Card offers 0% interest for 60 days if the full balance is paid within the grace period. After this period, interest starts accruing.

There are no hidden fees for issuing employee cards. This makes managing business expenses more straightforward and cost-effective. Always review the terms and conditions to understand any potential fees.

By considering these key features, businesses can choose a credit card that aligns with their financial needs and goals. The Flex Financial Platform stands out by integrating banking, credit card services, payments, and expense management, offering a comprehensive solution for business growth.

Simplified Steps For Approval

Applying for a business credit card like the Flex Credit Card can be straightforward. Following these simplified steps can make the process smooth and stress-free.

Step 1: Assess Your Business Credit Score

Begin by checking your business credit score. A good score improves your chances of approval. Use credit reporting agencies to get an accurate report. Ensure there are no errors that could affect your application.

Step 2: Choose The Right Credit Card

Select a card that fits your business needs. The Flex Financial Platform offers a variety of features:

- Net-60 on all purchases

- 0% interest for 60 days

- Credit limits that grow with your business

- Individual employee cards at no extra cost

Review the card’s benefits and ensure it aligns with your business goals.

Step 3: Gather Required Documentation

Prepare necessary documents before applying. Common requirements include:

- Business financial statements

- Tax returns

- Proof of business registration

- Personal identification of the business owner

Having these documents ready speeds up the process.

Step 4: Fill Out The Application Form

Complete the application form accurately. Provide all requested information about your business and yourself. Double-check for any errors or omissions to avoid delays.

Step 5: Submit The Application And Wait For Approval

Submit your completed application. The Flex Financial Platform offers a streamlined process. Once submitted, wait for the approval. You may receive a response within a few days.

Monitor your email or account for updates. Be ready to provide additional information if requested.

Following these steps simplifies the business credit card application process. The Flex Credit Card offers numerous benefits to support your business growth.

Pricing And Affordability

Understanding the pricing and affordability of business credit cards is crucial. Making the right choice can save money and provide valuable benefits. Let’s explore some key aspects.

Annual Fees And Additional Charges

Many business credit cards come with annual fees. These fees can vary widely. Some cards offer no annual fees, while others may charge several hundred dollars per year.

Flex Credit Card offers no annual fees, providing significant savings. There are also no additional costs for issuing individual employee cards. This makes it an affordable choice for businesses of any size.

It’s essential to be aware of other potential charges. These can include late payment fees, foreign transaction fees, and cash advance fees. With Flex Credit Card, there are no hidden charges, making it a transparent option.

Comparing Costs Across Different Cards

Comparing costs across different business credit cards helps in making an informed decision. Here’s a quick comparison:

| Card Name | Annual Fee | Interest Rate | Additional Fees |

|---|---|---|---|

| Flex Credit Card | None | 0% for 60 days | None |

| Card A | $95 | 18% APR | Late payment fee |

| Card B | $199 | 15% APR | Foreign transaction fee |

This comparison highlights how Flex Credit Card stands out. It offers no annual fees, 0% interest for 60 days if the balance is paid within the grace period, and no additional fees.

Choosing the right card can impact your business finances. Opt for cards like Flex Credit Card that offer affordability without compromising on features.

Pros And Cons Of Business Credit Cards

Applying for a business credit card can be a strategic move for any enterprise. Understanding the pros and cons can help you decide if it aligns with your financial goals. Below we explore the advantages and potential drawbacks of using business credit cards.

Advantages Of Using Business Credit Cards

Business credit cards offer multiple benefits that can contribute to the growth and efficiency of your enterprise.

- Flexible Credit Terms: Enjoy net-60 on all purchases with 0% interest for 60 days, provided you pay the full balance within this grace period.

- High Credit Limits: Credit limits grow as your business expands, allowing you to access more funds as needed.

- Expense Management: Effortless tracking and management of expenses through integrated platforms like the Flex Financial Platform.

- Employee Cards: Issue individual employee cards at no extra cost, simplifying team spending and management.

- Security Features: Benefit from FDIC insurance up to $3M, automated fraud monitoring, and robust encryption.

- APY on Idle Cash: Earn up to 2.99% APY on cash on hand, providing a return on idle funds.

Potential Drawbacks To Consider

Despite the many advantages, there are some drawbacks to consider when applying for a business credit card.

- Interest Accumulation: Interest starts accruing post the 60-day grace period if the full balance is not paid, which can lead to higher costs.

- Potential for Overspending: High credit limits can tempt overspending, leading to financial strain if not managed properly.

- Annual Fees: Some business credit cards come with annual fees, which can add to your business expenses.

- Impact on Credit Score: Although Flex Credit Card claims no impact on credit score upon application, other cards may affect your business credit score.

Weighing these pros and cons can help you make an informed decision about whether a business credit card is right for you.

Recommendations For Ideal Users And Scenarios

Deciding if a business credit card is the right choice can be challenging. This section offers insights into who should consider applying for a business credit card and under which scenarios it is most beneficial.

Best Practices For Small Businesses

Small businesses can greatly benefit from using the Flex Financial Platform. It integrates banking, payments, and expense management into one seamless platform. Here are some best practices:

- Expense Management: Use the Flex Credit Card to manage and track expenses effortlessly. The platform offers individual employee cards at no extra cost, simplifying expense tracking for your team.

- Cash Flow Management: With the Net-60 payment terms and 0% interest for 60 days, businesses can manage cash flow more efficiently.

- Maximize Earnings: Earn up to 2.99% APY on idle cash with Flex Banking, providing an additional income stream.

- Security: Benefit from FDIC insurance up to $3M, automated fraud monitoring, and robust encryption for data security.

When To Consider A Business Credit Card

Understanding when to apply for a business credit card is crucial. Here are scenarios where a business credit card can be particularly useful:

- Starting a New Business: New businesses often need flexible financing options. The Flex Credit Card offers credit limits that grow with your business, providing much-needed capital.

- Managing Business Expenses: If your business has significant expenses, the Net-60 terms and 0% interest can help manage these costs effectively.

- Improving Cash Flow: Flex Banking offers streamlined receipt capture and free ACH/wire payments, helping to maintain a healthy cash flow.

- Enhancing Security: Protect your business finances with features like automated fraud monitoring, MFA, and robust encryption.

Using the Flex Financial Platform can simplify financial management and support business growth with its comprehensive features and benefits.

Frequently Asked Questions

What Is A Business Credit Card?

A business credit card is a financial tool for business expenses. It separates personal and business finances, simplifies accounting, and often offers rewards.

How To Apply For A Business Credit Card?

To apply, gather financial documents, choose a card, and complete the application. Provide business and personal information.

What Are The Benefits Of A Business Credit Card?

Business credit cards offer rewards, expense management, and credit building. They also provide higher credit limits and employee cards.

Can A Startup Get A Business Credit Card?

Yes, startups can get business credit cards. They may need a strong personal credit score and business plan.

Conclusion

Completing a business credit card application might seem daunting, but it doesn’t have to be. Understanding each step helps make the process smoother and faster. Research thoroughly, gather necessary documents, and choose the right card. Consider using the Flex Financial Platform for your business needs. It integrates banking, credit card services, and expense management seamlessly. A well-chosen business credit card can offer significant benefits and help your business grow. Take the time to apply properly and enjoy the rewards of responsible credit card use.