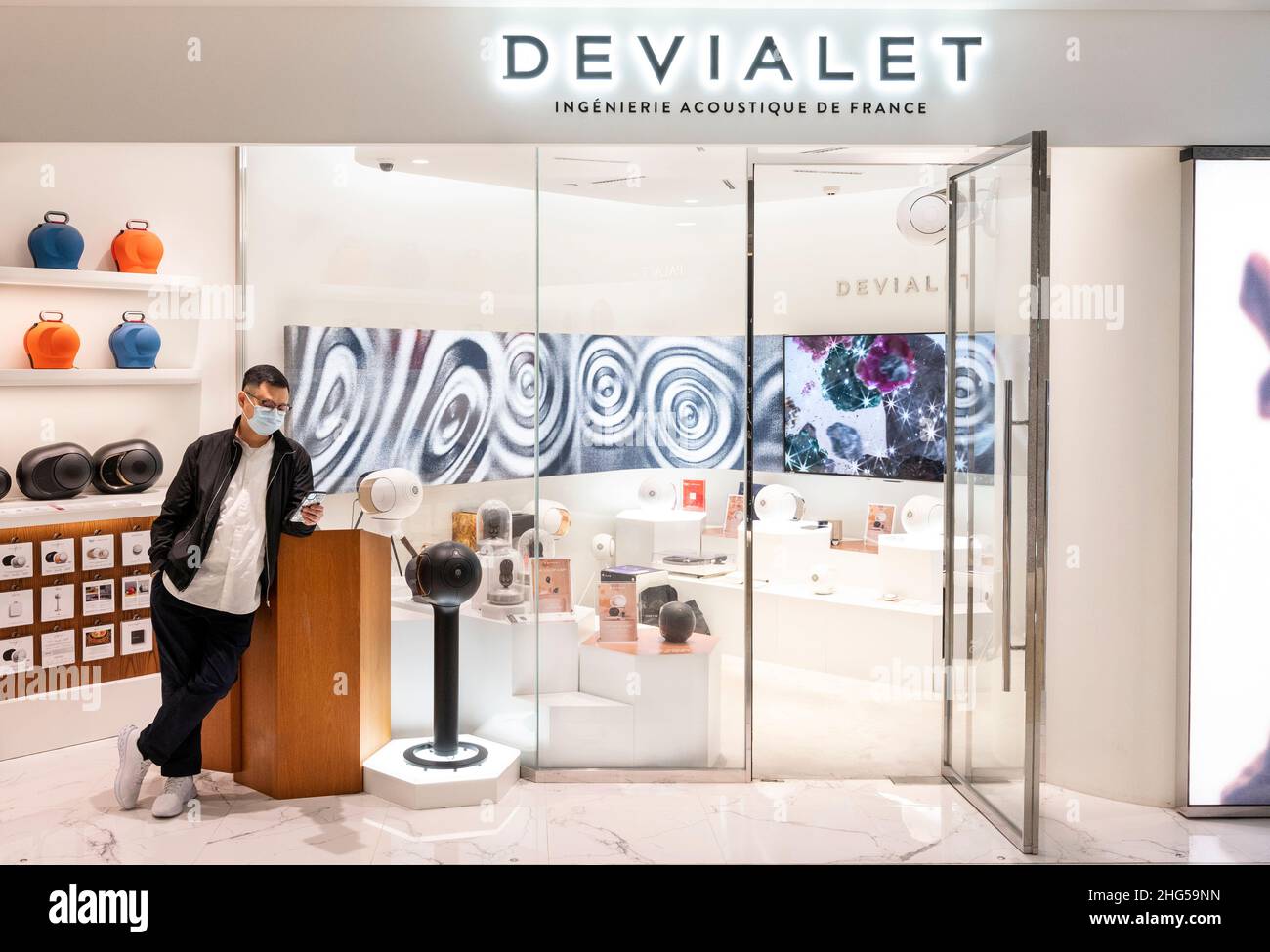

Build Credit With Vialet: Unlock Financial Freedom Today

Building credit is essential for personal and business financial health. VIALET offers a unique solution to help you achieve this goal efficiently.

VIALET Business Account stands out as an all-in-one growth engine designed to simplify financial management for businesses. This account supports instant money transfers and open banking solutions, making it a versatile tool for any business. With the ability to set up multiple IBANs, assign different access levels, and perform multi-currency transactions, VIALET ensures seamless financial operations. Additionally, their virtual corporate cards and mass payout features provide secure and automated payment solutions. These features, combined with personalized support and robust security, make VIALET a reliable choice for businesses looking to build and maintain strong credit. Ready to explore VIALET? Visit their website for more information.

Introduction To Vialet And Its Purpose

VIALET offers innovative solutions to help businesses grow. With its business account, companies can manage finances effortlessly. VIALET focuses on simplifying transactions and providing secure, efficient services. Let’s explore how VIALET can assist in building credit for your business.

Understanding Vialet

VIALET is a comprehensive business account designed for seamless money management. It supports instant money transfers and allows businesses to manage multiple IBANs from a single account. This flexibility helps businesses streamline their financial operations.

The platform supports various payment methods, including SEPA, SEPA Instant, and SWIFT. Businesses can also make multi-currency payments in EUR, USD, GBP, and more. VIALET ensures transparent charges and competitive rates.

The Importance Of Building Credit

Building credit is crucial for any business. Good credit can lead to better loan terms, lower interest rates, and increased trust from suppliers and partners. A strong credit profile can also help in securing more favorable terms with vendors.

Maintaining a good credit score involves timely payments, managing debts, and keeping a low credit utilization ratio. These factors collectively enhance a business’s financial health and credibility.

How Vialet Can Help

VIALET’s business account can assist in building credit through various features:

- Instant Money Transfers: Ensure all payments are timely, enhancing your credit score.

- Multiple IBANs: Manage different financial streams effectively, keeping your finances organized.

- Virtual Corporate Cards: Set daily spending limits and make secure payments, aiding in credit management.

- Mass Payouts via API: Automate regular payments to multiple recipients, ensuring consistency and reliability.

Moreover, VIALET’s robust security features protect your financial data, providing peace of mind. Personalized support from a dedicated account manager ensures that your business’s unique needs are met effectively.

Using VIALET, businesses can benefit from lower fees, allowing more investment in growth. The platform’s quick setup and fast transactions make it a convenient choice for businesses looking to build and maintain a strong credit profile.

Key Features Of Vialet

Vialet offers a comprehensive suite of features designed to help businesses build credit and manage their finances efficiently. Below are the key features that make Vialet stand out:

Credit Building Tools

Vialet provides robust credit building tools to help businesses improve their credit scores. These tools include:

- Instant money transfers for quick financial transactions.

- Multiple IBANs from a single account to manage different business needs.

- Virtual corporate cards with daily spending limits for secure payments.

User-friendly Interface

Vialet boasts a user-friendly interface that simplifies account management. Key aspects include:

- Easy setup for business accounts, allowing quick access to financial tools.

- Multiple team member access with different levels of permissions.

- Integration with preferred apps via B2B API connections.

Vialet offers extensive financial education resources to help businesses make informed decisions. Features include:

- Transparent charges and rates for multi-currency payments in EUR, USD, GBP, and more.

- Dedicated account manager for personalized support and guidance.

- Optimized checkout options for e-commerce, enhancing payment methods.

Secure And Private Transactions

Security is a top priority for Vialet. The platform ensures:

- 24/7 advanced security features to protect financial data.

- Secure payments for salaries, vendors, and expenses using virtual cards.

- Automated mass payouts via API to multiple recipients.

Credit Building Tools: A Closer Look

Building a strong credit score is crucial for financial health. VIALET offers various tools to help you improve and monitor your credit effectively. Let’s explore these credit-building tools in detail.

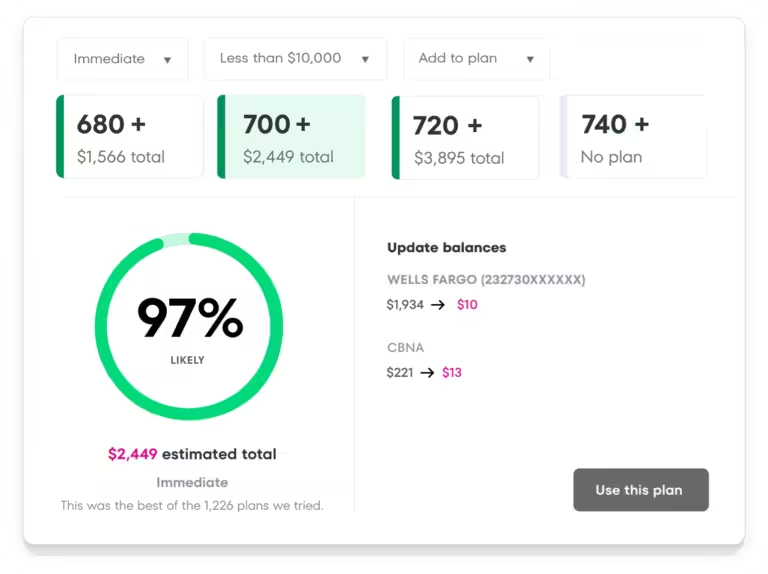

Credit Score Monitoring

One of the most important aspects of credit building is monitoring your credit score. VIALET provides a robust credit score monitoring feature. This tool allows you to keep track of your credit score changes and understand the factors affecting it. Regular monitoring helps you stay aware of your credit status and take timely action to improve it.

| Benefits | Details |

|---|---|

| Real-time updates | Receive instant notifications about any changes in your credit score. |

| Detailed Reports | Get comprehensive reports that highlight key factors affecting your credit. |

| Easy Access | View your credit score anytime through the VIALET platform. |

Credit Improvement Tips

VIALET offers personalized tips to help you improve your credit score. These tips are based on your current credit status and financial behavior. By following these tips, you can make informed decisions to enhance your credit profile.

- Pay Bills On Time: Timely bill payments positively impact your credit score.

- Reduce Debt: Lowering your debt levels can significantly improve your credit rating.

- Avoid New Credit: Limiting new credit inquiries helps maintain a good score.

These actionable tips are easy to follow and can lead to significant improvements in your credit health.

Personalized Credit Plans

Each individual’s financial situation is unique. VIALET understands this and offers personalized credit plans tailored to your specific needs. These plans are designed to address your financial goals and help you build a strong credit profile.

- Assessment: Analyze your current credit status and financial habits.

- Goal Setting: Define clear and achievable credit-building goals.

- Action Plan: Create a step-by-step plan to reach your credit goals.

With a personalized plan from VIALET, you can take control of your credit journey and achieve your financial objectives efficiently.

User-friendly Interface: Ease Of Use

VIALET stands out with its user-friendly interface, ensuring ease of use for all. The intuitive design, mobile app accessibility, and excellent customer support make managing your business finances simple and efficient.

Intuitive Design

The VIALET platform boasts an intuitive design that allows users to navigate effortlessly. Key features include:

- Instant money transfers

- Easy setup of multiple IBANs

- Team member access with different levels

The interface is designed to be straightforward, with clear and concise menus and options. This helps businesses manage their finances without any hassle.

Mobile App Accessibility

The VIALET mobile app ensures that you can manage your business account on the go. The app provides features like:

- Instant notifications for transactions

- Access to multiple accounts in various currencies

- Secure payments using virtual corporate cards

With the mobile app, you can keep track of your business finances anytime, anywhere, ensuring you never miss an important transaction.

Customer Support

VIALET offers exceptional customer support to assist you with any queries. Key support features include:

- Direct communication with a dedicated account manager

- 24/7 advanced security features

- Personalized support for high-risk companies

For further inquiries, you can contact support at support@vialet.eu or visit the VIALET website for more information.

These features ensure that VIALET is not only user-friendly but also reliable and secure, making it a preferred choice for many businesses.

Comprehensive Financial Education

Building credit with VIALET is not just about using the right tools. It also involves understanding how to use them effectively. VIALET offers comprehensive financial education to help users make informed financial decisions. This guidance is available through various resources that cater to different learning preferences.

Educational Resources

VIALET provides a wide range of educational resources. These materials are designed to enhance financial literacy and credit management skills. Users can access articles, guides, and tutorials on topics like managing business accounts, understanding IBANs, and optimizing payment platforms.

- Articles on financial best practices

- Guides for multi-currency payment management

- Tutorials on setting up virtual corporate cards

Workshops And Webinars

Interactive learning is a key part of VIALET’s educational approach. They offer workshops and webinars that cover various financial topics. These sessions provide practical insights into managing business finances, using open banking solutions, and automating payments.

| Workshop Topic | Date | Duration |

|---|---|---|

| Understanding SEPA and SWIFT Payments | 10th Nov 2023 | 1 Hour |

| Optimizing Business Account Setups | 20th Nov 2023 | 1.5 Hours |

One-on-one Coaching

Personalized support is available through one-on-one coaching. This service is designed to address specific financial queries and provide tailored advice. Users can schedule sessions with dedicated account managers who understand their unique business needs.

- Schedule a session with an account manager

- Discuss specific financial challenges

- Receive tailored advice and strategies

By leveraging these educational resources, VIALET ensures that users are well-equipped to build and manage their credit effectively. This comprehensive approach fosters financial confidence and success.

Security And Privacy

Ensuring the security and privacy of your financial data is paramount. With VIALET, robust security features and stringent privacy policies protect your information. Let’s delve into the specifics of how VIALET safeguards your data.

Data Encryption

VIALET employs advanced data encryption techniques to secure your financial transactions. This encryption ensures that your data is unreadable to unauthorized parties. Here are the key aspects of VIALET’s data encryption:

- 256-bit SSL encryption for data in transit

- Encryption of sensitive data at rest

- Regular security audits to identify vulnerabilities

Privacy Policies

VIALET’s privacy policies are designed to protect your personal and financial information. These policies include:

| Policy | Description |

|---|---|

| Data Collection | Only necessary data is collected. |

| Data Usage | Data is used solely to improve user experience. |

| Third-party Sharing | Data is not shared with third parties without consent. |

User Trust And Safety

Building user trust and safety is a priority for VIALET. The platform implements several measures to ensure users feel secure:

- 24/7 monitoring of all transactions

- Real-time alerts for suspicious activities

- Dedicated support team available for immediate assistance

These measures help maintain a secure environment for all users, ensuring peace of mind.

Pricing And Affordability

Choosing the right business account is crucial for any company. VIALET offers a range of pricing options to suit different business needs. Understanding the costs and benefits is essential for making an informed decision.

Subscription Plans

VIALET provides several subscription plans to cater to various business sizes and requirements. Although specific pricing details are not provided, here are the general features included in the plans:

- Instant money transfers

- Multiple IBANs from a single account

- Team member access with different levels

- Support for SEPA, SEPA Instant, SWIFT payments

- Accounts in multiple currencies (EUR, USD, GBP, PLN, SEK, DKK, CZK, CHF)

- Virtual Visa or Mastercard

- Mass payouts via API

- B2B API connections

- Acquiring for E-commerce

Free Vs. Paid Features

VIALET offers both free and paid features to maximize flexibility. Here’s a comparison:

| Feature | Free Plan | Paid Plan |

|---|---|---|

| Instant Money Transfers | Limited | Unlimited |

| Multiple IBANs | No | Yes |

| Team Member Access | Basic | Advanced |

| SEPA Payments | Yes | Yes |

| Multi-Currency Payments | Limited | Extended |

| Virtual Corporate Cards | Basic | Advanced |

Value For Money

VIALET offers transparent fees and lower costs, allowing businesses to invest more in growth. The combination of advanced features and personalized support provides excellent value for money.

With robust security and quick setup, VIALET ensures a smooth experience. The dedicated account manager helps businesses navigate any issues, providing reliable and fast support.

For businesses seeking a versatile and secure financial solution, VIALET delivers a comprehensive package at competitive rates.

Pros And Cons Of Vialet

Vialet is a comprehensive business account solution that offers a range of features for seamless financial management. This section will explore the advantages and potential drawbacks of using Vialet, as well as provide user feedback and reviews.

Advantages Of Using Vialet

Vialet offers several benefits that make it an attractive option for businesses:

- Flexible Business Account: Businesses can enjoy instant money transfers and the ability to manage multiple IBANs from a single account. Team members can be added with varying access levels, enhancing collaborative efforts.

- Payment Platform: Supports SEPA, SEPA Instant, and SWIFT payments, providing a variety of options for international and local transactions.

- Multi-Currency Payments: Accounts can be managed in multiple currencies including EUR, USD, GBP, PLN, SEK, DKK, CZK, and CHF. Charges and rates are transparent, ensuring clarity in financial transactions.

- Virtual Corporate Cards: Vialet offers secure virtual Visa or Mastercard options with daily spending limits, ideal for managing salaries, vendor payments, and expenses.

- Mass Payouts via API: Automates regular payments to multiple recipients, streamlining payroll and supplier payments.

- B2B API Connections: Integrates with preferred apps, automating payments and ensuring timely supplier payments.

- Acquiring for E-commerce: Optimizes checkout processes with preferred payment methods and offers instant funds through e-commerce platform plugins.

- Speed & Ease of Use: Quick setup of business accounts and fast transactions.

- Personalized Support: Direct communication with a dedicated account manager.

- Robust Security: 24/7 advanced security features to protect financial data.

- Transparent Fees: Lower fees allowing businesses to invest more in growth.

Potential Drawbacks

While Vialet offers many advantages, there are some potential drawbacks:

- Pricing Details: Specific pricing details are not provided, which may cause uncertainty for potential users.

- Refund or Return Policies: The product information does not mention specific refund or return policies, which might be a concern for some businesses.

User Feedback And Reviews

Many users have shared positive experiences with Vialet:

- High Satisfaction: Users appreciate the quick onboarding process, international payment solutions, and private banker support.

- Reliability: High-risk companies find Vialet’s services reliable, with fast response times from the support team.

- Integration and Flexibility: Positive feedback on SEPA & SWIFT integration and flexible, reliable solutions.

For further inquiries, contact support at support@vialet.eu or visit the Vialet website for more information.

Who Should Use Vialet?

Vialet is a versatile business account solution designed to streamline financial operations. It offers multiple features that cater to a wide range of users. Let’s explore who can benefit from using Vialet.

Ideal Users And Scenarios

Vialet is perfect for business owners who need flexible financial management. It is ideal for:

- Small to Medium Enterprises (SMEs): Efficient money transfers and multiple IBANs.

- Startups: Quick setup and easy access for team members.

- E-commerce Businesses: Optimized checkout and instant funds.

- Freelancers: Secure payments and multi-currency accounts.

These users benefit from Vialet’s robust features, ensuring smooth financial operations.

Personal And Professional Benefits

Vialet provides numerous advantages for both personal and professional use:

- Speed & Ease of Use: Quick setup and fast transactions.

- Personalized Support: Direct communication with a dedicated account manager.

- Robust Security: 24/7 advanced security features protect financial data.

- Transparent Fees: Lower fees allow more investment in business growth.

These benefits make Vialet a reliable choice for managing business finances.

Success Stories

Many businesses have found success using Vialet. Here are some testimonials:

- High-risk Companies: Reliable service and fast response times from the support team.

- International Payment Solutions: Users praised the quick onboarding process.

- Private Banker Support: High satisfaction with SEPA & SWIFT integration.

These stories highlight Vialet’s effectiveness in meeting diverse business needs.

Conclusion: Unlocking Financial Freedom With Vialet

Building credit with Vialet opens up a world of opportunities for businesses. It provides tools and support to manage finances effectively, ensuring seamless transactions and fostering growth. Vialet’s business account is a comprehensive solution tailored to meet the needs of modern businesses.

Summary Of Benefits

- Speed & Ease of Use: Quick setup and fast transactions.

- Personalized Support: Dedicated account managers for direct communication.

- Robust Security: 24/7 advanced security features to protect financial data.

- Transparent Fees: Lower fees to allow more investment in growth.

Final Thoughts

Vialet offers an all-in-one growth engine for businesses. It supports instant money transfers, multiple IBANs, and team member access with different levels. The platform integrates SEPA, SEPA Instant, and SWIFT payments, ensuring seamless international transactions.

With accounts in various currencies and transparent charges, Vialet ensures businesses can operate globally without hidden costs. The virtual corporate cards come with daily spending limits, making secure payments easy and efficient.

Moreover, Vialet’s mass payouts and B2B API connections automate regular payments and integrate with preferred apps. This ensures timely payments and meets supplier deadlines. The optimized checkout for e-commerce and instant funds through platform plugins enhance the overall user experience.

Call To Action

Ready to take your business to the next level? Explore Vialet’s comprehensive solutions and start building your financial freedom today. Visit Vialet for more information or contact support at support@vialet.eu for any inquiries.

Frequently Asked Questions

How Does Vialet Help Build Credit?

Vialet helps build credit by reporting your financial activities to credit bureaus. Timely payments on Vialet accounts improve your credit score.

Is Vialet Suitable For Beginners?

Yes, Vialet is suitable for beginners. It offers user-friendly tools and resources to help you understand and manage your credit.

What Are Vialet’s Main Features?

Vialet’s main features include credit monitoring, financial education, and reporting to credit bureaus. These tools help improve your credit score.

Can I Track My Credit Score With Vialet?

Yes, Vialet allows you to track your credit score. Regular updates help you monitor your progress and make informed decisions.

Conclusion

Building credit with VIALET is straightforward and beneficial for businesses. The platform offers flexible, secure accounts and easy money transfers. Multiple IBANs and team access simplify management. Virtual corporate cards ensure secure payments. Automate payouts and integrate with various apps. VIALET supports your business growth efficiently. Ready to start? Explore more details on the VIALET website.