Budgeting Tools For Credit Repair: Boost Your Financial Health

Managing your budget is crucial for repairing your credit. With the right tools, you can track expenses, manage debts, and improve your financial health.

Credit repair often feels overwhelming, but budgeting tools can simplify the process. These tools help you understand where your money goes and how to manage it better. Whether you’re dealing with credit card debt or trying to save for a big purchase, budgeting tools can make a significant difference. They provide a clear picture of your finances, helping you make informed decisions. Using these tools, you can create a realistic plan to tackle debt and improve your credit score. Discover how budgeting tools can aid in credit repair and get started on the path to financial stability. Fabrick is one such tool that can help you on this journey. Explore its features and see how it can assist you in managing your finances effectively.

Introduction To Budgeting Tools For Credit Repair

Repairing your credit score can seem daunting. Budgeting tools simplify the process. These tools help you track expenses and manage finances effectively. Understanding how these tools aid in credit repair is crucial.

Understanding The Importance Of Credit Repair

Credit repair is vital for financial health. A good credit score opens doors to better loan rates. It also helps in securing credit cards and rental agreements. Poor credit can limit financial opportunities. Thus, repairing credit should be a priority.

How Budgeting Tools Can Aid In Credit Repair

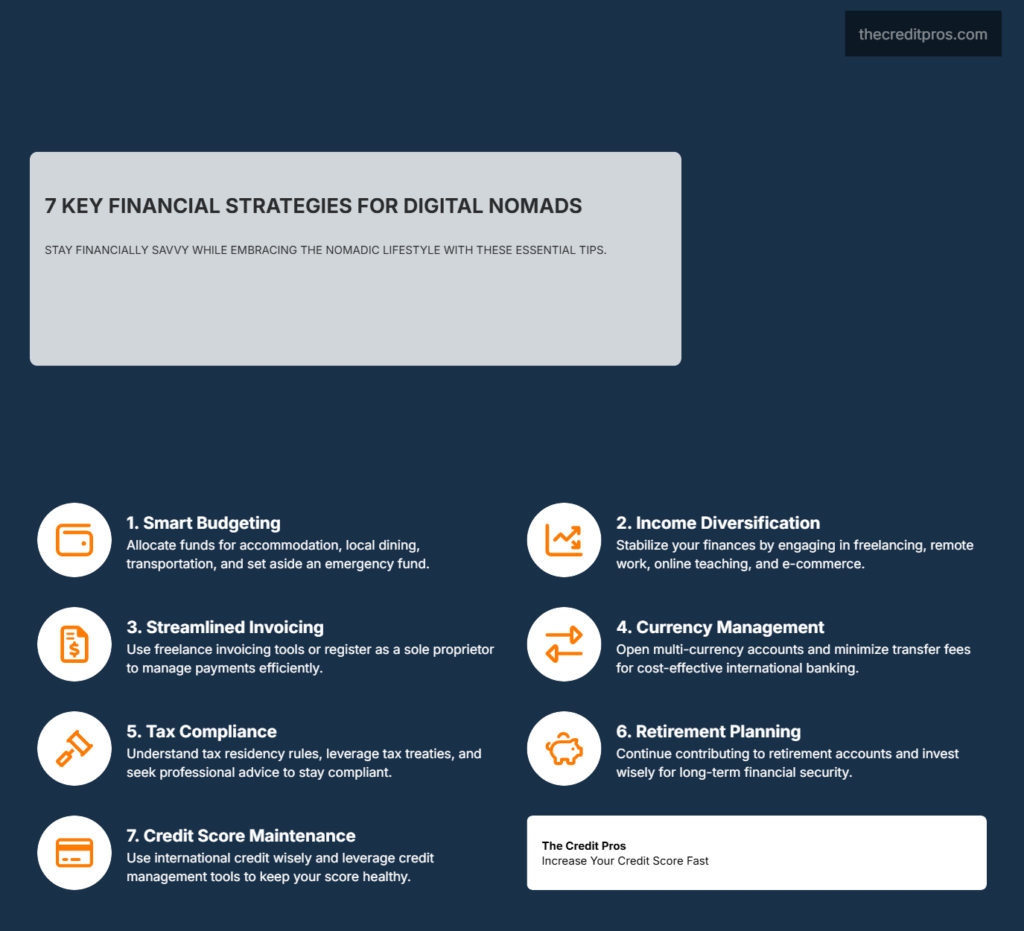

Budgeting tools help in planning and tracking expenses. They ensure you stay within your financial limits. These tools categorize spending, making it easy to identify unnecessary expenses. Here are some ways budgeting tools assist in credit repair:

- Tracking Spending: Monitor where your money goes.

- Setting Financial Goals: Plan for debt repayment and savings.

- Creating Budgets: Allocate funds for essentials and avoid overspending.

- Alerts and Reminders: Get notified about due dates for bills.

Using these tools can make a significant difference. They provide a clear picture of your financial situation. This clarity helps in making informed decisions. A disciplined approach to budgeting can lead to successful credit repair.

Key Features Of Top Budgeting Tools

Top budgeting tools offer a variety of features to help you manage your finances and improve your credit score. These tools not only track your expenses but also provide personalized plans and insights. Here are some key features to look for when choosing a budgeting tool.

Automated Expense Tracking

Automated expense tracking is essential for accurate budgeting. With this feature, the tool links to your bank accounts and credit cards. It categorizes your spending automatically. This saves time and reduces errors.

Customizable Budget Plans

Every individual has unique financial needs. Customizable budget plans allow you to create a budget that fits your lifestyle. You can adjust categories and set spending limits. This helps you stick to your financial goals.

Credit Score Monitoring

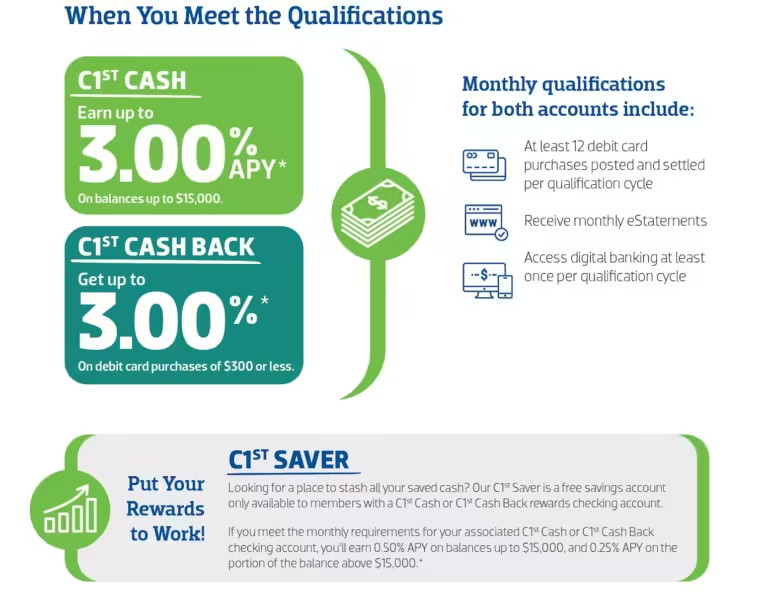

Monitoring your credit score is crucial for credit repair. Some budgeting tools offer integrated credit score monitoring. This feature provides regular updates on your credit score. It also offers tips to improve your credit standing.

Debt Reduction Planning

Paying off debt is a major step towards financial freedom. Budgeting tools with debt reduction planning help you create a strategy. They offer insights on which debts to pay off first. This can save you money on interest and reduce your debt faster.

Financial Goal Setting

Setting financial goals is important for long-term success. Budgeting tools that support financial goal setting allow you to track your progress. Whether it’s saving for a vacation or building an emergency fund, this feature keeps you motivated.

Pricing And Affordability Of Budgeting Tools

When it comes to repairing your credit, finding the right budgeting tool is crucial. Understanding the pricing and affordability of these tools can help you make an informed decision. Here, we break down the differences between free and paid tools, explore subscription plans, and assess their cost-effectiveness for long-term use.

Free Vs. Paid Tools: What You Need To Know

Free Tools: Many budgeting tools offer free versions with basic features. These can be a good start if you are new to budgeting or have a limited budget. Free tools often include features such as:

- Expense tracking

- Basic budget creation

- Simple financial reports

Paid Tools: Paid tools typically offer more advanced features. They might be ideal for those who need more comprehensive support. Paid tools can include:

- Advanced analytics

- Customizable budgets

- Integration with other financial accounts

Choosing between free and paid tools depends on your specific needs and financial goals.

Subscription Plans And Their Benefits

Subscription plans for budgeting tools often come in various tiers. Each tier provides different levels of functionality and support. Common subscription plans include:

| Plan | Monthly Cost | Features |

|---|---|---|

| Basic | $5 | Expense tracking, Budget creation |

| Standard | $10 | All Basic features, Advanced reports, Financial goals |

| Premium | $20 | All Standard features, Account integration, Personalized advice |

Subscription plans offer flexibility. You can choose the one that fits your needs and upgrade as your financial situation improves.

Cost-effectiveness For Long-term Use

When evaluating the cost-effectiveness of a budgeting tool, consider the following factors:

- Initial Cost: Free tools have no initial cost, while paid tools require a subscription fee.

- Long-Term Savings: Paid tools often help you save more money in the long run by providing detailed insights and personalized advice.

- Support and Updates: Paid tools usually offer better customer support and regular updates to improve functionality and security.

Investing in a good budgeting tool can lead to significant long-term benefits. It can help you repair your credit more efficiently and maintain financial stability.

Pros And Cons Of Using Budgeting Tools For Credit Repair

Budgeting tools can be a valuable asset in the journey of credit repair. They help manage finances more effectively and provide a clear picture of financial health. However, like any tool, they come with their own set of advantages and disadvantages. Below, we explore the pros and cons of using budgeting tools for credit repair.

Advantages: Streamlined Financial Management

Using budgeting tools for credit repair offers several advantages. One significant benefit is the streamlined financial management they provide. Here’s how:

- Easy Tracking: Budgeting tools make tracking income and expenses simple. Users can see where their money goes.

- Automated Calculations: These tools perform calculations automatically. This reduces human error and saves time.

- Goal Setting: Users can set financial goals and monitor progress. This keeps them motivated to stay on track.

- Spending Insights: Detailed reports and charts offer insights into spending habits. This helps identify areas to cut costs.

Such features are invaluable for those looking to improve their credit score. They provide a clear path to financial stability.

Disadvantages: Potential Over-reliance On Tools

Despite the benefits, there are some disadvantages to consider. One major drawback is the potential for over-reliance on these tools:

- Dependency: Users might become too dependent on the tools. They may neglect developing their own financial skills.

- Technical Issues: Software glitches or data breaches can occur. These can disrupt financial planning and cause stress.

- Cost: Some budgeting tools come with subscription fees. These can add up over time and strain a tight budget.

- Data Privacy: There is always a risk of sensitive information being compromised. Users must ensure the tool they choose has strong security measures.

While budgeting tools offer many benefits, they are not a substitute for good financial habits. Users should use these tools to aid, not replace, their financial decision-making process.

Specific Recommendations For Ideal Users

Choosing the right budgeting tools can significantly enhance your credit repair journey. Different tools suit different needs, whether you’re just starting, managing complex finances, or focusing on debt reduction. Below are tailored recommendations for various user types.

Best Tools For Beginners

For those new to credit repair, simple and user-friendly tools are best. These tools help track expenses, set budgets, and monitor progress without overwhelming users.

- Mint: Offers a straightforward interface and helps track expenses and income. It also provides budget recommendations.

- YNAB (You Need A Budget): Focuses on proactive budgeting. It’s great for learning the basics of financial management.

Advanced Tools For Comprehensive Financial Management

For users with more complex financial situations, advanced tools offer a wider range of features. These tools help manage multiple accounts, investments, and detailed financial planning.

- Quicken: Provides comprehensive financial management, including investments, loans, and business finances.

- Personal Capital: Excellent for tracking net worth, managing investments, and detailed financial planning.

Tools For Those Focused On Debt Reduction

If your primary goal is debt reduction, tools that focus on this area can be particularly effective. These tools help create payoff plans and track progress.

- Debt Payoff Planner: Creates a customized plan to pay off debts. It’s easy to use and keeps you motivated.

- Fabrick: While detailed information is unavailable, Fabrick’s focus on credit cards and business suggests it could be useful for managing debt effectively.

Conclusion: Boost Your Financial Health With Budgeting Tools

Improving your financial health requires smart budgeting. Using the right tools can make all the difference. Let’s recap the benefits and encourage you to take action.

Recap Of Benefits

Budgeting tools offer several advantages:

- Track spending: Stay aware of where your money goes.

- Set financial goals: Plan for short-term and long-term needs.

- Identify savings: Find areas where you can cut costs.

- Improve credit score: Better manage bills and payments.

- Reduce stress: Gain peace of mind with organized finances.

These tools streamline your budgeting process. They help you stay on top of your finances and make informed decisions. Your financial health improves when you use these tools consistently.

Encouragement To Take Action

Start using budgeting tools today. They are your ally in credit repair. Begin by choosing the right tool that fits your needs. Explore options like Fabrick, which offers features to help manage your credit and business finances.

Don’t wait for financial issues to pile up. Taking action now will help you regain control. Remember, the first step is always the hardest. But with the right tools, you can make progress every day. Commit to a brighter financial future.

Frequently Asked Questions

What Are Budgeting Tools For Credit Repair?

Budgeting tools for credit repair help manage your finances and improve your credit score. They track expenses, set savings goals, and monitor credit reports.

How Do Budgeting Tools Improve Credit?

Budgeting tools improve credit by helping you manage expenses, pay bills on time, and reduce debt. They create a financial plan that boosts your credit score.

Are Budgeting Tools Free To Use?

Many budgeting tools offer free versions with essential features. Some advanced tools may require a subscription for additional features and benefits.

Can Budgeting Tools Track Credit Scores?

Yes, many budgeting tools can track your credit score. They provide updates and insights to help you maintain or improve your credit.

Conclusion

Fixing your credit can feel overwhelming. Budgeting tools simplify this process. They help track spending and manage debt. Fabrick is a great option to consider. It offers effective solutions for credit repair. Using tools like Fabrick can make budgeting easier. Stay consistent and patient. Watch your credit score improve over time. Remember, good financial habits lead to better credit. Start today for a brighter financial future.