Budget-Friendly Credit Cards: Top Picks for Smart Savings

In today’s world, managing finances smartly is crucial. Having a budget-friendly credit card can make all the difference.

Credit cards with low fees and practical benefits help save money and improve financial health. For businesses seeking a reliable financial tool, the FairFigure Card stands out. This credit monitoring and financing tool supports businesses in enhancing their credit scores, accessing funds, and keeping track of their credit reports in real-time. With features like same-day funding and no personal credit checks, the FairFigure Card offers a practical solution for businesses aiming to grow. Discover how the FairFigure Card can benefit your business and support financial stability by visiting FairFigure today. Keep reading to learn more about budget-friendly credit cards that offer value without breaking the bank.

Introduction To Budget-friendly Credit Cards

Budget-friendly credit cards can be a lifeline for many individuals. They offer a practical solution to manage finances without breaking the bank. These cards often come with low fees and interest rates. This makes them an attractive option for those looking to save money while still enjoying the benefits of a credit card.

Understanding The Need For Budget-friendly Credit Cards

Many people struggle with high-interest rates and fees. This is where budget-friendly credit cards come into play. They provide a way to manage credit without the high costs. FairFigure Card, for instance, offers several benefits that cater to budget-conscious users:

- Business Credit Monitoring: Real-time access to business tri-bureau scores.

- Credit Building: Reports payment history to boost scores.

- Funding Access: Same-day funding with no personal credit checks.

- Credit Reporting Correction: Identify and correct wrong information.

- Easy Application Process: Uses business EIN for application.

How Budget-friendly Credit Cards Can Help Save Money

Using a budget-friendly credit card can lead to significant savings. Here’s how:

- Lower Interest Rates: These cards often feature lower interest rates, reducing the cost of borrowing.

- Fewer Fees: Many budget-friendly cards come with minimal fees, saving money on annual and late fees.

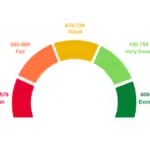

- Improved Credit Scores: Better credit scores can lead to lower interest rates and better loan terms. FairFigure Card helps improve business credit scores by up to 60% in three months.

Additionally, some budget-friendly credit cards offer rewards and cashback programs. These benefits can add up over time, providing extra savings. With the FairFigure Card, businesses can monitor their credit, secure funding, and correct reporting errors, all while keeping costs low.

For businesses, the FairFigure Card provides an affordable way to manage and improve their credit. This can lead to better funding opportunities and lower interest rates. Budget-friendly credit cards like FairFigure offer a practical solution for businesses to grow and succeed financially.

Key Features Of Budget-friendly Credit Cards

Budget-friendly credit cards offer several features that help you save money while providing valuable benefits. These cards are designed to keep costs low and enhance your financial flexibility. Below are some key features to look for in budget-friendly credit cards.

Low Or No Annual Fees

A significant advantage of budget-friendly credit cards is the low or no annual fees. Many budget-friendly cards waive the annual fee entirely, while others offer a minimal fee. This feature helps you save money, making the card more affordable in the long run.

- Annual fee waived for the first year

- Minimal fees starting as low as $0

- Access to benefits without additional costs

Cashback And Rewards Programs

Many budget-friendly credit cards offer cashback and rewards programs. These programs allow you to earn points or cashback on everyday purchases. Accumulated rewards can be redeemed for various benefits, including statement credits, gift cards, or travel.

| Reward Type | Examples |

|---|---|

| Cashback | 1% to 5% cashback on purchases |

| Points | Earn points for each dollar spent |

| Travel Rewards | Redeem points for flights or hotel stays |

Introductory Apr Offers

Budget-friendly credit cards often come with introductory APR offers. These offers provide a low or 0% interest rate for an initial period, usually ranging from 6 to 18 months. This feature can help you save on interest charges, especially for large purchases or balance transfers.

- 0% APR for the first 12 months

- Low introductory rates for balance transfers

- Reduced interest on purchases

Balance Transfer Options

Another valuable feature of budget-friendly credit cards is the balance transfer options. These options allow you to transfer existing high-interest debt to a new card with a lower interest rate. This can help you pay off debt faster and save on interest charges.

- Low balance transfer fees

- Extended low-interest periods for balance transfers

- Easy transfer process with minimal paperwork

These features make budget-friendly credit cards an excellent choice for those looking to save money and manage their finances better. By choosing a card with low fees, rewards programs, and favorable APR offers, you can enjoy the benefits without breaking the bank.

Top Budget-friendly Credit Cards For 2023

Finding the right credit card can be a game-changer for your finances. In 2023, several budget-friendly options can help you save money and build credit. Let’s explore the top budget-friendly credit cards for 2023.

Card 1: Features, Benefits, And Ideal Users

Features

- Business Credit Monitoring: Real-time access to business tri-bureau scores.

- Credit Building: Reports payment history to commercial bureaus.

- Funding Access: Same-day funding with no personal credit checks.

- Credit Reporting Correction: Identify and correct wrong information.

- Easy Application Process: Uses business EIN for application.

Benefits

- Improved Credit Scores: Up to 60% improvement in 3 months.

- Same-Day Funding: Access funds without personal credit checks.

- Accurate Credit Reporting: Reduces errors harming credit scores.

- Flexible Payback Terms: Customize payment plans.

- Business Growth: Unlock new funding options.

Ideal Users

Business owners seeking to improve credit scores and secure funding. Perfect for those who need real-time credit monitoring and same-day funding without personal credit checks.

Card 2: Features, Benefits, And Ideal Users

Features

- Cash Back Rewards: Earn cash back on every purchase.

- Low Interest Rate: Enjoy a low APR on purchases.

- No Annual Fee: Save money with no yearly fee.

- Balance Transfer Option: Transfer balances at a low rate.

- Fraud Protection: Stay protected with zero liability on unauthorized charges.

Benefits

- Save Money: Earn cash back and avoid annual fees.

- Lower Interest Costs: Benefit from a low APR.

- Debt Management: Transfer balances and pay less interest.

- Security: Enjoy peace of mind with fraud protection.

- Convenience: Easy to manage and use.

Ideal Users

Individuals looking for a credit card with rewards and low costs. Suitable for those who want to manage debt efficiently and enjoy added security.

Card 3: Features, Benefits, And Ideal Users

Features

- Introductory 0% APR: Enjoy 0% APR on purchases for the first 12 months.

- Rewards Program: Earn points on every purchase.

- Travel Benefits: Access travel perks and discounts.

- Extended Warranty: Get extended warranties on purchases.

- Purchase Protection: Protect your purchases from damage or theft.

Benefits

- Interest Savings: Pay no interest for the first year.

- Earn Rewards: Accumulate points for future use.

- Travel Savings: Enjoy discounts and perks while traveling.

- Product Protection: Benefit from extended warranties and purchase protection.

- Financial Flexibility: Manage finances with ease.

Ideal Users

Ideal for those who want to save on interest and earn rewards. Great for frequent travelers and shoppers looking for extra protection and benefits.

Pricing And Affordability Breakdown

The FairFigure Card is designed to provide businesses with an affordable and efficient way to monitor and improve their credit scores. This section breaks down the key aspects of its pricing and affordability to help you understand the costs involved.

Comparing Annual Fees

The FairFigure Card offers a FairFigure Premium Monitor service that provides access to the Foundation Report and commercial scores. This service is available for an affordable price, ensuring businesses can monitor their credit without a significant financial burden.

Here is a comparison table of the annual fees for the FairFigure Card:

| Service | Annual Fee |

|---|---|

| FairFigure Premium Monitor | Affordable Price |

Interest Rates And Aprs

The FairFigure Card provides funding amounts based on your business revenue, starting from $8,000. The application process involves no personal credit checks, which can be beneficial for businesses seeking quick access to funds.

Unlike traditional credit cards, the FairFigure Card focuses on improving business credit scores and offering same-day funding without the need for a personal guarantee.

Hidden Costs To Watch Out For

Transparency is key with the FairFigure Card. There are no hidden costs that could catch businesses off guard. The application process is straightforward, using the business EIN, and does not impact personal credit scores.

- No personal credit checks

- Secure data handling with Plaid

- Accurate credit reporting

These features ensure that businesses can manage their finances effectively without worrying about unexpected fees or charges.

For more details, visit the FairFigure website and explore how the FairFigure Card can benefit your business.

Pros And Cons Of Budget-friendly Credit Cards

Budget-friendly credit cards can be a smart choice for businesses looking to manage their finances effectively. These cards offer benefits such as saving money and earning rewards, but they also come with potential drawbacks and limitations. Understanding both sides can help you make an informed decision.

Pros: Saving Money And Earning Rewards

One of the biggest advantages of budget-friendly credit cards is the ability to save money. These cards often come with low or no annual fees, making them a cost-effective option for businesses. Additionally, they can offer competitive interest rates, which can help reduce the cost of carrying a balance.

Another significant benefit is earning rewards. Many budget-friendly credit cards offer reward programs that allow you to earn points, cashback, or miles for every dollar spent. This can translate into significant savings over time, especially for businesses with high expenses.

For instance, the FairFigure Card provides not only business credit monitoring but also funding access with no personal credit checks. This can be particularly beneficial for businesses looking to improve their credit scores while saving on interest and fees.

Cons: Potential Drawbacks And Limitations

While budget-friendly credit cards have their advantages, they also come with some potential drawbacks. One major limitation is the lower credit limits compared to premium cards. This can be a constraint for businesses that require larger credit lines to manage their expenses.

Another drawback is the limited reward structures. Budget-friendly cards may offer fewer rewards or less lucrative points compared to higher-end cards. This means businesses might not earn as much in rewards, which can be a disadvantage for those looking to maximize their earnings.

Lastly, some budget-friendly credit cards may have fewer perks and benefits. For example, they might lack travel insurance, purchase protection, or other premium features that come with more expensive cards. This can be a consideration for businesses that value these additional benefits.

Real-world Usage Reviews And Experiences

Real-world reviews and experiences can provide valuable insights into the effectiveness of budget-friendly credit cards. Many users appreciate the savings and rewards these cards offer, highlighting the low fees and competitive interest rates as major advantages.

For example, businesses using the FairFigure Card have reported improved credit scores and access to same-day funding. These users value the easy application process and the fact that it does not impact personal credit scores. The flexible payback terms and accurate credit reporting are also frequently mentioned as positive aspects.

However, some users have noted the limitations in credit limits and rewards structures. They mention that while the cards are budget-friendly, they may not provide the same level of benefits as premium options. This is an important consideration for businesses evaluating their credit card choices.

Overall, budget-friendly credit cards like the FairFigure Card can offer significant benefits for businesses, but it’s essential to weigh these against the potential drawbacks to make the best decision for your financial needs.

Who Should Consider Budget-friendly Credit Cards?

Budget-friendly credit cards offer numerous advantages for specific users and scenarios. They are designed to be accessible and beneficial for those who need credit while managing their finances efficiently.

Ideal Users And Scenarios

Budget-friendly credit cards are perfect for individuals with limited or no credit history. Students, recent graduates, and those rebuilding credit can benefit significantly. These cards usually have lower fees and interest rates, making them manageable for those on a tight budget.

- Students: Great for building credit history.

- New Graduates: Ideal for managing early financial responsibilities.

- Credit Rebuilders: Helps improve credit scores with responsible use.

Tips For Maximizing Benefits

To make the most of budget-friendly credit cards, consider the following tips:

- Pay on Time: Always make payments by the due date to avoid late fees.

- Keep Balances Low: Maintain a low balance to improve your credit score.

- Monitor Spending: Track your expenses to stay within your budget.

- Use Rewards Wisely: Some budget-friendly cards offer rewards. Utilize them effectively.

When To Consider Other Types Of Credit Cards

While budget-friendly credit cards have many benefits, there are times when you might need other types of credit cards:

| Scenario | Recommended Card Type |

|---|---|

| Travel Benefits | Travel Rewards Credit Card |

| High Spending Capacity | Premium Credit Card |

| Business Expenses | Business Credit Card |

If you need specific benefits like travel rewards or higher spending limits, consider exploring other credit card options. Each card type serves different needs and can provide unique advantages based on your financial goals.

Frequently Asked Questions

What Are Budget-friendly Credit Cards?

Budget-friendly credit cards have low fees and interest rates. They offer rewards and benefits that save money. They help manage finances effectively.

How To Choose A Budget-friendly Credit Card?

Compare interest rates, fees, and rewards. Look for cards with no annual fees. Check for low APRs and cashback offers.

Are Budget-friendly Credit Cards Good For Beginners?

Yes, they are ideal for beginners. They have low fees and simple terms. They help build credit without high costs.

What Are The Benefits Of Budget-friendly Credit Cards?

They offer low fees, affordable interest rates, and rewards. They help save money and improve credit scores. They are easy to manage.

Conclusion

Choosing the right budget-friendly credit card can save you money. Carefully compare features and fees. Look for cards that match your spending habits. Consider the FairFigure Card for business needs. It offers credit monitoring and same-day funding. Improve your business credit score with ease. For more details, visit FairFigure. Make an informed choice and enjoy financial benefits. Happy saving!