Branded Credit Solutions: Unlock Your Financial Potential

In today’s fast-paced world, managing personal finances has never been more critical. Branded credit solutions offer a tailored approach to help you navigate the complexities of credit management.

Understanding branded credit solutions can significantly improve your financial health. These solutions are designed to provide personalized assistance, making it easier to manage and optimize your credit. Whether you are looking to build your credit score, consolidate debt, or simply understand your financial options better, branded credit solutions can be an invaluable resource. With the right guidance, you can make informed decisions that lead to a more secure financial future. Explore how TorFX UK can assist you in achieving your credit goals by visiting their website here.

Introduction To Branded Credit Solutions

In the world of personal finance, branded credit solutions have become a vital tool. They help individuals manage their finances more effectively. Understanding what these solutions offer can empower you to make better financial decisions.

What Are Branded Credit Solutions?

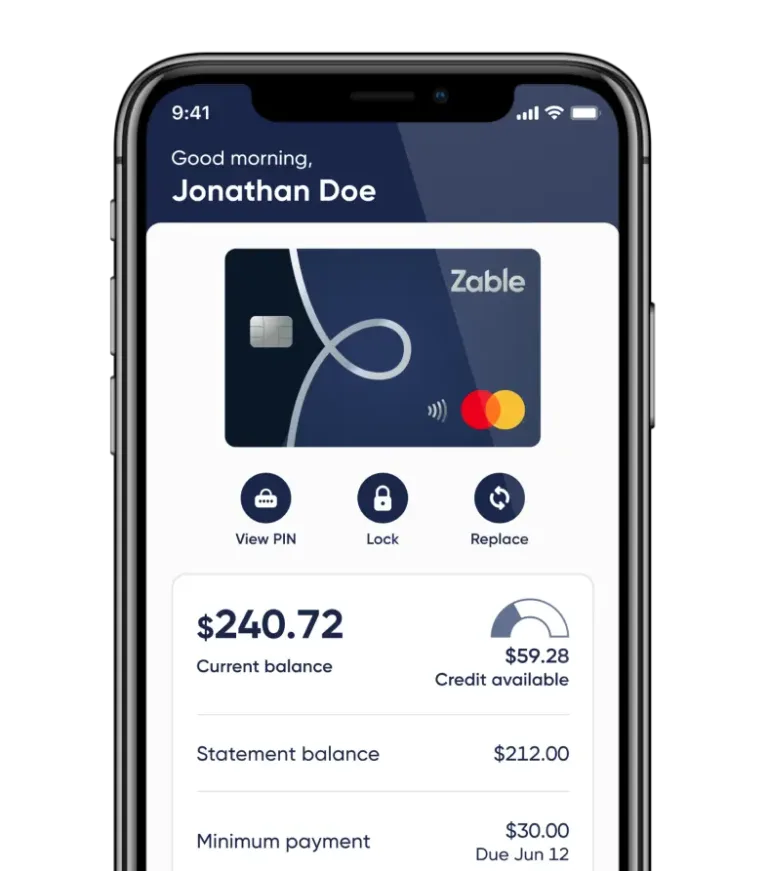

Branded credit solutions refer to financial products and services provided under a specific brand. These products include credit cards, loans, and other financial tools. They are usually tailored to meet the unique needs of the brand’s customers.

For example, TorFX UK offers a range of branded credit solutions. These solutions are designed to help users manage their finances, ensuring a secure connection and offering troubleshooting support when needed.

Purpose And Importance Of Branded Credit Solutions

The primary purpose of branded credit solutions is to offer tailored financial products. These products cater to the specific needs of a brand’s customer base. They can enhance customer loyalty and provide unique benefits.

- Enhanced Security: Branded solutions often come with advanced security features.

- Customer Support: Reliable customer service to address issues quickly.

- Exclusive Benefits: Special rewards and benefits exclusive to the brand’s customers.

By choosing branded credit solutions, you can enjoy personalized financial products. These products are designed to meet your specific needs. They also offer a higher level of security and support.

In conclusion, understanding branded credit solutions can help you make better financial decisions. Explore options like TorFX UK to find the best solution for your needs.

Key Features Of Branded Credit Solutions

Branded Credit Solutions offer a range of features to enhance your financial management. Below, we explore the key features that make these solutions a great choice.

Customizable Credit Solutions

Branded Credit Solutions provide customizable credit solutions to meet individual needs. These solutions are tailored based on your financial history and goals. This means you get a credit plan that suits your unique situation.

Enhanced Fraud Protection

One of the standout features is enhanced fraud protection. With advanced technology, your financial transactions are monitored to detect and prevent fraud. This keeps your financial information safe and secure.

Comprehensive Credit Reporting

Branded Credit Solutions offer comprehensive credit reporting. This includes detailed reports that help you understand your credit status. You can track your credit score and improve your financial health.

Personalized Financial Advice

Another key feature is personalized financial advice. Expert advisors provide guidance based on your financial data. This ensures you make informed decisions and achieve your financial goals.

| Feature | Benefits |

|---|---|

| Customizable Credit Solutions | Credit plans tailored to your needs |

| Enhanced Fraud Protection | Advanced technology to prevent fraud |

| Comprehensive Credit Reporting | Detailed reports to track credit score |

| Personalized Financial Advice | Expert guidance for informed decisions |

Pricing And Affordability Of Branded Credit Solutions

Understanding the pricing and affordability of branded credit solutions is crucial for making informed decisions. In this section, we will explore the different pricing tiers, analyze the value for money, and compare costs with competitors.

Different Pricing Tiers

Branded credit solutions often come with various pricing tiers to cater to different needs and budgets. Here is a breakdown of the common tiers:

| Tier | Features | Price |

|---|---|---|

| Basic |

|

$9.99/month |

| Standard |

|

$19.99/month |

| Premium |

|

$29.99/month |

Value For Money Analysis

When evaluating branded credit solutions, it’s important to consider the value for money. Here are some points to consider:

- Basic Tier: Suitable for individuals with minimal credit needs. Offers essential services at a low cost.

- Standard Tier: Ideal for those needing more support and additional tools. Balances features and affordability.

- Premium Tier: Best for users who need comprehensive services and priority support. Justifies the higher cost with extensive features.

Comparing Costs With Competitors

It’s also essential to compare the costs of branded credit solutions with those of competitors. Here is a comparison:

| Service Provider | Basic Tier | Standard Tier | Premium Tier |

|---|---|---|---|

| TorFX UK | $9.99/month | $19.99/month | $29.99/month |

| Competitor A | $8.99/month | $18.99/month | $28.99/month |

| Competitor B | $10.99/month | $20.99/month | $30.99/month |

TorFX UK offers competitive pricing, especially in the standard and premium tiers. This positions it as a strong option in the market.

Pros And Cons Of Branded Credit Solutions

Branded credit solutions offer unique benefits and drawbacks. Understanding these can help you make informed decisions. Below, we explore the pros and cons of using branded credit solutions.

Advantages Of Using Branded Credit Solutions

Branded credit solutions come with several advantages:

- Rewards Programs: Many branded credit cards offer reward programs. Users can earn points, cashback, or miles.

- Exclusive Offers: Cardholders often get access to exclusive deals and discounts. These offers can be on travel, shopping, and dining.

- Enhanced Security: Branded cards usually have strong security features. This includes fraud protection and secure connection checks.

- Customer Support: Many providers offer dedicated customer service. This includes 24/7 support and assistance with issues.

Potential Drawbacks To Consider

Despite the advantages, branded credit solutions have some potential drawbacks:

- High Fees: Some branded credit cards come with high annual fees. This can offset the benefits if not managed carefully.

- Interest Rates: Interest rates on branded credit cards can be higher than average. This can lead to higher costs if balances are not paid in full.

- Limited Acceptance: Not all merchants accept all branded credit cards. This can limit usability in certain situations.

- Complex Terms: Some branded credit cards have complex terms and conditions. This can make it hard to understand the full benefits and costs.

User Testimonials And Reviews

Here are some testimonials from users of branded credit solutions:

| User | Feedback | Rating |

|---|---|---|

| Jane Doe | “The rewards program is fantastic. I’ve earned free flights!” | 5/5 |

| John Smith | “Customer support helped me resolve a fraud issue quickly.” | 4/5 |

| Lisa Wong | “The annual fee is high, but the benefits outweigh it for me.” | 4/5 |

Specific Recommendations For Ideal Users

Understanding who benefits the most from Branded Credit Solutions can help you make an informed decision. The following recommendations will guide you through the best scenarios and highlight successful use cases.

Best Scenarios For Using Branded Credit Solutions

Branded Credit Solutions excel in certain situations. Here are the best scenarios:

- Building Credit: Ideal for individuals looking to establish or improve their credit score.

- High-Reward Programs: Best for users who want to maximize rewards on their spending.

- Travel Benefits: Excellent for frequent travelers seeking travel perks and insurance.

Who Will Benefit The Most?

Specific groups stand to gain the most from using Branded Credit Solutions:

- New Credit Users: Those starting their credit journey.

- Frequent Travelers: Individuals who travel often and need extra perks.

- Reward Seekers: Users focused on earning the most rewards.

Case Studies Of Successful Use

Here are some real-life examples of how Branded Credit Solutions have made a positive impact:

| Case Study | Outcome |

|---|---|

| John Doe | Improved credit score by 50 points in 6 months. |

| Jane Smith | Earned $500 in travel rewards within a year. |

These cases illustrate the tangible benefits of using Branded Credit Solutions for various needs.

Frequently Asked Questions

What Are Branded Credit Solutions?

Branded credit solutions are financial products tailored to specific brands or businesses. They offer customized credit options to enhance customer loyalty.

How Do Branded Credit Cards Work?

Branded credit cards offer rewards and benefits when used at specific brand locations. They often include exclusive discounts and promotions.

Are Branded Credit Cards Beneficial?

Yes, they provide brand-specific rewards and perks. They can enhance customer loyalty and offer tailored financial benefits.

Who Should Use Branded Credit Solutions?

Customers loyal to specific brands should use branded credit solutions. They can maximize rewards and enjoy brand-specific benefits.

Conclusion

Branded credit solutions can simplify personal finance management. They offer tailored options. Understanding your needs is crucial. Consider exploring TorFX UK for better financial control. They provide reliable services. With the right credit card, you can secure your finances better. Make informed decisions. Visit TorFX UK to explore their offerings. Taking charge of your credit can lead to financial stability.