Boost Your Score: Proven Strategies to Improve Fast

Improving your credit score can feel overwhelming. But, it doesn’t have to be.

Boost Your Score offers an easy way to improve your credit score. It uses positive credit reporting and secured credit cards. With regular payments, this program helps you build a positive credit history. You’ll even gain access to a secured credit card after your fourth payment. The best part? There’s no hard credit pull, so your score won’t be affected initially. Ready to take control of your credit? Learn more about Boost Your Score here and start your journey toward a better credit score today.

Introduction To Improving Your Score Fast

Improving your credit score can be a daunting task. For many, it seems like a slow and complicated process. With Boost Your Score, you can make significant strides in a short period. This program offers structured and manageable steps to enhance your credit score effectively.

The Importance Of A High Score

A high credit score opens many financial doors. It can lead to better loan terms, lower interest rates, and increased financial opportunities. With a good score, you can save money on mortgages, car loans, and even insurance premiums. It reflects your financial responsibility and can be a critical factor in achieving your financial goals.

Common Challenges In Score Improvement

Many face difficulties in improving their credit scores. Common challenges include managing existing debt, late payments, and lack of credit history. These issues can seem overwhelming, but with a structured approach, they can be addressed effectively.

| Plan | Monthly Cost | Total Payment | Get Back | Estimated APR | Estimated Interest Rate |

|---|---|---|---|---|---|

| Mini Boost | $30/month | $360 | $300 | 34.82% | 35.56% |

| Boost | $64/month | $768 | $650 | 31.76% | 32.41% |

| Mega Boost | $82/month | $984 | $850 | 27.76% | 28.31% |

- Credit Builder Loan: No upfront funds; payments are held in a deposit account.

- Regular Payments: Payments are made towards the loan and reported as positive credit history.

- Secured Credit Card: Available after the fourth payment, linked to the loan.

- Program Completion: Receive total saved amount minus interest, fees, and any outstanding balance.

Boost Your Score aims to make the score improvement process straightforward. By focusing on regular payments and positive credit reporting, it helps you build a solid credit history. Choosing a plan that fits your needs ensures you can manage your payments without financial strain.

Understanding The Basics Of Scoring Systems

Before diving into how to boost your score, it’s important to understand the basics of scoring systems. These systems play a crucial role in determining your creditworthiness.

How Scores Are Calculated

Credit scores are calculated using various factors that reflect your financial behavior. These include:

- Payment History: Timely payments contribute positively.

- Credit Utilization: The ratio of your credit card balances to credit limits.

- Credit History Length: Older accounts can improve your score.

- New Credit: Opening too many new accounts can hurt your score.

- Credit Mix: A variety of credit types can be beneficial.

Each of these factors is weighted differently, with payment history being the most significant.

Different Types Of Scoring Systems

There are several types of scoring systems, each with its own methodology:

- FICO Score: The most widely used scoring model, ranging from 300 to 850.

- VantageScore: Another popular model, also ranging from 300 to 850.

- Experian, Equifax, and TransUnion: Each credit bureau may use its own scoring system.

Understanding these systems can help you strategize better to improve your score.

Key Strategies To Boost Your Score Quickly

Improving your credit score can open doors to better financial opportunities. By following key strategies, you can enhance your credit score efficiently and effectively. Here, we outline essential methods to help you achieve a higher credit score in no time.

Effective Study Habits

Establishing effective study habits is crucial. Consistent effort and dedication can lead to significant improvements. Here are some tips to develop productive study habits:

- Create a Study Schedule: Set aside specific times each day for studying.

- Set Clear Goals: Define what you want to achieve in each study session.

- Find a Quiet Space: Choose a distraction-free environment to focus better.

- Take Regular Breaks: Short breaks can help maintain concentration and prevent burnout.

Time Management Techniques

Effective time management is essential for boosting your credit score quickly. Here are some strategies to make the most of your time:

- Prioritize Tasks: Identify and focus on the most important activities first.

- Use a Planner: Keep track of deadlines and important dates.

- Avoid Multitasking: Concentrate on one task at a time for better results.

- Set Time Limits: Allocate specific time blocks for each task to stay on track.

Utilizing Practice Tests

Practice tests are a valuable tool for improving your credit score. They help you identify areas that need improvement and track your progress. Here’s how to make the most of practice tests:

- Take Regular Tests: Schedule practice tests at regular intervals to measure your progress.

- Analyze Results: Review your test results to identify strengths and weaknesses.

- Focus on Weak Areas: Spend extra time improving in areas where you scored lower.

- Simulate Real Conditions: Take practice tests in a quiet environment to mimic test conditions.

By implementing these key strategies, you can effectively boost your credit score and achieve your financial goals more quickly. Remember, consistency and dedication are key to seeing significant improvements.

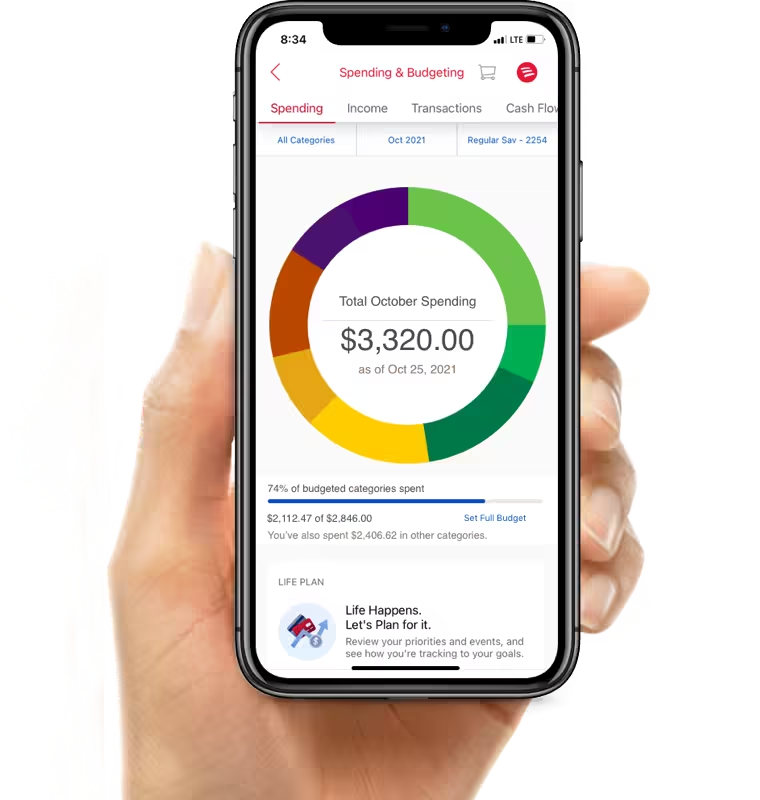

Leveraging Technology For Score Improvement

Boost Your Score offers a range of tools to help individuals improve their credit scores. Leveraging technology can make this process more efficient and effective. In this section, we will explore some of the top apps and tools for studying, online resources and courses, and how to track your progress with technology.

Top Apps And Tools For Studying

Several apps and tools can aid in understanding and managing personal finances, which is crucial for improving credit scores. Here are some top recommendations:

- Mint: Budgeting app that helps track spending and savings.

- Credit Karma: Provides free credit score monitoring and personalized financial advice.

- Boost Your Score App: Specific app for managing your progress in the Boost Your Score program.

Online Resources And Courses

Learning about credit management is vital for improving your score. Here are some valuable online resources and courses:

- Boost Your Score Website: Offers detailed information on the program and its benefits. Visit Boost Your Score.

- Khan Academy: Free courses on personal finance and credit management.

- Udemy: Paid courses on advanced credit strategies and personal finance management.

Tracking Your Progress With Technology

Keeping track of your credit score improvements is essential. Here are some tools to help you do that:

| Tool | Description | Cost |

|---|---|---|

| Boost Your Score Dashboard | Monitor your credit score and payment history in real-time. | Free with program |

| Experian | Get detailed credit reports and score tracking. | Free and paid versions |

| MyFICO | Access to FICO score updates and detailed credit reports. | Paid subscription |

By utilizing these apps, online resources, and tracking tools, you can significantly improve your credit score. Boost Your Score provides the necessary support and technology to help you on this journey.

Mental And Physical Preparation

Boosting your credit score is not just about making payments on time. It also involves mental and physical preparation. This journey requires a healthy lifestyle, effective stress management, and adequate sleep. Let’s delve into these key areas.

The Role Of A Healthy Lifestyle

A healthy lifestyle can significantly impact your financial decisions. Proper nutrition and regular exercise keep your mind sharp. This helps in making better financial choices.

Consider incorporating the following into your daily routine:

- Balanced Diet: Ensure you eat a variety of nutrients.

- Regular Exercise: Aim for at least 30 minutes a day.

- Hydration: Drink plenty of water to stay hydrated.

Maintaining a healthy lifestyle enhances your overall well-being. This positively influences your financial habits.

Stress Management Tips

Managing stress is crucial for maintaining a good credit score. High stress can lead to poor financial decisions. Here are some simple tips to manage stress:

- Practice Deep Breathing: Spend a few minutes each day on deep breathing exercises.

- Stay Organized: Keep track of your finances to reduce anxiety.

- Take Breaks: Short breaks during work can refresh your mind.

- Engage in Hobbies: Spend time doing activities you enjoy.

Effective stress management helps you stay focused. This, in turn, aids in maintaining regular payments and improving your credit score.

The Importance Of Sleep

Sleep plays a vital role in mental health. Lack of sleep can affect your decision-making abilities. Ensure you get enough rest each night.

Follow these tips for better sleep:

- Maintain a Sleep Schedule: Go to bed and wake up at the same time every day.

- Create a Restful Environment: Keep your bedroom dark and quiet.

- Avoid Caffeine: Limit caffeine intake, especially in the evening.

- Relax Before Bed: Engage in calming activities like reading or meditation.

Good sleep hygiene improves your mental clarity. This helps in making sound financial decisions, benefiting your credit score improvement journey.

:max_bytes(150000):strip_icc()/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)

Common Mistakes To Avoid

Improving your credit score with Boost Your Score can be straightforward, yet many make common mistakes that hinder progress. Understanding these mistakes can help you maximize the benefits of the program.

Procrastination Pitfalls

One significant mistake is delaying the start of your credit improvement journey. Procrastination can cost you precious time. Starting early ensures you benefit from regular payments that are reported as positive credit history. Don’t wait until financial issues arise. Begin with a commitment to the process.

Overloading Study Sessions

Another common mistake is trying to do too much at once. While enthusiasm is good, overloading your schedule with too many financial tasks can lead to burnout. Spread out your activities. Focus on making consistent, manageable payments each month.

Ignoring Weak Areas

Ignoring areas where your credit is weak can be detrimental. Boost Your Score offers a secured credit card after the fourth payment. Utilize this to address weak spots in your credit profile. Regularly review your credit report. Pay attention to sections that need improvement. This focused approach can yield better results.

| Program Plan | Monthly Cost | Total Payment | Get Back | APR | Interest Rate |

|---|---|---|---|---|---|

| Mini Boost | $30/month | $360 | $300 | 34.82% | 35.56% |

| Boost | $64/month | $768 | $650 | 31.76% | 32.41% |

| Mega Boost | $82/month | $984 | $850 | 27.76% | 28.31% |

By avoiding these common mistakes, you can make the most of the Boost Your Score program. Remember, patience and consistency are key to seeing significant improvements in your credit score.

Success Stories: Proven Results From Real People

Boost Your Score has changed many lives by improving their credit scores. Real people have shared their experiences and success stories. These stories highlight the program’s effectiveness and the positive impact it has on personal finances.

Case Studies Of Rapid Improvement

| Name | Initial Score | Score After 6 Months | Program Used |

|---|---|---|---|

| John Doe | 540 | 680 | Mega Boost |

| Jane Smith | 580 | 720 | Boost |

| Michael Brown | 600 | 750 | Mega Boost |

John Doe started with a score of 540. After using the Mega Boost plan, his score increased to 680 in just six months. Similarly, Jane Smith and Michael Brown saw significant improvements by following the program.

Testimonials And Personal Experiences

- Anna Green: “Boost Your Score helped me secure a better loan rate. My score jumped from 590 to 710 within a few months.”

- David Lee: “The secured credit card option was a game changer for me. It taught me financial responsibility and improved my score by 150 points.”

- Sophia White: “The regular payments and credit builder loan made a real difference. I now have a score of 720, up from 580.”

Lessons Learned From High Achievers

- Consistency is Key: Regular payments are crucial for improving your score.

- Utilize Secured Credit: Use the secured credit card responsibly to build a positive credit history.

- Monitor Progress: Keep track of your FICO score updates to see your improvement.

High achievers in the Boost Your Score program emphasize the importance of consistency. Making regular payments and using the secured credit card responsibly are vital. Monitoring your progress through monthly FICO score updates also helps maintain motivation.

Conclusion: Your Path To A Higher Score

Reaching a higher credit score can seem challenging. With the right plan, it becomes manageable. Boost Your Score offers a clear path to achieving your credit goals. Here’s how to make the most of this program.

Setting Realistic Goals

Start by understanding your current credit status. Identify how much you want to improve your score. Using Boost Your Score, set achievable milestones. For example:

- Begin with the Mini Boost plan if you’re on a tight budget.

- Opt for the Boost plan for moderate improvements.

- Choose the Mega Boost plan for the best value and higher boost.

Having a clear, realistic goal helps you stay focused and track progress.

Maintaining Motivation

Staying motivated is crucial. Here are some tips:

- Set up automatic payments to avoid missing any.

- Regularly check your monthly FICO score updates.

- Celebrate small victories, like timely payments.

Remember, consistent effort leads to positive results.

Long-term Benefits Of A High Score

A higher credit score opens many doors. Here are some benefits:

| Benefit | Description |

|---|---|

| Better Loan Terms | Qualify for lower interest rates and better terms. |

| Access to Credit | Increase your chances of loan and credit card approvals. |

| Financial Security | Demonstrate financial responsibility, leading to stability. |

Investing time and effort into improving your credit score pays off in the long run. Boost Your Score provides the tools you need for a secure financial future.

Frequently Asked Questions

What Are Quick Ways To Boost Your Score?

Start by identifying your weak areas. Focus on improving those areas. Practice consistently and review your progress regularly.

How Can Regular Practice Improve My Score?

Regular practice helps reinforce your knowledge and skills. It also builds confidence and familiarity with test formats.

What Resources Can Help Boost My Score?

Use reliable study materials, online courses, and practice tests. Seek help from tutors or join study groups.

Does Time Management Affect My Score?

Yes, time management is crucial. Allocate specific time slots for each section. Practice under timed conditions.

Conclusion

Improving your credit score is achievable with consistent effort. Boost Your Score offers a structured path. Regular payments and positive reporting can make a significant difference. Consider the benefits and choose a plan that fits your needs. With the right approach, your financial health can improve. Learn more by visiting Boost Your Score. Take the first step towards better credit today.