Boost Credit Score Quickly: Proven Tips to Raise Your Score Fast

Improving your credit score can seem like a daunting task. But it doesn’t have to be.

A good credit score is crucial for securing loans, mortgages, and better interest rates. If you’re looking to boost your credit score quickly, there are several effective strategies you can implement right now. Whether you’re a seasoned investor or just starting, understanding the factors that impact your credit score is essential. By focusing on key areas such as timely payments, reducing debt, and monitoring your credit report, you can see significant improvements in a short period. For those in the real estate investing niche, resources like SubTo offer invaluable support and guidance. With the right approach and tools, you can achieve a better credit score and unlock new financial opportunities.

Introduction To Boosting Your Credit Score Quickly

Boosting your credit score quickly is essential for financial health. A good credit score opens doors to better interest rates and loan approvals. Let’s explore how you can improve your credit score swiftly.

Understanding The Importance Of A Good Credit Score

Your credit score reflects your creditworthiness. Lenders use it to assess the risk of lending money to you. A high credit score indicates responsible financial behavior, making you a reliable borrower.

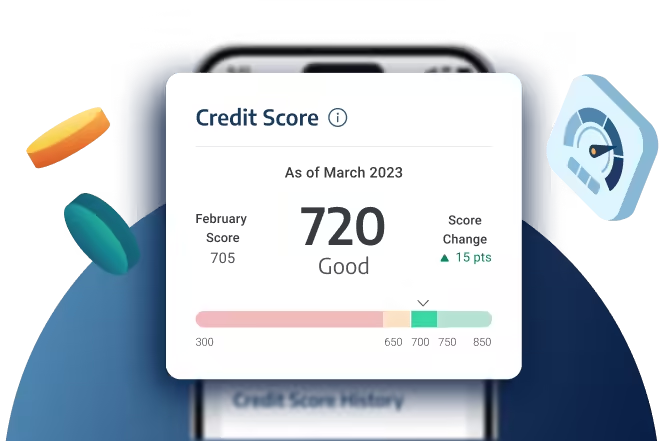

Credit scores range from 300 to 850. Scores above 700 are considered good, while scores above 800 are excellent. Maintaining a good credit score can save you money and stress in the long run.

How A Higher Credit Score Can Benefit You

Higher credit scores come with several advantages. Here are some key benefits:

- Lower interest rates on loans and credit cards

- Better approval odds for rental applications

- Higher credit limits

- More favorable insurance premiums

Improving your credit score can lead to significant financial savings. For instance, you might get a mortgage at a lower interest rate, reducing your monthly payments.

Moreover, employers sometimes check credit scores as part of the hiring process. A good credit score can enhance your job prospects.

SubTo is an educational resource for real estate investors. It focuses on creative financing and offers community support, essential documents, and member-run accountability groups. With SubTo, you get guidance, motivation, and resources to take immediate action and achieve success in real estate investing.

For more information, visit the SubTo website and explore the “Success Page” for member stories.

Key Tips To Improve Your Credit Score Fast

Improving your credit score quickly can seem challenging. But with the right strategies, you can see results faster than you might expect. Here are some key tips to enhance your credit score effectively.

Check Your Credit Report For Errors

Start by getting a copy of your credit report from major credit bureaus. Look for any errors or inaccuracies. Dispute any mistakes you find. Correcting errors can boost your score quickly.

Pay Down Credit Card Balances Strategically

Focus on paying down high-interest credit card balances first. This can lower your credit utilization ratio. Aim to keep it below 30%. Paying more than the minimum payment can also help.

Use A Personal Loan To Consolidate Debt

Consider consolidating your high-interest debts into a personal loan. This can simplify your payments. It can also reduce the overall interest you pay. A personal loan may lower your credit utilization ratio.

Become An Authorized User On A Credit Card

Ask a trusted friend or family member to add you as an authorized user on their credit card. Ensure their account is in good standing. Their positive payment history can reflect on your credit report. This can improve your score.

Increase Your Credit Limits

Request a credit limit increase from your credit card issuer. Higher credit limits can reduce your credit utilization ratio. Ensure you don’t increase your spending. This strategy can help boost your credit score.

Understanding The Impact Of Each Strategy

Boosting your credit score quickly requires understanding the impact of various strategies. Each method has unique benefits and potential effects on your score. By knowing how each strategy works, you can make informed decisions that lead to faster credit improvement.

How Error Corrections Can Boost Your Score

Errors on your credit report can significantly lower your score. Correcting these errors can lead to immediate improvements. Here’s how:

- Request a copy of your credit report from major bureaus.

- Review the report for inaccuracies such as incorrect personal information or account errors.

- Dispute any errors found with the credit bureau.

Even small inaccuracies can have a big impact. Ensure all information is accurate to reflect your true creditworthiness.

The Benefits Of Reducing Credit Card Balances

High credit card balances can negatively affect your score. Reducing these balances can help:

- Pay down high-interest debts first to save money.

- Focus on reducing balances to below 30% of your credit limit.

- Consider making multiple payments within a month to keep balances low.

Lower balances improve your credit utilization ratio, a key factor in your credit score.

The Role Of Debt Consolidation In Credit Improvement

Debt consolidation can simplify payments and improve your score. Here are the benefits:

- Combines multiple debts into one manageable payment.

- Often comes with a lower interest rate, reducing overall debt.

- Helps prevent missed or late payments by simplifying your finances.

By consolidating debt, you streamline your finances and reduce the risk of late payments, which boosts your score.

Advantages Of Becoming An Authorized User

Becoming an authorized user on someone else’s credit card can benefit your score. Consider these points:

- Inherits the primary cardholder’s credit history.

- Beneficial if the cardholder has a good payment history and low credit utilization.

- No responsibility for the debt, but gain the positive credit impact.

This strategy can add positive credit history to your report, improving your score.

Impact Of Higher Credit Limits On Your Score

Requesting higher credit limits can improve your credit utilization ratio. Here’s how it works:

- Ask your credit card issuer for a credit limit increase.

- Ensure not to increase your spending with the higher limit.

- Monitor your credit report to see the impact.

A higher limit means lower credit utilization, which is favorable for your credit score.

By understanding and applying these strategies, you can see quick improvements in your credit score. Each method targets different aspects of your credit profile, contributing to overall better financial health.

Common Mistakes To Avoid

Boosting your credit score quickly requires careful planning and avoiding common pitfalls. Many people make mistakes that can negatively impact their credit score. Understanding these mistakes can help you stay on track and improve your score efficiently.

Opening Too Many New Accounts At Once

Opening multiple new credit accounts in a short period can harm your credit score. Each application results in a hard inquiry on your credit report, which can lower your score. Additionally, new accounts lower the average age of your credit history, another factor in your score.

- Each inquiry can decrease your score by a few points.

- New accounts can reduce the average age of your credit history.

- It may signal financial instability to lenders.

Closing Old Credit Accounts

Closing old credit accounts might seem like a good idea, but it can negatively affect your credit score. Older accounts contribute to the length of your credit history, an important factor in your score calculation. Additionally, closing accounts reduces your available credit, increasing your credit utilization ratio.

| Impact | Details |

|---|---|

| Credit History Length | Older accounts improve the length of your credit history. |

| Credit Utilization | Closing accounts reduces available credit, raising utilization ratio. |

Ignoring Your Credit Report

Not reviewing your credit report can lead to missed errors and potential fraud. Regularly checking your report helps you identify and correct mistakes. It also ensures you stay informed about your credit status.

- Identify errors that could lower your score.

- Detect fraudulent activities early.

- Stay informed about your credit status.

Visit each of the three major credit bureaus annually to get a free copy of your credit report. Correcting errors can improve your score significantly.

Pros And Cons Of Quick Credit Score Improvement Strategies

Boosting your credit score quickly can have significant impacts on your financial life. While there are many benefits, there are also potential risks. Understanding these can help you make informed decisions.

Immediate Benefits And Long-term Advantages

Quick credit score improvement strategies can provide several immediate benefits:

- Improved credit card and loan approval chances.

- Lower interest rates on loans and credit cards.

- Better rental opportunities and lower security deposits.

In the long-term, maintaining a higher credit score can lead to:

- Greater financial flexibility and independence.

- Access to premium credit cards with better rewards.

- Enhanced job opportunities, as some employers check credit scores.

Potential Risks And Drawbacks

While quick fixes can be effective, there are potential risks to consider:

- Short-term boosts may not be sustainable without consistent effort.

- Some strategies might involve high fees or potential scams.

- Quick fixes might not address underlying financial habits.

To avoid these drawbacks, it’s essential to:

- Verify the credibility of the credit repair company.

- Ensure that any quick strategy is part of a long-term financial plan.

- Develop good financial habits to maintain a high credit score.

Consider these factors carefully before pursuing quick credit score improvement strategies. Make sure to balance immediate benefits with potential risks for a sustainable financial future.

Who Can Benefit The Most From These Strategies?

Improving a credit score quickly can be essential for various individuals. Different groups might find these strategies particularly beneficial. Here, we explore who can benefit the most.

Individuals With High Credit Card Balances

People with high credit card balances often struggle with their credit scores. High balances can negatively impact your credit utilization ratio, which is a significant part of your credit score.

To benefit from these strategies, focus on paying down your balances. Consider transferring your balance to a card with a lower interest rate. This can reduce the amount you owe faster.

| Strategy | Benefit |

|---|---|

| Pay Down Balances | Reduces Credit Utilization Ratio |

| Balance Transfer | Lower Interest, Faster Payoff |

People With Errors On Their Credit Reports

Errors on credit reports can severely damage your credit score. Incorrect information can lower your score and affect your financial opportunities.

Regularly check your credit report for mistakes. Dispute any errors you find to improve your score. By correcting inaccuracies, you can see a quick boost in your credit score.

- Check Credit Report Regularly

- Dispute Incorrect Information

- Monitor for Changes

Those With Limited Credit Histories

Individuals with limited credit histories often have lower credit scores. This can make it harder to obtain loans or credit cards.

To build your credit history, consider applying for a secured credit card. Use it responsibly and make timely payments. Another option is to become an authorized user on someone else’s credit card.

- Apply for a Secured Credit Card

- Make Timely Payments

- Become an Authorized User

These strategies can help you build a solid credit history and improve your credit score over time.

Frequently Asked Questions

How Can I Boost My Credit Score Quickly?

Pay off outstanding debts and keep balances low. Dispute any errors on your credit report. Avoid opening new accounts.

What Is The Fastest Way To Improve Credit Score?

Pay down high credit card balances. Make timely payments. Correct any inaccuracies on your credit report.

Can Paying Off Debt Improve My Credit Score?

Yes, paying off debt can improve your credit score. It reduces your credit utilization ratio.

How Does Credit Utilization Affect My Score?

Credit utilization significantly affects your score. Keep it below 30% for better results.

Conclusion

Improving your credit score quickly requires discipline and smart strategies. Follow these tips to see progress. You can also explore resources like SubTo. It offers guidance and support for real estate investors. Learn more about it here. Stay committed, and you will achieve your financial goals. Remember, consistency is key. Small steps lead to big changes over time. Keep monitoring your progress regularly. Your efforts will pay off.