Best Student Credit Card Comparison

The best student credit cards often offer rewards, low fees, and tools to build credit. Popular options include Discover it® Student Cash Back and Journey® Student Rewards from Capital One.

Finding the right student credit card can be challenging but rewarding. Many student credit cards provide benefits like cashback, no annual fees, and credit-building tools. These cards help students manage their finances while establishing a credit history. Discover it® Student Cash Back offers 5% cashback in rotating categories.

Journey® Student Rewards from Capital One gives a flat 1% cashback on all purchases. Always compare interest rates, fees, and rewards to choose the best card. Opt for a card that fits your spending habits and financial goals. Make timely payments to build a strong credit score.

Top Student Credit Cards

Choosing the best student credit card can be overwhelming. But with the right information, students can find the perfect card to build their credit and manage their finances. Here is a detailed comparison of the top student credit cards available today.

Card 1 Overview

Card 1 offers excellent rewards and benefits for students. This card has no annual fee and provides cash back on various purchases.

- Annual Fee: $0

- Cash Back: 5% on select categories

- Intro APR: 0% for the first 6 months

- Regular APR: 14.99% – 23.99% variable

This card also offers a sign-up bonus after spending $500 in the first three months. Students can benefit from free access to their FICO score and other credit tools.

Card 2 Overview

Card 2 is another great option for students. It features a user-friendly mobile app and rewards for good grades.

- Annual Fee: $0

- Cash Back: 2% on all purchases

- Intro APR: 0% for the first 7 months

- Regular APR: 15.99% – 24.99% variable

Students who maintain a GPA of 3.0 or higher can earn extra rewards. This card also comes with no foreign transaction fees, making it ideal for studying abroad.

Card 3 Overview

Card 3 focuses on helping students build their credit. It includes a simple rewards program and helpful financial tools.

- Annual Fee: $0

- Cash Back: 1% on all purchases

- Intro APR: 0% for the first 8 months

- Regular APR: 16.99% – 25.99% variable

Students can get a statement credit for making on-time payments. The card also offers free access to a credit score dashboard and educational resources.

| Feature | Card 1 | Card 2 | Card 3 |

|---|---|---|---|

| Annual Fee | $0 | $0 | $0 |

| Cash Back | 5% on select categories | 2% on all purchases | 1% on all purchases |

| Intro APR | 0% for 6 months | 0% for 7 months | 0% for 8 months |

| Regular APR | 14.99% – 23.99% | 15.99% – 24.99% | 16.99% – 25.99% |

Each of these cards offers unique advantages tailored to student needs. Students should compare these features and choose the card that best aligns with their financial goals.

Key Features To Consider

Choosing the best student credit card can be challenging. It’s important to understand the key features. These features will help you make an informed decision.

Interest Rates

Interest rates are crucial. The interest rate determines how much extra money you pay if you carry a balance. Student credit cards often have lower interest rates. Look for cards with an APR (Annual Percentage Rate) that fits your budget.

| Card | APR Range |

|---|---|

| Card A | 12.99% – 19.99% |

| Card B | 14.99% – 21.99% |

| Card C | 15.99% – 23.99% |

Rewards Programs

Rewards programs can be very beneficial. They offer cashback, points, or miles. Look for a card that offers rewards on everyday purchases.

- Cashback: Earn money back on your purchases.

- Points: Accumulate points to redeem for goods or services.

- Miles: Use miles for travel-related expenses.

Here are some examples:

| Card | Rewards |

|---|---|

| Card A | 1% cashback on all purchases |

| Card B | 2 points per $1 spent on groceries |

| Card C | 1 mile per $1 spent on travel |

Annual Fees

Annual fees are an essential factor. Many student credit cards have no annual fee. This is ideal for students. You should avoid cards with high annual fees.

Check the table below:

| Card | Annual Fee |

|---|---|

| Card A | $0 |

| Card B | $25 |

| Card C | $50 |

Best For Low Interest Rates

Choosing the right student credit card can be a daunting task. Many students want the best low interest rates. Low interest rates help students manage their finances better. This section will guide you through the best options available.

Card Options

Several credit cards offer low interest rates for students. Here are some top picks:

- Discover it® Student Cash Back

- Journey® Student Rewards from Capital One®

- Bank of America® Travel Rewards for Students

Pros And Cons

| Card | Pros | Cons |

|---|---|---|

| Discover it® Student Cash Back |

|

|

| Journey® Student Rewards from Capital One® |

|

|

| Bank of America® Travel Rewards for Students |

|

|

Best For Rewards

Choosing the right student credit card can be overwhelming. If you want to earn rewards, it’s crucial to pick wisely. Here, we break down the best student credit cards for rewards into two main categories: Cashback Cards and Travel Rewards.

Cashback Cards

Cashback cards offer simple, straightforward rewards. You get a percentage back on every purchase. Here’s a table to help you compare the top cashback cards:

| Card | Cashback Rate | Annual Fee | Special Features |

|---|---|---|---|

| Discover it® Student Cash Back | 5% on rotating categories | $0 | Unlimited cashback match for first year |

| Chase Freedom® Student | 1% on all purchases | $0 | $50 bonus after first purchase |

Travel Rewards

Travel rewards cards are perfect if you love to explore. Earn points for flights, hotels, and more. Check out the best travel rewards cards:

| Card | Points Earned | Annual Fee | Special Features |

|---|---|---|---|

| Bank of America® Travel Rewards for Students | 1.5 points per dollar | $0 | 25,000 bonus points if you spend $1,000 in 90 days |

| Deserve® EDU Mastercard for Students | 1% unlimited cash back | $0 | Amazon Prime Student subscription |

Best For No Annual Fee

Choosing the right student credit card can be overwhelming. It’s important to find one that suits your needs. For students, a card with no annual fee is a great option. It helps you save money and manage finances effectively.

Top Picks

Here are some top picks for student credit cards with no annual fee:

| Credit Card | Rewards | Sign-Up Bonus |

|---|---|---|

| Discover it® Student Cash Back | 5% cash back on rotating categories | $20 statement credit for good grades |

| Chase Freedom® Student Credit Card | 1% cash back on all purchases | $50 bonus after first purchase |

| Capital One® Journey® Student Credit Card | 1% cash back on all purchases | None |

Benefits

Student credit cards with no annual fee offer various benefits:

- Cost Savings: No annual fees mean more money saved.

- Rewards: Earn cash back or points on purchases.

- Build Credit: Start building a credit history early.

- Easy Approval: Designed for students with limited credit history.

Cost savings is a major benefit. You won’t have to pay an annual fee, which helps you save. Many of these cards also offer rewards. You can earn cash back or points on your purchases. This is a great way to get more for your money.

Another key benefit is the ability to build credit. Using a student credit card responsibly helps you build a good credit history. This is important for your financial future. These cards are also designed for easy approval. They cater to students with limited or no credit history.

How To Apply

Applying for a student credit card can be easy. Follow our guide to get your card quickly. Learn about the eligibility criteria and the application process.

Eligibility Criteria

Before applying, ensure you meet the eligibility criteria. Most student credit cards have simple requirements:

- Be at least 18 years old.

- Have a valid Social Security Number (SSN).

- Be enrolled in a college or university.

- Have a source of income or a co-signer.

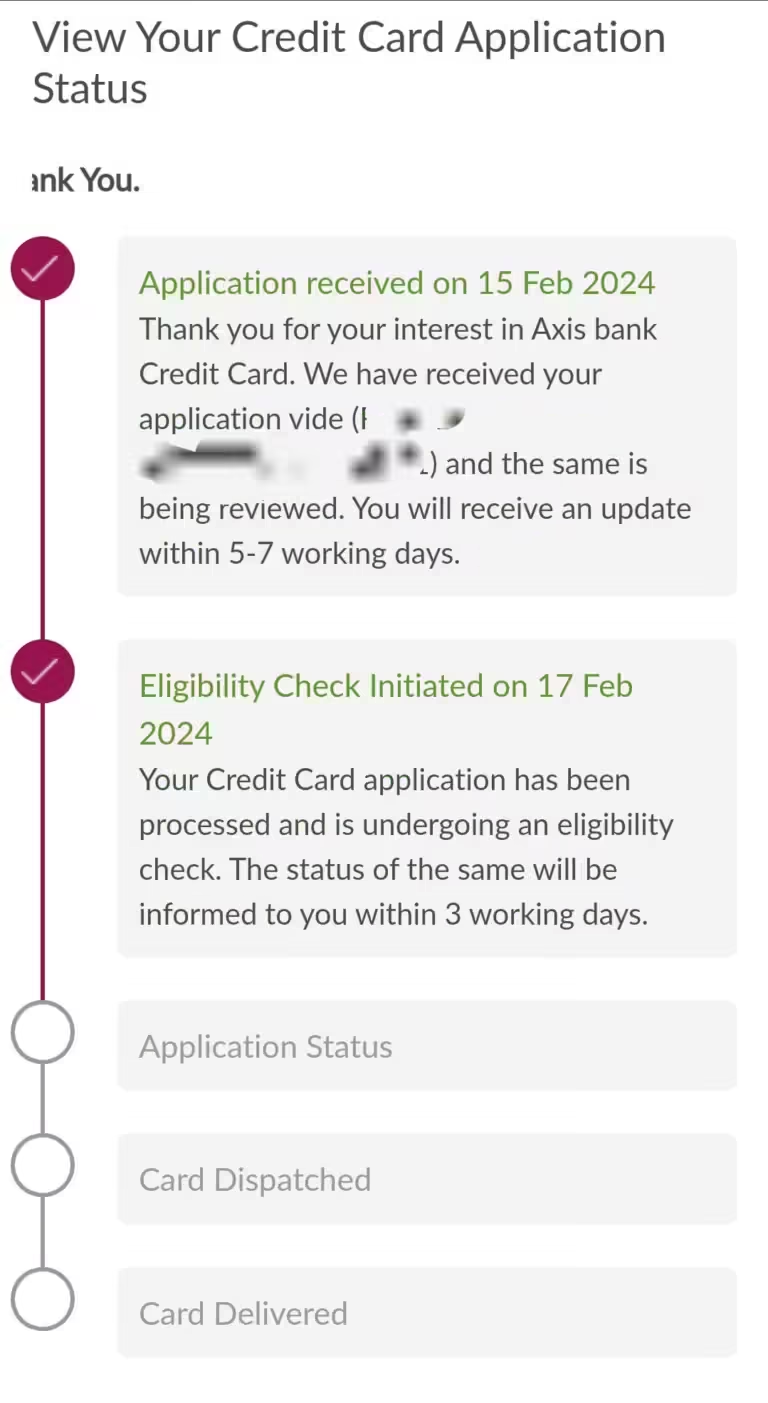

Application Process

Follow these steps to apply for a student credit card:

- Research and compare different student credit cards.

- Choose a card that fits your needs.

- Visit the card issuer’s website.

- Fill out the application form with your details.

- Submit the form and wait for approval.

Here is a table showing the main steps:

| Step | Action |

|---|---|

| 1 | Research and compare cards |

| 2 | Choose the best card |

| 3 | Visit the issuer’s website |

| 4 | Fill out the application form |

| 5 | Submit and wait for approval |

Once approved, your card will arrive in the mail. Start using it responsibly to build your credit score.

Tips For Using Student Credit Cards

Student credit cards can be a great tool for young adults. Using them wisely helps build credit and manage finances. Below are some essential tips to ensure you make the most of your student credit card.

Building Credit

Building credit is crucial for future financial success. Start by making small, manageable purchases. Always pay your balance in full each month. This shows lenders you are reliable. Set up payment reminders or automatic payments. This helps avoid missed payments.

Keep your credit utilization low. Try not to use more than 30% of your limit. For example, if your limit is $1,000, keep spending below $300. This helps improve your credit score. Check your credit report regularly. Ensure all information is correct.

Avoiding Debt

Avoiding debt is key to financial health. Create a monthly budget. Include your credit card expenses in this budget. Stick to it to avoid overspending. Only charge what you can pay off each month.

Understand the interest rates on your card. High interest rates can lead to debt quickly. If you can’t pay the balance in full, pay as much as possible. This reduces the amount of interest you pay.

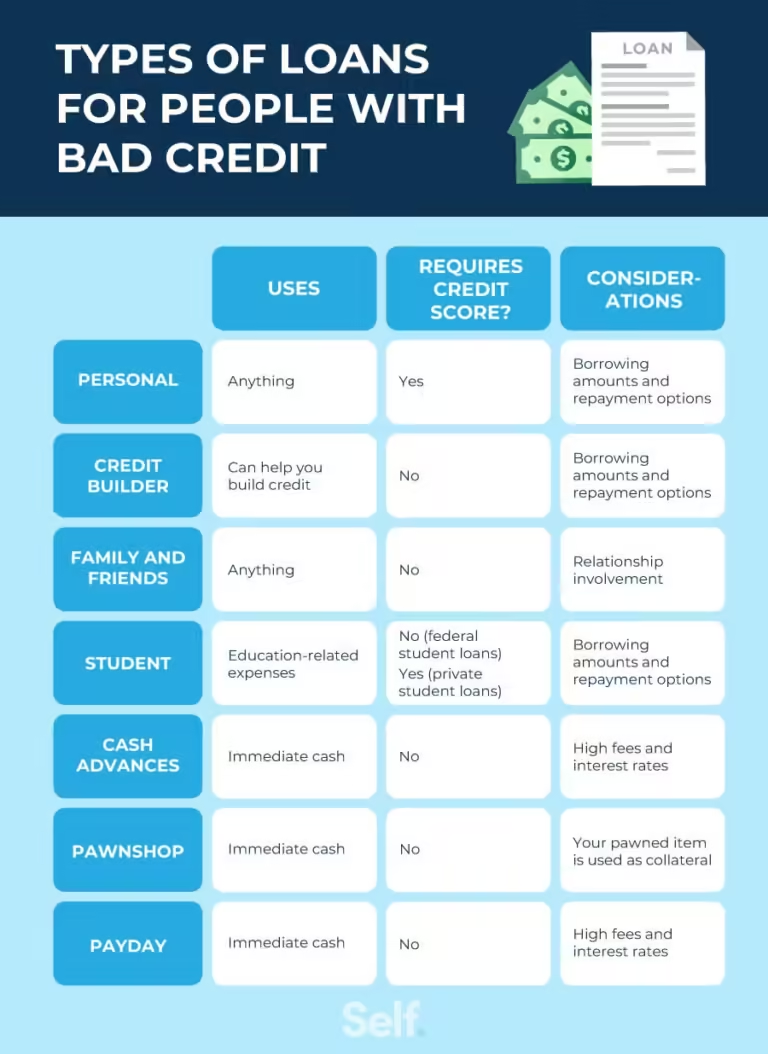

Avoid cash advances. These often come with high fees and interest rates. If you need cash, consider other options first.

| Tip | Description |

|---|---|

| Build Credit | Make small purchases and pay in full each month. |

| Credit Utilization | Keep spending below 30% of your credit limit. |

| Check Credit Report | Regularly review your credit report for accuracy. |

| Create a Budget | Include credit card expenses in your monthly budget. |

| Understand Interest Rates | Know the interest rates to avoid high debt. |

| Avoid Cash Advances | Cash advances come with high fees and rates. |

Frequently Asked Questions

What Is The Best Student Credit Card?

The best student credit card varies based on individual needs. Look for low interest rates, no annual fees, and rewards.

How To Choose A Student Credit Card?

Choose a student credit card with low interest rates, no annual fees, and rewards suited to your spending habits.

Do Student Credit Cards Build Credit?

Yes, student credit cards help build credit if you make timely payments and maintain a low credit utilization ratio.

Are Student Credit Cards Free?

Most student credit cards have no annual fees. Always check for other fees like late payment or foreign transaction fees.

Conclusion

Choosing the right student credit card can boost your financial health. Consider rewards, fees, and interest rates carefully. Each card offers unique benefits tailored to student needs. Make an informed decision to build credit and enjoy perks. Explore your options and select the best card for your financial journey.