Best Practices For Credit Repair: Boost Your Credit Score Fast

Credit repair can feel overwhelming. But, with the right practices, it becomes manageable.

Credit repair involves improving your credit score by addressing errors and managing debt. This process can boost your financial health, allowing you to access better interest rates and financial products. To start, you need reliable strategies and tools. FairFigure, a trusted credit repair resource, offers guidance to navigate this journey effectively. Understanding best practices for credit repair is crucial for achieving financial stability and peace of mind. By adopting the right methods, you can take control of your credit and secure a brighter financial future. Let’s explore these practices to get you on the path to credit success. Learn more about FairFigure here.

Introduction To Credit Repair

Credit repair is the process of improving your credit score. This is done by identifying and addressing errors or negative items on your credit report. A good credit score is vital for financial stability and access to credit. Understanding credit repair can empower you to take control of your financial future.

Understanding Credit Scores

Your credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Higher scores indicate better creditworthiness. Scores are calculated based on your credit history, including:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- New credit (10%)

- Types of credit used (10%)

Knowing the components of your credit score helps you understand how different factors affect your overall score. This knowledge is crucial for effective credit repair.

Why Credit Repair Is Important

Credit repair is important for several reasons:

- Lower Interest Rates: A higher credit score can lead to lower interest rates on loans and credit cards.

- Better Loan Approval Chances: Lenders are more likely to approve loans for individuals with good credit.

- Improved Employment Opportunities: Some employers check credit scores as part of their hiring process.

- Housing Opportunities: Landlords often check credit scores when renting properties.

By taking steps to repair your credit, you can improve your financial health and open up more opportunities.

Key Steps To Begin Credit Repair

Fixing your credit can seem overwhelming, but it doesn’t have to be. By following a few essential steps, you can start to see improvements in your credit score. Below, we’ll cover the key steps to begin your credit repair journey.

Reviewing Your Credit Report

The first step in repairing your credit is to review your credit report. You can request a free copy of your credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Look through your reports carefully. Make sure all information is correct and up-to-date.

Consider creating a table to organize key information:

| Credit Bureau | Website | Report Frequency |

|---|---|---|

| Experian | www.experian.com | Annually |

| Equifax | www.equifax.com | Annually |

| TransUnion | www.transunion.com | Annually |

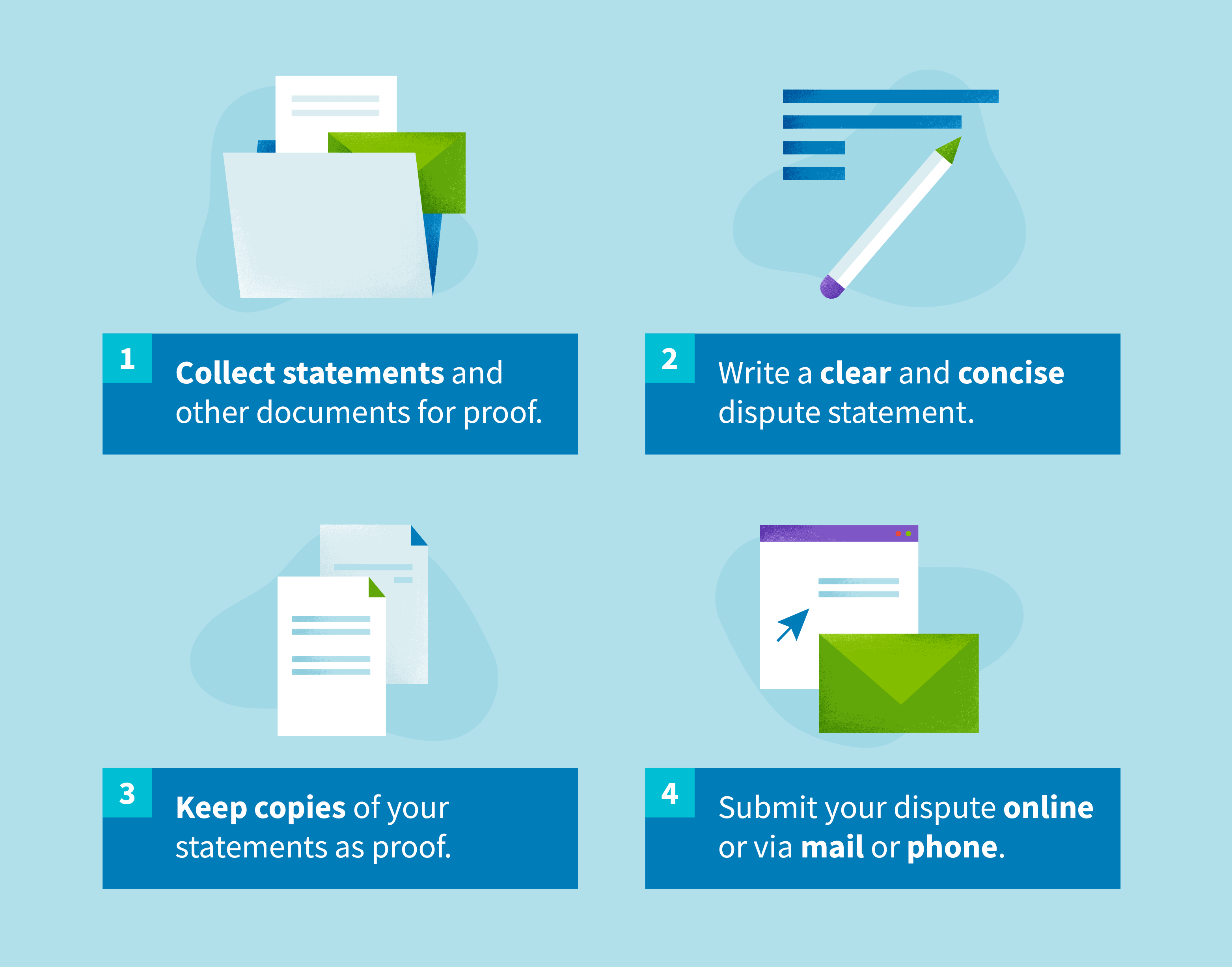

Identifying Errors And Disputing Them

The next step is to identify and dispute any errors on your credit report. Errors can include incorrect personal information, accounts that don’t belong to you, or incorrect account statuses. These errors can negatively impact your credit score.

To dispute an error, gather all relevant documentation. Write a detailed dispute letter. Include your contact information, a description of each error, and copies of supporting documents. Send the letter to the credit bureau reporting the error.

Here’s a simple guide to follow:

- Review your report for errors

- Gather supporting documents

- Write a dispute letter

- Send the letter to the credit bureau

By following these steps, you can start the process of repairing your credit and improving your financial health. For more detailed guidance, consider using resources like FairFigure.

Strategies To Improve Your Credit Score

Improving your credit score is crucial for financial health. It can open doors to better loan terms and lower interest rates. Here are some effective strategies to boost your credit score.

Paying Down Debt

High debt balances can negatively impact your credit score. Focus on paying down your debts. Prioritize high-interest debts first. This approach is called the debt avalanche method. It can save you money over time.

Another method is the debt snowball method. Start by paying off small debts first. This can give you a sense of accomplishment. Both methods can effectively reduce your debt.

| Method | Approach |

|---|---|

| Debt Avalanche | Paying off high-interest debts first |

| Debt Snowball | Paying off small debts first |

Establishing A Good Payment History

Consistently making on-time payments is crucial. It is the most significant factor in your credit score. Set up automatic payments to avoid missing due dates. Even one missed payment can harm your score.

If you have a history of late payments, start paying on time now. Over time, this will positively impact your score. Consider using payment reminders. Many banks offer free reminders via email or text.

Limiting Credit Inquiries

Too many credit inquiries can lower your score. Only apply for credit when necessary. Each inquiry can reduce your score by a few points. Multiple inquiries in a short period can be detrimental.

Try to keep credit inquiries to a minimum. If you need to shop for a loan, do it within a short period. This way, it is treated as a single inquiry. This practice is known as rate shopping.

By following these strategies, you can improve your credit score. Remember, patience and consistency are key. It takes time to see significant improvements.

Utilizing Credit Repair Tools

Improving your credit score can be challenging. Luckily, there are various tools to help you. These tools offer efficient ways to monitor and improve your credit standing. Let’s explore some of the best practices for using credit repair tools.

Credit Monitoring Services

Credit monitoring services keep track of your credit report. They provide alerts about changes to your credit file. FairFigure is a notable service in this category. It helps you stay informed and detect any suspicious activity.

Here are some benefits:

- Real-time alerts on credit changes

- Monthly credit report updates

- Access to credit scores

Using these services can help you act quickly if your credit report has errors.

Credit Repair Software

Credit repair software simplifies the process of fixing your credit. FairFigure offers tools to automate dispute letters and track progress.

Advantages include:

- Automated dispute letter templates

- Track dispute status and outcomes

- Educational resources to improve credit habits

These tools make credit repair easier and more effective.

Diy Credit Repair Vs. Professional Services

When it comes to improving your credit score, there are two main approaches: DIY credit repair and professional services. Each method has its own set of benefits and considerations. Understanding these can help you make an informed choice.

Benefits Of Diy Credit Repair

DIY credit repair can be empowering. It allows you to take control of your financial future. Here are some benefits:

- Cost-effective: You save money by not paying for professional services.

- Full control: You manage each step of the process.

- Learning experience: You gain valuable knowledge about credit management.

By handling credit repair yourself, you become more aware of your financial habits. This can lead to better financial decisions in the future.

When To Consider Professional Help

There are times when professional credit repair services might be the better choice. Here are some situations:

- Complex issues: If your credit problems are complicated, professionals can offer expert advice.

- Time constraints: If you lack the time to manage the process yourself.

- Legal expertise: Professionals can help navigate legal aspects of credit repair.

Professional services can save you time and stress, allowing you to focus on other important aspects of your life.

Common Credit Repair Mistakes To Avoid

Credit repair can be tricky. Many people make errors, which can harm their credit scores. Avoiding common mistakes helps you achieve better results faster.

Falling For Credit Repair Scams

Many credit repair scams promise quick fixes. They often ask for upfront fees and make bold claims. Scammers may say they can remove all negative information from your credit report. Remember, no one can legally remove accurate and timely negative information.

To avoid scams, research any credit repair company. Check reviews and ensure they have a good reputation. The Federal Trade Commission (FTC) offers guidelines on spotting scams. Be cautious if a company asks for payment before services are provided. It’s also wise to avoid companies that advise you to create a new identity.

Neglecting To Follow Up On Disputes

Following up on disputes is crucial. After filing a dispute with a credit bureau, monitor the progress. Credit bureaus have 30 days to investigate and respond. If you don’t follow up, the dispute might be ignored or resolved incorrectly.

Keep records of all correspondence. This includes letters, emails, and phone calls. Document dates and outcomes. If the bureau does not respond, you may need to contact them again. Persistence is key to resolving disputes successfully.

Use tools like FairFigure to track your disputes. This tool helps you stay organized and ensures you don’t miss any important updates. Keeping a close eye on your disputes can make a significant difference in your credit repair journey.

Maintaining A Healthy Credit Score

Maintaining a healthy credit score is crucial for financial stability. It can affect your ability to secure loans, get favorable interest rates, and even impact job opportunities. Here are some best practices to help you keep your credit score in good shape.

Consistent Monitoring Of Credit Reports

Consistent monitoring of credit reports is essential. Regular checks ensure accuracy and help you spot errors quickly. FairFigure offers tools to easily track your credit reports. Visit FairFigure for more details. Staying vigilant helps you catch identity theft early.

Here’s how to monitor your credit reports effectively:

- Check your reports from all three major bureaus: Experian, TransUnion, and Equifax.

- Look for discrepancies, such as incorrect balances or unfamiliar accounts.

- Dispute any errors you find immediately.

- Review your reports at least once a year.

Financial Habits For Long-term Success

Developing strong financial habits is key to a healthy credit score. Here are some tips:

- Pay your bills on time: Late payments can harm your score.

- Keep balances low: High credit card balances can negatively affect your score.

- Use credit wisely: Avoid opening too many new accounts at once.

- Maintain old accounts: Longer credit history can improve your score.

Consistent good habits are the backbone of a strong credit score. Tools like FairFigure can help you track and manage your credit effectively.

By following these best practices, you can maintain a healthy credit score and enjoy financial peace of mind.

Frequently Asked Questions

What Is Credit Repair?

Credit repair is the process of improving your credit score. It involves correcting errors on your credit report.

How Can I Repair My Credit?

Review your credit report for errors. Dispute inaccuracies. Pay down debts and avoid late payments.

How Long Does Credit Repair Take?

Credit repair typically takes 3 to 6 months. The duration depends on the number of errors and your efforts.

Can I Repair My Credit Myself?

Yes, you can repair your credit yourself. It involves reviewing your report, disputing errors, and managing debts.

Conclusion

Repairing your credit takes patience and effort. Stick to the best practices mentioned above. Monitor your credit report regularly. Dispute any errors you find. Make consistent, on-time payments. Keep your credit card balances low. Consider using tools like FairFigure to help manage your credit. Stay disciplined and avoid new debt. Over time, your credit score will improve. Remember, good credit opens many financial doors. Stay committed and watch your credit grow stronger.