Best Practices For Credit Health: Boost Your Financial Future

Maintaining good credit health is crucial for financial stability. It can impact your ability to secure loans, credit cards, and even housing.

Understanding best practices for credit health is the first step toward a strong financial future. Credit health isn’t just about having a good credit score; it’s about understanding the factors that influence it and taking proactive steps to manage it. Regularly checking your credit report, paying bills on time, and keeping credit card balances low are vital practices. Tools like Credit Sesame can assist you in this journey by providing daily access to your credit score, personalized recommendations, and much more. By following these best practices, you can ensure your credit health is always in top shape. For more information, visit Credit Sesame.

Introduction To Credit Health

Understanding your credit health is essential for financial stability. Good credit health can open doors to loans, better interest rates, and financial opportunities. Let’s explore the fundamentals of credit health and why it matters.

Understanding Credit Health

Credit health refers to the status of your credit score and credit report. It is influenced by various factors such as payment history, credit utilization, and account age.

- Payment History: Timely payments boost your score.

- Credit Utilization: Lower utilization rates are better.

- Account Age: Older accounts positively impact scores.

Maintaining good credit health involves monitoring these factors regularly.

Importance Of Good Credit Health

Good credit health is crucial for several reasons:

- Loan Approvals: Higher chances of getting approved.

- Interest Rates: Better rates for loans and credit cards.

- Financial Opportunities: Access to more financial products.

With services like Credit Sesame, you can monitor your credit health daily. Credit Sesame provides free access to your credit score and credit report summary. It also offers personalized actions to improve your score, making it easier to maintain good credit health.

Using tools like Credit Sesame can help you stay on top of your credit health. Their features include:

| Feature | Benefit |

|---|---|

| Daily Credit Score | Monitor your score every day. |

| Credit Report Summary | Access a summary of your credit report. |

| Personalized Actions | Get recommendations to improve your score. |

| Sesame Grade | Understand the five major factors impacting your score. |

| Credit Products | Find offers for credit cards and loans. |

| Credit Builder | Build credit with everyday purchases. |

Maintaining good credit health is a continuous process. With the right tools and knowledge, you can achieve and maintain a healthy credit profile.

Key Factors Affecting Credit Health

Maintaining good credit health is crucial. It impacts your ability to secure loans, credit cards, and even rental agreements. Understanding the key factors that influence your credit health can help you take proactive steps to improve it. Here are the essential elements to consider:

Credit Score Components

Your credit score is calculated based on several components. These include:

- Payment History: Timely payments are crucial.

- Credit Utilization: The amount of available credit you are using.

- Length of Credit History: How long you have had credit accounts.

- Types of Credit Accounts: A mix of credit types, such as credit cards and loans.

- New Credit Inquiries: Recent applications for new credit.

Impact Of Payment History

Payment history is the most critical component, making up 35% of your credit score. Missing payments or paying late can significantly damage your score. To maintain a good score, always pay your bills on time.

Role Of Credit Utilization

Credit utilization accounts for 30% of your credit score. It measures the ratio of your current credit balances to your credit limits. Aim to keep your credit utilization below 30%. For example, if your credit limit is $10,000, try not to carry a balance higher than $3,000.

| Credit Limit | Recommended Utilization |

|---|---|

| $1,000 | $300 |

| $5,000 | $1,500 |

| $10,000 | $3,000 |

Length Of Credit History

The length of your credit history contributes 15% to your credit score. This factor considers how long your credit accounts have been open, including the age of your oldest account, the age of your newest account, and the average age of all your accounts. Keeping older accounts open can be beneficial.

Types Of Credit Accounts

Diverse credit accounts make up 10% of your credit score. Having a mix of credit types, such as installment loans, credit cards, and retail accounts, can positively influence your score. It shows lenders you can manage different kinds of credit responsibly.

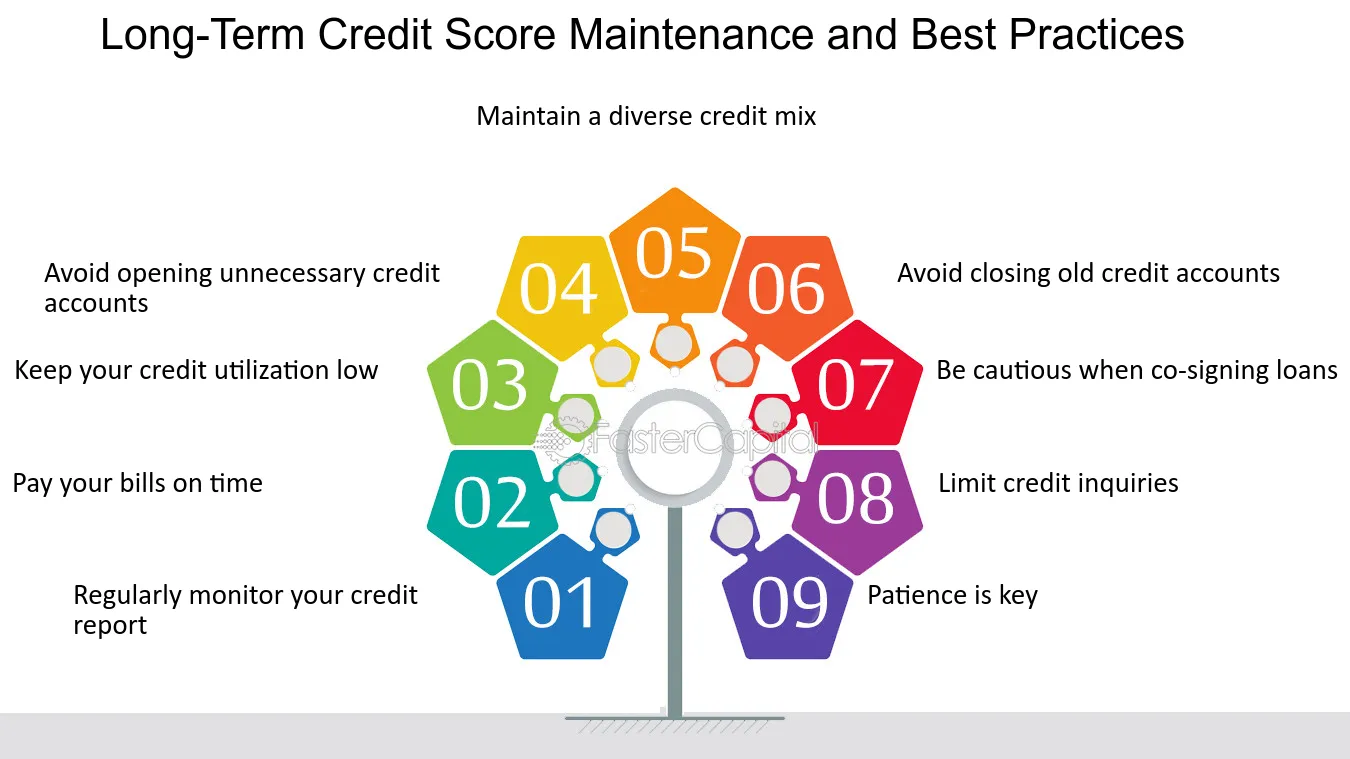

Strategies To Improve Credit Health

Improving credit health requires consistent effort and smart financial habits. By adopting effective strategies, you can enhance your credit score and maintain a healthy credit profile. Here are some key strategies to consider:

Timely Bill Payments

Paying your bills on time is crucial. Late payments can negatively affect your credit score. Set up reminders or automate payments to ensure you never miss a due date. This practice reflects positively on your credit report.

Reducing Outstanding Debt

Reduce outstanding debt to improve your credit health. Focus on paying off high-interest debt first. Create a budget to allocate extra funds toward debt repayment. This approach helps lower your credit utilization ratio.

Keeping Credit Card Balances Low

Maintain low balances on your credit cards. High balances can hurt your credit score. Aim to keep your credit utilization below 30%. Regularly monitor your spending and pay off balances in full each month if possible.

Avoiding New Credit Applications

Limit new credit applications. Each application can result in a hard inquiry, which may lower your credit score. Only apply for new credit when necessary. Consider using credit monitoring tools to keep track of your credit inquiries.

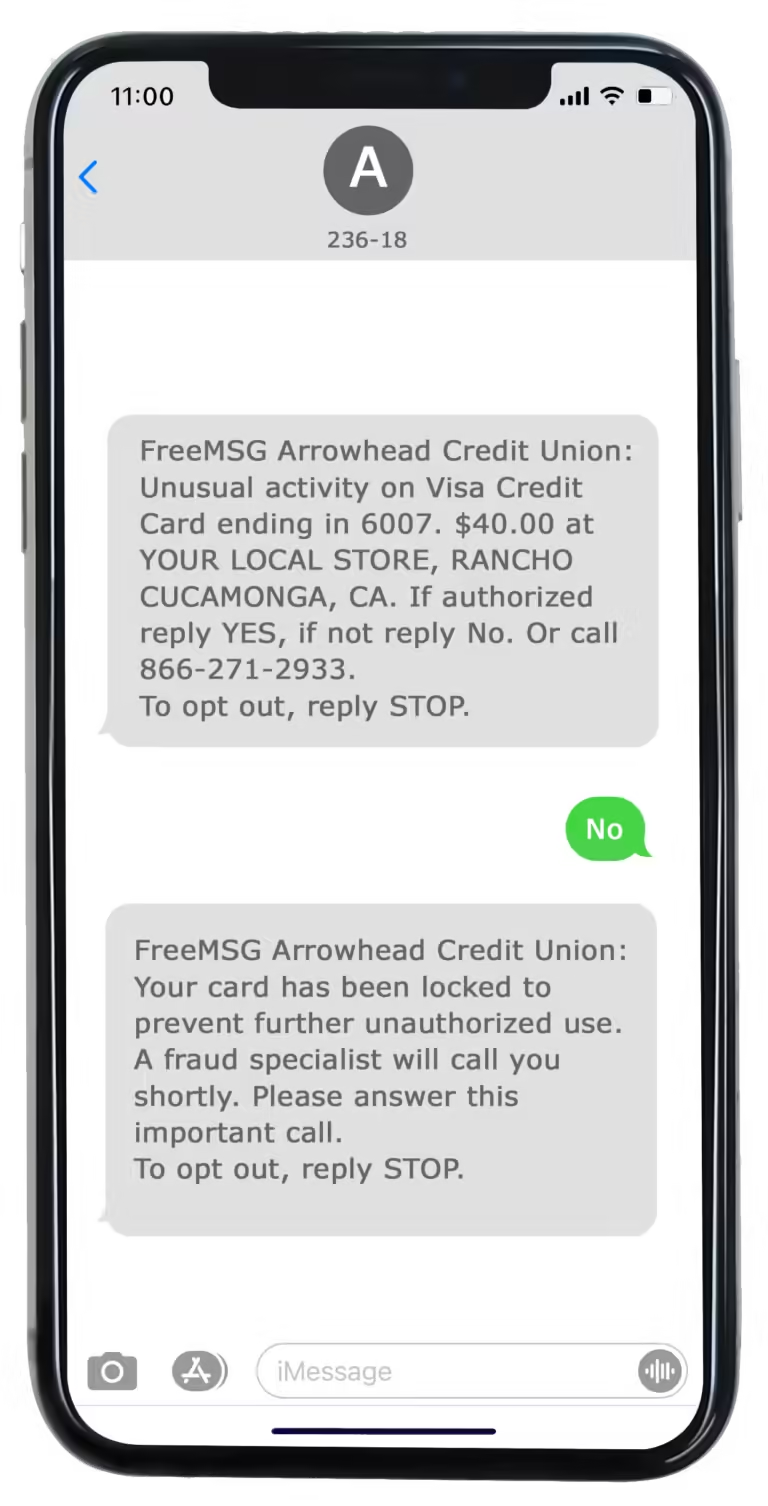

Monitoring Credit Reports Regularly

Regularly monitor your credit reports for accuracy. Use services like Credit Sesame to access your credit score and report summary daily. Look for errors or signs of fraud and dispute any inaccuracies immediately.

With these strategies, you can take control of your credit health. Consistent effort and smart financial decisions will help you achieve and maintain a strong credit score.

Tools And Resources For Managing Credit

Maintaining good credit health is essential for financial stability. Various tools and resources can help you manage and improve your credit. Here, we will explore some of the best options available.

Credit Monitoring Services

Credit monitoring services help you keep track of your credit score and report. They alert you to any changes or suspicious activity. One notable service is Credit Sesame. It provides users with daily access to their credit score and report summary for free. It also offers personalized actions to improve credit health.

- Daily Credit Score: Users can check their credit score every day.

- Credit Report Summary: Access to a summary of the credit report.

- Personalized Actions: Recommendations to help improve credit scores.

- Sesame Grade: A clear letter grade reflecting the five major factors impacting the credit score.

Credit Sesame also offers credit products such as credit cards and loans, helping users make informed financial decisions.

Credit Counseling Agencies

Credit counseling agencies provide guidance and support for managing credit and debt. They offer advice on budgeting and debt repayment. These agencies can negotiate with creditors to lower interest rates or create manageable payment plans.

It’s essential to choose a reputable agency. Look for non-profit organizations accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

Debt Management Plans

A debt management plan (DMP) is a structured repayment program. It consolidates your debt into a single monthly payment. Credit counseling agencies often offer DMPs. They work with your creditors to reduce interest rates and waive fees.

DMPs can be a useful tool for those struggling with high-interest debt. They help you regain control of your finances and reduce debt over time. Always ensure you understand the terms and fees associated with a DMP before enrolling.

Financial Education Programs

Financial education programs provide valuable knowledge on managing credit and finances. These programs cover various topics, including budgeting, saving, and investing. They help you make informed decisions and improve your financial literacy.

Many organizations offer free or low-cost financial education programs. Libraries, community centers, and online platforms are great places to start. Increasing your financial knowledge can lead to better credit health and overall financial well-being.

Common Credit Health Mistakes To Avoid

Maintaining good credit health is essential for financial stability. Avoiding common mistakes can significantly impact your credit score. Here are some frequent credit health errors and how to avoid them.

Ignoring Credit Reports

Many people overlook their credit reports. This is a mistake. Regularly checking your credit report helps you identify errors and fraudulent activities. Use services like Credit Sesame to monitor your credit score and report summary daily. Early detection of issues can prevent long-term damage to your credit health.

Maxing Out Credit Cards

Maxing out credit cards can harm your credit score. High credit utilization indicates to lenders that you might be a risk. Aim to keep your credit utilization below 30%. If you struggle with this, consider using Credit Sesame’s personalized actions to manage your credit better.

Closing Old Credit Accounts

Closing old credit accounts can lower your credit score. These accounts contribute to your credit history length, which is a key factor in your credit score. Instead of closing them, keep them open and use them occasionally. This practice helps maintain a longer credit history and a better score.

Making Only Minimum Payments

Paying only the minimum amount due on your credit cards can lead to high-interest debt. This practice can lower your credit score over time. Try to pay more than the minimum to reduce your debt faster. Using tools like Credit Sesame’s credit builder can help you manage payments and improve your credit health.

Benefits Of Maintaining Good Credit Health

Maintaining good credit health offers numerous advantages. It not only boosts your financial profile but also opens doors to better financial opportunities. Let’s explore the key benefits:

Lower Interest Rates

Having a good credit score typically means lower interest rates on loans and credit cards. With lower interest rates, you can save a significant amount of money over time. For instance, a mortgage with a lower rate can save you thousands of dollars in interest payments.

Better Loan Approval Chances

Lenders are more likely to approve loans for individuals with good credit health. A strong credit score demonstrates your ability to manage debt responsibly. This can increase your chances of getting approved for various loans, including personal loans, auto loans, and mortgages.

Improved Financial Opportunities

Good credit health unlocks better financial opportunities. You may receive more attractive offers for credit cards with better rewards programs, lower fees, and higher credit limits. Additionally, you can qualify for higher loan amounts, enabling you to make larger purchases or investments.

Higher Credit Limits

With a good credit score, creditors are more willing to increase your credit limits. Higher credit limits can improve your credit utilization ratio, which is beneficial for your credit score. It also provides you with greater financial flexibility and purchasing power.

To maintain and improve your credit health, using services like Credit Sesame can be highly beneficial. Credit Sesame offers daily access to your credit score, personalized actions to improve your credit, and various credit products to help manage your financial health.

| Feature | Details |

|---|---|

| Daily Credit Score | Users can check their credit score every day. |

| Credit Report Summary | Access to a summary of the credit report. |

| Personalized Actions | Recommendations to help improve credit scores. |

| Sesame Grade | A clear letter grade reflecting the five major factors impacting the credit score. |

| Credit Products | Offers for credit cards, home loans, auto loans, and more. |

| Credit Builder | Build credit with everyday purchases using a prepaid debit card (Sesame Cash). |

By leveraging these tools, you can stay on top of your credit health and reap the benefits of maintaining a good credit score.

Conclusion: Building A Strong Credit Future

Establishing and maintaining good credit health is essential for financial stability. It requires consistent effort and strategic planning. Utilizing resources like Credit Sesame can make a significant difference. Let’s summarize key points and encourage ongoing credit management.

Recap Of Key Points

- Daily Credit Score: Regularly check your credit score to stay informed.

- Credit Report Summary: Review your credit report summary to understand your financial standing.

- Personalized Actions: Follow recommendations to improve your credit score.

- Sesame Grade: Pay attention to the letter grade reflecting major credit factors.

- Credit Products: Explore offers for credit cards, home loans, and auto loans.

- Credit Builder: Use tools like Sesame Cash to build credit with everyday purchases.

Encouragement For Consistent Credit Management

Consistency is key to maintaining good credit health. Monitor your credit score daily with Credit Sesame. Follow the personalized actions recommended to improve your score.

Use credit products wisely. Choose ones that have high approval odds and suit your needs. Always stay informed about your credit report summary.

Remember, building a strong credit future requires ongoing effort. Keep an eye on your Sesame Grade and work on the factors impacting it. Utilize secure and free resources like Credit Sesame for better credit management.

By staying proactive and informed, you can achieve and maintain excellent credit health.

Frequently Asked Questions

How Can I Improve My Credit Health?

Monitor your credit report regularly. Pay bills on time. Reduce your credit card balances. Avoid applying for too much new credit.

What Affects My Credit Score The Most?

Payment history is the most critical factor. Missing or late payments can significantly impact your credit score negatively.

How Often Should I Check My Credit Report?

Check your credit report at least once a year. Regular monitoring helps you identify and correct errors promptly.

Is It Bad To Have Multiple Credit Cards?

Not necessarily. Properly managing multiple credit cards can help your credit health. Ensure timely payments and maintain low balances.

Conclusion

Maintaining good credit health is crucial for financial stability. Regularly monitor your credit score and report summary. Identify factors impacting your score and take action to improve it. Utilize tools like Credit Sesame to manage your credit effectively. They offer daily credit score updates, personalized recommendations, and various credit products. Staying informed and proactive can make a big difference. For more details on how Credit Sesame can help you, visit their website: Credit Sesame. Keep your credit health in check and enjoy the benefits of better financial management.