Best Credit Repair Tools: Top Picks for Fast Results

Navigating the world of credit repair can be overwhelming. With the right tools, though, it becomes manageable.

Credit repair tools can help you improve your credit score, resolve disputes, and manage debts. Understanding which tools are best for your needs is crucial for effective credit management. In this blog, we will explore the best credit repair tools available today.

These tools offer unique features and benefits to help you regain control over your financial health. Whether you need automated assistance or professional legal review, there is a tool designed to meet your specific needs. Stay tuned to discover how you can leverage these tools to improve your credit score and achieve financial freedom.

Introduction To Credit Repair Tools

In today’s financial landscape, maintaining a good credit score is essential. Credit repair tools can help you manage and improve your credit score. These tools offer various services to help you dispute errors, manage debt, and understand your credit report. In this section, we will explore the best credit repair tools available, how they work, and why you need them.

What Are Credit Repair Tools?

Credit repair tools are software or services designed to help individuals improve their credit scores. They offer various features such as error dispute management, debt settlement assistance, and credit monitoring. These tools can help you identify and correct inaccuracies on your credit report, negotiate with creditors, and provide insights into improving your credit health.

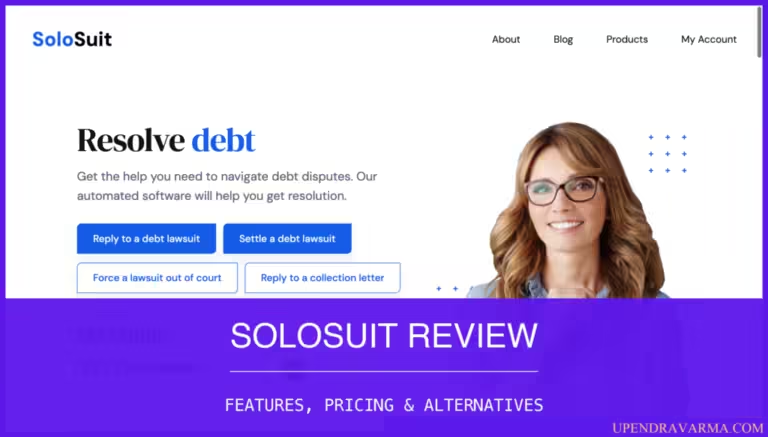

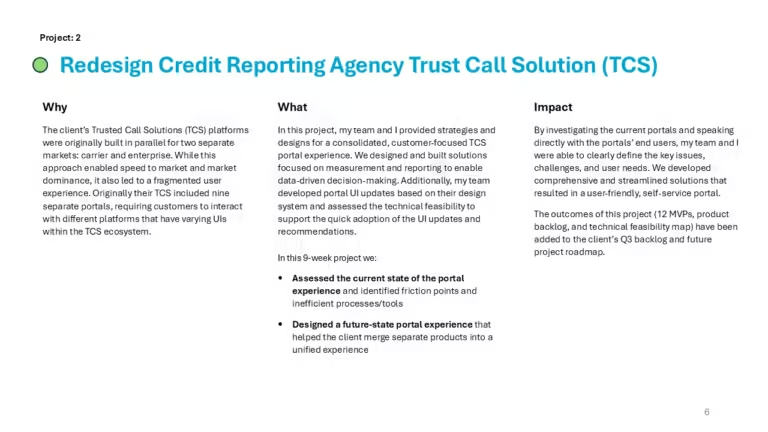

An example of a credit repair tool is the Solo Debt Resolution Software. This tool helps individuals navigate debt disputes and respond to debt lawsuits. It provides automated assistance in compiling responses, arranging settlements, and ensuring legal documents are reviewed by an attorney.

| Main Features | Benefits |

|---|---|

|

|

Why You Need Credit Repair Tools

Using credit repair tools can help you save time and money. These tools automate the complex processes of disputing errors and negotiating debts. They ensure that your credit report is accurate and up-to-date, which is crucial for maintaining a good credit score. A good credit score can help you get better interest rates on loans and credit cards.

Solo Debt Resolution Software, for example, has helped protect $1.71 billion and assisted 262,000 people. Its automated assistance and attorney review features streamline the process of responding to debt lawsuits and settling debts, making it easier for you to manage your credit.

With credit repair tools, you can take control of your financial future. These tools offer valuable insights and assistance in improving your credit score. This can lead to better financial opportunities and peace of mind.

Key Features Of Top Credit Repair Tools

Understanding the essential features of credit repair tools can help you make an informed decision. These tools offer a range of functionalities designed to improve your credit score efficiently. Below, we explore some of the key features that top credit repair tools offer.

Credit Monitoring And Alerts

Credit monitoring and alerts are crucial for staying updated on your credit status. The best tools provide real-time alerts for any changes in your credit report. This helps you to act swiftly against any potential issues or fraudulent activities.

Features often include:

- Real-time notifications: Immediate alerts for any changes.

- Comprehensive monitoring: Keeps an eye on various credit factors.

- Fraud detection: Alerts you to suspicious activities.

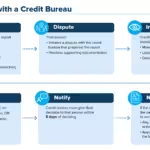

Dispute Automation

Dispute automation simplifies the process of challenging inaccuracies in your credit report. Top tools offer automated systems to file disputes quickly and efficiently. This feature saves time and ensures that your disputes are filed correctly.

Key benefits include:

- Automated filing: Reduces manual effort.

- Accuracy: Ensures all necessary details are included.

- Follow-up: Tracks the progress of your disputes.

Credit Score Tracking

Credit score tracking is vital for monitoring your credit improvement efforts. Leading tools provide detailed insights into your credit score progress over time. This allows you to see how your actions are impacting your score.

Key features include:

- Regular updates: Keeps your credit score information current.

- Detailed reports: Offers insights into score changes.

- Historical data: Tracks score trends over time.

Financial Education Resources

Financial education resources help you understand how to manage your credit effectively. The best credit repair tools offer a wealth of educational materials. These resources can include articles, videos, and interactive tools.

Educational features often include:

- Comprehensive guides: Detailed articles on credit management.

- Video tutorials: Easy-to-follow educational videos.

- Interactive tools: Calculators and planners to help manage finances.

By leveraging these key features, you can take control of your credit health and work towards a better financial future.

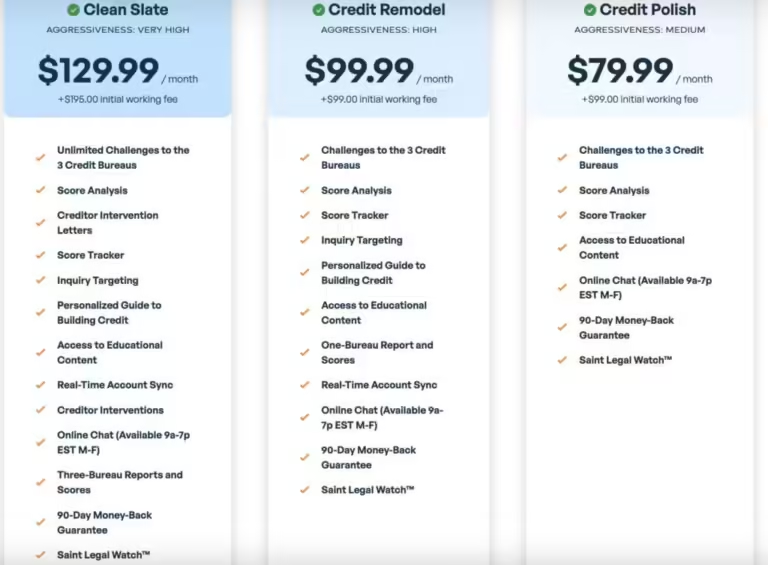

Pricing And Affordability

Understanding the cost and value of credit repair tools is essential. SoloSuit offers various pricing options to fit different budgets. Let’s break down the pricing structure and see what makes SoloSuit a good choice.

Subscription Plans

SoloSuit does not provide detailed pricing information upfront. However, the service typically offers subscription plans that cater to different needs and budgets. These plans help users respond to debt lawsuits and settle debts.

| Plan Type | Features |

|---|---|

| Basic Plan |

|

| Premium Plan |

|

Free Vs. Paid Options

SoloSuit primarily focuses on paid options to ensure quality service. The platform offers automated software to manage debt disputes effectively. While free options are not highlighted, the investment in paid plans includes:

- Automated Assistance: Streamlines debt dispute processes.

- Attorney Review: Ensures legal documents are accurate.

- Nationwide Coverage: Services available in all 50 states.

Value For Money

SoloSuit provides excellent value for money with its proven track record. With $1.71 billion protected and 262,000 people helped, users can trust the service to manage debt disputes. Key benefits include:

- Automated assistance for quick and efficient responses.

- Attorney-reviewed documents for legal accuracy.

- Nationwide coverage ensures accessibility.

Choosing SoloSuit means investing in a reliable credit repair tool with a strong support system. The benefits outweigh the costs, making it a smart choice for those dealing with debt issues.

:max_bytes(150000):strip_icc()/BestCreditRepairCompaniesRecirc-c69998e0889c4deca944218a9b912c76.png)

Pros And Cons Of Using Credit Repair Tools

Credit repair tools can be a valuable resource for individuals looking to improve their credit scores. These tools offer automated assistance, legal document reviews, and nationwide coverage. However, like any service, they come with their own set of advantages and limitations.

Advantages Of Credit Repair Tools

- Automated Assistance: Many credit repair tools, such as Solo Debt Resolution Software, provide automated assistance. This feature streamlines the process of responding to debt lawsuits and settling debts.

- Attorney Review: Legal documents are reviewed by an attorney before filing, ensuring accuracy and compliance with legal standards.

- Nationwide Coverage: Services are available in all 50 states, making it accessible regardless of location.

- Proven Track Record: Solo has protected $1.71 billion and helped 262,000 people, showcasing its effectiveness.

Common Drawbacks And Limitations

- Not a Law Firm: Solo is not an attorney or law firm and does not provide legal advice.

- No Guarantees: There are no guarantees regarding case outcomes, which can be uncertain.

- Legal Information Only: The site contains legal information, not legal advice, which might not be sufficient for complex cases.

- Pricing Details: Pricing details are not explicitly provided, making it hard to budget for the service.

- Refund Policies: No specific refund or return policies are mentioned, which can be a concern for some users.

Overall, credit repair tools like Solo Debt Resolution Software can be beneficial. They offer convenience, legal oversight, and wide accessibility. Yet, they have limitations and don’t guarantee specific outcomes. Users should weigh these pros and cons before deciding.

Specific Recommendations For Ideal Users

Choosing the best credit repair tool depends on your unique situation. Below are specific recommendations tailored for different types of users.

Best For Individuals With Poor Credit

If you have poor credit, Solo Debt Resolution Software from SoloSuit can be a valuable resource. Solo provides automated assistance in responding to debt lawsuits and settling debts outside of court. This software helps you compile responses within 14-30 days of receiving a complaint, followed by an attorney review and filing.

Main Features:

- Reply to a Debt Lawsuit

- Settle a Debt

Disclaimers:

- Not an attorney or law firm

- Contains legal information, not legal advice

- No guarantees regarding case outcomes

Best For Those New To Credit Repair

For newcomers, a user-friendly and comprehensive tool is essential. SoloSuit offers an intuitive platform with automated features that guide users through the debt resolution process. The software’s simplicity and step-by-step guidance make it ideal for those unfamiliar with credit repair procedures.

Benefits:

- Simplifies complex legal processes

- Ensures compliance with legal standards

Disclaimers:

- Not an attorney or law firm

- Contains legal information, not legal advice

- No guarantees regarding case outcomes

Best For Budget-conscious Users

Budget-conscious users need affordable yet effective solutions. SoloSuit provides a cost-effective way to manage debt disputes and settlements. Although pricing details are not explicitly provided, the platform’s track record suggests it offers value for money.

Disclaimers:

- Not an attorney or law firm

- Contains legal information, not legal advice

- No guarantees regarding case outcomes

Top Credit Repair Tools: A Detailed Review

Credit repair tools can be invaluable in improving your credit score. Below, we review the top tools available, detailing their features, pricing, pros, and cons. This will help you choose the best tool for your needs.

Tool 1: Features, Pricing, Pros And Cons

Solo Debt Resolution Software is an automated software designed to assist individuals in navigating debt disputes.

| Features | Details |

|---|---|

| Reply to a Debt Lawsuit | Helps compile a response within 14-30 days with attorney review and filing. |

| Settle a Debt | Assists in arranging settlements with collectors outside of court, potentially at a reduced amount. |

Pricing: Not explicitly provided.

Pros:

- Automated assistance simplifies the debt dispute process.

- Attorney review ensures legal document accuracy.

- Nationwide coverage in all 50 states.

- Proven track record with $1.71 billion protected and 262,000 people helped.

Cons:

- Not an attorney or law firm; does not provide legal advice.

- No specific refund or return policies mentioned.

Tool 2: Features, Pricing, Pros And Cons

Details for Tool 2 will be added here.

Tool 3: Features, Pricing, Pros And Cons

Details for Tool 3 will be added here.

Frequently Asked Questions

What Are The Best Credit Repair Tools?

The best credit repair tools include Credit Karma, Lexington Law, and Credit Sesame. These tools help monitor credit scores, dispute errors, and offer personalized advice.

How Do Credit Repair Tools Work?

Credit repair tools work by analyzing your credit report. They identify errors, dispute inaccuracies, and provide tips to improve your credit score.

Are Credit Repair Tools Effective?

Yes, credit repair tools are effective. They help identify errors, provide dispute assistance, and offer strategies to improve your credit score.

Do Free Credit Repair Tools Exist?

Yes, free credit repair tools exist. Credit Karma and Credit Sesame offer free credit monitoring and basic repair services to users.

Conclusion

Choosing the right credit repair tools can make a difference. SoloSuit is an excellent choice for resolving debt issues. Its automated software helps with debt lawsuits and settlements. Legal documents get attorney review, ensuring accuracy. Explore more about SoloSuit here. Start your journey to better credit today.