Best Credit Cards for College Students 2024

The best credit cards for college students in 2024 offer low interest rates, no annual fees, and rewards programs. These features help students build credit responsibly.

Choosing the right credit card is crucial for college students. A good student credit card can help build a strong credit history, which is vital for future financial endeavors. Ideal cards for students come with low interest rates, no annual fees, and attractive rewards programs.

They often provide benefits like cashback on purchases, which can be a great incentive for responsible spending. Some cards also include tools for managing finances, making them perfect for students new to credit. Ensuring these features can set students on a path to financial success.

Read This Article: Credit Card Tips for College Students

Credit Card Tips for College Students

Factors To Consider

Choosing the right credit card as a college student can be daunting. Understanding the key factors can make your decision easier. Here are the most important aspects to consider.

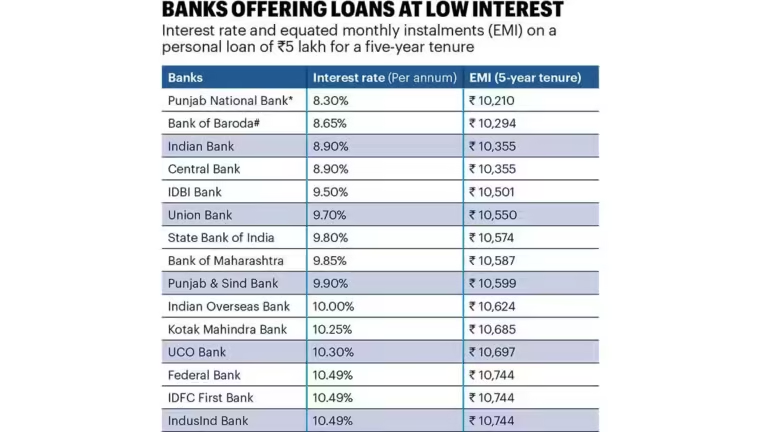

Interest Rates

Interest rates determine how much extra you’ll pay on borrowed money. Look for cards with low annual percentage rates (APR). Some cards offer a 0% introductory APR. This can be helpful if you need to carry a balance. Always read the fine print to know when the introductory period ends.

Annual Fees

Annual fees are charges you pay yearly for using the card. Many student credit cards have no annual fee. This can save you money. If a card does have an annual fee, weigh it against the benefits it offers.

Rewards Programs

Rewards programs can add value to your spending. Look for cards that offer cash back, points, or travel rewards. Compare different rewards programs to see which fits your lifestyle. Some cards offer higher rewards for certain types of purchases, like groceries or gas.

Credit Limits

Credit limits set the maximum amount you can borrow. Student credit cards often have lower limits. This can help you avoid overspending. Check if the card offers credit limit increases over time. This can help you build credit responsibly.

| Factor | Key Points |

|---|---|

| Interest Rates | Low APR, 0% introductory APR |

| Annual Fees | No annual fee, weigh benefits |

| Rewards Programs | Cash back, points, travel rewards |

| Credit Limits | Low limits, potential for increases |

Top Credit Cards

Choosing the right credit card as a college student is crucial. The right card helps manage finances and build credit. Here are the top credit cards for 2024.

Best For Cashback

Cashback cards offer great rewards for everyday spending.

- Discover it® Student Cash Back: Earn 5% cash back on rotating categories. 1% on other purchases.

- Citi Rewards+℠ Student Card: Get 2X points at supermarkets and gas stations. 1X on all other purchases.

Best For Travel Rewards

Travel rewards cards are ideal for students who love to travel.

- Bank of America® Travel Rewards Credit Card for Students: Earn unlimited 1.5 points for every $1 spent on all purchases.

- Chase Sapphire Preferred® Card: Earn 2X points on travel and dining. 1X on all other purchases.

Best For Low Interest Rates

Low-interest cards help save money on interest charges.

- Journey® Student Rewards from Capital One®: Enjoy a variable APR as low as 17.99%. Earn 1% cash back on all purchases.

- Wells Fargo Cash Back College Card: Offers a 0% intro APR for six months. 11.15% to 21.15% variable APR thereafter.

Best For Building Credit

These cards help students build and improve their credit scores.

- Deserve® EDU Mastercard for Students: No credit history required. Earn 1% cash back on all purchases.

- Capital One® Secured Mastercard®: Requires a refundable security deposit. Helps build or rebuild credit history.

Best Cashback Cards

Finding the right credit card can be challenging for college students. Cashback cards offer great rewards for everyday purchases. Let’s explore the Best Cashback Cards for college students in 2024.

Features And Benefits

Cashback cards provide rewards for spending on specific categories.

- High Cashback Rates: Earn up to 5% on select purchases.

- No Annual Fees: Save money without extra charges.

- Introductory Offers: Enjoy 0% APR for the first six months.

- Student Perks: Special bonuses for good grades or on-time payments.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Best Travel Rewards Cards

Travel rewards cards are a great option for college students. They offer perks like free flights, hotel stays, and other travel-related benefits. Here are the best travel rewards cards for college students in 2024.

Features And Benefits

Travel rewards cards come with many features and benefits. Here are some key highlights:

- Sign-Up Bonuses: Earn points or miles after meeting a spending requirement.

- No Foreign Transaction Fees: Save money on purchases abroad.

- Travel Insurance: Coverage for trip cancellations and lost luggage.

- Airport Lounge Access: Enjoy exclusive lounges with select cards.

- Flexible Redemption Options: Use points for flights, hotels, and car rentals.

Pros And Cons

Understanding the pros and cons of travel rewards cards is essential. Here’s a quick overview:

| Pros | Cons |

|---|---|

| Earn free travel and upgrades | May have annual fees |

| No foreign transaction fees | Interest rates can be high |

| Access to airport lounges | Spending requirements for bonuses |

| Travel insurance coverage | Points may expire |

Choosing the right travel rewards card can maximize your travel benefits. Compare the features, benefits, pros, and cons to find the best card for your needs.

Best Low Interest Rate Cards

College students often face tight budgets. Low interest rate credit cards help manage expenses. These cards offer lower APRs, making them ideal for students. Discover the top picks for 2024.

Features And Benefits

Low interest rate cards come with many features and benefits. Here’s a breakdown:

- Low APR: These cards offer lower annual percentage rates.

- No Annual Fee: Many cards do not charge an annual fee.

- Introductory Rates: Some cards have 0% APR for an introductory period.

- Rewards Programs: Earn points or cash back on purchases.

- Credit Building: Helps students build their credit score over time.

Pros And Cons

Understanding the pros and cons helps students make informed decisions.

| Pros | Cons |

|---|---|

|

|

Best Cards For Building Credit

College students often need their first credit card to build credit. The right credit card can help. These cards have low fees and easy approval. They also offer rewards and benefits.

Features And Benefits

Choosing a credit card with good features is important. Here are some key features:

- No Annual Fee: Many cards do not charge an annual fee.

- Low APR: Look for cards with low-interest rates.

- Rewards Programs: Some cards offer cash back or points.

- Credit Monitoring: Many cards offer free credit score tracking.

These benefits can help students manage their finances. They also help build a good credit history.

Pros And Cons

Here are the pros and cons of the best credit cards for building credit:

| Pros | Cons |

|---|---|

|

|

Weigh these pros and cons before choosing a card. This helps make an informed decision.

Tips For Using Credit Cards Wisely

Credit cards can be helpful for college students. They build credit and manage expenses. But using them wisely is key. Here are some tips to help you.

Paying Off Balances

Always pay your balance on time. This avoids interest and late fees. Try to pay the full balance each month. If you can’t, pay more than the minimum.

- Set up automatic payments to avoid late fees.

- Pay in full to avoid high interest rates.

- Use a budget to ensure you can pay your balance.

Monitoring Spending

Track your spending to avoid overspending. Many credit cards offer apps for tracking expenses. Use these tools to stay within your budget.

| Tool | Benefit |

|---|---|

| Mobile Apps | Track expenses in real-time |

| Email Alerts | Get notifications for due dates and limits |

Understanding Credit Scores

Your credit score is important. It affects your ability to get loans and rent apartments. Using your credit card wisely helps build a good credit score.

- Pay your bills on time.

- Keep your credit utilization low.

- Check your credit report regularly.

Good credit opens many doors. Start building it now!

Frequently Asked Questions

What Are The Best Credit Cards For Students?

The best credit cards for students offer rewards, low fees, and educational resources. Look for cards with cashback, no annual fees, and student-friendly features.

How Can Students Build Credit With A Credit Card?

Students can build credit by using their card responsibly. Pay on time, keep balances low, and avoid unnecessary debt. Consistent, responsible use will improve credit scores.

Are There Credit Cards With No Annual Fees For Students?

Yes, many student credit cards have no annual fees. These cards are designed to be affordable and help students manage their finances effectively.

Do Student Credit Cards Offer Rewards?

Yes, many student credit cards offer rewards. These can include cashback, points, or travel perks, tailored to student spending habits.

Conclusion

Choosing the right credit card can boost financial health for students. Consider rewards, fees, and APR. Make informed decisions to build credit. The best credit cards for college students in 2024 offer valuable benefits. Start your financial journey wisely with the right card.

Your future self will thank you.