Best Credit Card Processor: Top Solutions for Your Business

Choosing the best credit card processor is crucial for your business. It affects your operations and customer satisfaction.

In today’s fast-paced market, having a reliable credit card processor can make a big difference. Whether you run a small shop or a large enterprise, efficient payment handling is key. With so many options available, picking the right one can be tough. Credit card processors like Square Register offer integrated systems that simplify transactions and business management. This blog will guide you through the top choices, helping you find the best fit for your needs. From user-friendly interfaces to versatile payment options, we’ll cover the features that matter most. Explore the best credit card processors to streamline your business operations and boost efficiency. Ready to upgrade your payment system? Check out Square for an all-in-one solution.

Introduction To Credit Card Processors

Understanding credit card processors is crucial for any business that accepts card payments. These processors handle the transactions between the customer and the business. They ensure the secure transfer of funds. Choosing the right processor can impact your business operations and customer satisfaction.

What Is A Credit Card Processor?

A credit card processor is a service that manages card transactions. It connects your business to the customer’s bank. The processor verifies the card details and approves the transaction. This process ensures that the payment is secure and funds are transferred correctly.

Importance Of Choosing The Right Processor For Your Business

Selecting the right credit card processor is vital. It affects transaction speed, fees, and security. A good processor ensures quick and secure transactions. This keeps customers happy and protects your business from fraud.

Consider factors like cost, compatibility, and features. Look for a processor that fits your business size and type. For example, Square Register is an all-in-one solution.

| Feature | Square Register |

|---|---|

| Integrated System | Combines hardware and software |

| Versatile Payment Options | Accepts cards and mobile payments |

| User-Friendly Interface | Easy to navigate |

| Built-in Software | Handles payments, payroll, and more |

Square Register simplifies operations and offers scalability. It’s suitable for various industries, from retail to food services.

- Efficiency: Speeds up the checkout process

- Portability: Solutions for on-the-go transactions

- Comprehensive Management: Integrates business operations

- Scalable: Grows with your business

For more information, visit the Square website.

Key Features To Look For In A Credit Card Processor

Choosing the right credit card processor is crucial for your business. Here are some key features to look for in a credit card processor that can make a significant difference.

Security And Fraud Prevention

Security is paramount. Ensure the credit card processor has robust security measures in place. Look for features like end-to-end encryption, tokenization, and compliance with PCI DSS standards. Fraud prevention tools like real-time monitoring and machine learning algorithms can help detect and prevent fraudulent transactions.

Ease Of Integration

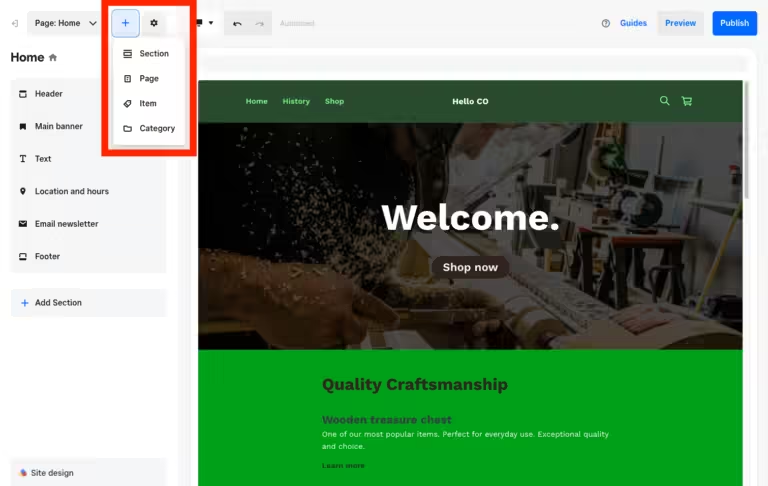

A good credit card processor should easily integrate with your existing systems. Check for compatibility with your POS systems, e-commerce platforms, and other business software. Square Register, for example, combines hardware and software in one package, making integration seamless and efficient.

Customer Support And Service

Reliable customer support is essential. Choose a processor that offers 24/7 support through various channels such as phone, email, and live chat. Square provides excellent customer support, available at 1 (855) 700-6000 for general inquiries and 1 (800) 470-1673 for sales inquiries.

Compatibility With Business Tools

Ensure the processor is compatible with tools you use. Square Register, for instance, integrates payments, payroll, inventory, and customer management into one system. This reduces the need for multiple devices and software, streamlining business operations.

Transaction Speed

Fast transaction processing is crucial for customer satisfaction. A good processor should handle transactions quickly and efficiently. Square Register is designed for quick and efficient transactions, simplifying and speeding up the checkout process.

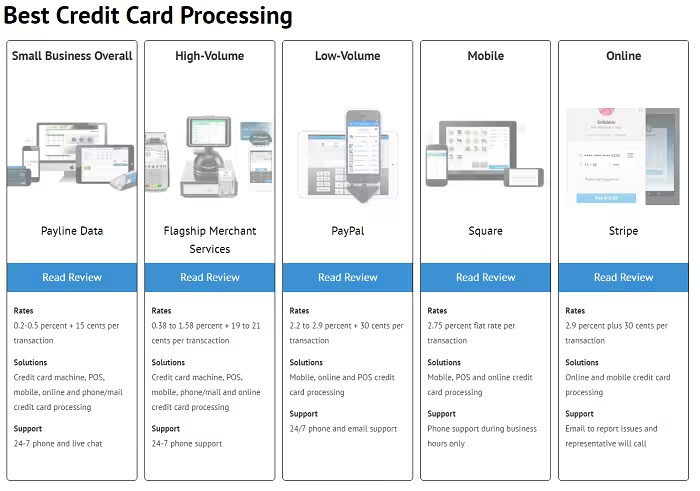

Top Credit Card Processors In 2023

Choosing the best credit card processor can be overwhelming. Each business has unique needs. In 2023, several processors stand out for their specific strengths. Here’s a look at the top choices for different business types.

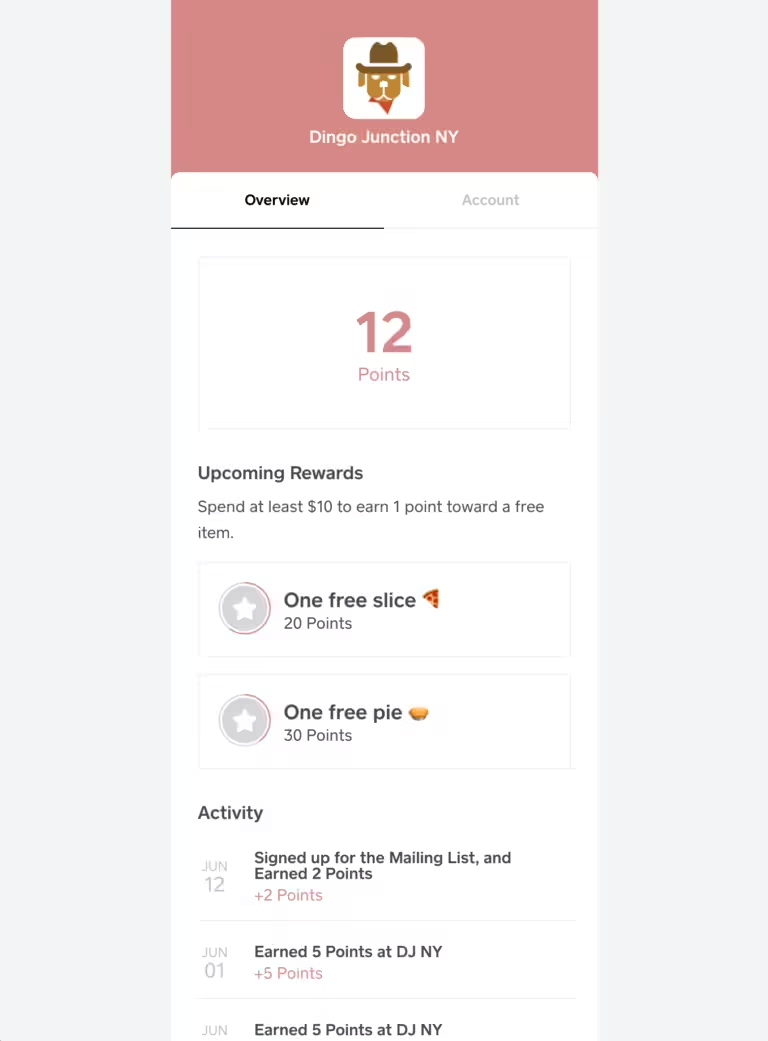

Square: Best For Small Businesses

Square Register is an all-in-one point-of-sale (POS) system. It integrates hardware and software to streamline business operations. The system handles payments, payroll, and more.

- Integrated System: Combines hardware and software in one package.

- Versatile Payment Options: Accepts cards and mobile payments.

- User-Friendly Interface: Easy to navigate for quick transactions.

- Built-in Software: Manages payments, payroll, inventory, and customers.

Square simplifies the checkout process. It offers portable solutions like Square Terminal. Ideal for small businesses, it integrates various operations into one system. For pricing, contact sales.

Stripe: Best For Online Transactions

Stripe is a popular choice for online businesses. It offers advanced tools for handling e-commerce transactions. Stripe supports various payment methods and currencies.

- Developer-Friendly: Easy to integrate with websites and apps.

- Global Reach: Accepts payments in multiple currencies.

- Advanced Security: Protects against fraud and unauthorized transactions.

- Customizable: Flexible APIs for tailored solutions.

Stripe is ideal for businesses with a strong online presence. It provides robust security and customization options.

Paypal: Best For Flexibility

PayPal is known for its flexibility. It supports both online and in-person transactions. Businesses can easily integrate PayPal with their existing systems.

- Wide Acceptance: Trusted by millions globally.

- Easy Integration: Works with various e-commerce platforms.

- Mobile Payments: Accepts payments via mobile app.

- Buyer Protection: Ensures secure transactions.

PayPal is suitable for businesses seeking a versatile payment solution. It offers ease of use and widespread acceptance.

Toast: Best For Restaurants

Toast is a specialized POS system for the restaurant industry. It offers features tailored to the needs of food service businesses.

- Restaurant-Specific Tools: Menu management, table tracking, and order processing.

- Integrated Payments: Handles transactions seamlessly.

- Employee Management: Tracks schedules and payroll.

- Customer Insights: Provides data on customer preferences and trends.

Toast helps restaurants improve efficiency. It combines payment processing with restaurant management tools.

Shopify Payments: Best For E-commerce

Shopify Payments is designed for e-commerce businesses. It integrates directly with Shopify’s platform, simplifying payment processing.

- Seamless Integration: Works perfectly with Shopify stores.

- Multiple Payment Options: Accepts credit cards, Apple Pay, and Google Pay.

- Fraud Analysis: Protects against fraudulent transactions.

- Transparent Pricing: Clear and competitive rates.

Shopify Payments is best for online retailers using Shopify. It offers a seamless and secure payment experience.

Detailed Review Of Top Credit Card Processors

Choosing the best credit card processor can significantly impact your business operations. In this detailed review, we cover the features, pricing, pros, and cons of some of the top credit card processors. This guide will help you make an informed decision.

Square: Features, Pricing, Pros And Cons

Square Register is an all-in-one point-of-sale (POS) system designed to streamline business operations by integrating hardware and software to handle payments, payroll, and more.

| Feature | Description |

|---|---|

| Integrated System | Combines hardware and software in a single package. |

| Versatile Payment Options | Accepts various payment methods, including cards and mobile payments. |

| User-Friendly Interface | Easy to navigate, designed for quick and efficient transactions. |

| Built-in Software | Handles payments, payroll, inventory, and customer management. |

Pricing Details

- No specific pricing details provided. Contact sales for quotes.

Pros

- Efficiency: Simplifies and speeds up the checkout process.

- Portability: Offers solutions like Square Terminal for on-the-go transactions.

- Comprehensive Management: Integrates various business operations into one system.

- Scalable: Suitable for small businesses to large enterprises.

Cons

- No specific refund or return policy details provided.

Stripe: Features, Pricing, Pros And Cons

Stripe is a robust payment processing platform known for its developer-friendly tools and customization options.

Features

- Customizable APIs for seamless integration.

- Supports multiple payment methods including cards, ACH, and digital wallets.

- Advanced fraud detection tools.

- Detailed reporting and analytics.

Pricing Details

- 2.9% + 30¢ per successful card charge.

- Custom pricing available for enterprise solutions.

Pros

- Highly customizable for developers.

- Supports a wide range of payment methods.

- Offers advanced security features.

- Detailed and comprehensive reporting tools.

Cons

- May be complex for non-developers.

- Pricing can become high for small transactions.

Paypal: Features, Pricing, Pros And Cons

PayPal is a widely recognized payment processing system known for its ease of use and global reach.

Features

- Accepts payments from over 200 countries and regions.

- Supports multiple currencies.

- Quick and easy setup.

- Buyer and seller protection programs.

Pricing Details

- 2.9% + 30¢ per transaction.

- Discounted rates for nonprofits.

Pros

- Global acceptance and reach.

- Easy to set up and use.

- Offers protection programs for both buyers and sellers.

- Supports multiple currencies.

Cons

- Higher fees for international transactions.

- Account holds and limitations can occur.

Toast: Features, Pricing, Pros And Cons

Toast is a cloud-based restaurant management platform that offers point-of-sale, online ordering, and payroll solutions.

Features

- Designed specifically for restaurants.

- Integrated online ordering and delivery management.

- Employee management and payroll features.

- Detailed sales and labor reporting.

Pricing Details

- Custom pricing based on business needs.

Pros

- Comprehensive solution for restaurants.

- Integrates online ordering and delivery.

- Detailed reporting and analytics.

- Employee management tools.

Cons

- Custom pricing can be expensive.

- Primarily focused on the restaurant industry.

Shopify Payments: Features, Pricing, Pros And Cons

Shopify Payments is a built-in payment solution for Shopify users, simplifying the payment process for online stores.

Features

- Seamless integration with Shopify stores.

- Supports multiple payment methods.

- Automatic setup and easy to use.

- Fraud analysis tools included.

Pricing Details

- 2.9% + 30¢ per transaction for online credit card rates.

- Lower rates available for higher-tier plans.

Pros

- Seamless integration with Shopify.

- Easy to set up and use.

- Supports multiple payment methods.

- Includes fraud analysis tools.

Cons

- Only available for Shopify users.

- Higher fees for lower-tier plans.

Pricing And Affordability

Choosing the best credit card processor is crucial for any business. One of the most important factors to consider is pricing and affordability. Let’s dive into the various aspects of pricing, including transaction fees, subscription plans, and hidden costs.

Transaction Fees And Rates

Most credit card processors charge a fee for each transaction. These transaction fees can vary based on the type of card used and the nature of the transaction.

| Card Type | In-Person Rate | Online Rate |

|---|---|---|

| Credit Card | 2.6% + $0.10 | 2.9% + $0.30 |

| Debit Card | 2.6% + $0.10 | 2.9% + $0.30 |

For example, using Square Register, the in-person rate for credit and debit cards is 2.6% + $0.10, while the online rate is 2.9% + $0.30.

Subscription Plans

Some credit card processors offer subscription plans. These plans can reduce transaction fees or provide additional features. Square provides different solutions for various business needs, but specific plan details are not provided.

Potential customers are encouraged to contact sales for customized quotes. A subscription plan can be beneficial for businesses with high transaction volumes. It helps in reducing the overall cost of processing payments.

Hidden Costs To Watch Out For

When evaluating credit card processors, consider possible hidden costs. These can include:

- Setup Fees: One-time fees for setting up your account.

- Monthly Fees: Regular charges for using the service.

- Withdrawal Fees: Fees for transferring funds to your bank account.

Square Register aims to be transparent with its pricing. However, always read the fine print and ask about any additional fees that might apply.

In summary, understanding the pricing and affordability of a credit card processor is vital. By carefully considering transaction fees, subscription plans, and hidden costs, you can make an informed decision that best fits your business needs.

Pros And Cons Of Using Credit Card Processors

Credit card processors like Square offer businesses the ability to accept various payment methods seamlessly. They come with their own set of advantages and disadvantages. Understanding these can help businesses make informed decisions.

Benefits Of Using Credit Card Processors

- Efficiency: Systems like Square Register simplify and speed up the checkout process. This leads to shorter wait times for customers and faster service.

- Portability: Solutions such as Square Terminal allow businesses to accept payments on the go. This is ideal for mobile businesses or pop-up shops.

- Comprehensive Management: Integrated systems reduce the need for multiple devices and software. They handle payments, payroll, inventory, and customer management in one package.

- Versatile Payment Options: Businesses can accept various payment methods, including credit cards and mobile payments. This flexibility can attract more customers.

- User-Friendly Interface: Easy navigation ensures quick and efficient transactions. Employees can learn the system quickly, reducing training time.

- Scalability: Suitable for small to large businesses across different industries. Whether in retail, food & beverage, or professional services, the system can grow with the business.

Drawbacks And Potential Issues

- Cost: Pricing details are not always clear. Potential customers may need to contact sales for customized quotes, which can be time-consuming.

- Dependence on Technology: Businesses rely on the system’s hardware and software. Technical issues can disrupt operations and lead to lost sales.

- Customer Support: While support is available, getting help can sometimes be slow. This can be frustrating during critical moments.

- Refund and Return Policies: Specific details are not always provided. Businesses may need to contact customer support to get clear information.

Choosing the right credit card processor involves weighing these pros and cons. For more information on Square’s offerings, visit their website.

Recommendations For Ideal Users Or Scenarios

Choosing the right credit card processor depends on your business type and needs. Here are some tailored recommendations for different scenarios.

Best Solutions For Small Businesses

Small businesses often require affordable and easy-to-use solutions. Square Register offers a comprehensive package that integrates hardware and software, making it ideal for small business owners. The user-friendly interface ensures quick and efficient transactions, while the built-in software handles payments, payroll, and inventory. This all-in-one system simplifies operations and is scalable as your business grows.

Best Solutions For Large Enterprises

Large enterprises need robust systems that can handle high transaction volumes and complex operations. Square Register’s scalable nature and comprehensive management features make it suitable for large businesses. It integrates various operations into one system, reducing the need for multiple devices and software, enhancing efficiency across departments.

Best Solutions For E-commerce Businesses

E-commerce businesses require versatile payment options and seamless integration with online platforms. Square Register accepts various payment methods, including cards and mobile payments, catering to the diverse needs of online shoppers. Its built-in software supports inventory and customer management, ensuring a smooth operation for e-commerce enterprises.

Best Solutions For Brick-and-mortar Stores

Brick-and-mortar stores benefit from efficient checkout processes and on-the-go transaction capabilities. Square Register offers a portable solution like Square Terminal for mobile payments, enhancing customer experience. Its integrated system simplifies the checkout process, making it ideal for retail environments.

For more information, visit Square.

Frequently Asked Questions

What Is A Credit Card Processor?

A credit card processor handles transactions between merchants and banks. It ensures payments are secure and swift.

Why Choose The Best Credit Card Processor?

Choosing the best ensures lower fees, faster transactions, and better security. It enhances customer experience and trust.

What Fees Do Credit Card Processors Charge?

Credit card processors typically charge transaction fees, monthly fees, and sometimes setup fees. Rates vary by provider.

How To Find The Best Credit Card Processor?

Compare fees, features, and customer reviews. Look for excellent customer support and security features.

Conclusion

Choosing the right credit card processor is crucial for your business success. Square Register offers an all-in-one solution that simplifies payments and business operations. Its user-friendly interface and versatile payment options enhance efficiency. Whether running a small shop or a large enterprise, Square Register adapts to your needs. For more details, visit the Square website here. Explore how Square can streamline your business today.