Best Credit Card Options: Top Picks for 2024

Choosing the right credit card can be challenging. With so many options, where do you start?

This guide will help you navigate the best credit card options available today. Credit cards are essential tools for managing finances and building credit. They offer various perks, from cashback and rewards to travel benefits. But not all credit cards are created equal. Finding the best one depends on your needs and spending habits. Whether you’re looking for low-interest rates, no annual fees, or generous rewards, this blog will explore the top credit card choices. Ready to discover which card suits you best? Let’s dive into the options that can help you make the most of your financial journey. For more information, visit the official Melio website here.

Introduction To Best Credit Card Options For 2024

Finding the best credit card can be challenging. With so many options available, it’s crucial to make an informed decision. The right credit card can help you save money, earn rewards, and build credit. This guide will help you explore the best credit card options for 2024.

The Importance Of Choosing The Right Credit Card

Choosing the right credit card is essential. It can impact your financial health and daily life. The right card can offer valuable rewards and benefits. Consider your spending habits and financial goals. Look for cards with low interest rates, high rewards, and valuable perks.

Using the wrong card can lead to high fees and interest charges. It can also hurt your credit score. Always compare different cards before making a decision. Look for transparency in fees and terms. This will help you avoid surprises and maximize benefits.

Overview Of The 2024 Credit Card Landscape

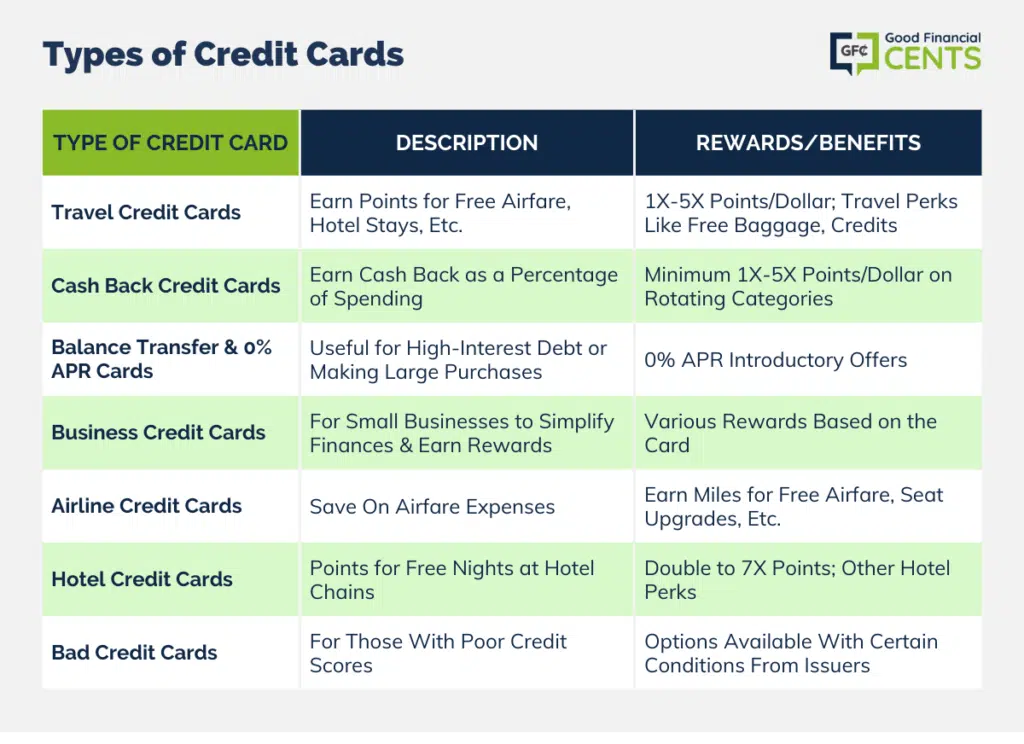

The credit card landscape in 2024 offers many exciting options. New cards are focusing on rewards, security, and flexibility. Many cards offer attractive sign-up bonuses and cash-back rewards. Some cards cater to travelers with travel points and no foreign transaction fees.

There are also cards designed for business owners. These cards offer higher credit limits and business-specific perks. Credit card companies are enhancing security features. This includes real-time fraud alerts and virtual card numbers. These changes aim to provide better protection for users.

Below is a brief overview of some popular credit card categories:

| Card Category | Key Features |

|---|---|

| Cash-Back Cards | Earn cash-back on purchases; no annual fee |

| Travel Cards | Earn travel points; no foreign transaction fees |

| Business Cards | Higher limits; business-specific rewards |

| Balance Transfer Cards | Low or 0% intro APR on balance transfers |

Top Credit Cards For Rewards

Choosing the right credit card can significantly boost your rewards. Whether you prefer travel perks, cash back, or overall rewards, there is a card tailored for you. Below are our top recommendations for the best rewards credit cards.

Best Overall Rewards Credit Card

The Chase Sapphire Preferred® Card stands out for its versatile rewards. Earn 2x points on travel and dining, and 1x point on all other purchases. The points are highly flexible, transferable to various travel partners. Additionally, enjoy a generous sign-up bonus after spending a certain amount in the first three months.

Best Travel Rewards Credit Card

For avid travelers, the American Express® Gold Card is a top choice. Earn 3x points on flights booked directly with airlines and 4x points at restaurants. The card also offers credits for Uber and airline fees, making travel more affordable. Plus, the points can be transferred to numerous airline and hotel loyalty programs.

Best Cash Back Credit Card

The Citi® Double Cash Card is ideal for those who prefer straightforward cash rewards. Earn 2% cash back on all purchases, 1% when you buy, and an additional 1% when you pay. There are no categories to track, and no caps on the amount of cash back you can earn. It’s a simple, effective way to maximize your cash rewards.

Top Credit Cards For Balance Transfers

Balance transfer credit cards can help you manage your debt more effectively. They offer an excellent way to pay off high-interest credit card balances. Here, we will explore the best options available, their key features and benefits, and how they can save you money.

Best Balance Transfer Credit Card

The best balance transfer credit card offers low or 0% introductory APR for balance transfers. It also has a reasonable ongoing APR and minimal fees.

| Credit Card | Intro APR | Ongoing APR | Balance Transfer Fee |

|---|---|---|---|

| Card A | 0% for 18 months | 14.99% – 24.99% | 3% |

| Card B | 0% for 20 months | 15.99% – 25.99% | 5% |

| Card C | 0% for 15 months | 13.99% – 23.99% | 3% |

Key Features And Benefits Of Balance Transfer Cards

Balance transfer cards come with several key features and benefits:

- 0% Introductory APR: Pay no interest for a set period.

- Lower ongoing APR: Pay lower interest rates after the intro period.

- No annual fee: Save more with no yearly charges.

- Flexible credit limits: Manage larger debts with higher limits.

How Balance Transfer Cards Can Save You Money

Balance transfer cards can save you money in various ways:

- Lower interest payments: Reduce your monthly interest charges.

- Consolidate debt: Combine multiple balances into one payment.

- Pay off debt faster: Use savings on interest to pay down principal.

With these cards, you can focus on reducing debt without the burden of high-interest rates.

Top Credit Cards For Low Interest Rates

Choosing the right credit card can make a big difference in your financial health. Low interest rate credit cards are particularly beneficial for those who carry a balance month-to-month. These cards help minimize interest charges, making it easier to pay off debt. Here are the top options to consider.

Best Low Interest Credit Card

When searching for the best low interest credit card, look for the annual percentage rate (APR). Cards with a low APR can save you money on interest, especially if you tend to carry a balance.

| Credit Card | APR Range | Annual Fee |

|---|---|---|

| Card A | 12.99% – 22.99% | $0 |

| Card B | 13.49% – 23.49% | $0 |

| Card C | 11.99% – 20.99% | $39 |

Benefits Of Low Interest Rate Cards

Low interest rate credit cards come with several advantages:

- Reduced interest payments: Lower APR means less money spent on interest.

- Easier debt management: Helps in paying off balances faster.

- Cost-effective for large purchases: Ideal for spreading payments over time.

Ideal Users For Low Interest Credit Cards

These cards are perfect for:

- Individuals who carry a balance: Minimize interest costs while paying off debt.

- People planning large purchases: Spread out payments without high interest.

- Those consolidating debt: Lower APR makes it easier to manage multiple debts.

Choosing a low interest credit card can significantly improve your financial health. By focusing on low APR, you can save on interest and manage debt more effectively.

Top Credit Cards For Building Credit

Building credit is essential for a healthy financial future. The right credit card can help you boost your credit score. Here are some top options to consider:

Best Credit Card For Building Credit

Finding the best credit card for building credit can be challenging. Here are some top choices:

| Credit Card | Annual Fee | Key Feature |

|---|---|---|

| Discover it® Secured | $0 | Cashback rewards |

| Capital One Platinum Secured | $0 | Low deposit requirements |

| OpenSky® Secured Visa® Credit Card | $35 | No credit check |

How These Cards Help Improve Your Credit Score

Credit-building cards help you improve your credit score by:

- Reporting to the major credit bureaus

- Encouraging responsible credit usage

- Providing tools to monitor your credit

Regular on-time payments and keeping balances low are crucial. These actions positively impact your credit score over time.

Target Audience For Credit-building Cards

Credit-building cards are ideal for:

- Individuals with no credit history

- People looking to rebuild their credit

- Students and young adults

These cards offer a fresh start. They provide opportunities to prove creditworthiness. Choose the right card based on your needs. Start building a strong credit history today.

Top Credit Cards For Students

Choosing the right credit card can help students build credit and manage their finances. Below are some of the best credit card options for students, each with unique benefits and features tailored to meet student needs.

Best Credit Card For Students

Finding the best credit card for students can be challenging. Here are some top picks:

- Discover it® Student Cash Back: Offers 5% cash back on rotating categories and 1% on all other purchases.

- Journey® Student Rewards from Capital One: Provides 1% cash back on all purchases, plus a bonus for paying on time.

- Deserve® EDU Mastercard for Students: No annual fee and gives 1% cash back on all purchases.

Key Features And Benefits For Students

These credit cards offer several features and benefits designed for students:

| Credit Card | Key Features | Benefits |

|---|---|---|

| Discover it® Student Cash Back | 5% cash back on rotating categories | 1% cash back on all other purchases |

| Journey® Student Rewards from Capital One | 1% cash back on all purchases | Bonus for paying on time |

| Deserve® EDU Mastercard for Students | No annual fee | 1% cash back on all purchases |

Why Student Credit Cards Are Important

Student credit cards play a crucial role in financial education. They help students build credit history, which is essential for future financial endeavors. With responsible use, students can learn to manage credit and avoid debt.

These credit cards also offer rewards and benefits that can save students money. Cash back on purchases, no annual fees, and bonuses for on-time payments can make a significant difference in a student’s budget.

Overall, student credit cards are a valuable tool for building financial literacy and establishing a strong credit foundation.

Top Credit Cards For Small Business Owners

As a small business owner, finding the right credit card can be crucial. It helps in managing expenses, earning rewards, and building business credit. Here’s a look at some of the top credit cards for small business owners.

Best Credit Card For Small Businesses

Chase Ink Business Preferred is a top choice for many small business owners. It offers a high rewards rate on travel and business expenses. The card provides 3 points per $1 on the first $150,000 spent on travel and selected business categories each year.

The American Express Business Gold card is another excellent option. It offers 4x Membership Rewards® points in two categories where your business spends the most each month. Categories include airfare purchased directly from airlines and advertising in select media.

Finally, consider the Capital One Spark Cash for Business card. It provides unlimited 2% cash back on every purchase, which makes it simple and rewarding.

Benefits Of Using Business Credit Cards

- Separate personal and business expenses: Simplifies bookkeeping and tax filing.

- Earn rewards and cashback: Many cards offer points, miles, or cash back on purchases.

- Build business credit: Helps in securing future financing for business growth.

- Access to higher credit limits: Businesses often get higher limits than personal cards.

How Business Credit Cards Can Help Manage Expenses

Business credit cards can streamline expense management. They provide detailed monthly statements, making it easier to track spending. Many cards also offer expense management tools and integrations with accounting software.

Using a business credit card can also help in managing cash flow. It allows you to make necessary purchases even if cash is tight, giving you some breathing room until your revenue comes in.

Lastly, many business credit cards offer employee cards at no additional cost. This means you can provide your team with cards while maintaining control over spending limits and monitoring their purchases.

Pricing And Affordability Breakdown

Choosing the right credit card requires understanding the costs involved. This section offers a detailed breakdown of annual fees, interest rates, and other hidden charges. We also compare which cards give you the best value for your money.

Annual Fees And Interest Rates Comparison

Annual fees and interest rates can significantly impact the cost of using a credit card. Here’s a comparison of some popular credit cards:

| Credit Card | Annual Fee | Interest Rate (APR) |

|---|---|---|

| Card A | $95 | 18.99% |

| Card B | $0 | 15.24% |

| Card C | $450 | 22.99% |

Hidden Fees To Be Aware Of

Hidden fees can catch you by surprise. Here are some common fees to watch out for:

- Late Payment Fees: Charged if you miss a payment deadline.

- Foreign Transaction Fees: Applied for purchases made outside the country.

- Balance Transfer Fees: Incurred when transferring balances from other cards.

- Cash Advance Fees: Charged for withdrawing cash from your credit card.

Which Cards Offer The Best Value For Money

Some cards offer great value for money, balancing fees and benefits:

- Card B: No annual fee and a low-interest rate make it economical.

- Card A: Moderate annual fee with good rewards points.

- Card C: High annual fee, but excellent travel perks and rewards.

Consider your spending habits to choose the best card for your needs.

Pros And Cons Of The Top Credit Cards

Choosing the right credit card can be a game-changer for managing your finances. With many options available, understanding the pros and cons of the top credit cards is crucial. Here we break down the advantages, common drawbacks, and real-world usage experiences of some of the best credit cards.

Advantages Of Using Each Top Credit Card

| Credit Card | Advantages |

|---|---|

| Card A |

|

| Card B |

|

| Card C |

|

Common Drawbacks And Limitations

- Card A: High balance transfer fee, limited acceptance at some merchants.

- Card B: Foreign transaction fees, lower reward points on non-travel purchases.

- Card C: High annual fee, high interest rates on cash advances.

Real-world Usage Experiences

Card A: Users report that the low interest rates help manage debt effectively. However, they often face challenges with acceptance at smaller merchants.

Card B: Many appreciate the no annual fee and travel perks. Yet, some users feel the foreign transaction fees can be a burden during international trips.

Card C: High credit limit and exclusive discounts are seen as major benefits. On the flip side, the high annual fee is a common complaint among users.

Specific Recommendations For Ideal Users

Choosing the right credit card can be challenging. Different cards offer various benefits tailored to specific needs. Here are some top recommendations for different types of users.

Which Credit Card Is Best For Frequent Travelers

Frequent travelers need a card that offers travel rewards and no foreign transaction fees. The Chase Sapphire Preferred is an excellent choice. It offers:

- 2x points on travel and dining

- 1x points on all other purchases

- 25% more value when you redeem for travel through Chase Ultimate Rewards

Another great option is the American Express Platinum. This card provides:

- 5x points on flights booked directly with airlines

- 5x points on prepaid hotels booked through amextravel.com

- Extensive airport lounge access

Which Credit Card Suits Regular Shoppers

Regular shoppers should look for cards with cashback rewards and low-interest rates. The Citi Double Cash Card is a top choice. It offers:

- 2% cashback on all purchases (1% when you buy, 1% when you pay)

- No annual fee

- 0% intro APR on balance transfers for 18 months

The Blue Cash Preferred Card from American Express is another great option. This card provides:

- 6% cashback at U.S. supermarkets (on up to $6,000 per year in purchases)

- 3% cashback at U.S. gas stations

- 1% cashback on other purchases

Best Options For Those Looking To Build Credit

For those looking to build or rebuild their credit, a secured credit card is often the best option. The Discover it Secured card is highly recommended. It offers:

- 2% cashback at gas stations and restaurants (up to $1,000 in combined purchases each quarter)

- 1% cashback on all other purchases

- No annual fee

Another good choice is the Capital One Secured Mastercard. This card features:

- Reports to all three major credit bureaus

- Requires a refundable security deposit

- Access to a higher credit line after making your first five monthly payments on time

Frequently Asked Questions

What Are The Top Credit Cards For Rewards?

The top credit cards for rewards include Chase Sapphire Preferred, American Express Gold, and Capital One Venture. These cards offer excellent points, cashback, and travel benefits. Consider your spending habits to choose the best one.

Which Credit Card Has The Lowest Interest Rates?

The Citi Diamond Preferred Card is known for its low interest rates. It offers 0% APR for the first 18 months. After that, the variable APR ranges from 14. 74% to 24. 74%.

How To Choose The Best Credit Card?

To choose the best credit card, consider your spending habits and financial goals. Look for cards with rewards, low interest rates, and no annual fees. Compare different options and read customer reviews.

Are There Credit Cards With No Annual Fee?

Yes, there are many credit cards with no annual fee. Examples include the Chase Freedom Unlimited and Discover it Cash Back. These cards offer great rewards without the annual cost.

Conclusion

Choosing the right credit card can save you money and offer perks. Compare options to find what fits your needs best. For business payments, consider using Melio. It simplifies transactions and streamlines processes. Always stay informed and make the best financial choices. Happy card hunting!