Best Credit Card For Cashback: Maximize Your Rewards Today

Finding the best credit card for cashback can boost your savings. Cashback rewards offer a simple way to get money back on everyday purchases.

In the vast world of credit cards, choosing one that maximizes your cashback can be overwhelming. Different cards offer varying percentages of cashback on categories like groceries, dining, and travel. Some even provide bonus rewards for specific spending. By selecting the right credit card, you can earn while you spend, helping to reduce overall costs. With the right information and guidance, you can find a card that fits your spending habits and financial goals. Ready to discover the top options for cashback? Let’s dive into the details and find the best credit card that suits your needs. To learn more, visit TorFX UK.

Introduction To Cashback Credit Cards

Cashback credit cards are a popular choice for many individuals. They offer a percentage of your spending back as cash rewards. These cards are simple to use and can help you save money on everyday purchases. With the right strategy, you can maximize your rewards and make the most of your spending.

Understanding Cashback Rewards

Cashback rewards are incentives offered by credit card companies. When you make a purchase, a small percentage of the amount is returned to you. This reward is usually credited to your account as cash or points. The cashback percentage can vary based on the card and the type of purchase.

For example, some cards offer higher cashback rates for specific categories. These categories might include groceries, gas, or dining out. Understanding these categories can help you choose the best card for your spending habits.

Why Choose A Cashback Credit Card?

There are several reasons to choose a cashback credit card. First, they provide a straightforward way to earn rewards. Every time you make a purchase, you get a portion of your money back.

- Simple Rewards: No need to track points or miles.

- Versatility: Use rewards for anything, from bill payments to shopping.

- Ease of Use: No complex redemption process; cashback is often automatic.

Additionally, many cashback cards come with other benefits. These might include no annual fees, sign-up bonuses, and promotional APRs. All these features make cashback credit cards a valuable tool in managing personal finances.

Key Features Of Top Cashback Credit Cards

Choosing the best credit card for cashback can greatly enhance your spending power. Various cards offer unique features that cater to diverse financial habits. Below are some essential features to look for in top cashback credit cards.

High Cashback Rates

One of the most attractive features of cashback credit cards is their high cashback rates. These rates can range from 1% to 5%, depending on the card and the spending category. Higher cashback rates mean more money back in your pocket for everyday purchases.

Bonus Categories

Many top cashback credit cards offer bonus categories. These categories provide higher cashback percentages on specific types of spending, such as groceries, dining, or gas. For example, a card might offer 3% cashback on groceries and 1% on all other purchases.

No Annual Fees

A significant benefit of some cashback credit cards is that they come with no annual fees. This can save you money in the long run, especially if you do not plan to spend large amounts on the card. Many cards offer competitive features without the burden of annual fees.

Introductory Offers And Sign-up Bonuses

Many cashback credit cards come with introductory offers and sign-up bonuses. These bonuses can include a significant amount of cashback if you spend a certain amount within the first few months. For instance, you might receive $150 cashback after spending $500 in the first three months.

Cashback Redemption Options

Flexibility in cashback redemption options is another key feature. Top cards allow you to redeem your cashback in various ways, such as statement credits, direct deposits, or gift cards. This flexibility makes it easier to use your earned cashback as per your needs.

Comparing Top Cashback Credit Cards

Choosing the best credit card for cashback can be challenging. To make it easier, we’ve compared the top cashback credit cards. Each card offers unique features and benefits to fit different needs. Below, we break down the features and benefits of three top cards: Card A, Card B, and Card C.

Card A: Features And Benefits

Card A stands out for its generous cashback rates and additional perks. Here’s what you need to know:

- Cashback Rate: 2% on all purchases.

- Annual Fee: No annual fee.

- Sign-Up Bonus: $150 if you spend $500 in the first 3 months.

- Additional Perks: Access to exclusive shopping events and discounts.

Card A is ideal for those who want consistent cashback on all purchases without an annual fee. The sign-up bonus is a great added benefit for new cardholders.

Card B: Features And Benefits

Card B is perfect for those who prefer higher cashback rates in specific categories. Here’s a closer look:

- Cashback Rate: 5% on groceries, 3% on dining, 1% on all other purchases.

- Annual Fee: $95 per year.

- Sign-Up Bonus: $200 if you spend $1,000 in the first 3 months.

- Additional Perks: Travel insurance and purchase protection.

Card B offers excellent cashback rates on groceries and dining, making it a great choice for food lovers. The annual fee is offset by the high cashback rates and valuable travel perks.

Card C: Features And Benefits

Card C provides a balanced mix of cashback rates and travel rewards. Here are the details:

- Cashback Rate: 3% on travel, 2% on gas, 1% on all other purchases.

- Annual Fee: $50 per year.

- Sign-Up Bonus: $100 if you spend $500 in the first 3 months.

- Additional Perks: Airport lounge access and no foreign transaction fees.

Card C is perfect for frequent travelers. The cashback on travel and gas, combined with travel perks like airport lounge access, make it a valuable card for those who travel often.

| Card | Cashback Rate | Annual Fee | Sign-Up Bonus | Additional Perks |

|---|---|---|---|---|

| Card A | 2% on all purchases | No annual fee | $150 if you spend $500 in 3 months | Exclusive shopping events and discounts |

| Card B | 5% on groceries, 3% on dining, 1% on other purchases | $95 per year | $200 if you spend $1,000 in 3 months | Travel insurance and purchase protection |

| Card C | 3% on travel, 2% on gas, 1% on other purchases | $50 per year | $100 if you spend $500 in 3 months | Airport lounge access, no foreign transaction fees |

Pricing And Affordability Breakdown

Understanding the costs associated with cashback credit cards is crucial. This section delves into the pricing and affordability of the best cashback credit cards available. We will cover various fees and charges that could impact your decision.

Annual Fees

Annual fees are a common cost associated with credit cards. Some cards may offer no annual fees, while others may charge a fee for the additional perks they offer. Consider if the benefits outweigh the cost:

| Credit Card | Annual Fee |

|---|---|

| Cashback Card A | $0 |

| Cashback Card B | $95 |

| Cashback Card C | $150 |

Interest Rates

Interest rates can significantly impact the overall cost of using a credit card. It’s essential to compare the APR (Annual Percentage Rate) of different cards:

- Introductory APR: Some cards offer 0% APR for an initial period.

- Regular APR: This is the ongoing interest rate after the introductory period.

| Credit Card | Introductory APR | Regular APR |

|---|---|---|

| Cashback Card A | 0% for 12 months | 14.99% – 24.99% |

| Cashback Card B | 0% for 15 months | 13.99% – 23.99% |

| Cashback Card C | N/A | 15.99% – 25.99% |

Foreign Transaction Fees

If you travel frequently, foreign transaction fees are an important consideration. These fees are charged on purchases made outside your home country:

- Cashback Card A: No foreign transaction fees.

- Cashback Card B: 3% of each transaction.

- Cashback Card C: 2.7% of each transaction.

Other Hidden Costs

Hidden costs can add up quickly. It’s important to be aware of these potential charges:

- Late Payment Fees: Typically range from $25 to $40.

- Balance Transfer Fees: Usually 3% to 5% of the amount transferred.

- Cash Advance Fees: Often around 5% or $10, whichever is greater.

By understanding these costs, you can make a more informed decision about which cashback credit card is right for you.

Pros And Cons Based On Real-world Usage

Choosing the right credit card can be tricky. The best credit card for cashback offers real benefits but also has some drawbacks. Here, we delve into the pros and cons based on real-world usage. This will help you make an informed decision.

Pros Of Using Cashback Credit Cards

- Money Back on Purchases: You earn a percentage of your spending back.

- Easy to Use: Cashback is automatically credited to your account.

- Flexible Rewards: Cashback can be used for various things. Pay bills or save it.

Cons Of Using Cashback Credit Cards

- High Interest Rates: If not paid in full, interest can negate rewards.

- Annual Fees: Some cards charge fees that might offset cashback benefits.

- Limited Earning Potential: There might be caps on how much you can earn.

User Testimonials And Reviews

Real users provide insight into the practical benefits and drawbacks.

| User | Review |

|---|---|

| John D. | “I love the cashback rewards. It feels like free money!” |

| Jane S. | “The high interest rates are a downside. Pay in full always.” |

These testimonials highlight the importance of understanding both the pros and cons.

Specific Recommendations For Ideal Users

Choosing the best credit card for cashback can be tricky. Different cards suit different spending habits. Below are specific recommendations based on user needs.

Best For Frequent Shoppers

Frequent shoppers should consider a card that offers high cashback rates on everyday purchases. The Blue Cash Preferred® Card from American Express is an excellent choice. It offers:

- 6% cashback at U.S. supermarkets (up to $6,000 per year)

- 6% cashback on select U.S. streaming subscriptions

- 3% cashback at U.S. gas stations and on transit

These categories cover most regular expenses, making this card ideal for frequent shoppers.

Best For Travel Enthusiasts

Travel enthusiasts need a card that offers rewards on travel-related purchases. The Chase Sapphire Preferred® Card is highly recommended. It includes:

- 2x points on travel and dining at restaurants

- 1 point per dollar spent on all other purchases

- Points are worth 25% more when redeemed for travel through Chase Ultimate Rewards®

This card provides significant value for those who spend much on travel and dining.

Best For Low Spenders

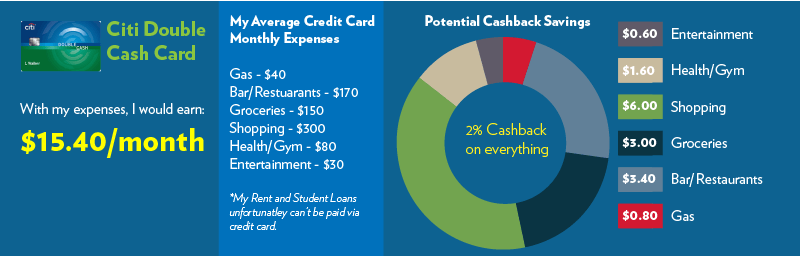

Low spenders can benefit from a card with no annual fee and simple cashback rewards. The Citi® Double Cash Card is a great option. It offers:

- 1% cashback when you buy

- 1% cashback as you pay for those purchases

- No annual fee

This card is perfect for those who prefer straightforward rewards without the need to track spending categories.

Best For Business Owners

Business owners need a card that maximizes rewards on business expenses. The Ink Business Cash® Credit Card from Chase is ideal. It provides:

- 5% cashback on the first $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services

- 2% cashback on the first $25,000 spent in combined purchases at gas stations and restaurants

- 1% cashback on all other purchases

This card can help businesses save significantly on operational costs.

How To Maximize Your Cashback Rewards

Maximizing your cashback rewards can help you get the most out of your credit card. By choosing the right card and using it wisely, you can significantly increase your rewards.

Tips For Choosing The Right Card

Choosing the right credit card is crucial for maximizing cashback rewards. Here are some tips:

- Annual Fees: Look for cards with low or no annual fees.

- Cashback Rates: Compare the cashback rates on different spending categories.

- Introductory Offers: Take advantage of sign-up bonuses and promotional rates.

- Spending Patterns: Choose a card that matches your spending habits.

Strategies For Maximizing Cashback

Once you have the right card, use these strategies to maximize your cashback:

- Use Your Card for Everyday Purchases: Use your credit card for daily expenses like groceries and gas.

- Pay Your Balance in Full: Avoid interest charges by paying your balance in full each month.

- Utilize Cashback Categories: Spend in categories with higher cashback rates.

- Monitor Special Offers: Keep an eye out for special promotions and cashback offers.

- Combine Rewards Programs: Use your card in conjunction with retailer loyalty programs for extra savings.

Common Mistakes To Avoid

To ensure you get the most out of your cashback rewards, avoid these common mistakes:

- Carrying a Balance: Interest charges can negate your cashback earnings.

- Ignoring Expiration Dates: Some cashback rewards have expiration dates; don’t let them expire.

- Missing Payment Deadlines: Late fees can diminish your overall rewards.

- Overlooking Terms and Conditions: Read the fine print to understand limitations and exclusions.

By following these tips and strategies, you can maximize your cashback rewards and enjoy the full benefits of your credit card.

Frequently Asked Questions

What Is The Best Credit Card For Cashback?

The best credit card for cashback depends on your spending habits. Look for cards with high cashback rates on categories you use often.

How Do Cashback Credit Cards Work?

Cashback credit cards return a percentage of your spending as cash rewards. These rewards can be redeemed as statement credits, direct deposits, or gift cards.

Are There Annual Fees For Cashback Credit Cards?

Some cashback credit cards have annual fees, while others don’t. Compare the benefits and rewards to determine if the fee is worth it for you.

Can I Get Cashback On All Purchases?

Most cashback credit cards offer rewards on all purchases. However, some cards provide higher cashback rates for specific categories like groceries or gas.

Conclusion

Choosing the best credit card for cashback can save you money. Evaluate your spending habits first. Then pick a card that rewards those purchases. Consider fees, rewards, and benefits. It’s important to read the fine print before committing. A suitable cashback card can offer great value. For more financial advice, check out TorFX UK. They can help you secure your finances. Make informed choices and enjoy the rewards. Thank you for reading!