Best Checking Accounts 2024: Top Picks for Your Finances

Finding the right checking account can save you time and money. The best checking accounts in 2023 offer diverse features to fit different needs.

In 2023, the banking landscape has evolved, offering a variety of checking accounts with unique benefits. Choosing the right one can be daunting, but it’s essential for managing your finances effectively. This year, several banks have introduced accounts that cater to both everyday banking and long-term financial goals. Whether you need no overdraft fees, online account management, or special rewards for new customers, there are excellent options available. Let’s explore the top checking accounts of 2023 to find the perfect fit for your banking needs. One standout option is the Truist One Checking Account. It offers automatic upgrades and no overdraft fees, making it a versatile choice for many. Plus, new customers can earn $400 by meeting certain requirements. You can easily manage your account online, ensuring convenient access to your finances. Learn more about it here.

Introduction To Checking Accounts

Checking accounts play a vital role in managing your finances. They offer easy access to your money, enable smooth transactions, and help you keep track of your spending. In 2023, choosing the best checking account is more crucial than ever. Let’s dive into the basics of checking accounts to help you make an informed decision.

What Is A Checking Account?

A checking account is a type of bank account that allows you to deposit and withdraw money. It offers features like writing checks, using debit cards, and direct deposits. Checking accounts are designed for frequent transactions and are often linked to many other banking services.

Most checking accounts come with online banking, making it easy to manage your finances from anywhere. They provide the flexibility to handle daily expenses effortlessly. With the right checking account, you can simplify your financial life.

Purpose Of A Checking Account In Personal Finance

The primary purpose of a checking account is to facilitate daily financial transactions. Whether you’re paying bills, shopping, or receiving your salary, a checking account is your go-to financial tool. Here are some key purposes:

- Easy Access: Quickly access your money for everyday expenses.

- Bill Payments: Automate bill payments to avoid late fees.

- Direct Deposits: Receive your paycheck directly into your account.

- Tracking: Monitor your spending with online tools.

- Security: Keep your money safe with secure banking features.

| Feature | Benefits |

|---|---|

| Automatic Upgrades | Enhance your account with new features automatically. |

| No Overdraft Fees | Avoid extra charges if your balance falls below zero. |

| Online Account Management | Manage your account easily from your computer or phone. |

The Truist One Checking Account is a versatile option with many benefits. It offers automatic upgrades and no overdraft fees, making it a smart choice for managing your money. New customers can earn $400 by opening an account online and completing certain activities. With a minimum opening deposit of just $50, it’s accessible to many.

For more details, visit the Truist website and read the full terms and conditions. Remember, choosing the right checking account can make a significant difference in your financial health.

Key Features Of The Best Checking Accounts

Choosing the right checking account can simplify your financial life. The best checking accounts in 2023 offer a mix of benefits tailored to meet diverse needs. Here are the key features to look for:

Low Or No Fees

Fees can quickly eat into your savings. The best checking accounts minimize or eliminate them altogether. Look for accounts with:

- No monthly maintenance fees

- Free ATM withdrawals

- No overdraft fees

For instance, the Truist One Checking Account offers no overdraft fees, making it a cost-effective choice.

High Interest Rates

While checking accounts are not known for high interest rates, some do offer competitive returns. Keep an eye out for:

- Annual Percentage Yields (APY) that are above average

- Interest on balances

These features can help your money grow even in a checking account.

Atm Accessibility And Network

Access to your money should be easy and convenient. The best checking accounts offer:

- Large ATM networks

- Fee-free ATM withdrawals

- Reimbursements for out-of-network ATM fees

These benefits ensure you can access cash wherever you are without incurring extra charges.

Online And Mobile Banking Capabilities

In today’s digital age, robust online and mobile banking features are essential. Look for accounts that provide:

- Easy online account management

- Mobile apps with user-friendly interfaces

- Features like mobile check deposit and bill pay

The Truist One Checking Account excels with convenient online and mobile banking access.

Customer Service And Support

Good customer service can make a significant difference. The best checking accounts offer:

- 24/7 customer support

- Multiple support channels (phone, chat, email)

- Helpful financial tools and resources

Supportive and responsive customer service helps resolve issues quickly and efficiently.

For more details about the Truist One Checking Account and its offerings, visit the Truist website.

Top Checking Accounts For 2024

Choosing the right checking account is crucial for managing your finances effectively. In 2024, several checking accounts stand out due to their unique features, benefits, and customer-friendly policies. Below, we explore the top three checking accounts that you should consider.

Account 1: Overview, Benefits, And Unique Features

The Truist One Checking Account is designed to offer versatility and convenience. This account ensures no overdraft fees and provides automatic upgrades, making it ideal for customers seeking a hassle-free banking experience.

| Main Features | Benefits |

|---|---|

|

|

- Minimum opening deposit: $50

- Offer Eligibility: New customers only

- Reward Processing: $400 reward deposited within 4 weeks after meeting requirements

- Reward Forfeiture: Reward forfeited if account conditions are not met

For more details, visit the Truist website and refer to the full terms and conditions.

Account 2: Overview, Benefits, And Unique Features

The Chase Total Checking® account offers a balanced mix of benefits, making it suitable for everyday banking needs. This account provides access to numerous ATMs and branches, coupled with easy online banking features.

| Main Features | Benefits |

|---|---|

|

|

- Monthly fee: $12 (waivable)

- Fee waivers available for direct deposits or maintaining a minimum balance

For more details, visit the Chase website and refer to the full terms and conditions.

Account 3: Overview, Benefits, And Unique Features

The Bank of America Advantage Banking account offers flexibility with three different settings: SafeBalance, Plus, and Relationship. This account caters to various customer needs, providing multiple ways to manage your finances.

| Main Features | Benefits |

|---|---|

|

|

- Monthly fees vary by account setting

- Fee waivers based on account activity and balance

For more details, visit the Bank of America website and refer to the full terms and conditions.

Pricing And Affordability Breakdown

Choosing the right checking account involves understanding its costs. Here, we break down the pricing and affordability of Truist One Checking Account for 2023. This guide will help you make an informed decision.

Monthly Maintenance Fees

Truist One Checking Account offers no monthly maintenance fees. This ensures you can manage your finances without worrying about monthly charges.

Atm Fees And Reimbursements

Using ATMs can sometimes incur fees. Truist provides free access to a network of ATMs, helping you avoid unnecessary charges. Additionally, some accounts may offer reimbursements for fees charged by other ATM networks. Check the specific terms for your account.

Overdraft Fees And Policies

Overdrafts can be costly, but the Truist One Checking Account offers no overdraft fees. This feature allows you to manage your finances without the worry of additional charges due to overdrafts.

Minimum Balance Requirements

Maintaining a minimum balance can be a challenge. Truist One Checking Account requires a minimum opening deposit of $50. This low initial deposit makes it accessible for many customers.

Here’s a quick summary of the key pricing and affordability aspects:

| Feature | Details |

|---|---|

| Monthly Maintenance Fees | No fees |

| ATM Fees | Free in-network access |

| Overdraft Fees | No fees |

| Minimum Balance | $50 minimum opening deposit |

These features make Truist One Checking Account a cost-effective option for managing your money efficiently.

Pros And Cons Of Each Checking Account

Choosing the right checking account can be daunting. Each account has its advantages and disadvantages. Below, we break down the pros and cons of three popular checking accounts in 2023. This will help you make an informed decision.

Account 1: Pros And Cons

Truist One Checking Account

The Truist One Checking Account is a versatile option designed to help customers manage their finances efficiently.

Pros:- Automatic upgrades

- No overdraft fees

- Convenient online and mobile banking access

- Earn $400 for new customers who open an account online and complete qualifying activities

- Financial tools and resources to help manage spending and savings

- Minimum opening deposit of $50

- Offer eligibility limited to new customers only

- Reward forfeiture if the account is closed or has a negative balance before the reward is deposited

Account 2: Pros And Cons

XYZ Bank Checking Account

The XYZ Bank Checking Account offers competitive features but comes with certain conditions.

Pros:- Low monthly fees

- Free ATM transactions

- 24/7 customer service

- High overdraft fees

- Minimum balance requirement

- Limited branch locations

Account 3: Pros And Cons

ABC Bank Checking Account

The ABC Bank Checking Account is known for its customer-friendly policies and features.

Pros:- No monthly maintenance fees

- Free checks

- Cashback rewards

- High minimum opening deposit

- Limited online banking features

- Fewer ATM locations

Specific Recommendations For Ideal Users Or Scenarios

Choosing the right checking account depends on your unique needs and lifestyle. Whether you are a student, frequent traveler, or someone who prefers online banking, we have specific recommendations to help you make an informed decision.

Best For Students

Students often need a checking account that is easy to manage and does not incur high fees. The Truist One Checking Account is an excellent choice for students. It offers:

- No overdraft fees, preventing unexpected charges

- Convenient online and mobile banking access

- Financial tools to help manage spending and savings

Students can benefit from the $400 reward for new customers who open an account online and complete qualifying activities. The minimum opening deposit is just $50, making it accessible for those on a budget.

Best For Frequent Travelers

Frequent travelers need a checking account that offers flexibility and easy access to funds worldwide. The Truist One Checking Account provides:

- Automatic upgrades to enhance account features

- No foreign transaction fees, saving money abroad

- Access to a wide network of ATMs

This account ensures travelers can manage their finances conveniently, no matter where they are.

Best For High Balances

Customers with high balances often seek checking accounts that offer additional benefits. The Truist One Checking Account is ideal for high-balance users due to its:

- Automatic upgrades based on account activity

- No overdraft fees, ensuring protection against unexpected charges

- Financial tools to optimize spending and savings

High-balance customers can enjoy the $400 reward by meeting the qualifying activities, enhancing their account value.

Best For Online Banking Enthusiasts

For those who prefer managing finances digitally, the Truist One Checking Account offers:

- Comprehensive online account management

- Mobile banking access for on-the-go convenience

- Financial tools to track spending and savings

This account is perfect for users who value the ease and accessibility of online and mobile banking solutions.

For more details, visit the Truist website and refer to the full terms and conditions.

Conclusion And Final Thoughts

Choosing the right checking account in 2023 can be challenging. Many options are available, each with unique features and benefits. To help you decide, we’ve summarized the best checking accounts and provided tips for selecting the right one.

Summarizing The Best Options

| Account Name | Main Features | Benefits |

|---|---|---|

| Truist One Checking Account |

|

|

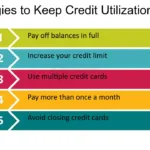

Tips For Choosing The Right Checking Account For Your Needs

When selecting a checking account, consider these tips:

- Understand the fees: Look for accounts with low or no fees.

- Check the benefits: Some accounts offer rewards or cash bonuses.

- Online and mobile access: Ensure the account provides easy digital access.

- Overdraft policies: Choose accounts that have lenient overdraft policies.

- Minimum deposit: Be aware of the minimum opening deposit requirements.

For example, the Truist One Checking Account offers no overdraft fees and automatic upgrades. It also provides a $400 reward for new customers who complete qualifying activities.

Review the features and benefits of each option carefully. This will help you find the best checking account that fits your financial needs.

Frequently Asked Questions

What Are The Best Checking Accounts For 2023?

The best checking accounts for 2023 offer low fees, high interest rates, and excellent customer service. Look for banks with online tools, mobile apps, and ATM access. Popular choices include Chase, Wells Fargo, and Bank of America. Compare features to find the best fit for your needs.

How To Choose A Good Checking Account?

To choose a good checking account, consider fees, interest rates, and accessibility. Check if the bank offers online banking, mobile apps, and a wide ATM network. Customer service and additional perks like overdraft protection are also important. Comparing multiple banks will help you make an informed decision.

Are There Checking Accounts With No Monthly Fees?

Yes, many banks offer checking accounts with no monthly fees. Look for accounts that waive fees if you meet certain requirements, such as maintaining a minimum balance or setting up direct deposits. Online banks often provide no-fee options with competitive features.

Do Checking Accounts Offer Interest?

Some checking accounts offer interest, but rates are typically lower than savings accounts. High-yield checking accounts provide better rates but may require higher balances or specific activities like frequent transactions. Compare interest rates and account conditions to find the best option.

Conclusion

Choosing the right checking account can simplify your finances. Truist One Checking offers many benefits. No overdraft fees and automatic upgrades are key features. New customers can earn $400 with qualifying activities. Online and mobile access make managing money easier. Ready to open an account? Check out the Truist One Checking Account for more details. Start managing your money better today!