Benefits Of Truist Checking Account: Unlock Financial Freedom

A checking account simplifies your financial life. The Truist One Checking Account does just that and more.

If you are looking for a reliable checking account with great benefits, the Truist One Checking Account is worth considering. This account not only offers automatic upgrades and no overdraft fees, but also has a special offer for new customers to earn $400 by completing specific qualifying activities. With features like online and mobile banking, and Zelle integration for easy money transfers, managing your finances has never been easier. Read on to explore the many advantages of the Truist One Checking Account and see why it could be the right choice for you. Learn more about Truist One Checking Account here.

Introduction To Truist Checking Account

The Truist One Checking Account offers unique benefits for customers seeking a reliable and rewarding banking experience. This account provides automatic upgrades, no overdraft fees, and a special offer for new customers. Let’s delve deeper into what Truist Bank offers and the advantages of having a checking account with them.

Overview Of Truist Bank

Truist Bank is a reputable financial institution known for its wide range of banking products and services. Their commitment to customer satisfaction is evident through their innovative banking solutions and excellent customer support. With Truist, you can expect:

- Comprehensive Online and Mobile Banking: Manage your finances with ease using Truist’s advanced online and mobile banking tools.

- Nationwide Access: Access your account and perform transactions at numerous locations across the United States.

- Customer-Centric Approach: Benefit from personalized banking services designed to meet your specific needs.

Purpose And Advantages Of A Checking Account

A checking account serves as a fundamental financial tool for managing daily transactions and expenses. The Truist One Checking Account stands out with its numerous advantages:

| Feature | Benefit |

|---|---|

| Automatic Upgrades | Your account improves over time without additional effort. |

| No Overdraft Fees | Avoid unexpected charges and manage your funds better. |

| $400 Reward | New customers can earn a $400 bonus with qualifying activities. |

| Zelle Integration | Send money easily and securely using Zelle®. |

In addition to these features, the Truist One Checking Account offers:

- Convenient Access: Manage your account through Truist’s mobile app and online banking.

- Cash Back Offers: Access various Truist credit card offers with cash back rewards.

Opening a Truist One Checking Account is simple, with a minimum deposit of just $50. Ensure you use promo code DC2425TR1400 and complete the qualifying direct deposits to earn your $400 reward.

For more information or to open an account, visit the Truist website or contact their support team at 844-4TRUIST (844-487-8478).

Key Features Of Truist Checking Account

The Truist One Checking Account is designed to offer convenience and value. It comes with numerous benefits that make managing your finances easier and more rewarding. Let’s explore the key features that make this account stand out.

No Monthly Maintenance Fees

One of the most appealing features of the Truist One Checking Account is the absence of monthly maintenance fees. This means you can enjoy the benefits of your checking account without worrying about recurring charges eating into your balance.

Overdraft Protection Options

With no overdraft fees, the Truist One Checking Account provides peace of mind. Even if you accidentally overspend, you won’t be hit with hefty penalties. This feature can help you manage your finances more effectively.

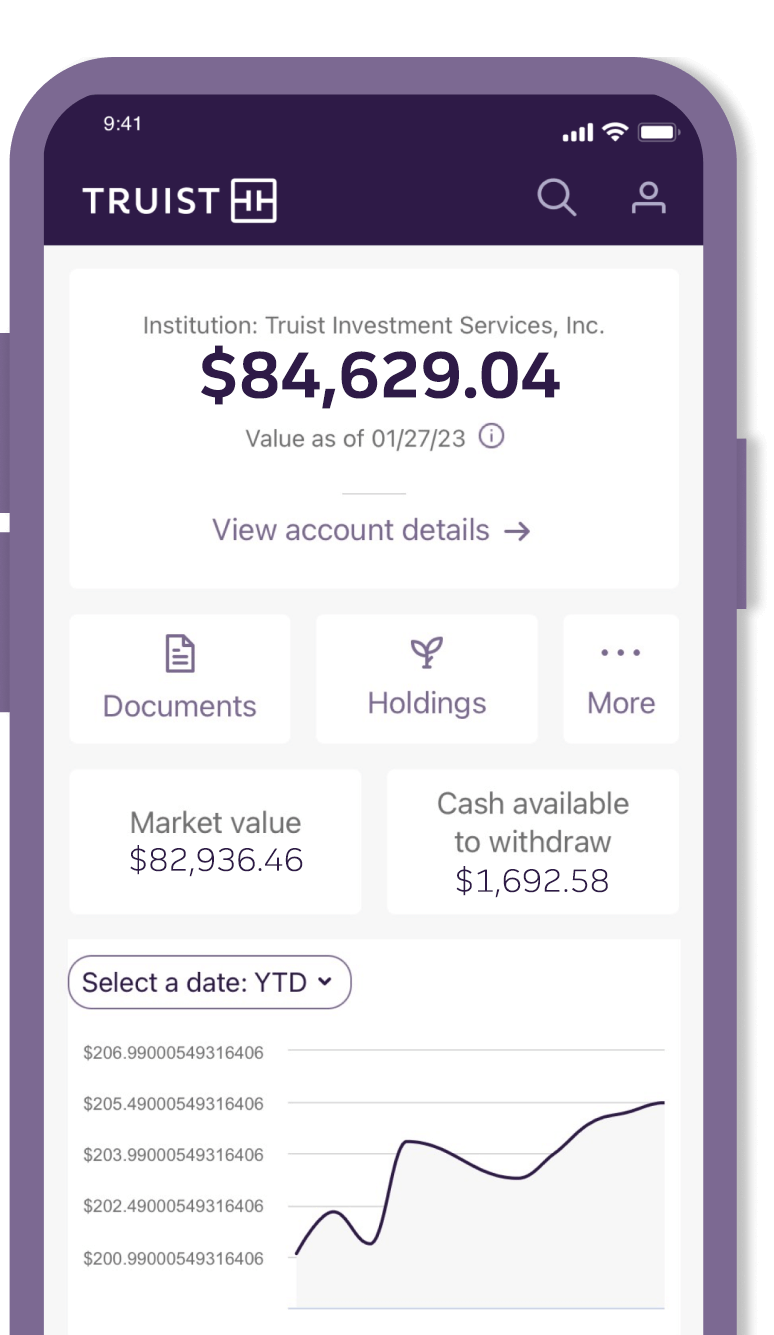

Online And Mobile Banking Capabilities

The Truist One Checking Account offers robust online and mobile banking tools. You can easily manage your account from anywhere, at any time. Features include:

- Access to account balances and transaction history

- Bill payment capabilities

- Mobile check deposit

- Integration with Zelle® for easy money transfers

Rewards And Cash Back Opportunities

New customers can earn a $400 reward by opening an account online and completing qualifying activities. Additionally, Truist offers various credit card options with cash back rewards that can further enhance your banking experience.

Access To A Large Atm Network

Truist provides convenient access to a large network of ATMs. This makes it easier to withdraw cash or check your balance without incurring additional fees. With numerous ATMs across the country, you can access your money wherever you are.

| Feature | Details |

|---|---|

| No Monthly Fees | Enjoy your account without monthly maintenance fees. |

| No Overdraft Fees | Spend without the worry of overdraft charges. |

| Online and Mobile Banking | Manage your account anytime, anywhere. |

| Rewards and Cash Back | Earn rewards and cash back with qualifying activities. |

| Large ATM Network | Access your money easily with a wide network of ATMs. |

These features make the Truist One Checking Account a compelling choice for anyone seeking a reliable and rewarding banking solution.

Pricing And Affordability

The Truist One Checking Account offers a range of features designed to provide value and convenience. Understanding the pricing and affordability of this account is crucial for making an informed decision.

Cost Breakdown And Fee Structure

The Truist One Checking Account has a minimum opening deposit of $50. For new customers, there is a special offer to earn $400 by completing specific qualifying activities, such as receiving at least two qualifying Direct Deposits totaling $1,000 or more within 120 days of account opening.

One of the standout features is the absence of overdraft fees. This can save customers significant money compared to other checking accounts that charge for overdrafts. There are also no monthly maintenance fees, which adds to the affordability of this account.

Minimum Balance Requirements

There are no specific minimum balance requirements for the Truist One Checking Account. This means you won’t need to maintain a certain amount in your account to avoid fees, making it more accessible for a wider range of customers.

Hidden Fees To Watch Out For

While the Truist One Checking Account is designed to be transparent and affordable, it’s important to be aware of any potential hidden fees. Currently, there are no hidden fees noted, but always review the terms and conditions to ensure you fully understand any possible charges.

Additionally, ensure your account remains in good standing. The $400 reward may be forfeited if the account changes to a non-eligible type, is closed before the reward is deposited, or has a $0.00 or negative balance at the time of verification.

Pros And Cons Of Truist Checking Account

The Truist One Checking Account offers a range of benefits and some limitations. This section explores the advantages and potential drawbacks of using this account.

Advantages Of Using Truist Checking Account

- Automatic Upgrades: The account upgrades automatically over time, enhancing your banking experience.

- No Overdraft Fees: Enjoy peace of mind with no charges for overdrafts.

- Online and Mobile Banking: Access your account easily through Truist’s online and mobile banking tools.

- Zelle Integration: Send money effortlessly using Zelle®.

- $400 Reward: New customers can earn $400 by opening the account online and completing qualifying activities.

- Convenient Access: Manage your account with Truist’s mobile app and online banking.

- Cash Back Offers: Access various Truist credit card offers with cash back rewards.

Potential Drawbacks And Limitations

- Minimum Opening Deposit: A minimum deposit of $50 is required to open the account.

- Reward Eligibility: The $400 reward requires the account to be opened online with promo code DC2425TR1400 and at least 2 qualifying Direct Deposits totaling $1,000 or more within 120 days of account opening.

- Non-Transferable Offer: The offer cannot be combined with other checking offers and may be discontinued at any time.

- Eligibility Restrictions: Offer available only to US residents in specific states, excluding Truist employees or current/past account holders within the specified timeframe.

- Reward Forfeiture: The reward is forfeited if the account changes to a non-eligible type, is closed before the reward is deposited, or has a $0.00 or negative balance at the time of verification.

Ideal Users And Scenarios

The Truist One Checking Account stands out with its unique features and benefits. It is designed to cater to a wide range of users. Below, we will explore who can benefit most from this account and the best use cases and situations.

Who Can Benefit Most From Truist Checking Account

Several groups of people can benefit greatly from the Truist One Checking Account:

- New Customers: Those new to Truist can earn a $400 reward by completing specific qualifying activities. This makes it an attractive option for individuals seeking to switch banks.

- Online and Mobile Banking Users: With access to Truist’s online and mobile banking tools, tech-savvy customers can manage their accounts conveniently from anywhere.

- Individuals Concerned About Overdraft Fees: This account does not charge overdraft fees, providing peace of mind for those worried about unexpected charges.

- Users Interested in Cash Back Offers: Access to various Truist credit card offers with cash back rewards is ideal for users looking to maximize their spending.

Best Use Cases And Situations

The Truist One Checking Account is versatile and suitable for various scenarios:

| Scenario | How Truist One Checking Account Helps |

|---|---|

| Everyday Banking | Manage daily transactions with ease using online and mobile banking. |

| Direct Deposits | Receive at least 2 direct deposits totaling $1,000 or more within 120 days to qualify for the $400 reward. |

| Money Transfers | Send money quickly and securely using Zelle® integration. |

| Cash Back Rewards | Earn cash back through various Truist credit card offers. |

| Fee Management | Benefit from no overdraft fees and automatic account upgrades over time. |

These features make the Truist One Checking Account an ideal choice for many users in different scenarios. Whether managing daily finances, seeking rewards, or avoiding fees, this account offers valuable benefits.

Frequently Asked Questions

What Are The Benefits Of Truist Checking Account?

Truist checking accounts offer no monthly fees, access to over 3,000 ATMs, and online banking. They also provide mobile check deposits, fraud protection, and personalized customer service. Additionally, you can enjoy cashback rewards and easy account management.

Does Truist Checking Account Have Monthly Fees?

No, most Truist checking accounts do not have monthly fees. However, some specific accounts might have conditions to waive fees. Always check the terms when signing up to ensure you meet the criteria.

Is Truist Checking Account Safe?

Yes, Truist checking accounts are safe. They provide advanced fraud protection, secure online banking, and account alerts. Truist also offers FDIC insurance for added security. They continuously monitor accounts for suspicious activity.

Can I Deposit Checks With Truist Mobile App?

Yes, you can deposit checks using the Truist mobile app. The app allows you to conveniently and securely deposit checks anytime, anywhere. Simply take a photo of the check and follow the prompts.

Conclusion

Truist One Checking Account offers numerous benefits for users. Enjoy no overdraft fees and easy money transfers with Zelle. Earn a $400 reward by completing qualifying activities. Manage your account online or through the mobile app. The account also upgrades automatically over time. Visit the Truist website to learn more and open your account today. Make banking convenient and rewarding with Truist One Checking.