Benefits Of Credit Repair: Unlock Financial Freedom Today

Credit repair can significantly improve your financial health. It involves correcting errors and improving your credit score.

Understanding the benefits of credit repair is essential for anyone looking to secure better financial opportunities. A good credit score opens doors to various financial benefits. It can lead to lower interest rates on loans and credit cards, saving you money in the long run. Improved credit can also help you secure better terms on mortgages and car loans. Additionally, it enhances your chances of getting approved for rental applications and even some job opportunities. By focusing on credit repair, you can take control of your financial future and unlock these advantages. Ready to start your credit repair journey? Explore options like Funding Societies, which offer tailored solutions for your needs. Visit Funding Societies for more information.

Introduction To Credit Repair

Having a good credit score is essential. It impacts many aspects of your financial life. Credit repair is a process that helps improve your credit score. This process is beneficial in many ways.

What Is Credit Repair?

Credit repair involves correcting errors on your credit report. It can also involve improving your credit habits. This may include paying bills on time and reducing debt. Credit repair services help individuals and businesses enhance their credit scores.

The Importance Of Good Credit

Good credit is crucial for several reasons:

- Lower interest rates: Better credit scores can lead to lower interest rates on loans.

- Loan approvals: Higher credit scores increase the chances of loan approvals.

- Better terms: Good credit can help you get better terms on financing and credit cards.

- Employment opportunities: Some employers check credit scores during the hiring process.

Common Misconceptions About Credit Repair

There are several misconceptions about credit repair:

- Instant results: Credit repair is not an overnight process. It takes time to improve your credit score.

- Only for bad credit: Even those with good credit can benefit from credit repair. It helps maintain and improve their scores.

- Self-improvement: While you can repair credit yourself, professional services offer expertise and faster results.

Understanding these aspects can help you make informed decisions about credit repair.

Key Features Of Credit Repair Services

Credit repair services offer numerous benefits to individuals seeking to improve their credit scores. These services provide a structured approach to address credit issues. Below are some key features of credit repair services.

Credit Report Analysis

Credit repair services begin with a thorough credit report analysis. Experts review your credit report to identify any inaccuracies or negative items. This analysis helps understand factors affecting your credit score. It includes:

- Identifying errors in personal information

- Detecting inaccurate account statuses

- Spotting duplicate accounts

- Highlighting unauthorized hard inquiries

Dispute Resolution With Credit Bureaus

One of the most critical features is dispute resolution with credit bureaus. If inaccuracies are found, the credit repair service will dispute these errors with the credit bureaus. The process includes:

- Preparing and sending dispute letters

- Following up with credit bureaus

- Ensuring errors are corrected

Credit Score Monitoring And Alerts

Credit repair services offer ongoing credit score monitoring and alerts. This feature helps you stay updated on changes to your credit report. It includes:

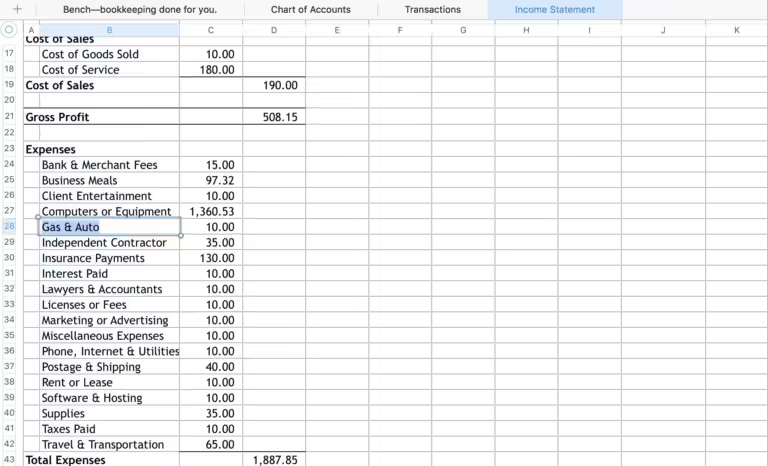

| Service | Description |

|---|---|

| Credit Score Updates | Regular updates on your credit score |

| Alerts | Notifications of significant changes or new inquiries |

Personalized Financial Advice

Finally, credit repair services provide personalized financial advice. Experts offer guidance based on your specific financial situation. This advice helps you make informed decisions to improve your credit score. It covers:

- Debt management strategies

- Budgeting tips

- Credit utilization management

Benefits Of Credit Repair

Credit repair can significantly improve your financial health. It involves addressing errors on your credit report, negotiating with creditors, and implementing strategies to improve your credit score. Here are some key benefits of credit repair:

Improved Credit Scores

One of the primary benefits of credit repair is the potential to improve your credit scores. By correcting inaccuracies and removing negative items from your credit report, you can see a significant boost in your credit score. A higher credit score reflects positively on your financial responsibility.

Lower Interest Rates On Loans

With a better credit score, you can qualify for lower interest rates on loans. This can save you a substantial amount of money over time. Lower interest rates mean lower monthly payments and less paid in interest over the life of the loan.

Better Chances Of Loan And Credit Card Approvals

Credit repair increases your chances of loan and credit card approvals. Lenders and credit card companies are more likely to approve your applications if you have a good credit score. This gives you access to better financial products and services.

Access To Better Housing And Employment Opportunities

A good credit score can also provide access to better housing and employment opportunities. Many landlords and employers check credit reports as part of their screening process. A good credit score can make you a more attractive candidate for rental properties and job positions.

Reduced Financial Stress

Improving your credit score can lead to reduced financial stress. Knowing that you have a good credit score can give you peace of mind. It can also make it easier to manage your finances and achieve your financial goals.

Pricing And Affordability Of Credit Repair Services

Understanding the pricing and affordability of credit repair services is crucial. Customers need to know the costs involved before committing. This section explores the different aspects of service fees, compares companies, and analyzes the cost versus benefit.

Understanding Service Fees

Credit repair services often come with varying fees. These fees might include:

- Initial setup fees

- Monthly service charges

- Per-dispute fees

Each company has its own pricing model. Some charge a flat fee, while others charge based on the number of disputes. Understanding these fees helps in making an informed decision.

Comparing Different Credit Repair Companies

It’s essential to compare different credit repair companies. Here’s a simple table to help understand various pricing structures:

| Company | Initial Setup Fee | Monthly Fees | Per-Dispute Fee |

|---|---|---|---|

| Company A | $99 | $79 | $15 |

| Company B | $89 | $69 | $10 |

| Company C | $109 | $89 | $20 |

Comparing these companies helps in choosing the one that fits your budget and needs.

Cost Vs. Benefit Analysis

Evaluating the cost vs. benefit of credit repair services is important. Consider the following:

- Potential credit score increase

- Long-term savings on interest rates

- Improved loan approval chances

For example, improving your credit score might lead to lower interest rates on loans. This can save you thousands over time, making the investment in credit repair worthwhile.

Additionally, better credit scores can open opportunities for higher credit limits and better loan terms. This cost-benefit analysis helps in determining the true value of investing in credit repair services.

Pros And Cons Of Using Credit Repair Services

Credit repair services can offer significant benefits, but they also come with potential drawbacks. Let’s explore the advantages and disadvantages of using these services. Understanding both sides will help you make an informed decision.

Advantages Of Professional Credit Repair

- Expertise: Professionals understand credit laws and can efficiently navigate the complexities.

- Time-Saving: Credit repair specialists handle the paperwork, saving you valuable time.

- Personalized Strategies: They create customized plans tailored to your specific credit issues.

- Improved Credit Score: Effective strategies can lead to a higher credit score in a shorter period.

- Legal Protection: Professionals ensure all actions comply with credit laws, reducing legal risks.

Potential Drawbacks To Consider

- Cost: Professional services can be expensive, potentially adding to your financial strain.

- Scams: Not all credit repair companies are reputable; some may take advantage of you.

- No Guarantees: No service can guarantee an improvement in your credit score.

- Dependency: Relying on professionals might prevent you from learning to manage your credit.

Real-world User Experiences

Users of credit repair services often share their experiences. Some report significant improvements in their credit scores, appreciating the expert guidance and time-saving benefits. They highlight the personalized attention they received, which helped them understand their credit issues better.

Conversely, some users express dissatisfaction due to the high costs and lack of guaranteed results. They caution others to research thoroughly before choosing a credit repair service to avoid scams and unrealistic promises.

Specific Recommendations For Ideal Users

Credit repair can transform financial health, but it’s especially beneficial for certain users. Knowing who benefits most and when credit repair is most effective can help in making informed decisions.

Who Can Benefit Most From Credit Repair?

Individuals with poor credit scores can see significant improvements. Small business owners needing loans will also benefit. Credit repair is ideal for those facing high-interest rates due to poor credit.

| Ideal Users | Benefits |

|---|---|

| Individuals with Low Credit Scores | Improved credit score, access to better loan terms |

| Small Business Owners | Better financing options, lower interest rates |

| High-Interest Rate Payers | Reduced interest rates, more savings |

Scenarios Where Credit Repair Is Most Effective

Credit repair is most effective before applying for a mortgage. It also helps when preparing for significant financial changes, like starting a business. Individuals planning for major purchases, such as cars or homes, benefit greatly.

- Before applying for a mortgage

- Preparing for business financing

- Planning for major purchases

Diy Credit Repair Vs. Professional Services

Deciding between DIY credit repair and professional services depends on individual needs. DIY credit repair is cost-effective but requires time and effort. Professional services offer expertise and quicker results.

| Aspect | DIY Credit Repair | Professional Services |

|---|---|---|

| Cost | Low | Varies, but generally higher |

| Time Investment | High | Low |

| Expertise | Limited | High |

| Results | Slower | Faster |

Choosing the right approach depends on personal circumstances. Those with time and patience may prefer DIY. Individuals needing fast results may opt for professional services.

Conclusion: Achieving Financial Freedom Through Credit Repair

Credit repair can unlock numerous benefits, paving the way for financial freedom. By addressing credit issues, individuals can access better financial opportunities. This section will recap key benefits, provide final thoughts, and suggest next steps.

Recap Of Key Benefits

Credit repair offers several advantages:

- Improved Credit Score: A higher score opens doors to better loan terms.

- Lower Interest Rates: Save money with reduced rates on loans and credit cards.

- Better Insurance Premiums: Enjoy lower premiums on various insurance policies.

- Increased Financial Opportunities: Access to higher credit limits and more financial products.

- Peace of Mind: Feel confident in financial decisions and planning.

Final Thoughts And Encouragement

Credit repair is a crucial step toward achieving financial goals. It requires time, effort, and patience but the rewards are substantial. Improved credit can lead to lower costs and better opportunities.

Stay committed to the process and celebrate small victories. Each improvement brings you closer to financial freedom.

Next Steps To Take

To begin your credit repair journey, consider these steps:

- Obtain Credit Reports: Get copies from major credit bureaus.

- Review for Errors: Identify and dispute inaccuracies.

- Pay Down Debts: Focus on reducing outstanding balances.

- Build Positive History: Make timely payments and manage credit wisely.

- Seek Professional Help: Consider credit repair services for guidance.

Taking these steps can lead to better financial health and greater opportunities. Start your journey today and work towards financial freedom.

Frequently Asked Questions

What Is Credit Repair?

Credit repair involves fixing your credit report to improve your credit score. It can include disputing errors and negotiating with creditors.

How Does Credit Repair Work?

Credit repair works by identifying and disputing incorrect information on your credit report. This can result in a higher credit score.

Why Is Credit Repair Important?

Credit repair is important because a good credit score can lead to better loan terms, lower interest rates, and more financial opportunities.

Can Credit Repair Improve My Credit Score?

Yes, credit repair can improve your credit score by removing errors and negotiating with creditors to remove negative items.

Conclusion

Credit repair offers numerous benefits. It improves your financial health and opportunities. Better credit means lower interest rates and loan approvals. It also provides peace of mind and financial freedom. For business financing, consider Funding Societies. They offer quick and convenient financing solutions. Both SMEs and investors benefit from their services. Support your financial goals and explore credit repair today.