Beginner’s Guide to Credit Cards: Unlock Financial Freedom

Credit cards can be a powerful financial tool. They offer convenience and rewards.

But for beginners, understanding credit cards can be overwhelming. This guide will simplify the basics and help you make informed choices. Credit cards provide more than just a way to pay for things. They can help build your credit score, offer rewards, and provide various consumer protections. But if you’re new to the world of credit, it’s essential to understand how they work, the benefits they offer, and the responsibilities they entail. This beginner’s guide will walk you through everything you need to know. From choosing the right card to managing your spending, you’ll learn the essentials to navigate credit cards confidently. And if you’re looking for a great starter card, consider the Firstcard® Secured Credit Builder Card. It’s designed for those new to credit, including international students and immigrants, making it a perfect fit for beginners.

Introduction To Credit Cards

Credit cards can be a powerful tool for managing your finances. They offer convenience, security, and a way to build your credit. Understanding how credit cards work is essential for making the most of their benefits while avoiding common pitfalls.

What Is A Credit Card?

A credit card is a plastic or metal card issued by banks or financial institutions. It allows you to borrow money up to a certain limit to pay for goods and services. You can use it for purchases online, in stores, or even withdraw cash from ATMs.

Credit cards come with an array of features, including rewards, cashback, and special offers. For example, the Firstcard® Secured Credit Builder Card is designed to help build credit, even for those without an SSN.

How Credit Cards Work

When you use a credit card, you borrow money from the card issuer to make a purchase. You will receive a statement each month showing the amount you owe. You can choose to pay off the full amount or make a minimum payment.

Credit cards come with an interest rate known as the Annual Percentage Rate (APR). Paying the full balance each month helps avoid interest charges. Some cards like the Firstcard® offer 0% APR on all purchases, making it easier to manage payments.

Credit cards also report your payment history to credit bureaus. Regular, on-time payments help build a positive credit history, which is crucial for future financial opportunities.

Benefits Of Using Credit Cards

Using credit cards responsibly offers several advantages:

- Build Credit: Regular use and timely payments help build your credit score.

- Rewards and Cashback: Earn rewards, cashback, and discounts on purchases. For instance, Firstcard® offers up to 15% cashback at over 29,000 partner merchants.

- Security: Credit cards come with fraud protection and zero liability for unauthorized transactions.

- Convenience: Easily make online and in-store purchases without carrying cash.

- Financial Tracking: Manage and track expenses through detailed statements and user-friendly apps.

For those new to credit cards, the Firstcard® offers a secured credit builder card that includes multilingual customer support and no annual fees, making it an excellent choice for international students and immigrants.

| Plan | Monthly Cost | Features |

|---|---|---|

| Standard Plan | $4.99 | 0.75% APY, up to 15% cashback, 3% foreign transaction fee |

| Build Your Credit Plan | $8.99 | 2.00% APY, up to 15% cashback, 1.5% foreign transaction fee |

| Premium Plan | $12.99 | 4.00% APY, up to 15% cashback, 0% foreign transaction fee |

For more details, visit the Firstcard website or contact their support team.

Choosing Your First Credit Card

Selecting your first credit card is a significant step in building a strong financial foundation. The right choice can help you build credit, earn rewards, and manage expenses efficiently. Below are some essential factors to consider when choosing your first credit card.

Types Of Credit Cards

Understanding the different types of credit cards is crucial. Here’s a quick overview:

- Secured Credit Cards: Ideal for beginners, these require a security deposit.

- Student Credit Cards: Designed for students with limited credit history.

- Rewards Credit Cards: Offer cashback, points, or miles for purchases.

- Travel Credit Cards: Provide travel-related perks and rewards.

The Firstcard® Secured Credit Builder Card is a great option. It helps build credit without requiring a Social Security Number (SSN).

Factors To Consider

When choosing your first credit card, consider the following factors:

| Factor | Details |

|---|---|

| Annual Percentage Rate (APR) | Look for cards with 0% APR, like Firstcard. |

| Fees | Avoid cards with high fees. Firstcard has no annual, late, or overdraft fees. |

| Rewards | Consider cards with cashback or rewards. Firstcard offers up to 15% cashback. |

| Credit Building | Choose a card that reports to credit bureaus. Firstcard reports to all three major bureaus. |

| Security | Ensure the card has fraud protection. Firstcard uses Mastercard’s Zero Liability Fraud Protection. |

How To Apply For A Credit Card

Applying for your first credit card is straightforward. Follow these steps:

- Research different credit cards. Compare their features and benefits.

- Visit the credit card issuer’s website. For Firstcard, go to https://www.firstcard.app/.

- Fill out the application form. Provide accurate personal and financial information.

- Submit the application. Wait for approval, which may take a few days.

- Once approved, activate your card. Follow the issuer’s instructions to start using it.

Remember, choosing the right credit card is the first step toward financial independence. The Firstcard® Secured Credit Builder Card is an excellent choice for building credit and earning rewards.

Understanding Credit Card Features

Credit cards come with various features that can benefit you in multiple ways. Understanding these features is crucial for making the most out of your credit card. Let’s delve into some of the key features that you should be aware of.

Credit Limits And Interest Rates

Your credit limit is the maximum amount you can spend on your card. Staying within this limit is essential to avoid penalties. Interest rates, represented as an APR (Annual Percentage Rate), are charged on the outstanding balance if not paid in full. For instance, Firstcard® Secured Credit Builder Card offers a 0% APR on all purchases, making it an excellent option for beginners.

Reward Programs And Cashback Offers

Many credit cards provide rewards and cashback offers for spending. These incentives can help you save money or earn points. Firstcard offers up to 15% cashback at over 29,000 partner merchants and up to 10% random cashback through its app feature. Such programs make spending more rewarding.

Balance Transfers And Introductory Offers

Balance transfers allow you to move your debt from one card to another, usually with a lower interest rate. Introductory offers often include 0% interest for a specific period. While Firstcard focuses on credit building and cashback rewards, other cards might offer balance transfer options that can save you money on interest payments.

| Firstcard Plans | Monthly Fee | APY | Foreign Transaction Fee |

|---|---|---|---|

| Standard Plan | $4.99 | 0.75% | 3% |

| Build Your Credit Plan | $8.99 | 2.00% | 1.5% |

| Premium Plan | $12.99 | 4.00% | 0% |

Using these features wisely can help you manage your finances better and make informed decisions about your credit usage. Always read the terms and conditions to understand the full extent of the benefits your card offers.

Managing Credit Card Debt

Learning how to manage credit card debt is essential for financial health. Credit cards can be beneficial tools, but they come with responsibilities. Understanding how to handle debt can prevent financial stress and build a positive credit history.

Tips For Responsible Spending

- Set a budget: Always know how much you can spend each month.

- Track expenses: Use apps to monitor your spending.

- Avoid impulse purchases: Think before buying non-essential items.

- Use rewards wisely: Maximize benefits from cashback and rewards.

Paying Off Your Balance

Paying off your balance on time is crucial. Here are some tips:

- Pay more than the minimum: Reduce your balance faster and save on interest.

- Automate payments: Ensure you never miss a due date.

- Prioritize high-interest debt: Focus on paying off cards with higher APRs first.

With the Firstcard® Secured Credit Builder Card, enjoy 0% APR on all purchases, making it easier to manage and pay off your balance.

Dealing With Late Payments

Late payments can hurt your credit score. Here’s how to handle them:

- Contact your issuer: Explain your situation and request a waiver.

- Make a payment ASAP: Reduce the impact on your credit score.

- Set reminders: Use calendar alerts to remember due dates.

Firstcard offers no late fees, making it a great option for building credit without the stress of extra charges.

Managing credit card debt doesn’t have to be daunting. With tools like the Firstcard® Secured Credit Builder Card, you can build credit and enjoy rewards without the risk of overspending.

Building And Maintaining Good Credit

Building and maintaining good credit is crucial for a healthy financial future. A good credit score opens doors to better loan rates, favorable credit card offers, and more financial opportunities. Let’s explore the importance of credit scores, how to improve them, and common mistakes to avoid.

Importance Of Credit Scores

Your credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850, with higher scores indicating better credit. Lenders use your credit score to determine the risk of lending you money.

- Loan Approval: A higher credit score increases your chances of loan approval.

- Interest Rates: Good credit scores help you secure loans with lower interest rates.

- Credit Card Offers: Better scores qualify you for credit cards with higher limits and rewards.

Maintaining a good credit score is essential for financial stability and gaining access to better financial products.

How To Improve Your Credit Score

Improving your credit score involves consistent and responsible financial behavior. Here are some effective strategies:

- Pay Bills on Time: Timely payments positively impact your credit score. Set reminders or use automatic payments.

- Keep Balances Low: Maintain a low credit utilization ratio. Try to use less than 30% of your available credit.

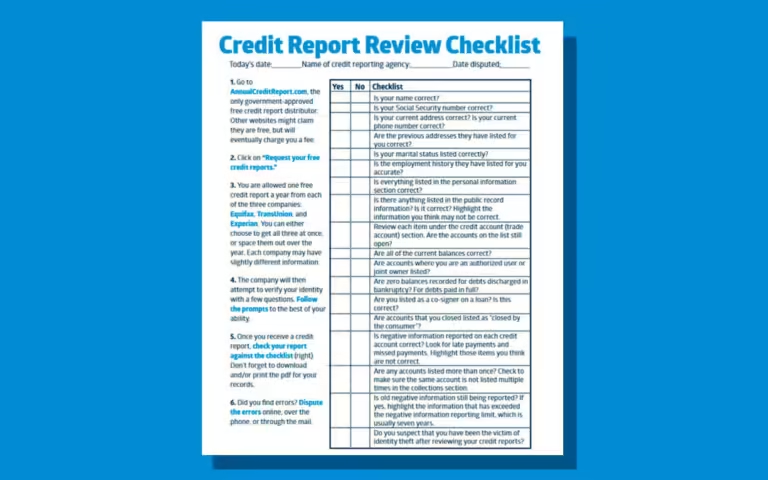

- Check Credit Reports: Regularly review your credit reports for errors and dispute inaccuracies.

- Use a Secured Card: Consider a product like Firstcard® Secured Credit Builder Card to build credit without the risk of overspending. This card reports to all three major credit bureaus.

By following these steps, you can steadily improve your credit score and enjoy the benefits of good credit.

Common Credit Card Mistakes To Avoid

Many people make mistakes with credit cards that can harm their credit scores. Here are some common pitfalls and how to avoid them:

- Late Payments: Missing payments can significantly damage your credit score. Always pay on time.

- Maxing Out Credit Cards: High credit utilization can lower your score. Keep balances low.

- Ignoring Statements: Regularly check your statements for any unauthorized charges or errors.

- Applying for Too Many Cards: Too many credit inquiries can negatively impact your score. Apply only when necessary.

Avoiding these mistakes will help you maintain a healthy credit score and enjoy the financial benefits that come with it.

Pros And Cons Of Credit Cards

Credit cards can be both beneficial and risky. Understanding the advantages and disadvantages helps in making informed financial decisions. Let’s dive into the key aspects.

Advantages Of Credit Cards

- Build Credit: Regular use and timely payments help build and improve your credit score.

- Cashback Rewards: Some cards, like Firstcard®, offer up to 15% cashback at partner merchants.

- Purchase Protection: Credit cards often include fraud protection and insurance on purchases.

- Easy Tracking: Credit card statements help in monitoring and managing expenses.

- No Fees: Certain cards have no annual, late, or overdraft fees, reducing the cost of usage.

Disadvantages Of Credit Cards

- Debt Risk: Overspending can lead to high levels of debt due to interest rates.

- Fees: Some cards have fees, like foreign transaction fees, that add to the cost.

- Impact on Credit Score: Late payments and high balances negatively impact your credit score.

- Complex Terms: Understanding terms and conditions can be complicated.

Real-world Usage Examples

Consider a student from abroad using the Firstcard® Secured Credit Builder Card. They can build their credit history without an SSN, thanks to the card’s features.

Another example: A frequent traveler benefits from the 0% APR on purchases and earns cashback, even on international transactions.

An individual looking to manage their finances can use the user-friendly app to track expenses and earn interest on their deposits.

Here’s a comparison of Firstcard® plans:

| Plan | Monthly Fee | Cashback | APY | Foreign Transaction Fee |

|---|---|---|---|---|

| Standard Plan | $4.99 | Up to 15% | 0.75% | 3% |

| Build Your Credit Plan | $8.99 | Up to 15% | 2.00% | 1.5% |

| Premium Plan | $12.99 | Up to 15% | 4.00% | 0% |

Recommendations For Ideal Users

Choosing the right credit card can be a daunting task, especially for beginners. Firstcard® Secured Credit Builder Card offers unique features and benefits tailored to different types of users. Here are our recommendations for ideal users:

Students And Young Adults

Firstcard® is perfect for students and young adults. It helps build credit without the risk of overspending. With no credit checks or hard inquiries, this card is accessible to those who are just starting their financial journey.

- No SSN required, making it ideal for international students.

- 0% APR on all purchases, avoiding interest charges.

- Up to 15% cashback at over 29,000 partner merchants.

- Credit building with reporting to all three major credit bureaus.

The Standard Plan at $4.99/month offers essential features like credit monitoring and up to 15% cashback. This affordability makes it a great choice for students.

Frequent Travelers

Frequent travelers benefit greatly from Firstcard®. The Premium Plan at $12.99/month includes:

- 4.00% APY on deposits.

- 0% foreign transaction fee, saving money on international purchases.

- 0% APR on all purchases.

- Secure transactions with Mastercard’s Zero Liability Fraud Protection.

This plan ensures secure and cost-effective spending while traveling abroad. The multilingual customer support also aids in addressing any issues in different languages.

Everyday Shoppers

Everyday shoppers will appreciate the cashback and credit-building features. The Build Your Credit Plan at $8.99/month is ideal for regular use:

- Earn up to 15% merchant cashback and up to 10% random cashback.

- 2.00% APY on deposits.

- 0% APR on all purchases.

- Easy to manage and track expenses through a user-friendly app.

Regular shoppers benefit from the cashback rewards and secure transactions, making daily purchases more rewarding.

For more information and to apply for the Firstcard® Secured Credit Builder Card, visit Firstcard’s official website.

Frequently Asked Questions

What Is A Credit Card?

A credit card is a financial tool. It allows you to borrow money for purchases. You repay the borrowed amount later.

How Do Credit Cards Work?

Credit cards let you buy now and pay later. You get a credit limit to spend. You must repay the amount borrowed.

What Are The Benefits Of Credit Cards?

Credit cards offer convenience and rewards. They help build your credit score. Some provide travel and purchase protection.

How Can I Apply For A Credit Card?

You can apply online or at a bank. Compare different cards before applying. Ensure you meet the eligibility criteria.

Conclusion

Starting with credit cards can feel overwhelming. Remember, it’s a learning journey. Choose a card that suits your needs. Always pay bills on time. Understand the terms and benefits offered. Consider a secured card like Firstcard® Secured Credit Builder Card for building credit. This card helps international students and others without SSN. Manage spending wisely and reap rewards. With patience, you’ll build a strong credit history. Happy credit building!