Banking For Startups: Essential Tips for Financial Success

Starting a business is challenging. Banking should not add to that stress.

Whether you’re launching a startup or managing a small business, finding the right banking solution is vital. Enter Found, an all-in-one financial platform designed for freelancers, contractors, and small business owners. Found offers smart banking, bookkeeping, and tax tools that simplify your financial management. With features like real-time tax calculations, virtual cards, and automated expense tracking, this platform helps you save time and focus on growing your business. No hidden fees, easy sign-up, and seamless integration make Found an ideal choice for startups. Ready to simplify your banking? Explore more about Found here.

Introduction To Banking For Startups

Starting a business can be exciting. Effective financial management is crucial for long-term success. Understanding banking options designed for startups can streamline operations and support growth. This guide will introduce essential banking aspects for new businesses.

The Importance Of Financial Management For Startups

Financial management is vital for startups. It helps in tracking income, managing expenses, and planning for future investments. Proper financial oversight ensures startups can make informed decisions and avoid cash flow problems.

- Budgeting: Helps allocate resources efficiently.

- Expense Tracking: Prevents overspending and identifies cost-saving opportunities.

- Tax Management: Ensures compliance and maximizes deductions.

Using a comprehensive financial tool like Found can simplify these tasks. It offers features like smart online banking, real-time tax calculation, and automated expense tracking.

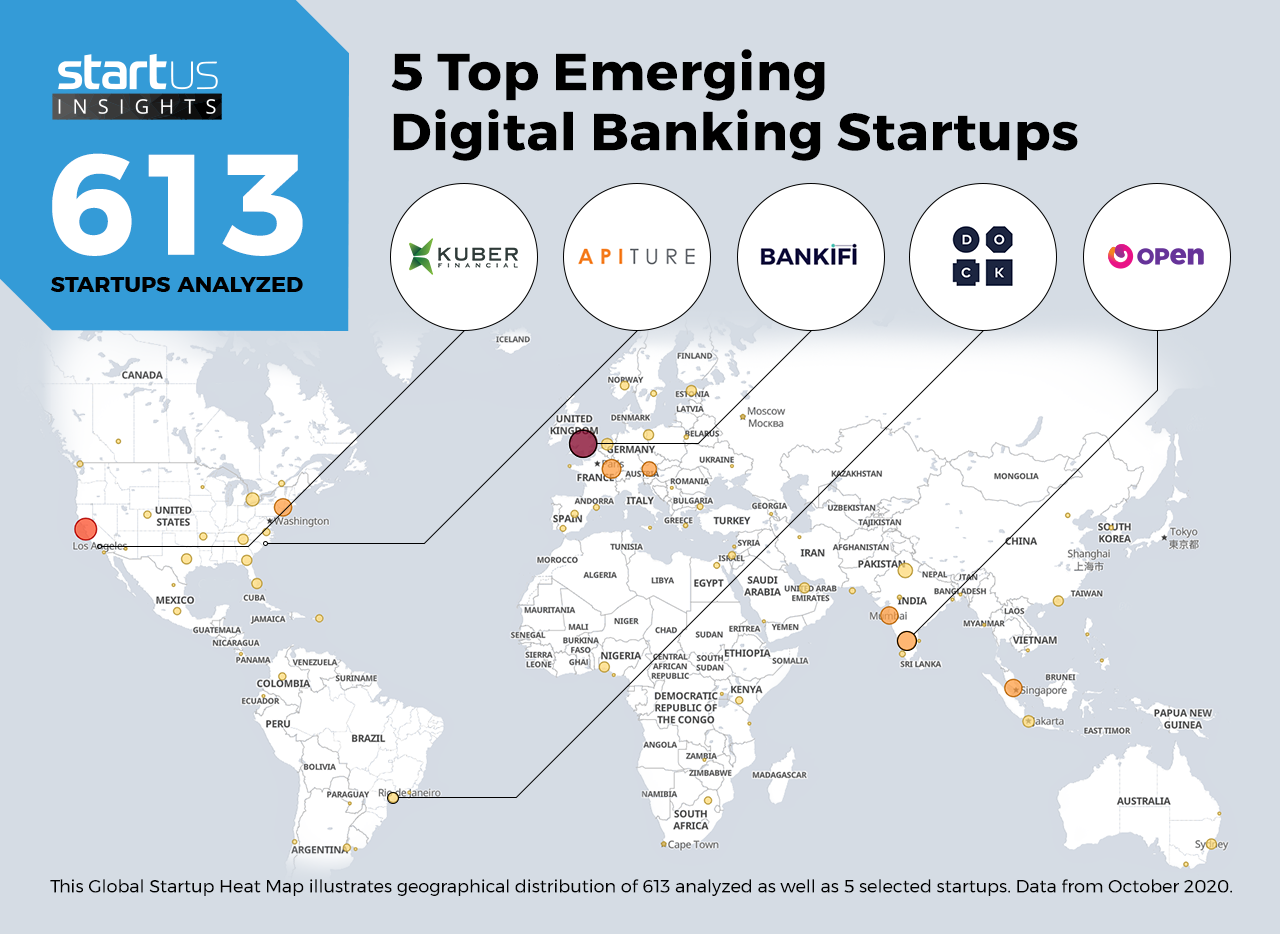

Overview Of Banking Options For Startups

Startups have various banking options to consider. Each option offers different features tailored to business needs. Here are some common banking options for startups:

| Banking Option | Features |

|---|---|

| Traditional Banks |

|

| Online Banks |

|

| Fintech Platforms |

|

Found is a prime example of a fintech platform. It combines banking, invoicing, and bookkeeping in one app. This makes it ideal for freelancers, contractors, and small business owners.

Choosing the right banking option depends on your startup’s specific needs. Evaluate each option’s features and benefits to make an informed decision.

Choosing The Right Bank For Your Startup

Starting a new business is an exciting journey filled with many decisions. One important decision is choosing the right bank for your startup. The right bank can provide the support, tools, and features needed to manage your business finances effectively.

Factors To Consider When Selecting A Bank

- Account Fees: Look for banks with no hidden fees, like Found, which offers no account maintenance fees.

- Accessibility: Ensure the bank is accessible via multiple platforms, including iOS, Android, and desktop.

- Security: Choose banks with FDIC-insured funds, data encryption, and fraud monitoring.

- Ease of Use: A user-friendly interface can save time and reduce stress.

- Additional Services: Consider banks that offer integrated financial management, invoicing, and expense tracking.

Comparing Traditional Banks Vs. Online Banks

| Traditional Banks | Online Banks |

|---|---|

| Physical branches available | Online access 24/7 |

| Face-to-face customer service | Remote customer service |

| Potential hidden fees | No hidden fees (e.g., Found) |

| Slower account opening process | Quick and easy sign-up |

| Limited integration with other tools | Integrated financial tools |

How To Open A Business Bank Account

- Choose a bank that aligns with your business needs. Consider options like Found for startups.

- Gather necessary documents. Typically, you need your EIN, business formation documents, and personal identification.

- Complete the application. For online banks like Found, this process is often quick and can be done entirely online.

- Set up your online banking. Ensure your account is ready to manage cash flow and organize money with custom pockets.

- Integrate additional services. Utilize tools like real-time tax calculation and automated expense tracking.

Key Banking Features For Startups

Starting a new business is challenging. Having the right banking features can make managing finances easier. Here are some essential banking features that startups need.

Business Checking And Savings Accounts

Business checking and savings accounts are foundational for startups. Found offers smart online banking with no hidden fees. You can manage cash flow, create virtual cards, and organize money with custom pockets.

| Feature | Description |

|---|---|

| Smart Online Banking | Manage cash flow, create virtual cards, organize money. |

| No Hidden Fees | No account maintenance fees, no minimum balance. |

| Easy Sign-Up | Quick registration without credit checks. |

Merchant Services And Payment Processing

Accepting payments is crucial for startups. Found integrates financial management, allowing you to create and send professional, trackable invoices. This makes payment processing seamless.

- Create and send invoices.

- Track payments easily.

- Integrated financial management.

Online And Mobile Banking Tools

Online and mobile banking tools provide startups with flexibility. Found offers accessible banking on iOS, Android, and desktop. This ensures you can manage your finances from anywhere.

- Access on multiple devices.

- Manage finances on-the-go.

- Seamless integration with daily life.

Business Loans And Credit Lines

Funding is essential for growth. While Found does not specifically mention business loans, their platform’s comprehensive financial tools can help you manage finances better, making it easier to qualify for loans elsewhere.

- Comprehensive financial tools.

- Expense tracking and bookkeeping.

- Automated tax calculations.

In summary, Found provides a robust financial solution tailored for startups. Their tools and features support efficient financial management, enabling you to focus on growing your business.

Managing Cash Flow Effectively

Effective cash flow management is crucial for startups. It ensures that your business remains solvent and can meet its financial obligations. By managing cash flow effectively, you can avoid the pitfalls that many startups face and keep your operations running smoothly.

Creating A Cash Flow Forecast

Creating a cash flow forecast helps you plan for the future. It allows you to predict your cash inflows and outflows. This helps in making informed decisions.

| Month | Expected Inflows | Expected Outflows | Net Cash Flow |

|---|---|---|---|

| January | $10,000 | $8,000 | $2,000 |

| February | $12,000 | $9,000 | $3,000 |

Use the Found platform to organize your money with custom pockets. This makes forecasting easier and more precise.

Strategies For Improving Cash Flow

There are several strategies you can use to improve cash flow. Here are some effective methods:

- Negotiate better terms with suppliers to extend payment periods.

- Offer discounts for early payments to customers.

- Reduce unnecessary expenses and streamline operations.

The Found platform can help you manage expenses with automated, paper-free bookkeeping. This saves time and reduces errors.

The Role Of Invoicing And Receivables Management

Invoicing and receivables management play a vital role in cash flow. Prompt and accurate invoicing ensures timely payments. Use the Found app to create and send professional, trackable invoices.

- Create detailed invoices with clear payment terms.

- Follow up on unpaid invoices promptly.

- Consider using an invoicing tool like Found for efficiency.

With Found, you can track expenses, manage invoices, and organize your finances in one place. This integrated approach simplifies cash flow management for startups.

Visit Found for more information on how this platform can support your startup.

Budgeting And Financial Planning

Effective budgeting and financial planning are critical for startups. Without these, it’s easy to lose track of expenses and miss out on growth opportunities. Found offers tools to help startups manage their finances efficiently.

Setting Up A Realistic Budget

A realistic budget sets the foundation for your startup’s financial health. Found’s smart online banking allows you to manage cash flow and organize money into custom pockets. This helps in setting clear financial goals and planning for expenses.

To create a budget, list all potential expenses. Consider costs like:

- Office space

- Employee salaries

- Marketing

- Product development

Compare these with your projected revenue to ensure you stay within your means. Found’s easy sign-up process and no hidden fees make it simple to get started.

Tracking Expenses And Adjusting Budget

Tracking expenses is crucial. Found’s automated expense tracking and paper-free bookkeeping make this easier. Regularly review your expenses to identify areas where you can cut costs or need to invest more.

Use Found’s real-time tax calculation and auto-categorization for write-offs to simplify this process. Adjust your budget as necessary to stay aligned with your financial goals.

Importance Of Financial Projections

Financial projections help you anticipate future revenue and expenses. They are essential for securing investors and planning for growth. Found’s integrated financial management tools can assist in creating accurate projections.

By using these tools, you can create professional, trackable invoices and manage all finances within one app. This eliminates the need to switch between different platforms and ensures your financial projections are based on real data.

Having a clear understanding of your financial future allows you to make informed decisions and keep your startup on the path to success.

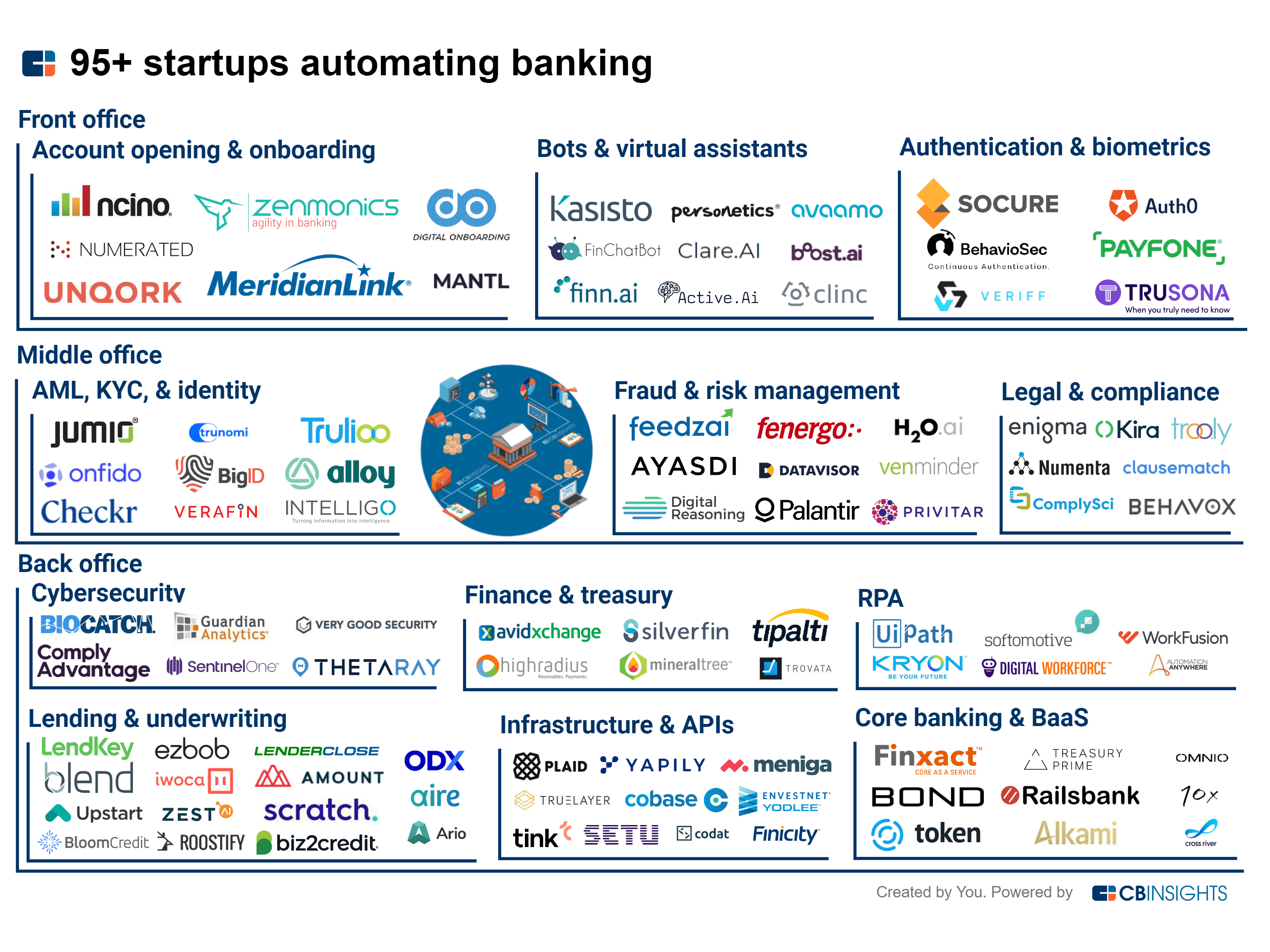

Financial Tools And Software For Startups

Starting a business is an exciting journey, but managing finances can be daunting. Using the right financial tools and software can simplify this process. These tools help startups manage their banking, bookkeeping, and taxes efficiently, ensuring smooth operations and compliance.

Popular Financial Software Options

Several software options are popular among startups for their ease of use and comprehensive features. Here are a few:

- Found: An all-in-one financial technology platform. It offers smart banking, bookkeeping, and tax tools for freelancers, contractors, and small business owners. Learn more.

- QuickBooks: Known for its robust accounting features. It helps with invoicing, expense tracking, and financial reporting.

- Xero: A favorite among startups for its user-friendly interface. It includes tools for managing invoices, bank reconciliation, and financial reporting.

- FreshBooks: Ideal for small businesses. It offers invoicing, expense tracking, and time tracking features.

Benefits Of Using Financial Management Tools

Using financial management tools offers several benefits for startups:

- Time-Saving Automation: Tools like Found automate bookkeeping and tax calculations, saving valuable time.

- Improved Accuracy: Automated systems reduce errors in financial records.

- Integrated Financial Management: Platforms like Found allow management of all finances within one app, eliminating the need to switch between different tools.

- Enhanced Security: Financial tools offer robust security features like data encryption and fraud monitoring.

- Cost Efficiency: Many tools offer free plans or cost-effective subscriptions, making them affordable for startups.

How To Integrate Software With Your Bank

Integrating financial software with your bank can streamline your financial management:

- Select a financial tool that supports bank integration. Platforms like Found offer seamless banking integration.

- Log in to your financial software account and navigate to the bank integration section.

- Enter your bank account details. Ensure you have secure access to your banking credentials.

- Follow the prompts to authorize the connection between your bank and the software.

- Once connected, you can manage your finances directly from the software, viewing transactions, managing expenses, and more.

Using tools like Found simplifies this process with easy sign-up and no hidden fees, making it an excellent choice for startups.

Understanding And Managing Business Credit

For startups, understanding and managing business credit is crucial. Good credit can lead to better loan terms, lower interest rates, and more opportunities. This section will guide you on how to build and maintain your business credit effectively.

Building Business Credit From Scratch

Starting from zero can be daunting, but it’s achievable. Follow these steps:

- Register Your Business: Ensure your business is legally recognized.

- Obtain an EIN: An Employer Identification Number is like a social security number for your business.

- Open a Business Bank Account: Use a smart online banking solution like Found to manage cash flow efficiently.

- Apply for a Business Credit Card: Start with a card that reports to credit bureaus.

- Establish Trade Lines: Work with suppliers that report payments to credit agencies.

Tips For Maintaining A Good Credit Score

Maintaining a good credit score requires discipline and strategic planning. Here are some tips:

- Pay Bills on Time: Late payments can hurt your score.

- Monitor Your Credit: Regularly check your credit report for errors.

- Keep Balances Low: High balances can negatively impact your credit utilization ratio.

- Limit Credit Applications: Too many inquiries can lower your score.

- Use Smart Banking Tools: Platforms like Found offer features such as expense tracking and real-time tax calculations to help you stay on top of your finances.

How Business Credit Impacts Your Startup

Business credit impacts various aspects of your startup:

| Aspect | Impact |

|---|---|

| Loan Approval | Good credit increases your chances of loan approval. |

| Interest Rates | Better credit scores lead to lower interest rates. |

| Vendor Relationships | Strong credit can lead to favorable terms with suppliers. |

| Insurance Premiums | Good credit can result in lower insurance premiums. |

Using a comprehensive platform like Found can simplify managing your business credit. With features like automated bookkeeping and tax tools, it helps you maintain good financial health. Found ensures you make timely payments and keep your credit score intact.

Tax Planning And Compliance

Effective tax planning and compliance are crucial for startups. Managing taxes efficiently can save money and avoid legal issues. Let’s dive into the key aspects of tax planning and compliance for startups.

Understanding Business Taxes

Business taxes can be complex. Startups must understand the different types of taxes they need to pay. These include income tax, sales tax, payroll tax, and self-employment tax. Each type has specific rules and rates.

Income tax is based on the profits your business makes. Sales tax is collected from customers on goods and services sold. Payroll tax applies if you have employees, and self-employment tax is for business owners.

| Tax Type | Description |

|---|---|

| Income Tax | Tax on business profits |

| Sales Tax | Tax on goods and services sold |

| Payroll Tax | Tax on employee wages |

| Self-Employment Tax | Tax for business owners |

Tips For Effective Tax Planning

Effective tax planning can optimize your financial operations. Here are some tips to help you manage your taxes better:

- Keep accurate records: Record all income and expenses. This helps in accurate tax calculations.

- Understand deductions: Know what expenses you can deduct. This reduces taxable income.

- Plan for quarterly taxes: Pay estimated taxes quarterly to avoid penalties.

- Use tax software: Consider using software like Found for real-time tax calculations and auto-categorization of write-offs.

How To Stay Compliant With Tax Regulations

Staying compliant with tax regulations is vital. Non-compliance can lead to penalties and interest charges. Here are some ways to ensure compliance:

- Register your business: Ensure your business is registered with the appropriate tax authorities.

- File on time: Submit your tax returns before the deadline. Late filing can result in penalties.

- Stay updated: Keep up with tax law changes. This ensures you follow the latest rules.

- Use professional help: Hire a tax professional if needed. They can guide you through complex tax issues.

Using a platform like Found can simplify these tasks. Found offers automated bookkeeping, real-time tax calculations, and easy tax payments, ensuring that you stay compliant without much effort.

Securing Funding For Your Startup

Securing funding is a crucial step for any startup. With the right approach, it can fuel growth and help achieve your business goals. This section will guide you through various funding options, how to prepare for investor meetings, and provide tips for successfully securing funding.

Overview Of Funding Options

Startups have several funding options available, each with its pros and cons. Here are some common choices:

- Bootstrapping: Using your own savings to fund the business. This gives you full control but may limit growth.

- Friends and Family: Borrowing money from people you know. This can be easier to secure but may strain personal relationships.

- Angel Investors: Wealthy individuals who invest in startups. They often provide mentorship along with funding.

- Venture Capital: Investment firms that provide capital for equity. They usually seek high growth potential.

- Crowdfunding: Raising small amounts of money from many people, typically via platforms like Kickstarter or Indiegogo.

- Bank Loans: Traditional loans from banks. They require a solid business plan and repayment with interest.

How To Prepare For Investor Meetings

Preparation is key to impressing potential investors. Here are essential steps to take:

- Research Investors: Understand their investment criteria and past investments.

- Develop a Strong Pitch: Craft a compelling story about your business and its potential.

- Create a Financial Plan: Show realistic financial projections and how funds will be used.

- Know Your Market: Provide data on market size, target audience, and competitive landscape.

- Practice Your Presentation: Rehearse your pitch to convey confidence and clarity.

Tips For Successfully Securing Funding

Follow these tips to increase your chances of securing funding:

- Build a Strong Team: Investors look for a capable and committed team.

- Show Traction: Demonstrate early success, such as user growth or revenue.

- Be Transparent: Honesty about challenges and risks builds trust.

- Follow Up: Send a thank-you note and keep investors updated.

- Use Financial Tools: Platforms like Found offer smart banking and bookkeeping tools, which can impress investors with your financial management.

By understanding funding options, preparing thoroughly, and following best practices, you can secure the funding needed to grow your startup.

Pros And Cons Of Different Banking Solutions

Choosing the right banking solution is crucial for startups. Each option has its advantages and drawbacks. This section explores traditional banking, online and mobile banking, and potential drawbacks to consider.

Advantages Of Traditional Banking

Traditional banks have a long history of providing reliable services. Here are some benefits:

- Personal Relationships: Face-to-face interactions with bankers.

- Wide Range of Services: Loans, credit cards, and more.

- Security: Established security protocols and FDIC insurance.

Benefits Of Online And Mobile Banking

Online and mobile banking offer convenience and efficiency. Some key benefits include:

- 24/7 Access: Manage finances anytime, anywhere.

- Cost-Effective: Often lower fees and no minimum balances.

- Integrated Tools: Platforms like Found provide bookkeeping, invoicing, and tax tools.

Found offers a comprehensive solution for freelancers and small businesses. Features include:

| Feature | Description |

|---|---|

| Smart Online Banking | Manage cash flow, virtual cards, and custom pockets. |

| No Hidden Fees | No account maintenance fees, no minimum balance. |

| Real-Time Tax Calculation | Automatically estimates your tax bill. |

| Integrated Financial Management | Manage all finances in one app. |

Potential Drawbacks To Consider

While both traditional and online banking have their benefits, there are potential drawbacks:

- Traditional Banking: Higher fees and less flexibility.

- Online Banking: Limited physical presence and customer service.

Understanding these pros and cons helps in making an informed decision for your startup’s banking needs.

Specific Recommendations For Startups

Starting a business involves many financial challenges. It’s essential to choose the right banking partner and adopt sound financial practices. Below are specific recommendations to help startups manage their finances effectively.

Best Banks For Startup Banking

Choosing the right bank is crucial for startups. Here are some of the best banks that cater to new businesses:

| Bank Name | Key Features | Fees |

|---|---|---|

| Found |

|

Free Plan available |

| Silicon Valley Bank |

|

Varies by service |

| Chase for Business |

|

Depends on account type |

Recommended Financial Practices

Adopting sound financial practices can significantly impact the success of your startup:

- Automate Bookkeeping: Use tools like Found to automate bookkeeping tasks.

- Track Expenses: Regularly monitor and categorize your expenses.

- Tax Savings: Auto-save for taxes using real-time tax calculation tools.

- Invoicing: Send professional invoices promptly to maintain cash flow.

- No Hidden Fees: Choose banking services with transparent fee structures.

Additional Resources For Financial Success

Here are some additional resources to help your startup achieve financial success:

- Financial Management Apps: Found offers integrated financial management within one app.

- Educational Content: Access webinars and tutorials on financial management for startups.

- Professional Advice: Seek advice from financial advisors specializing in startups.

- Networking Events: Attend events to connect with other entrepreneurs and financial experts.

- Online Communities: Join forums and groups for ongoing support and advice.

By following these specific recommendations, startups can effectively manage their finances, ensuring a smooth path to growth and success.

Frequently Asked Questions

What Is Startup Banking?

Startup banking refers to financial services tailored for new businesses. It includes business accounts, loans, and financial tools. These services help startups manage finances, grow, and succeed.

Why Do Startups Need Special Banking?

Startups need special banking for tailored financial solutions. These include specialized accounts, funding options, and financial tools that support growth and stability.

How To Choose A Bank For Startups?

Choose a bank by evaluating fees, services, and support. Look for banks offering tailored startup solutions, good customer support, and networking opportunities.

What Are Common Banking Services For Startups?

Common services include business accounts, loans, credit cards, and payment processing. These services help manage cash flow, expenses, and financial growth.

Conclusion

Startups thrive with the right financial tools. Found simplifies banking, bookkeeping, and taxes. This platform is designed for freelancers and small businesses. Save time and manage finances effortlessly. Interested in exploring Found? Check it out here.