Balance Transfer Credit Cards: Save Money and Reduce Debt Fast

Balance transfer credit cards can save you money on high-interest debt. These cards offer lower interest rates for transferring balances.

This helps you pay off your debt faster and save on interest. Balance transfer credit cards are a useful financial tool. They allow you to consolidate your debt from multiple cards into one. This makes managing payments easier and reduces the interest you pay. Many cards offer a 0% introductory rate for a set period, giving you time to pay down your balance without accruing extra interest. It’s important to compare different cards and their terms to find the best one for your needs. One great option is Nemo Money, which offers secure and commission-free trades. Understanding how these cards work can help you make smarter financial decisions and get out of debt quicker.

Introduction To Balance Transfer Credit Cards

Balance transfer credit cards can be a useful tool for managing debt. They allow you to move your existing credit card balance to a new card with a lower interest rate. This can help you save money on interest payments and pay off your debt faster.

What Is A Balance Transfer Credit Card?

A balance transfer credit card is a type of credit card that allows you to transfer your existing credit card debt to a new card. The new card often has a lower interest rate or even a 0% introductory rate for a certain period. This can make it easier to pay off your debt.

Purpose And Benefits Of Balance Transfer Credit Cards

The main purpose of a balance transfer credit card is to help you manage and reduce your debt. Here are some benefits:

- Lower Interest Rates: Many balance transfer cards offer low or 0% interest rates for an introductory period.

- Save Money on Interest: With a lower interest rate, you can save money on interest payments.

- Pay Off Debt Faster: More of your payment goes towards the principal balance, helping you pay off debt faster.

- Consolidate Debt: You can combine multiple credit card balances into one payment, making it easier to manage your finances.

Balance transfer credit cards can be a great option if used wisely. Ensure you understand the terms and fees involved before making a transfer. Consider how much you can save and whether you can pay off the balance during the introductory period.

Key Features Of Balance Transfer Credit Cards

Balance transfer credit cards offer a great way to manage and reduce debt. Understanding their key features can help you make an informed decision. Here are some important aspects to consider:

Introductory 0% Apr Period

Many balance transfer credit cards come with an introductory 0% APR period. This means you won’t pay interest on the transferred balance for a set time, often 6 to 18 months. This period can help you pay down your debt faster since all your payments go directly to reducing the principal balance.

Low Or No Balance Transfer Fees

Some cards offer low or no balance transfer fees. Typically, balance transfer fees range from 3% to 5% of the transferred amount. Finding a card with no fee or a low fee can save you money upfront.

Credit Limit Considerations

Balance transfer cards have credit limits that dictate how much debt you can transfer. Ensure the card’s limit is sufficient to cover your existing debt. Keep in mind that transferring a balance close to the card’s limit can affect your credit score.

Rewards And Benefits

Besides balance transfer features, some cards also offer rewards and benefits. Look for cards that provide cashback, points, or travel rewards. These perks can add value to your card and help offset any fees or interest you might incur.

How Balance Transfer Credit Cards Help Save Money

Balance transfer credit cards can be a powerful tool for managing debt. They offer several financial benefits that can help you save money. By transferring high-interest debt to a card with a lower interest rate, you can reduce your overall debt burden. Let’s explore how balance transfer credit cards help save money through various means.

Lower Interest Rates

One of the primary ways balance transfer credit cards save money is by offering lower interest rates. Many cards provide a 0% introductory APR for a set period. This allows you to pay off your debt without accruing additional interest. After the introductory period, the interest rate may increase, but it is often still lower than the rates on other credit cards.

| Card | Introductory APR | Duration |

|---|---|---|

| Card A | 0% | 12 months |

| Card B | 0% | 18 months |

Reduction In Monthly Payments

By transferring your balance to a card with a lower interest rate, you can achieve a reduction in monthly payments. Lower interest rates mean that more of your payment goes towards reducing the principal balance. This can help you pay off your debt faster and save on interest charges.

- Lower monthly payments

- More money applied to principal

- Faster debt reduction

Avoiding Late Fees

Balance transfer credit cards can help you avoid late fees. Many cards come with features that provide reminders for due dates or even automatic payments. By staying on top of your payments, you can avoid costly late fees, which can add up over time.

- Set up payment reminders

- Enable automatic payments

- Monitor due dates regularly

Using balance transfer credit cards wisely can significantly improve your financial health. Always read the terms and conditions to understand any fees or changes that may apply after the introductory period.

How Balance Transfer Credit Cards Help Reduce Debt

Balance transfer credit cards can be a powerful tool for managing and reducing debt. They offer several benefits that can help you regain control of your finances. Here’s how they work:

Debt Consolidation

Balance transfer credit cards allow you to consolidate multiple debts into one. This can simplify your financial management and reduce the total interest you pay. Instead of dealing with several credit card bills, you only have one payment to make each month. This can make it easier to keep track of your debt and stay organized.

Simplified Payments

Having only one payment to manage makes your financial life less complicated. Simplified payments mean fewer chances of missing a due date. Missing payments can lead to late fees and higher interest rates. With a balance transfer card, you streamline your payments and reduce the risk of additional charges.

Faster Debt Repayment

Many balance transfer credit cards offer a low or 0% introductory APR. This promotional period can last from six months to a year or more. During this time, more of your payment goes towards the principal balance, helping you pay off your debt faster. Paying off your debt sooner reduces the total interest paid over time.

| Feature | Benefit |

|---|---|

| Debt Consolidation | Combines multiple debts into one payment |

| Simplified Payments | Reduces risk of missed payments and late fees |

| Faster Debt Repayment | Low or 0% APR helps pay off debt quicker |

Balance transfer credit cards can be a strategic tool in your journey to reduce debt. By consolidating debts, simplifying payments, and taking advantage of low introductory rates, you can effectively manage and reduce your overall debt burden.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of balance transfer credit cards is essential. These cards offer unique benefits but come with various fees and charges. Here’s a detailed look at the costs associated with balance transfer credit cards.

Understanding Balance Transfer Fees

Balance transfer fees are charges applied when you move debt from one credit card to another. These fees typically range from 3% to 5% of the transferred amount. For example, transferring $1,000 can cost $30 to $50.

| Transferred Amount | 3% Fee | 5% Fee |

|---|---|---|

| $1,000 | $30 | $50 |

| $2,000 | $60 | $100 |

Consider these fees when deciding to transfer a balance. They can impact the overall savings.

Annual Fees And Other Charges

Some balance transfer credit cards come with annual fees. These can range from $0 to several hundred dollars. Always check if the benefits outweigh the cost.

- No annual fee cards: Ideal for those looking to save on costs.

- Cards with annual fees: Often provide extra rewards or benefits.

Other charges to consider include late payment fees and foreign transaction fees. Late fees can be as high as $40, while foreign transaction fees typically range from 1% to 3% of each transaction.

Comparing Interest Rates

Comparing interest rates is crucial. Balance transfer credit cards often offer an introductory 0% APR for a set period. This period can range from 6 to 21 months. After the introductory period, the standard interest rate applies, which can be 15% to 25% or higher.

| Introductory Period | 0% APR Duration | Standard APR |

|---|---|---|

| Card A | 12 months | 15.99% |

| Card B | 18 months | 20.99% |

Choose a card with a longer 0% APR period if you need more time to pay off your balance. Always review the standard APR, as it will apply after the introductory period ends.

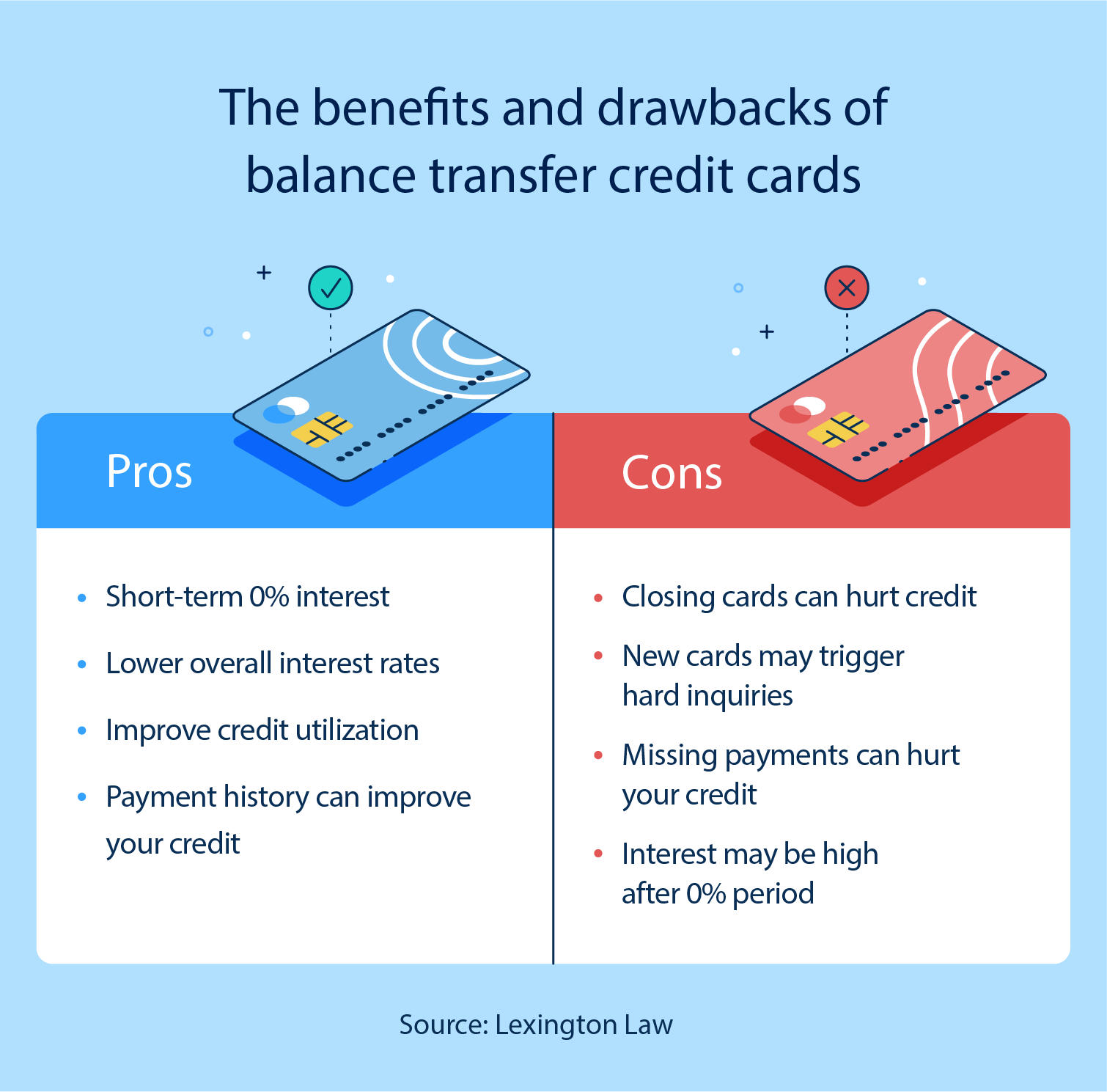

Pros And Cons Of Balance Transfer Credit Cards

Balance transfer credit cards can be a powerful financial tool. They help consolidate debt and potentially reduce interest rates. But they also come with their own set of risks. Understanding the pros and cons can help you make an informed decision.

Advantages Of Using Balance Transfer Credit Cards

- Lower Interest Rates: Many balance transfer cards offer 0% APR for an introductory period.

- Debt Consolidation: Combine multiple debts into one monthly payment.

- Improved Credit Score: Timely payments can boost your credit score.

- Interest-Free Period: Save money during the introductory period with no interest charges.

Balance transfer cards often provide lower interest rates. This can save a lot of money on high-interest debts. Consolidating debts into one payment can simplify your financial life. Timely payments can also improve your credit score. An interest-free period can offer significant savings.

Potential Drawbacks And Risks

- Balance Transfer Fees: Most cards charge a fee for transferring balances.

- High Interest Rates After Intro Period: Interest rates can spike after the introductory period.

- Credit Score Impact: Applying for new credit can temporarily lower your credit score.

- Limited Time Offer: The 0% APR is typically for a limited time.

Balance transfer fees can add to your debt. After the introductory period, interest rates may become very high. Applying for a new card can impact your credit score. The 0% APR offer is usually limited to a short timeframe.

| Advantages | Disadvantages |

|---|---|

| Lower Interest Rates | Balance Transfer Fees |

| Debt Consolidation | High Interest Rates After Intro Period |

| Improved Credit Score | Credit Score Impact |

| Interest-Free Period | Limited Time Offer |

Specific Recommendations For Ideal Users

Balance transfer credit cards can be a great financial tool. They help manage debt and save on interest. But they are not for everyone. Here are some specific recommendations to help you decide if a balance transfer credit card is right for you.

Best Scenarios For Using Balance Transfer Credit Cards

Balance transfer credit cards work best for those who have high-interest debt. If you have a good credit score, you can benefit from low or zero interest rates. This helps you pay off debt faster. Here are some scenarios where a balance transfer card could be ideal:

- High-interest credit card debt: Transfer balances from high-interest cards to save on interest.

- Consolidating multiple debts: Combine several debts into one payment for easier management.

- Temporary financial relief: Use the low-interest period to catch up on payments.

- Improving credit score: Paying down debt can help raise your credit score over time.

Who Should Avoid Balance Transfer Credit Cards

Balance transfer credit cards are not suitable for everyone. Some people may find them more of a burden than a benefit. If you fall into any of these categories, you might want to avoid balance transfer credit cards:

- Poor credit score: You may not qualify for the best rates, making the transfer less beneficial.

- High transfer fees: Fees can sometimes outweigh the interest savings.

- Ongoing spending issues: If you continue to rack up debt, a balance transfer card won’t solve your problems.

- Short introductory periods: If you cannot pay off the balance within the promotional period, you may end up with high-interest rates again.

Frequently Asked Questions

What Are Balance Transfer Credit Cards?

Balance transfer credit cards allow you to transfer existing debt to a new card. These cards often offer low or 0% introductory APR rates. This can help you save on interest payments.

How Do Balance Transfer Credit Cards Work?

You transfer debt from one or more cards to a new card. The new card often has a lower or 0% introductory APR. This can reduce interest costs.

Are Balance Transfer Credit Cards Worth It?

Yes, they can save you money on interest. They are worth it if you pay off the balance before the promotional period ends.

What Is The Best Balance Transfer Credit Card?

The best balance transfer credit card offers low or 0% APR. It should also have a long introductory period and minimal fees.

Conclusion

Balance transfer credit cards can simplify your financial life. They offer lower interest rates and help manage debt. Consider all fees and benefits before choosing one. Nemo Money can assist in achieving your financial goals. With Nemo, invest in global stocks and ETFs effortlessly. Start today and make smart financial moves. Visit Nemo Money to learn more.