Bad Credit Solutions: Proven Strategies to Rebuild Your Score

Bad credit can feel like a heavy burden. It affects loans, credit cards, and more.

But, there are solutions to improve your credit score. In this blog post, we will explore practical and effective ways to tackle bad credit. These methods can help you rebuild your financial health. From budgeting tips to smart credit usage, we’ll cover it all. One great option to consider is using platforms like Freecash. This site lets you earn money by completing tasks such as testing apps and playing games. With extra cash, you can manage debts better and slowly improve your credit score. Stay tuned to discover the best strategies for overcoming bad credit and setting yourself on the path to financial stability.

Introduction To Bad Credit Solutions

Struggling with bad credit can feel overwhelming. It impacts your financial health and limits your opportunities. But there are solutions available to rebuild your credit score. This section will help you understand the impact of bad credit and the importance of rebuilding your credit score.

Understanding The Impact Of Bad Credit

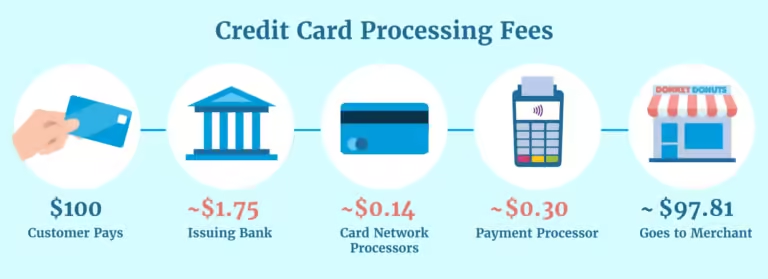

Bad credit affects your financial life in many ways. It can lead to higher interest rates on loans and credit cards. This means you pay more in the long run. You might face challenges in getting approved for new credit. Even basic services like renting an apartment or setting up utilities can become difficult.

Employers may check your credit history before hiring you. Poor credit can impact your employment prospects. Insurance companies may charge higher premiums. Bad credit can even affect your relationships. Understanding these impacts highlights the need for effective solutions.

The Importance Of Rebuilding Your Credit Score

Rebuilding your credit score is crucial. A good credit score opens up better financial opportunities. You can get lower interest rates on loans and credit cards. This saves you money. You may have an easier time securing housing and utilities. Employers may view you more favorably.

To rebuild your credit, consider using platforms like Freecash. Freecash allows you to earn money by completing tasks. You can test apps, play games, and take surveys. The earnings can help you pay off debts and manage your finances better. Consistent, responsible financial behavior will gradually improve your credit score.

| Task Type | Earnings |

|---|---|

| Testing Apps | $1.00 – $75 per app |

| Playing Games | $0.50 – $120 per game |

| Surveys | $1.00 per 5-10 minute survey |

Freecash also offers additional benefits. You can enjoy instant cashouts starting at $2.00. Daily bonuses and community support make it easier to earn. Over 151,744 users have rated Freecash 5.0, indicating its reliability.

Remember, rebuilding your credit takes time and effort. Stay consistent and use available tools to improve your financial health. Visit Freecash to start earning and managing your finances better.

Key Strategies To Improve Your Credit Score

Improving your credit score can feel like a daunting task, but it is achievable with the right strategies. Here, we will explore some key methods to help you enhance your credit score and secure a better financial future.

Review And Correct Your Credit Report

One of the first steps to improving your credit score is to review and correct your credit report. Obtain a copy of your credit report from the major credit bureaus. Look for any inaccuracies or errors. These could include incorrect personal information or wrong account details.

Dispute any errors you find with the credit bureau. This can help to remove negative information that should not be there. Correcting these mistakes can significantly boost your credit score.

Create A Budget And Stick To It

Creating a budget is essential for managing your finances effectively. List your income and expenses to understand where your money goes each month. Identify areas where you can cut costs.

Stick to your budget to avoid unnecessary spending. This will ensure you have enough funds to pay off debts and avoid late payments. A well-managed budget can prevent financial stress and improve your credit score over time.

Pay Your Bills On Time

Paying your bills on time is crucial for a healthy credit score. Late payments can have a significant negative impact on your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

Consistently paying your bills on time shows lenders that you are responsible with your finances. Over time, this practice will help to build a positive credit history and improve your credit score.

Unique Tools And Resources To Help Rebuild Your Credit

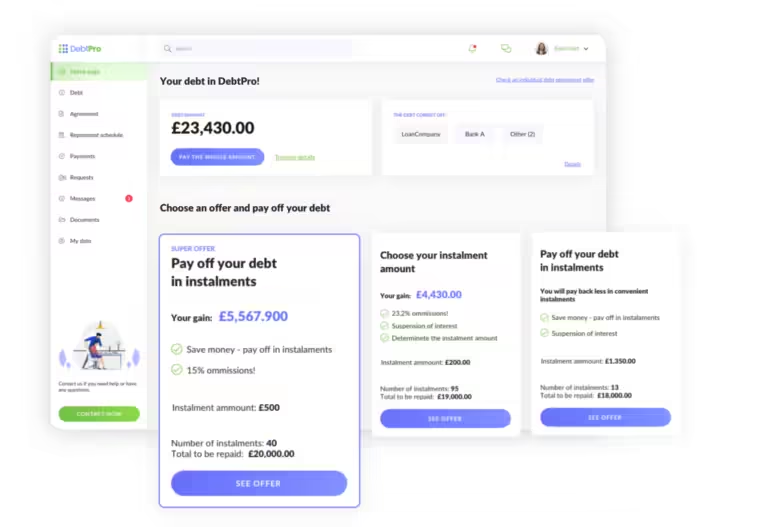

Rebuilding your credit can be a daunting task, but with the right tools and resources, it becomes manageable. There are several unique solutions available that can help you improve your credit score effectively. Here, we will explore various options, such as credit monitoring services, secured credit cards, and credit builder loans.

Credit Monitoring Services

Credit monitoring services provide a convenient way to keep track of your credit score and report. These services alert you to any significant changes or suspicious activities. This can help you catch errors or potential identity theft early.

- Alerts: Receive notifications for any changes in your credit report.

- Reports: Access detailed credit reports regularly.

- Score Tracking: Monitor your credit score over time.

Using a credit monitoring service can give you peace of mind and help you stay proactive in managing your credit.

Secured Credit Cards

Secured credit cards are a great tool for rebuilding credit. They require a deposit that serves as your credit limit. This reduces the risk for the lender and can help you establish a positive credit history.

| Feature | Benefit |

|---|---|

| Deposit Required | Acts as your credit limit |

| Regular Reporting | Reports to major credit bureaus |

| Credit Building | Helps improve credit score with responsible use |

By using a secured credit card responsibly, you can demonstrate good credit habits and gradually rebuild your credit score.

Credit Builder Loans

Credit builder loans are specifically designed to help improve your credit score. These loans work differently than traditional loans. Instead of receiving the loan amount upfront, the money is held in a secured account until you pay off the loan.

- Apply for the Loan: Choose a credit builder loan from a financial institution.

- Make Monthly Payments: Pay off the loan in monthly installments.

- Receive Funds: Once the loan is paid off, you get access to the funds.

This method helps you build credit by showing a history of on-time payments, which is reported to the credit bureaus.

These tools and resources are essential in your journey to rebuild your credit. Each option offers unique benefits and can be tailored to fit your individual needs.

The Role Of Professional Credit Counseling

Bad credit can be a significant obstacle in achieving financial stability. Professional credit counseling offers a structured way to manage and improve your credit score. With the right guidance, you can work towards better financial health and open up new opportunities for loans, credit cards, and more.

How Credit Counseling Works

Credit counseling typically involves a series of steps designed to help individuals understand their financial situation and create a plan to improve it. Here’s a basic rundown:

- Assessment: A credit counselor reviews your credit report and financial situation.

- Budgeting: Together, you create a realistic budget that addresses your income and expenses.

- Debt Management Plan (DMP): If necessary, a DMP is created to consolidate and manage your debts.

- Education: Counselors provide resources and education on managing credit and finances.

Choosing The Right Credit Counseling Service

Not all credit counseling services are created equal. Here are some tips to choose the right one:

- Accreditation: Ensure the service is accredited by reputable organizations like the National Foundation for Credit Counseling (NFCC).

- Fees: Look for transparent fee structures. Non-profit services often offer lower costs.

- Reputation: Check reviews and testimonials from other clients.

- Services Offered: Make sure they offer the specific services you need, such as debt management plans or credit education.

Benefits Of Credit Counseling

Professional credit counseling offers several benefits:

- Personalized Advice: Get tailored advice based on your specific financial situation.

- Debt Management: Consolidate and manage your debts more effectively.

- Improved Credit Score: Work towards improving your credit score with professional guidance.

- Financial Education: Gain valuable knowledge on managing your finances and credit.

- Stress Reduction: Alleviate the stress of managing multiple debts and financial issues.

Pros And Cons Of Various Bad Credit Solutions

Managing bad credit can be challenging. However, various solutions exist to help improve your credit score. Each solution has its own set of advantages and disadvantages. Understanding these can help you make informed decisions.

Credit Monitoring Services

Credit monitoring services are designed to track your credit report and alert you to any changes. These services can be beneficial in detecting fraud and monitoring your credit score.

- Pros:

- Early detection of fraudulent activities.

- Regular updates on credit score changes.

- Access to credit reports from multiple bureaus.

- Cons:

- Monthly subscription fees can be costly.

- Not all services offer comprehensive protection.

Secured Credit Cards

Secured credit cards require a cash deposit as collateral. They are a good way to rebuild credit since they report your activity to credit bureaus.

- Pros:

- Helps build or rebuild credit.

- Lower risk of overspending.

- Reports to all major credit bureaus.

- Cons:

- Requires an upfront deposit.

- High-interest rates and fees may apply.

Credit Builder Loans

Credit builder loans are designed to help improve your credit score. You make payments into a savings account, and the lender reports these payments to credit bureaus.

- Pros:

- Builds credit history with regular payments.

- Savings component can be a financial benefit.

- Reports to major credit bureaus.

- Cons:

- Interest rates can be high.

- Funds are not accessible until the loan is paid off.

Professional Credit Counseling

Professional credit counseling offers personalized advice to manage debt and improve credit scores. Credit counselors can help create a budget and negotiate with creditors.

- Pros:

- Personalized financial advice.

- Assistance with budgeting and debt management.

- Negotiation with creditors for better terms.

- Cons:

- Service fees can add up.

- May impact credit score if not managed properly.

Specific Recommendations For Different Scenarios

Finding solutions for bad credit can vary based on individual circumstances. Here are some specific recommendations tailored to different scenarios. Whether you have minimal credit history, are recovering from bankruptcy, or have consistent late payments, these suggestions can help you improve your credit score effectively.

For Individuals With Minimal Credit History

Building credit from scratch can be challenging. Here are some practical steps:

- Secured Credit Cards: These cards require a security deposit, which acts as your credit limit. They are ideal for building credit.

- Credit Builder Loans: These loans are designed to help you build credit. You borrow a small amount and repay it over time, demonstrating responsible credit use.

- Authorized User: Become an authorized user on a family member’s credit card. Their positive payment history can benefit your credit score.

- Freecash Tasks: Using platforms like Freecash to earn extra income can help you manage and pay off any new credit accounts you open.

For Those Recovering From Bankruptcy

Recovering from bankruptcy requires careful planning and disciplined financial management:

- Secured Credit Cards: Post-bankruptcy, secured cards are a great starting point. They help rebuild credit with responsible use.

- Credit Counseling: Seek advice from a credit counselor. They can provide a personalized plan to rebuild your credit.

- Freecash Earnings: Earn money through tasks on Freecash. Use the extra income to pay bills on time and reduce debt.

- Monitor Credit Reports: Regularly check your credit reports. Ensure all bankruptcy-related debts are accurately reported as discharged.

For Individuals With Consistent Late Payments

Consistent late payments can severely impact your credit score. Here are some strategies to address this:

- Automatic Payments: Set up automatic payments for your bills. This ensures timely payments and helps avoid late fees.

- Budgeting: Create a budget to manage your expenses. Allocate funds for debt repayment and avoid unnecessary spending.

- Freecash Income: Use earnings from Freecash to cover monthly bills. This extra income can be crucial for staying current on payments.

- Negotiate with Creditors: Contact your creditors to negotiate new payment terms. They may offer lower interest rates or extended payment plans.

Conclusion And Next Steps

Rebuilding your credit can be a challenging journey, but with the right tools and dedication, it is achievable. Below, we provide some actionable steps to guide you through this process.

Setting Realistic Expectations

It is crucial to set realistic expectations when working on improving your credit score. Understand that this process takes time and effort. Avoid expecting overnight results.

Here are some tips to help you set realistic expectations:

- Track your progress monthly.

- Focus on small, incremental improvements.

- Acknowledge and celebrate minor achievements.

Staying Committed To Your Credit Rebuilding Plan

Consistency is key in rebuilding your credit. Staying committed to your plan ensures steady progress. Here’s how you can stay on track:

- Create a detailed budget and stick to it.

- Pay your bills on time, every time.

- Regularly check your credit report for errors.

- Use tools like Freecash to earn extra income and pay down debts.

By completing tasks like testing apps, playing games, and taking surveys, you can earn money to support your credit rebuilding efforts. With high payouts and instant cashouts, Freecash provides a reliable way to boost your income.

Joining a community like Freecash can also offer support and motivation. With over 151,744 positive reviews and a 5.0 rating, it’s a trusted platform for many users.

Remember to leverage all available resources, stay focused, and be patient with yourself. In time, your credit score will reflect your hard work and dedication.

Frequently Asked Questions

What Is Bad Credit?

Bad credit refers to a low credit score due to past financial mistakes. It makes getting loans or credit cards difficult.

How Can I Fix Bad Credit?

Fixing bad credit involves paying bills on time, reducing debt, and checking your credit report for errors.

Are There Loans For Bad Credit?

Yes, some lenders offer loans specifically for people with bad credit. Interest rates may be higher.

Can Bad Credit Affect Job Prospects?

Yes, some employers check credit reports as part of the hiring process. Bad credit can influence their decision.

Conclusion

Finding solutions for bad credit is essential. Small steps can bring big results. Start with understanding your credit report. Work on improving your financial habits. Consider reputable platforms like Freecash. You can earn by completing simple tasks. It’s free to join and offers instant cashouts. This platform is highly rated by users. For more details, visit Freecash. Take control of your credit today. Start your journey towards better financial health. Simple actions can lead to significant improvements.