Apply Online For Credit Card: Fast, Easy Approval Today!

Applying for a credit card online is fast and convenient. You can do it from home and avoid long lines.

In today’s digital age, online applications have become the norm. Applying for a credit card online offers several advantages, including quick approval times and easy comparison of different cards. You can find a card that fits your financial needs and lifestyle. One such option is the Rewards Checking Plus from Upgrade. This card has no monthly fees and offers up to 2% cash back on purchases. Whether you need a card for everyday expenses or to build credit, applying online can be your best choice. Let’s explore why online applications are a smart move for your financial health.

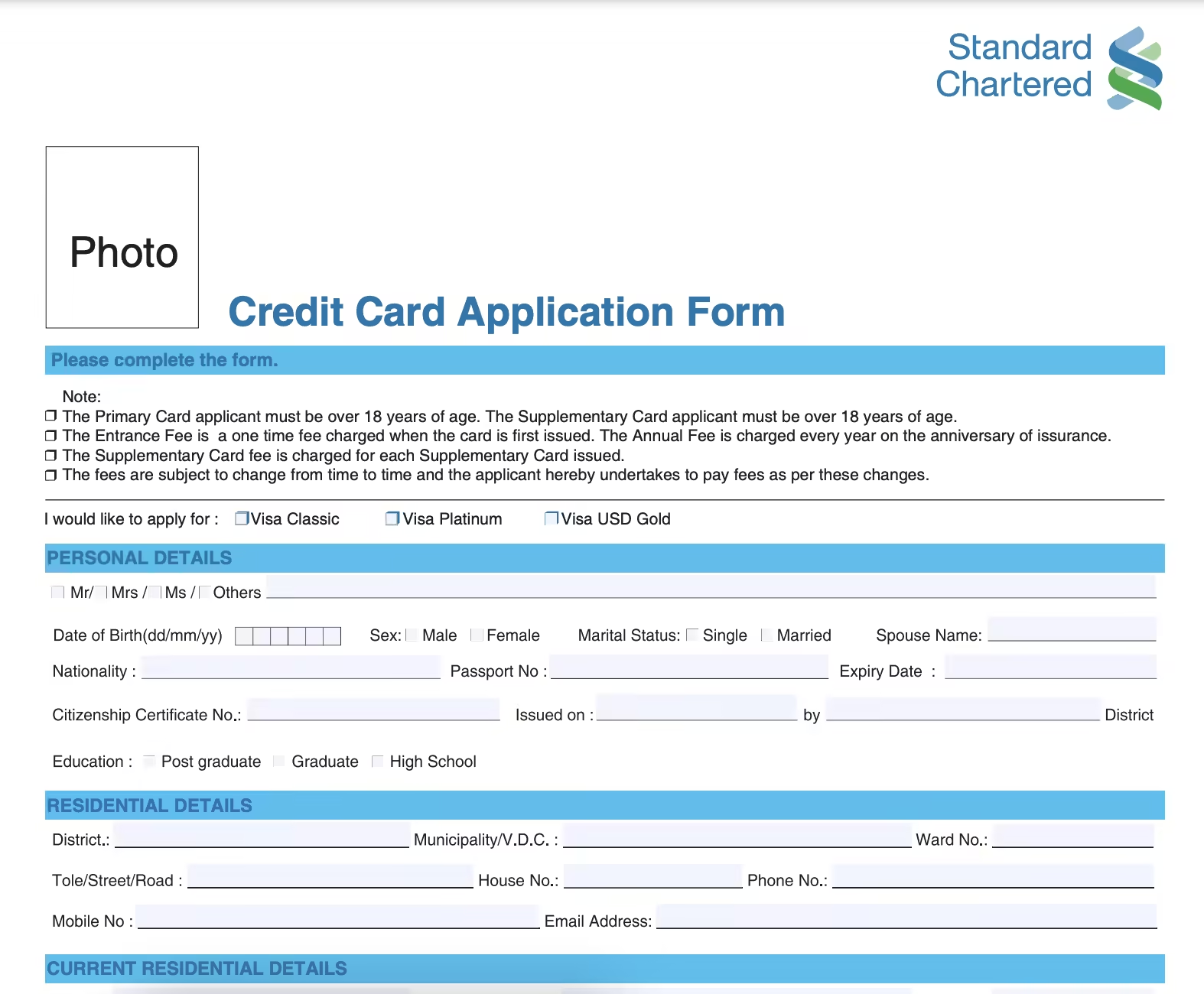

Credit: www.123formbuilder.com

Introduction To Applying Online For A Credit Card

Applying for a credit card online has never been easier. With the digital age, the process is convenient, fast, and secure. Whether you’re looking for rewards, low interest rates, or a specific feature, online applications offer a streamlined way to find the best card for your needs.

Overview Of Online Credit Card Applications

Online credit card applications allow you to apply from the comfort of your home. Many banks and financial institutions, such as Upgrade, provide detailed information about their credit card products on their websites. This includes key features, benefits, and eligibility criteria.

The process usually involves filling out an online form with your personal and financial information. Some sites offer instant approval, while others may take a few days to process your application. It’s important to have your documents ready to ensure a smooth application process.

Benefits Of Applying Online

There are several benefits to applying for a credit card online:

- Convenience: Apply at any time from anywhere with an internet connection.

- Speed: Online applications are often processed faster than paper applications.

- Comparison: Easily compare different credit card options side by side.

- Security: Reputable sites use encryption to protect your personal information.

- Transparency: Access detailed information about fees, rates, and rewards before applying.

For instance, the Rewards Checking Plus from Upgrade offers no monthly fees and up to 2% cash back on purchases. You can earn up to 4.14% APY when paired with Performance Savings. This makes it an attractive option for many users.

Additionally, applying online allows you to take advantage of special offers and promotions that may not be available offline. This can include lower interest rates, higher rewards, or waived fees for a certain period.

| Feature | Description |

|---|---|

| No monthly fees | Enjoy banking without the worry of monthly charges. |

| Cash Back | Earn up to 2% cash back on everyday purchases. |

| High APY | Earn up to 4.14% APY with Performance Savings. |

| Early Direct Deposit | Receive your paycheck up to two days early. |

By leveraging the benefits of online credit card applications, you can make an informed decision and find a card that aligns with your financial goals.

Key Features Of Online Credit Card Applications

Applying for a credit card online is now easier than ever. Understanding the key features of online credit card applications can help you make informed decisions. Below are some crucial aspects to consider:

Instant Approval And Processing

One of the most significant advantages is instant approval. Many online credit card applications offer quick decision-making, often within minutes. This means you can know right away if you are eligible for the card. Once approved, the processing starts immediately, allowing you to use your card faster.

User-friendly Application Process

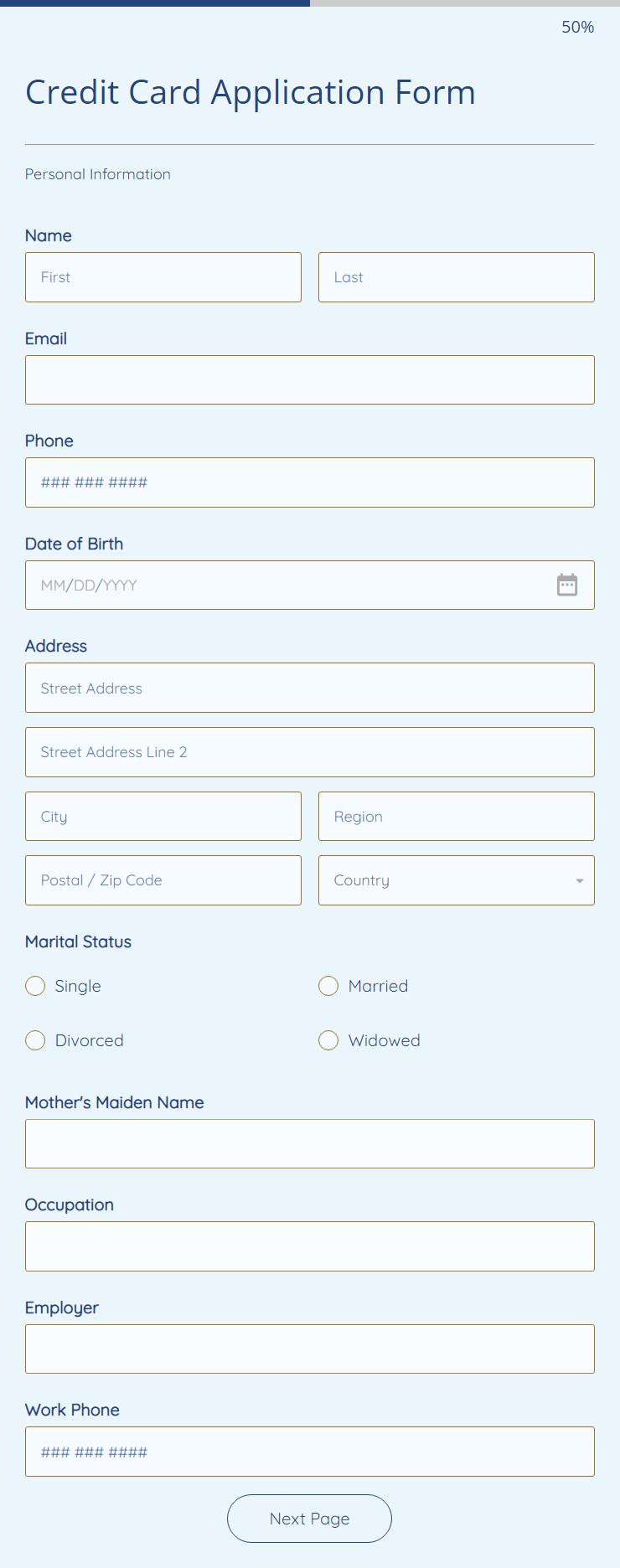

Online credit card applications are designed to be user-friendly. The forms are simple and straightforward. Many platforms guide you through each step, ensuring you provide all necessary information. This minimizes errors and speeds up the approval process. You can complete the application from the comfort of your home at any time.

Secure And Private Transactions

Security is a top priority in online credit card applications. Websites use encryption technology to protect your personal information. Your data is kept private and secure from unauthorized access. Ensuring your information is safe gives you peace of mind when applying online.

| Feature | Details |

|---|---|

| Instant Approval | Quick decision-making, know your eligibility in minutes. |

| Processing Time | Immediate start of card processing after approval. |

| User-Friendly | Simple, guided application process with minimal errors. |

| Security | Encryption technology ensures data protection and privacy. |

How To Apply For A Credit Card Online

Applying for a credit card online can be quick and convenient. You can complete the entire process from the comfort of your home. Here’s a step-by-step guide to help you through the application process for the Upgrade credit card.

Step-by-step Guide To The Application Process

- Visit the Official Website: Go to the Upgrade website.

- Select the Credit Card: Choose the Rewards Checking Plus card.

- Click on Apply Now: Look for the ‘Apply Now’ button and click it.

- Fill in Personal Details: Enter your name, address, and contact information.

- Provide Financial Information: Include details about your income and employment.

- Review and Submit: Check all the information for accuracy and submit the application.

Required Documents And Information

- Identification: A government-issued ID, such as a driver’s license or passport.

- Proof of Address: Utility bills or bank statements.

- Income Verification: Recent pay stubs or tax returns.

- Social Security Number: For identity verification and credit check.

Tips For A Successful Application

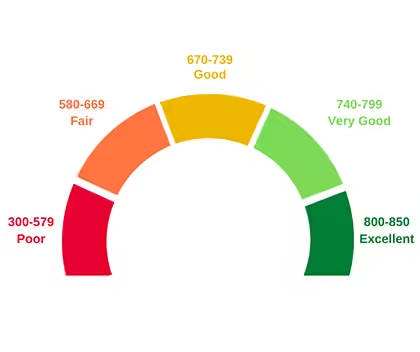

- Check Your Credit Score: Make sure your credit score is in good shape.

- Have All Documents Ready: Gather all required documents before starting the application.

- Provide Accurate Information: Ensure all details are correct to avoid delays.

- Review Terms and Conditions: Understand the card’s features, fees, and benefits.

Applying for the Upgrade Rewards Checking Plus card is straightforward. Follow these steps, and you’ll be ready to enjoy the benefits of cash back rewards and no monthly fees.

Comparing Different Credit Card Offers

Choosing the right credit card can be overwhelming with so many options available. Comparing different offers helps you find the best fit for your needs. Here, we break down the key factors to consider.

Understanding Various Credit Card Types

Credit cards come in different types, each with unique features. Here are the main types:

- Rewards Credit Cards: Earn points, miles, or cash back on purchases.

- Balance Transfer Cards: Offer low or 0% interest on transferred balances for a period.

- Secured Credit Cards: Require a deposit and are ideal for building credit.

- Student Credit Cards: Designed for college students with limited credit history.

Evaluating Interest Rates And Fees

Interest rates and fees can significantly impact your credit card experience. Consider these:

| Type | Details |

|---|---|

| APR (Annual Percentage Rate) | Range from 9.99% to 35.99%, depending on your credit score. |

| Annual Fees | Some cards have no annual fees, while others can charge up to $500. |

| Transaction Fees | Include balance transfer fees, cash advance fees, and foreign transaction fees. |

Assessing Rewards And Benefits

The rewards and benefits of a credit card can add significant value. Consider these factors:

- Cash Back: Earn up to 2% cash back on everyday expenses.

- Introductory Offers: Look for sign-up bonuses and 0% APR introductory periods.

- Additional Benefits: Some cards offer perks like travel insurance, purchase protection, and extended warranties.

For example, the Upgrade Rewards Checking Plus offers:

- No monthly fees

- Up to 2% cash back on purchases

- Early direct deposit, up to two days early

- No prepayment penalties on loans

When comparing credit card offers, focus on the features that align with your financial goals and spending habits. This ensures you maximize the benefits while minimizing costs.

Pricing And Affordability

When applying online for a credit card, understanding the pricing and affordability is crucial. The Upgrade credit card offers various features and benefits that come with specific costs. Below, we break down the annual fees, cost-saving features, and how to balance these benefits with the costs.

Breakdown Of Annual Fees And Charges

| Type of Fee | Details |

|---|---|

| Annual Fees | No annual fees |

| Monthly Fees | No monthly fees |

| Cash Back Limit | Limited to $500 in rewards per calendar year |

| Personal Loans APR | 9.99%-35.99% with an origination fee of 1.85%-9.99% |

| Flex Pay APR | 0%-36% |

Cost-saving Features And Perks

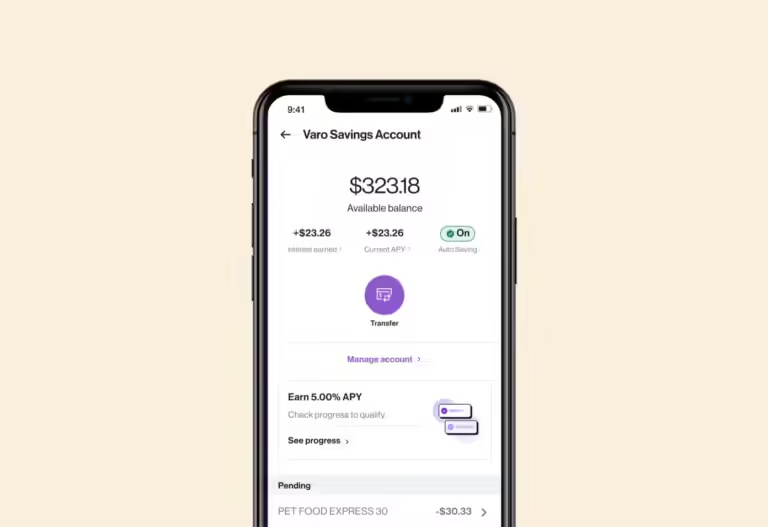

- No Monthly Fees: Enjoy a checking account without any monthly maintenance fees.

- Cash Back Rewards: Earn up to 2% cash back on common everyday expenses, subject to conditions.

- Performance Savings: Earn up to 4.14% APY when paired with Performance Savings.

- Early Direct Deposit: Get your direct deposit up to two days early.

- No Prepayment Penalties: Pay off personal loans anytime without extra charges.

Balancing Benefits With Costs

While the Upgrade credit card offers many benefits, it’s essential to balance these with the associated costs. Consider the following:

- Understand the Cash Back Limits: The cash back is limited to $500 per year. Calculate your spending to maximize this benefit.

- Evaluate Loan APRs: Personal loans have APRs from 9.99% to 35.99%. Ensure the loan terms fit your financial situation.

- Flex Pay Options: Flex Pay has APRs ranging from 0% to 36%. Use this feature wisely to manage payments.

By carefully considering these fees and benefits, you can make an informed decision about applying online for the Upgrade credit card.

Credit: www.chime.com

Pros And Cons Of Applying For A Credit Card Online

Applying for a credit card online has become very popular. It offers both convenience and potential drawbacks. Understanding these can help you make an informed decision.

Advantages Of Online Applications

- Convenience: Apply from the comfort of your home at any time.

- Speed: The process is usually faster compared to in-person applications.

- Comparison Shopping: Easily compare different credit card offers online.

- Instant Approval: Some credit cards offer instant approval, saving time.

- Access to Online Resources: Utilize online tools and calculators for better decisions.

Potential Drawbacks And Considerations

- Security Risks: Online applications may pose a risk of data breaches.

- Complex Terms: Some credit card offers have complex terms that can be confusing.

- Impulse Decisions: The ease of online applications can lead to impulsive decisions.

- Personal Data: Sharing personal information online can be a concern for some individuals.

Understanding both sides of applying for a credit card online helps you navigate the process confidently. Always read the terms carefully and consider your financial needs.

| Feature | Details |

|---|---|

| No Monthly Fees | Enjoy no monthly maintenance fees with Rewards Checking Plus. |

| Cash Back Rewards | Earn up to 2% cash back on purchases. |

| Performance Savings | Earn up to 4.14% APY when paired with Performance Savings. |

| Insurance | FDIC or NCUA insurance up to $250,000. |

For more details on the Rewards Checking Plus, visit Upgrade.

Specific Recommendations For Ideal Users

Choosing the right credit card can be a game-changer for managing personal finances. With numerous options available, it is crucial to understand which card best suits your needs. Here are specific recommendations for ideal users considering applying for a credit card online.

Best Practices For First-time Applicants

First-time applicants should prioritize credit cards with no monthly fees and rewards. The Upgrade Rewards Checking Plus is an excellent choice. It offers up to 2% cash back on purchases and no monthly fees. Here are some best practices:

- Start with a card that has a low or no annual fee.

- Look for cards that offer cash back on everyday expenses.

- Ensure the card reports to all three major credit bureaus.

- Understand the terms and conditions, including APRs and fees.

- Utilize early direct deposit to manage finances better.

Recommendations For Frequent Travelers

Frequent travelers need a credit card that offers travel-related perks. Although the Upgrade Rewards Checking Plus focuses on cash back, it can still be beneficial with its no monthly fees and cashback rewards. Consider these features:

- Cards offering travel insurance and trip cancellation coverage.

- Access to airport lounges and exclusive travel deals.

- High rewards on travel-related purchases.

- Low foreign transaction fees.

- Flexibility in redeeming rewards for travel expenses.

Advice For Individuals Looking To Build Credit

Building credit is essential for future financial opportunities. The Upgrade Rewards Checking Plus is a solid option due to its no monthly fees and cash back rewards. Follow these tips:

- Choose a credit card that reports to all three major credit bureaus.

- Opt for a card with a low credit limit to start.

- Pay your balance in full each month to avoid high interest rates.

- Set up automatic payments to ensure timely payments.

- Monitor your credit score regularly to track your progress.

By following these recommendations, you can effectively use a credit card to manage your finances and build a solid credit history. The Upgrade Rewards Checking Plus offers a great starting point with its no monthly fees and cashback rewards.

Credit: www.fssbonline.com

Frequently Asked Questions

How To Apply Online For A Credit Card?

Applying online for a credit card is easy. Visit the bank’s website, fill out the application form, and submit required documents.

What Documents Are Needed To Apply?

Typically, you’ll need proof of identity, address, and income. Common documents include your ID, utility bills, and salary slips.

Is It Safe To Apply Online For A Credit Card?

Yes, it’s safe to apply online through secure, official bank websites. Ensure the website uses encryption to protect your data.

How Long Does The Approval Process Take?

The approval process usually takes a few minutes to a few days. It depends on the bank’s verification procedures.

Conclusion

Applying online for a credit card offers convenience and speed. Upgrade’s Rewards Checking Plus stands out. It has no monthly fees and offers cash back rewards. You can earn up to 2% cash back on purchases. Enjoy benefits like early direct deposit and no prepayment penalties on loans. It’s a smart choice for managing personal finances. Explore more about Upgrade and apply now by visiting the official website. Simplify your financial life today.