Apply For Zilch: Unlock Zero-Interest Shopping Today

Looking for flexible payment solutions with rewards? Zilch offers credit options for UK residents, allowing you to spend responsibly and earn rewards.

Applying for Zilch can be a smart move for managing your finances. Zilch provides various payment plans with no hidden fees, making it easier to pay over time. With credit limits tailored to your affordability, you can ensure you spend within your means. Plus, you earn up to 5% back in rewards on purchases. Whether you choose to pay over six weeks, three months, or pay now for rewards, Zilch offers a hassle-free service. Live chat and phone support are available seven days a week, ensuring you get help when needed. Ready to apply for Zilch? Visit the Zilch website to get started.

Introduction To Zilch

Welcome to Zilch, a flexible payment solution designed for UK residents. Zilch offers a range of payment plans, credit limits, and rewards to make spending and managing finances easier. This section will introduce you to the key aspects of Zilch.

What Is Zilch?

Zilch is a credit service that provides flexible payment options with rewards for responsible spending. It offers various credit limits and payment plans, catering to different financial needs.

| Plan | Credit Limit | Representative APR |

|---|---|---|

| Zilch Classic | Up to £2250 | 18.6% |

| Zilch Up | Up to £600 | 25.2% |

| Zilch X (coming soon) | Up to £2250 | 14.99% |

The Purpose And Benefits Of Using Zilch

The primary purpose of Zilch is to provide flexible payment solutions. This helps users manage their finances more effectively. Zilch offers several benefits:

- Flexible Payment Plans: Choose to pay over 6 weeks, 3 months, or pay now.

- No Interest or Late Fees: Enjoy a service with no hidden charges.

- Rewards Program: Earn up to 5% back on purchases.

- Credit Building: Zilch Up helps build your credit score.

- Support Available: Get assistance via live chat or phone, seven days a week.

For instance, if you spend £495 on Zilch Classic, the total repayable amount is £500.30 over 6 weeks or 3 months, with a representative APR of 18.6%.

To apply for Zilch and explore more, visit the Zilch website or download the app from Google Play or Apple Store.

Credit: www.zilch.com

Key Features Of Zilch

Discover the key features of Zilch, a flexible payment solution that offers a variety of benefits. Zilch is designed to make purchasing easier and more rewarding for UK residents.

Zero-interest Payments

With Zilch, you can enjoy zero-interest payments on your purchases. There are no interest charges, making it easier to manage your finances without the worry of accumulating debt.

Flexible Payment Plans

Zilch offers flexible payment plans that suit your needs. You can choose to pay over 6 weeks or 3 months. Additionally, you can pay now and earn rewards. This flexibility allows you to manage your budget effectively.

Wide Range Of Partnered Retailers

Shop at a wide range of partnered retailers with Zilch. Whether you’re buying groceries, clothing, or electronics, Zilch has partnered with many retailers to provide you with more options.

Easy Application Process

The application process for Zilch is simple and straightforward. UK residents can apply easily without any hidden fees. Your credit limit is set according to your affordability, making it a responsible choice for managing your finances.

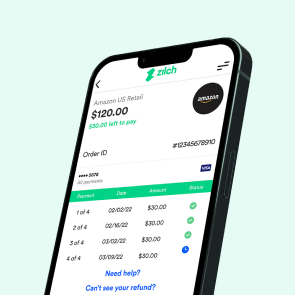

User-friendly Mobile App

Zilch offers a user-friendly mobile app that makes managing your payments easy. You can download the app from Google Play or the Apple Store. The app allows you to track your spending, manage your payment plans, and access support.

Here is a summary of Zilch’s key features:

| Feature | Description |

|---|---|

| Zero-Interest Payments | No interest charges on purchases |

| Flexible Payment Plans | Pay over 6 weeks, 3 months, or pay now |

| Wide Range of Partnered Retailers | Shop at various partnered retailers |

| Easy Application Process | Simple and transparent application process |

| User-Friendly Mobile App | Manage payments and track spending easily |

For more details and to apply for Zilch, visit the official Zilch website.

Pricing And Affordability

When considering Zilch, understanding its pricing and affordability is crucial. Zilch provides various payment plans with no hidden fees, making it an attractive option. Below, we dive deeper into how Zilch makes zero-interest possible, compare it with other payment options, and highlight potential hidden costs to be aware of.

How Zilch Makes Zero-interest Possible

Zilch’s zero-interest model stands out due to its transparent structure. Here are the key points:

- Flexible Payment Plans: Pay over 6 weeks, 3 months, or pay now for rewards.

- No Interest or Late Fees: Zilch does not charge interest or late fees, keeping costs predictable.

- Responsible Lending: Credit limits are set based on affordability, ensuring manageable repayments.

- Rewards Program: Earn up to 5% back in rewards on purchases, adding value to your spending.

Comparison With Other Payment Options

Comparing Zilch with other payment options highlights its unique benefits:

| Feature | Zilch | Traditional Credit Cards | Buy Now, Pay Later (BNPL) Services |

|---|---|---|---|

| No Interest | Yes | No | Varies |

| No Late Fees | Yes | No | Varies |

| Rewards Program | Yes (Up to 5%) | Yes (Varies) | Rarely |

| Credit Building | Yes (Zilch Up) | Yes | Rarely |

Potential Hidden Costs To Be Aware Of

Zilch prides itself on having no hidden fees. However, users should be aware of the following:

- Representative APR: Zilch Up has a 25.2% APR, Zilch Classic 18.6% APR, and Zilch X (coming soon) 14.99% APR.

- Payment Extensions: Extending payment deadlines by four or eight days may incur fees.

- Representative Example for Zilch Classic: 18.6% APR based on a total spend of £495 (+£5.30 fees), total repayable £500.30 over 6 weeks or 3 months. First payment £129.05, followed by three payments of £123.75.

Understanding these details ensures a clear picture of Zilch’s affordability and transparent pricing structure.

Credit: www.zilch.com

Pros And Cons Of Using Zilch

When considering Zilch, it’s essential to weigh the advantages and disadvantages. This helps determine if it suits your financial needs.

Advantages Of Zilch

- Flexible Payment Plans: Choose to pay over 6 weeks, 3 months, or pay immediately for rewards.

- No Interest or Late Fees: Enjoy interest-free credit with no penalties for late payments.

- Credit Limits: Access up to £2250 for Zilch Classic, up to £600 for Zilch Up, and up to £2250 for Zilch X (coming soon).

- Rewards Program: Earn up to 5% back in rewards on purchases.

- Responsible Lending: Limits are set according to affordability, helping to manage finances better.

- Hassle-Free Service: Transparent service with no hidden charges and easy-to-understand terms.

- Support Available: Customer support is available via live chat and phone, seven days a week.

- Credit Building: Options like Zilch Up can help build credit over time.

Disadvantages And Limitations

- Limited Availability: Only available for UK residents aged 18+ with credit subject to status.

- Representative APR: Zilch Up has a 25.2% APR, Zilch Classic has an 18.6% APR, and Zilch X (coming soon) has a 14.99% APR.

- Potential Fees for Extensions: Extending payment deadlines by four or eight days may incur fees.

- Credit Limits: Lower credit limits for Zilch Up users compared to Zilch Classic and Zilch X.

Real-world User Experiences

| Experience | Feedback |

|---|---|

| Payment Flexibility | Users appreciate the choice to pay over time or immediately for rewards. |

| Customer Support | Many users find the live chat and phone support helpful and responsive. |

| Credit Building | Some users have successfully improved their credit scores with Zilch Up. |

| Transparent Fees | Users value the clear and transparent fee structure, with no hidden charges. |

| Availability | Some users are disappointed that Zilch is only available to UK residents. |

Ideal Users And Scenarios For Zilch

Zilch is a versatile tool designed to help you manage your finances better. This section explores who can benefit the most from Zilch, the best shopping scenarios, and specific recommendations for different user types.

Who Can Benefit The Most From Zilch?

- Young Adults: Ideal for those starting their financial journey. Zilch Up helps build credit with flexible payment plans.

- Frequent Shoppers: Earn rewards on regular purchases. Up to 5% back on transactions.

- Budget-Conscious Individuals: No hidden fees or interest charges. Pay over time without extra costs.

- UK Residents: Zilch is available for UK residents aged 18 and above.

Best Shopping Scenarios For Zilch Usage

| Shopping Scenario | How Zilch Helps |

|---|---|

| Online Shopping | Pay over 6 weeks or 3 months. Earn rewards on each purchase. |

| Large Purchases | Spread the cost over time. Manage finances without stress. |

| Daily Necessities | Use Zilch Classic for up to £2250 credit limit. No late fees. |

| Seasonal Shopping | Flexible payment plans. Plan expenses during holidays. |

Specific Recommendations For Different User Types

Students: Use Zilch Up to build credit responsibly. Pay for textbooks and supplies over time.

Families: Zilch Classic offers a higher credit limit. Ideal for managing household expenses.

Freelancers: Flexible repayment options. Manage irregular income with ease.

Retirees: No hidden fees. Transparent service helps keep finances simple.

Credit: www.zilch.com

Frequently Asked Questions

What Is Zilch?

Zilch is a buy-now-pay-later service. It allows users to make purchases and pay later in installments.

How To Apply For Zilch?

To apply for Zilch, visit their website. Sign up with your details and follow the prompts.

Is Zilch Available For Everyone?

Zilch is available to residents of the UK. Users must be 18 years or older to apply.

What Are The Benefits Of Using Zilch?

Zilch offers interest-free installment plans. Users can manage their finances better and avoid high-interest rates.

Conclusion

Applying for Zilch can be a smart financial move. Enjoy flexible payment options and earn rewards. Zilch provides transparency with no hidden fees. Manage your finances better with responsible lending. Ready to apply? Visit the Zilch website to start your journey today.