Apply For Vialet Card: Unlock Exclusive Financial Freedom

Getting the right business account can be challenging. VIALET offers a solution tailored to your needs.

VIALET Business Account provides seamless money transfers and open banking options. It supports multiple currencies and payment methods, making it an ideal choice for businesses. With features like virtual corporate cards and mass payouts via API, managing finances becomes simple. Robust security ensures that your financial data is always protected. Quick account setup and transparent fees are just the icing on the cake. Ready to streamline your business finances? Apply for the VIALET Card today and experience a hassle-free financial journey. Learn more and apply now.

Introduction To Vialet Card

Are you looking for a reliable business account that offers more than just basic banking services? VIALET Business Account is an all-in-one solution designed to simplify your financial tasks. It is tailored for businesses that need efficient money transfers, multi-currency payments, and robust security.

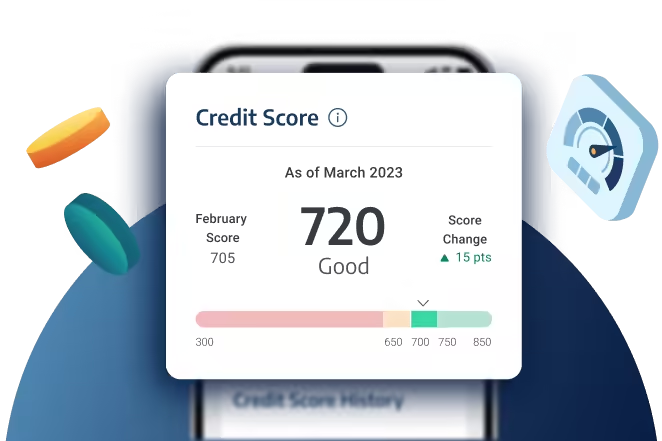

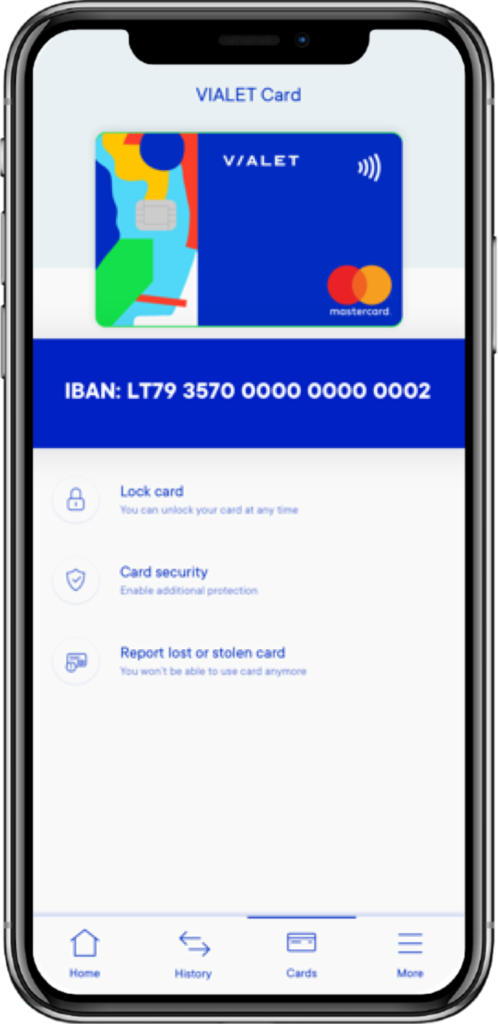

What Is Vialet Card?

The Vialet Card is a virtual corporate card that comes with the VIALET Business Account. It supports both Visa and Mastercard options. This card is perfect for managing business expenses and offers a convenient way to handle transactions without the need for physical cards.

Purpose And Benefits Of Vialet Card

The Vialet Card is designed to enhance your business operations. Here are the key purposes and benefits:

- Instant Money Transfers: Facilitates quick and easy money transfers.

- Multi-Currency Payments: Supports multiple currencies like EUR, USD, and GBP, among others.

- Virtual Corporate Cards: Provides secure virtual cards for business expenses.

- Automated Payments: Allows mass payouts via API, streamlining regular payments.

- B2B API Connections: Integrates with your preferred apps for automated payments.

- Enhanced Security: Offers 24/7 protection for your financial data.

Using the Vialet Card, businesses can optimize their operations with transparent charges, efficient support, and a focus on growth. The card allows businesses to make seamless transactions globally, ensuring they have the financial flexibility needed to thrive.

For more information or to apply, visit the VIALET website.

Key Features Of Vialet Card

The Vialet Card offers a range of impressive features that cater to both personal and business needs. Below are some of the key benefits that make it a top choice for users:

No Annual Fees

One of the most attractive features of the Vialet Card is the absence of annual fees. This means you can enjoy all the card’s benefits without worrying about any recurring costs. This makes it a cost-effective option for anyone looking for a dependable credit card.

Global Acceptance

The Vialet Card is widely accepted worldwide. Whether you are traveling for business or pleasure, you can use your card at millions of locations around the globe. This provides peace of mind knowing that your card will work wherever you go.

Advanced Security Measures

Security is a top priority for the Vialet Card. It incorporates advanced security measures to protect your financial data. Features include:

- 24/7 fraud monitoring

- EMV chip technology

- Two-factor authentication for online transactions

These measures ensure your transactions are secure and your information is safe.

Rewards And Cashback Programs

With the Vialet Card, you can earn rewards and cashback on your purchases. The card offers various programs tailored to your spending habits, allowing you to maximize your benefits. Some of the rewards include:

- Cashback on everyday purchases

- Points for travel and dining

- Exclusive discounts at partner merchants

These programs make the Vialet Card not just a payment tool, but a way to save money and enjoy special perks.

How To Apply For Vialet Card

Applying for a Vialet Card is simple. Follow our guide to get started. Learn about the eligibility criteria, the step-by-step application process, and the required documents.

Eligibility Criteria

To apply for a Vialet Card, ensure you meet the following criteria:

- Be at least 18 years old.

- Have a valid ID or passport.

- Provide proof of address.

- Have a valid email address and phone number.

- Possess a business registration if applying for a business account.

Step-by-step Application Process

Follow these steps to apply for your Vialet Card:

- Visit the Vialet website: Go to Vialet’s official website.

- Create an account: Click on the “Sign Up” button and fill in your details.

- Verify your email: Check your inbox for a verification email and follow the link.

- Complete your profile: Enter additional information like your address and phone number.

- Upload documents: Provide the necessary documents for verification.

- Submit your application: Review and submit your application for approval.

Required Documents

Prepare the following documents to complete your Vialet Card application:

| Document | Description |

|---|---|

| Identification | Valid ID or passport |

| Proof of Address | Utility bill or bank statement |

| Business Registration | For business accounts |

By following these steps and meeting the criteria, you can easily apply for your Vialet Card and enjoy the benefits it offers.

Pricing And Affordability

Understanding the pricing and affordability of the VIALET Business Account is essential for making an informed decision. This section breaks down the fee structure, interest rates, and how VIALET compares with competitors.

Fee Structure

The VIALET Business Account offers a transparent fee structure. Here are the key charges:

- Account Setup: Free

- Monthly Maintenance Fee: €10

- SEPA Transfers: €0.20 per transaction

- SWIFT Transfers: €5 per transaction

There are no hidden fees. VIALET focuses on clear and honest charges to help businesses manage their finances effectively.

Interest Rates

VIALET does not charge interest on the business account balances. This makes it an attractive option for businesses looking to avoid extra costs. Instead, the focus is on providing cost-effective transaction fees.

Comparison With Competitors

Let’s compare VIALET with other similar services:

| Feature | VIALET | Competitor A | Competitor B |

|---|---|---|---|

| Account Setup | Free | €20 | €15 |

| Monthly Maintenance Fee | €10 | €15 | €12 |

| SEPA Transfers | €0.20 | €0.30 | €0.25 |

| SWIFT Transfers | €5 | €10 | €8 |

VIALET stands out with lower fees and a transparent pricing model, making it a cost-effective choice for businesses.

Pros And Cons Of Vialet Card

Applying for a Vialet Card comes with its own set of advantages and disadvantages. Below, we will explore the pros and cons to help you make an informed decision. Understanding both sides can help you determine if this business account meets your needs.

Advantages Of Using Vialet Card

The Vialet Card offers several benefits, making it a strong contender for businesses. Here are some of the key advantages:

- Multi-Functional EUR Business Account: Supports SEPA, SEPA Instant, SWIFT payments, and local payment options, providing flexibility for various transactions.

- Multi-Currency Payments: Handles multiple currencies (EUR, USD, GBP, PLN, SEK, DKK, CZK, CHF) with clear and transparent rates.

- Virtual Corporate Cards: Offers virtual Visa or Mastercard for managing business expenses efficiently.

- Mass Payouts via API: Allows automated regular payments to numerous recipients, saving time and effort.

- B2B API Connections: Integrates preferred apps for automated payments and managing supplier deadlines.

- Acquiring for E-commerce: Optimizes checkout processes with preferred payment methods and open banking API.

- Speed & Ease of Use: Quick account setup and swift transactions ensure smooth operations.

- Personalized Support: Direct communication with an account manager for customized assistance.

- Robust Security: 24/7 protection of financial data with advanced security features ensures safety.

- Transparent Fees: Clear and honest fee structures focus on business growth without hidden charges.

Drawbacks To Consider

Despite its numerous advantages, the Vialet Card has some drawbacks to consider:

- Specific Pricing Details: Lack of detailed pricing information might be a concern for some businesses.

- Refund or Return Policies: No specific refund or return policies mentioned, which could be important for certain users.

Weigh these pros and cons carefully to decide if the Vialet Card aligns with your business needs.

Who Should Use Vialet Card?

The Vialet Card is an excellent choice for businesses. It offers a range of features designed to simplify financial transactions. But, who specifically would benefit most from using this card? Let’s dive into the details.

Ideal Users

Several types of users can benefit from the Vialet Card:

- Small to Medium Businesses (SMBs): Companies needing a flexible and multifunctional account.

- Freelancers: Individuals managing multiple clients and projects.

- E-commerce Companies: Businesses needing efficient payment solutions for online sales.

- International Traders: Companies dealing with multi-currency payments and international transactions.

Best Scenarios For Use

The Vialet Card can be particularly useful in several scenarios:

| Scenario | Description |

|---|---|

| Instant Money Transfers | Businesses needing quick access to funds and fast transactions. |

| Multi-Currency Payments | Companies dealing with clients or suppliers in different countries. |

| Team Collaboration | Organizations requiring multiple IBANs and different access levels for team members. |

| Automated Payments | Businesses looking to automate regular payments to numerous recipients. |

With features like virtual corporate cards, mass payouts via API, and B2B API connections, the Vialet Card simplifies financial operations for various business needs.

Frequently Asked Questions

How To Apply For A Vialet Card?

To apply for a Vialet card, visit their official website. Follow the online application process. Provide necessary personal information. Submit the required documents. Wait for approval.

What Are Vialet Card Benefits?

Vialet card offers many benefits. Enjoy low fees, secure transactions, and convenient online management. Access global payments and transfers easily.

Is Vialet Card Application Free?

Yes, applying for a Vialet card is free. There are no initial charges. However, check for any associated service fees.

Who Is Eligible For A Vialet Card?

Eligibility for a Vialet card requires being at least 18 years old. You need a valid ID and proof of address.

Conclusion

Applying for a VIALET card is a smart choice for business growth. The multi-functional business account offers efficient money management and seamless transactions. Enjoy benefits like virtual corporate cards and personalized support. Take control of your business finances with ease and transparency. Ready to simplify your business payments? Apply for VIALET card now and elevate your financial operations today.