Apply For Flex Credit Card: Unlock Exclusive Rewards Today

Are you a business owner looking for a credit card that grows with your business? The Flex Credit Card offers a unique solution designed specifically for business growth.

With features like 0% interest for 60 days, net-60 on all purchases, and individual employee cards at no extra cost, it’s a powerful tool for managing expenses and enhancing financial flexibility. Flex is more than just a credit card; it’s a comprehensive financial platform that integrates banking, treasury, and expense management. By applying for the Flex Credit Card, you tap into a seamless ecosystem that simplifies your financial operations. Enjoy benefits like high yield on cash balances, robust security measures, and a credit limit that scales with your business needs. Ready to take your financial management to the next level? Learn more and apply today by visiting Flex Financial Platform.

Introduction To The Flex Credit Card

The Flex Credit Card is a versatile financial tool designed for businesses. It offers unique benefits that help streamline expenses and manage finances effectively. This card stands out in the market with its flexibility and growth-oriented features.

Overview Of The Flex Credit Card

The Flex Credit Card is part of the Flex Financial Platform. It is issued by Patriot Bank, N.A., and is designed to meet the needs of growing businesses. The card offers:

- Net-60 on all purchases: Businesses have up to 60 days to pay for purchases without interest.

- 0% interest for 60 days: No interest on purchases if the balance is paid within the 60-day period.

- Credit limits that grow: Limits increase as your business expands.

- Individual employee cards: No extra cost for additional cards for team members.

- Expense management features: Streamlined tools to track and manage spending.

Purpose And Benefits Of The Card

The Flex Credit Card is designed to support business growth by providing financial flexibility and robust management features. Key benefits include:

| Benefit | Description |

|---|---|

| Ease of Use | Combines banking, treasury, and expense management into one platform. |

| Cost Efficiency | 0% interest for 60 days on purchases; no impact on credit score when applying. |

| High Yield | Earn up to 2.99% APY on cash balances. |

| Security | Advanced security measures including encryption and fraud monitoring. |

| Flexibility | Credit limits grow with your business; individual cards at no extra cost. |

By integrating the Flex Credit Card into your business, you can take advantage of its unique features and benefits to streamline your financial operations and support your business growth.

Key Features Of The Flex Credit Card

The Flex Credit Card offers a range of features designed to meet the needs of businesses. Here are some key features that make it an excellent choice for business growth.

Exclusive Rewards Program

The Flex Credit Card provides an exclusive rewards program that benefits your business. You can earn rewards on every purchase, helping you save money over time. This program is designed to give back to businesses, allowing them to reinvest in their growth.

- Earn rewards on all purchases

- Redeem rewards for business expenses

- No extra cost for participation

Flexible Spending Limits

With the Flex Credit Card, your spending limits grow with your business. This feature ensures that as your business expands, your credit card can support your increased expenses. No more worrying about hitting your limit during crucial times.

- Credit limits that grow with your business

- Individual employee cards at no extra cost

- Manage expenses with ease

Low Interest Rates

One of the standout features of the Flex Credit Card is its low interest rates. You can enjoy 0% interest for 60 days on all purchases, giving you a significant financial advantage. This feature helps you manage your cash flow more effectively.

| Interest Rate | Term |

|---|---|

| 0% | First 60 days |

Comprehensive Fraud Protection

The Flex Credit Card prioritizes your security with comprehensive fraud protection. Advanced measures like multi-factor authentication and automated fraud monitoring keep your financial information safe. Your business can operate with peace of mind, knowing that your data is secure.

- Proactive protection against phishing attempts

- Robust encryption for data security

- Automated fraud monitoring

- FDIC insurance up to $3M through Thread Bank

- Up to $75M in FDIC insurance through partner ADM

For more information, visit the Flex website.

How The Flex Credit Card Benefits You

The Flex Credit Card offers a range of benefits designed to support your business. From maximizing rewards to providing enhanced security, this card is a valuable asset. Let’s explore how the Flex Credit Card can benefit you.

Maximizing Rewards And Cashback

With the Flex Credit Card, you can maximize your rewards and cashback. Earn up to 2.99% APY on your cash on hand. This high yield on your balance ensures that your money works for you. Also, enjoy rewards on your purchases, turning everyday expenses into valuable benefits for your business.

Enhanced Financial Flexibility

The Flex Credit Card provides enhanced financial flexibility. Benefit from a net-60 payment term on all purchases. This means you have 60 days to pay off your balance without incurring any interest. Plus, the credit limits grow with your business, accommodating your expanding needs.

Cost Savings On Interest

One of the significant advantages of the Flex Credit Card is the cost savings on interest. Enjoy 0% interest for 60 days on all your purchases. As long as you pay off the balance within this period, you won’t incur any interest charges. This feature helps manage cash flow efficiently.

Peace Of Mind With Security Features

Security is paramount with the Flex Credit Card. It includes robust security features such as:

- Proactive protection against phishing attempts

- Robust encryption for data security

- Multi-Factor Authentication (MFA)

- Automated fraud monitoring

- FDIC insurance up to $3M through Thread Bank

- Up to $75M in FDIC insurance through partner ADM

These features provide peace of mind, knowing that your business transactions are secure.

For more information, visit the Flex Financial Platform.

Pricing And Affordability

When considering the Flex Credit Card, understanding its pricing and affordability is essential. This section will break down the key aspects, including annual fees, interest rates, and hidden fees, to help you make an informed decision.

Annual Fees And Charges

The Flex Credit Card offers a transparent fee structure. There are no annual fees associated with the card, which makes it an attractive option for businesses looking to minimize costs. Additionally, there are no charges for issuing individual employee cards. This allows businesses to provide cards to their team without incurring extra expenses.

Interest Rates Comparison

One of the standout features of the Flex Credit Card is its 0% interest for 60 days on all purchases. This interest-free period can significantly benefit businesses by providing extra time to manage cash flow without incurring interest charges.

Here is a brief comparison of the Flex Credit Card’s interest rates with other typical business credit cards:

| Credit Card | Interest Rate | Interest-Free Period |

|---|---|---|

| Flex Credit Card | 0% for 60 days | 60 days |

| Typical Business Card A | 15% – 20% | 25 days |

| Typical Business Card B | 18% – 24% | 30 days |

As seen, the Flex Credit Card offers a longer interest-free period, providing more financial flexibility for businesses.

Hidden Fees To Watch Out For

Flex Credit Card maintains transparency in its fee structure, ensuring no hidden fees. Here are some aspects to consider:

- No Annual Fees: Businesses do not need to worry about yearly charges.

- No Employee Card Fees: Issuing individual cards for employees is free.

- Interest-Free Period: 0% interest for 60 days, provided the balance is paid in full within the grace period.

These features ensure that businesses can manage their finances efficiently without unexpected costs.

For more detailed information, please visit the Flex website.

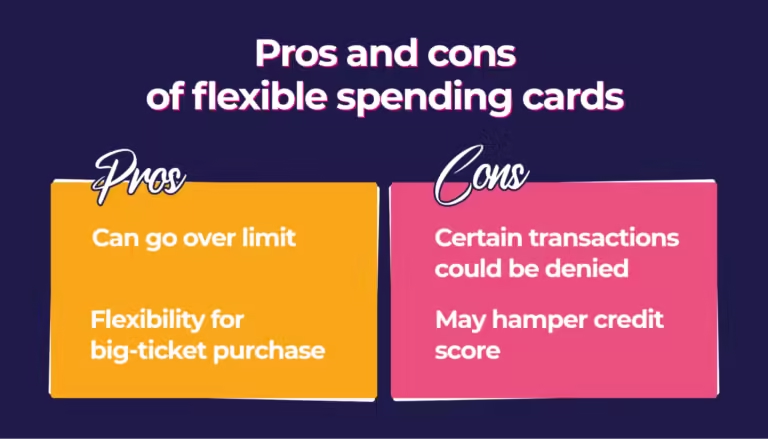

Pros And Cons Of The Flex Credit Card

When considering the Flex Credit Card for your business, it is important to weigh the advantages and potential drawbacks. This balanced view will help you make an informed decision that suits your financial goals.

Advantages Of Using The Flex Credit Card

- Net-60 on All Purchases: Enjoy a 60-day interest-free period on all purchases.

- 0% Interest for 60 Days: Pay no interest if the balance is cleared within 60 days.

- Credit Limits Grow with Your Business: Dynamic credit limits that scale with your business needs.

- Individual Employee Cards: Issue cards to employees at no extra cost.

- Expense Management Features: Simplify tracking and managing business expenses.

- High Yield: Earn up to 2.99% APY on cash balances.

- No Credit Score Impact: Applying for the card does not affect your credit score.

Potential Drawbacks To Consider

- APY Requirements: Higher APY rates require a substantial average daily balance.

- Interest Accrual: Interest will accrue if the balance is not paid within the 60-day interest-free period.

- Complex Terms: APY rates and credit card terms may be subject to changes based on Federal Funds Rate.

| Feature | Details |

|---|---|

| Net-60 Purchases | 60-day interest-free period on all purchases. |

| Interest-Free Period | 0% interest if the balance is paid within 60 days. |

| Credit Limits | Limits grow with your business needs. |

| Employee Cards | Individual cards at no extra cost. |

| Expense Management | Features for simplified expense tracking. |

| High APY | Up to 2.99% APY on cash balances. |

| Credit Score | No impact on credit score when applying. |

| APY Requirements | Higher APY rates require large balances. |

| Interest Accrual | Accrues if balance not paid in 60 days. |

| Terms Complexity | Subject to changes based on Federal Funds Rate. |

Who Should Apply For The Flex Credit Card?

The Flex Credit Card is designed to cater to businesses seeking efficient expense management, high credit limits, and simplified banking. With its unique set of features, it is an ideal choice for various user profiles and business scenarios.

Ideal User Profiles

- Small and Medium-Sized Businesses (SMBs): Businesses looking for scalable credit limits and simplified expense management.

- Startups: Companies that need flexible credit options to support their rapid growth and operational needs.

- Finance Managers: Professionals who require detailed expense tracking and management features.

- Remote Teams: Organizations with remote employees who need individual cards at no extra cost.

Best Use Case Scenarios

The Flex Credit Card excels in several business scenarios, thanks to its robust features:

- Expense Management: Use the card to streamline expense tracking and reporting with its integrated management features.

- Cash Flow Optimization: Benefit from the 0% interest for 60 days to manage cash flow more effectively.

- Team Spending: Issue individual employee cards to monitor and control team spending without additional costs.

- High Yield Savings: Earn up to 2.99% APY on cash balances, making it an attractive option for businesses with significant cash reserves.

In summary, the Flex Credit Card is a versatile tool for various business needs, offering high credit limits, zero interest for 60 days, and advanced expense management features.

How To Apply For The Flex Credit Card

Applying for the Flex Credit Card is a straightforward process. This guide will help you navigate through each step, ensuring you have all the required documents and information ready.

Step-by-step Application Process

- Visit the Flex Financial Platform.

- Navigate to the Credit Card section.

- Click on the “Apply Now” button.

- Fill out the application form with your business details.

- Submit the application and wait for approval.

The application process is designed to be quick and user-friendly. Once submitted, the Flex team will review your application and inform you of the next steps.

Documents And Information Required

To ensure a smooth application process, have the following documents and information ready:

- Business Identification Number (BIN)

- Business Financial Statements

- Proof of Address

- Personal Identification (Driver’s License or Passport)

- Bank Account Information

Having these documents on hand will help expedite the review process, allowing you to access the benefits of the Flex Credit Card sooner.

For more details on the benefits and features of the Flex Credit Card, visit the official website.

Frequently Asked Questions

What Is A Flex Credit Card?

A Flex Credit Card is a versatile financial tool. It offers flexible spending limits and rewards. Ideal for those needing adaptable credit solutions.

How Do I Apply For A Flex Credit Card?

To apply, visit the issuer’s website. Fill out the application form with personal and financial details. Submit and await approval.

What Are The Benefits Of A Flex Credit Card?

Flex Credit Cards offer numerous benefits. These include flexible spending limits, rewards programs, and often lower interest rates. They are ideal for managing finances.

Are There Any Fees For A Flex Credit Card?

Yes, Flex Credit Cards may have fees. These can include annual fees, late payment fees, and foreign transaction fees. Check the issuer’s terms.

Conclusion

Ready to streamline your business finances? The Flex Credit Card offers a simple, efficient solution. Benefit from 0% interest for 60 days and grow your credit limits as your business expands. Manage expenses effortlessly with individual employee cards at no extra cost. Plus, enjoy robust security features for peace of mind. Don’t miss out on optimizing your business growth and financial management. Apply for the Flex Credit Card today! Click here to get started: Flex Credit Card.