Apply For Credit Cards Online: Fast, Easy, and Convenient

Applying for credit cards online has never been easier. You can now compare various options and apply from the comfort of your home.

In today’s digital world, applying for credit cards online saves time and effort. Instead of visiting multiple banks, you can research and apply online in minutes. This process provides convenience, allowing you to review terms, benefits, and requirements with just a few clicks. Whether you need a card for personal use or to support your small business, online applications streamline the process. By choosing the right card, you can manage your finances better and enjoy various perks. Ready to find the perfect credit card? Start your journey with Funding Societies by visiting Funding Societies today!

Introduction To Applying For Credit Cards Online

Applying for a credit card online is now easier than ever. You can explore different options, compare features, and submit applications from the comfort of your home. This guide provides an overview of the benefits and steps involved in the online application process.

Why Apply For Credit Cards Online?

Online applications offer several advantages:

- Convenience: Apply from anywhere, at any time.

- Quick Comparison: Easily compare different cards and their features.

- Instant Approval: Many providers offer instant approval decisions.

- Secure Process: Modern encryption keeps your information safe.

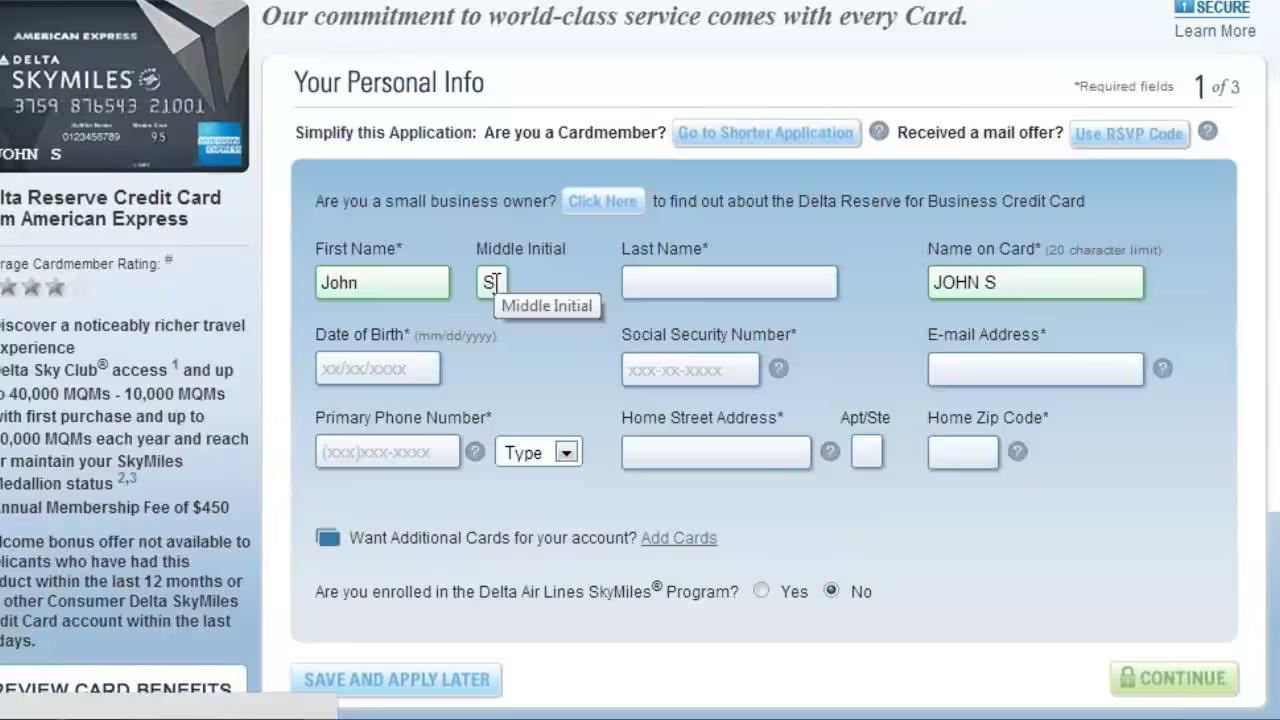

Overview Of The Online Application Process

The online application process is straightforward:

- Research: Visit the website of your chosen provider.

- Select: Choose the credit card that fits your needs.

- Complete Form: Fill out the online application form with your details.

- Submit: Submit the form and wait for the decision.

- Verification: If approved, complete any additional verification steps.

- Receive Card: Your new card will be mailed to you.

Applying for credit cards online saves time and effort, making it an attractive option for many individuals.

Key Features Of Online Credit Card Applications

Applying for credit cards online offers several advantages. Understanding these key features can help you make an informed decision. This section explores the benefits and functionalities of online credit card applications.

Instant Approval Decisions

One of the most attractive features of online credit card applications is instant approval decisions. You can know the status of your application within minutes. This fast process saves time and reduces stress.

Many online platforms use advanced algorithms and credit scoring systems. These tools evaluate your application quickly, providing you with immediate feedback.

Comparing Multiple Offers Easily

When applying online, you can compare multiple offers easily. Many websites and apps allow you to see various credit card options side by side. This feature helps you choose the best card for your needs.

Some platforms even offer comparison tables. These tables highlight key benefits, interest rates, and fees. This makes it simpler to compare and select the right credit card.

| Card Name | Interest Rate | Annual Fee | Rewards |

|---|---|---|---|

| Card A | 14.99% | $0 | Cashback |

| Card B | 18.99% | $95 | Travel Points |

| Card C | 12.99% | $50 | Rewards Points |

Secure And Confidential Application Process

The security and confidentiality of your personal information is paramount. Online credit card applications are designed with robust security measures. These include encryption and secure servers to protect your data.

Most reputable financial institutions use advanced technology. This ensures that your application details remain confidential and secure. Always check for security certifications before submitting your application.

Funding Societies, for example, provides a secure platform for applying for credit. They have measures in place to protect your information, ensuring your peace of mind.

Pricing And Affordability

Applying for credit cards online can offer significant benefits, especially when it comes to pricing and affordability. Understanding the costs associated with credit cards is essential to make an informed decision. Let’s delve into the various aspects to consider.

Understanding Interest Rates And Fees

One of the most crucial factors in credit card affordability is the interest rate. Interest rates can vary significantly between different cards. Generally, credit cards come with an Annual Percentage Rate (APR). This is the interest rate applied to your balance if you do not pay it off in full each month.

Aside from interest rates, be aware of other fees. Common fees include:

- Annual Fees: Some cards charge a yearly fee for the privilege of using the card.

- Late Payment Fees: If you miss a payment, you may incur a late fee.

- Foreign Transaction Fees: Charges for purchases made outside your home country.

Comparing Promotional Offers

Many credit cards offer promotional deals to attract new customers. These can be beneficial if used wisely. Here are some common promotional offers:

- Introductory 0% APR: Some cards offer 0% APR for an initial period, usually 6 to 18 months.

- Sign-Up Bonuses: Receive a cash bonus or reward points after spending a certain amount within the first few months.

- Balance Transfer Offers: Transfer your existing balance from another card at a lower interest rate.

Carefully compare these offers to find the best deal for your financial situation.

Evaluating The Long-term Costs

While promotional offers can provide immediate benefits, evaluating the long-term costs of a credit card is crucial. Consider the following:

- Regular APR: What is the interest rate after the introductory period ends?

- Annual Fees: Are the benefits worth the annual fee in the long run?

- Rewards Program: Does the rewards program align with your spending habits?

It’s essential to look beyond the initial offers and understand the long-term implications on your finances.

| Aspect | Details |

|---|---|

| Interest Rates | Varies, includes APR and promotional rates |

| Fees | Annual, late payment, foreign transaction |

| Promotional Offers | Introductory 0% APR, sign-up bonuses, balance transfer offers |

| Long-Term Costs | Regular APR, rewards program, annual fees |

By understanding these factors, you can make a well-informed decision when applying for credit cards online.

Pros And Cons Of Applying For Credit Cards Online

Applying for credit cards online has become increasingly popular. There are many advantages and some drawbacks to this approach. It’s essential to weigh both sides before making a decision.

Advantages Of Online Applications

- Convenience: Apply from the comfort of your home at any time.

- Speed: Online applications are processed faster than paper applications.

- Comparison: Easily compare different credit card offers and features.

- Instant Approval: Some cards provide instant approval decisions.

Potential Drawbacks To Consider

- Security Risks: Online applications involve sharing personal information over the internet.

- Limited Assistance: Lack of face-to-face interaction can make it hard to ask questions.

- Technical Issues: Website glitches or downtime can cause delays.

- Overwhelming Choices: The abundance of options might be confusing for some users.

Recommendations For Ideal Users

Applying for a credit card online can be a convenient and efficient process. It’s essential to identify which type of credit card suits your needs best. Below are some recommendations for different types of users.

Best Practices For First-time Applicants

First-time credit card applicants should consider cards with no annual fees. These cards help build credit without additional costs.

Look for cards that offer introductory APRs. This feature allows you to carry a balance without accruing interest during the introductory period.

Ensure the card reports to all three major credit bureaus. This action helps build your credit score more effectively.

Consider cards that offer cashback or reward points. These rewards can be beneficial as you start your credit journey.

Tips For Frequent Travelers

Frequent travelers should look for cards that offer travel rewards. These rewards can include points or miles for every dollar spent.

Choose cards that provide travel insurance and purchase protection. These benefits can save you money and provide peace of mind during trips.

Opt for cards with no foreign transaction fees. This feature is crucial for international travelers, saving you from extra charges.

Select cards that offer access to airport lounges. These lounges provide comfort and convenience during layovers.

Advice For Individuals Seeking Balance Transfers

If you aim to transfer a balance, look for cards with a 0% introductory APR on balance transfers. This feature can help you pay off debt without additional interest.

Check for low balance transfer fees. Some cards may charge a percentage of the amount transferred.

Ensure the card has a long introductory period for balance transfers. This period gives you more time to pay off the balance without interest.

Consider cards that also offer low regular APRs. If you can’t pay off the balance during the introductory period, a low regular APR will be beneficial.

Frequently Asked Questions

How Do I Apply For A Credit Card Online?

To apply for a credit card online, visit the card issuer’s website. Fill out the application form with your personal and financial information. Submit the form and wait for approval.

What Are The Benefits Of Applying Online?

Applying online is convenient and fast. You can compare different cards easily and receive instant approval notifications. It saves time and effort.

Can I Get Instant Approval For A Credit Card Online?

Yes, many card issuers offer instant approval for online applications. Ensure your information is accurate and meets the issuer’s criteria. Approval can be immediate.

What Information Is Needed To Apply Online?

You need to provide personal details like name, address, and social security number. Financial information like income and employment status is also required.

Conclusion

Applying for credit cards online is now easier than ever. Funding Societies offers excellent options for SMEs. Fast approval and quick funding are key benefits. Their micro and term loans suit various business needs. Investors also find great opportunities with short investment tenors. Visit Funding Societies for more information. Boost your business today with simple, quick, and reliable financing solutions. Grow your business with the support you need. Explore your options and see how Funding Societies can assist.