Apply For Credit Card: Unlock Exclusive Rewards & Benefits

Applying for a credit card can seem overwhelming. But it’s an essential step in building your financial future.

Whether you’re a first-time applicant or looking to add another card to your wallet, understanding the process is crucial. A credit card is more than just plastic; it’s a financial tool that can help you manage expenses and build credit. With so many options available, it’s important to know what to look for and how to apply effectively. This guide will walk you through the steps to apply for a credit card and introduce you to Nemo Money, a trusted partner in financial growth. Nemo offers secure, commission-free investing, making it a great choice for those looking to expand their financial horizons. Ready to get started? Learn more at Nemo Money.

Introduction To Applying For A Credit Card

Applying for a credit card can seem like a daunting task, but it doesn’t have to be. A credit card offers many advantages that can help you manage your finances better. Nemo Money offers a range of credit cards that cater to different needs. Whether you want to build your credit history, earn rewards, or have a convenient way to pay, there’s a credit card for you.

Why You Should Consider Applying For A Credit Card

Credit cards offer a host of benefits that can enhance your financial life:

- Build Credit History: A credit card helps you build and improve your credit score.

- Convenience: Credit cards are accepted globally, making transactions easier.

- Security: They offer better fraud protection compared to cash.

Choosing the right card can help you maximize these benefits. Nemo Money’s credit cards are designed to suit various financial needs, ensuring you get the best deal.

Overview Of Exclusive Rewards And Benefits

With Nemo Money credit cards, you get access to exclusive rewards and benefits:

| Feature | Details |

|---|---|

| Rewards Points | Earn points on every purchase, which can be redeemed for cash back, travel, and more. |

| No Annual Fees | Many of our credit cards come with no annual fees, saving you money. |

| Introductory Offers | Enjoy special introductory rates and bonuses when you sign up. |

These rewards and benefits make Nemo Money credit cards an attractive choice for managing your finances. Start your application today and take advantage of these exclusive offers.

Key Features Of Credit Cards

Credit cards offer a range of features that can benefit users in various ways. From rewards programs to introductory offers and additional perks, understanding these features helps you make the most of your credit card.

Rewards Programs: Points, Cash Back, And Travel Miles

Many credit cards offer rewards programs that let you earn points, cash back, or travel miles on purchases. These rewards can be redeemed for various benefits such as merchandise, statement credits, or travel expenses.

- Points: Earn points on every purchase and redeem them for gifts, services, or travel.

- Cash Back: Receive a percentage of your spending back in the form of cash rewards.

- Travel Miles: Accumulate miles that can be used towards airfare, hotel stays, and other travel-related expenses.

Introductory Offers: 0% Apr And Sign-up Bonuses

Credit cards often come with attractive introductory offers to entice new users. These offers can provide significant savings and benefits in the initial period.

- 0% APR: Enjoy zero interest on purchases and balance transfers for a set period, usually 6-18 months.

- Sign-Up Bonuses: Receive a lump sum of points, cash back, or miles after meeting a minimum spending requirement within the first few months.

Additional Perks: Concierge Services, Purchase Protection, And More

Credit cards also come with various additional perks that enhance their value. These perks can offer convenience, security, and extra benefits.

- Concierge Services: Access to dedicated assistance for travel bookings, event planning, and more.

- Purchase Protection: Coverage for damage or theft of new purchases within a certain period.

- Extended Warranties: Additional warranty on items purchased with the card.

- Travel Insurance: Coverage for trip cancellations, lost luggage, and travel accidents.

Understanding Credit Card Pricing And Affordability

Applying for a credit card like Nemo Money can be an exciting step. But understanding the costs is crucial. Knowing the different fees and charges helps you manage your finances better. Let’s explore the key components of credit card pricing and how to determine affordability.

Annual Fees: What To Expect And How To Justify Them

Many credit cards charge an annual fee. This fee can range from $0 to several hundred dollars. It’s essential to weigh the benefits against the cost.

- No Annual Fee Cards: Great for those who don’t use their cards often.

- Premium Cards: Offer perks like travel rewards, but charge higher fees.

Justify the annual fee by considering the card’s benefits. Rewards points, cashback, and travel perks can offset the cost.

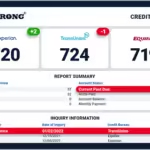

Interest Rates: Understanding Apr And How To Minimize Costs

Annual Percentage Rate (APR) is the interest you’ll pay on unpaid balances. APRs vary widely among credit cards.

| APR Type | Description |

|---|---|

| Introductory APR | Lower rate for a limited time. |

| Standard APR | Regular rate after the introductory period. |

Minimize costs by paying off the balance in full each month. Avoid carrying a balance to prevent interest charges.

Hidden Fees: What To Watch Out For

Credit cards often come with hidden fees. Be aware of these to avoid unexpected charges.

- Late Payment Fees: Charged if you miss a payment due date.

- Foreign Transaction Fees: Applied to purchases made outside your home country.

- Balance Transfer Fees: Fees for transferring a balance from one card to another.

Read the card’s terms and conditions to understand all potential fees. This helps you avoid surprises and manage your credit card effectively.

Pros And Cons Of Using Credit Cards

Credit cards are a popular financial tool. They offer both benefits and risks. This section explores the advantages and disadvantages of using credit cards.

Advantages: Building Credit

Using a credit card responsibly can help build your credit score. Paying bills on time and keeping balances low shows lenders you are reliable. This can make it easier to get loans in the future.

Advantages: Earning Rewards

Many credit cards offer rewards for spending. These can include cash back, travel points, or discounts. Rewards can save you money if you use your card wisely.

Advantages: Enhanced Security

Credit cards offer enhanced security features. Fraud protection and zero liability policies protect you from unauthorized charges. This can give you peace of mind when shopping online or in stores.

Disadvantages: Potential For Debt

Credit cards make it easy to spend more than you can afford. This can lead to significant debt. It’s essential to keep track of your spending and stay within your budget.

Disadvantages: Interest Costs

If you carry a balance, you will pay interest. Credit card interest rates are often high. This can make your debt grow quickly, costing you more in the long run.

Disadvantages: Credit Score Impact

Late payments or high balances can hurt your credit score. This can make it harder to get loans or other credit in the future. It’s important to manage your credit card use carefully.

For more information on credit cards and investing, check out Nemo Money. Nemo offers a range of services to help you invest wisely and securely.

Recommendations For Ideal Credit Card Users

Choosing the right credit card can enhance your financial management and rewards. Different cards cater to various needs. Here are some top picks for different user categories.

Best Credit Cards For Frequent Travelers

Frequent travelers can benefit from credit cards that offer travel rewards, no foreign transaction fees, and access to travel insurance.

| Card Name | Key Features |

|---|---|

| Travel Rewards Card |

|

| Airline Miles Card |

|

Top Choices For Cash Back Enthusiasts

Cash back enthusiasts should look for cards that offer high cash back rates on everyday purchases.

| Card Name | Key Features |

|---|---|

| Flat-Rate Cash Back Card |

|

| Category Cash Back Card |

|

Ideal Options For Students And First-time Cardholders

Students and first-time cardholders need cards that are easy to manage and offer useful rewards.

| Card Name | Key Features |

|---|---|

| Student Credit Card |

|

| Secured Credit Card |

|

Choosing the right credit card can help you manage your finances better and earn rewards. Select a card that matches your lifestyle and needs.

Frequently Asked Questions

How To Apply For A Credit Card?

Applying for a credit card is simple. Visit the bank’s website, fill out the online application form, and submit it.

What Are The Eligibility Criteria?

Eligibility criteria vary by bank. Common requirements include being at least 18 years old, having a steady income, and a good credit score.

Can I Apply For A Credit Card Online?

Yes, most banks offer online credit card applications. Visit their website, fill in your details, and submit the form.

How Long Does Approval Take?

Approval times vary. Generally, it takes between 7-14 days. Some banks offer instant approval for eligible applicants.

Conclusion

Applying for a credit card can be straightforward and beneficial. Assess your needs, compare options, and choose wisely. For secure investments with global stocks, consider Nemo. Nemo offers commission-free trading and robust security. To learn more, visit Nemo Money. Act now to manage finances and invest smartly.