Alternative Lending Options: Unlock Your Financial Freedom

Finding the right financial support can be challenging. Traditional banks often have strict lending requirements that many people can’t meet.

Alternative lending options offer a lifeline for those needing flexible and accessible financial solutions. These options can help individuals and businesses secure funds without the hurdles of conventional loans. Understanding the variety of alternative lending choices is crucial for making informed financial decisions.

Whether you need a personal loan, a business loan, or another type of financial assistance, exploring these alternatives can provide the support you need. In this blog post, we’ll dive into different alternative lending options that can make a significant difference in your financial journey. Ready to discover more? Let’s get started.

Introduction To Alternative Lending Options

In today’s fast-paced world, access to funds can be a challenge. Traditional lending avenues often come with strict requirements. This is where alternative lending options step in. They offer flexible solutions for borrowers with diverse needs. This section explores the basics of alternative lending.

Understanding The Need For Alternative Lending

Traditional loans can be inaccessible for many people. Banks have strict credit requirements. They also require extensive documentation. These barriers make it hard for some to get the funds they need.

Alternative lending options provide a solution. They are designed to be more inclusive. They cater to individuals with different financial backgrounds. This flexibility makes them an attractive option.

How Alternative Lending Differs From Traditional Lending

The key difference lies in the application process. Traditional loans often involve lengthy paperwork. They also require a high credit score. On the other hand, alternative lending options are more flexible.

Alternative lenders use different criteria. They may look at education or job history. They also use technology to speed up the approval process. This allows for quicker access to funds.

Upstart Personal Loans, for instance, offers a streamlined process. They use artificial intelligence to evaluate applications. This means faster approval times for borrowers.

| Traditional Lending | Alternative Lending |

|---|---|

| Strict credit requirements | Flexible credit evaluation |

| Lengthy paperwork | Minimal documentation |

| Slow approval process | Quick approval times |

In summary, alternative lending options offer more flexibility. They are designed to meet the needs of a wider range of borrowers. This makes them a valuable resource in today’s financial landscape.

Key Features Of Alternative Lending Options

Alternative lending options offer unique features that set them apart from traditional loans. These features make them appealing to a wider audience. Let’s explore some key aspects of alternative lending options.

Diverse Loan Types And Flexibility

Alternative lenders provide a variety of loan types to meet different needs. These include:

- Personal loans

- Business loans

- Peer-to-peer loans

- Invoice financing

Flexibility is another crucial feature. Borrowers can often choose the loan amount and repayment terms. This allows for personalized financial solutions.

Speed And Accessibility

One major benefit is the speed at which funds are disbursed. Many alternative lenders approve and release funds within 24 hours. This quick access to funds can be crucial in times of need.

Accessibility is also a key feature. Many lenders have online platforms. This allows borrowers to apply from anywhere, anytime.

Lower Qualification Barriers

Traditional lenders often have strict qualification criteria. Alternative lending options have lower qualification barriers. This makes them accessible to more people.

Factors that are considered include:

- Credit score

- Income level

- Employment status

Some lenders, like Upstart Personal Loans, use AI to assess creditworthiness. This opens up opportunities for those with a limited credit history.

Popular Alternative Lending Platforms

In today’s financial landscape, traditional lending options are not the only choice. Alternative lending platforms offer diverse solutions for borrowers. These platforms provide more flexibility and accessibility, especially for those with unique financial needs. Below are some of the most popular alternative lending platforms.

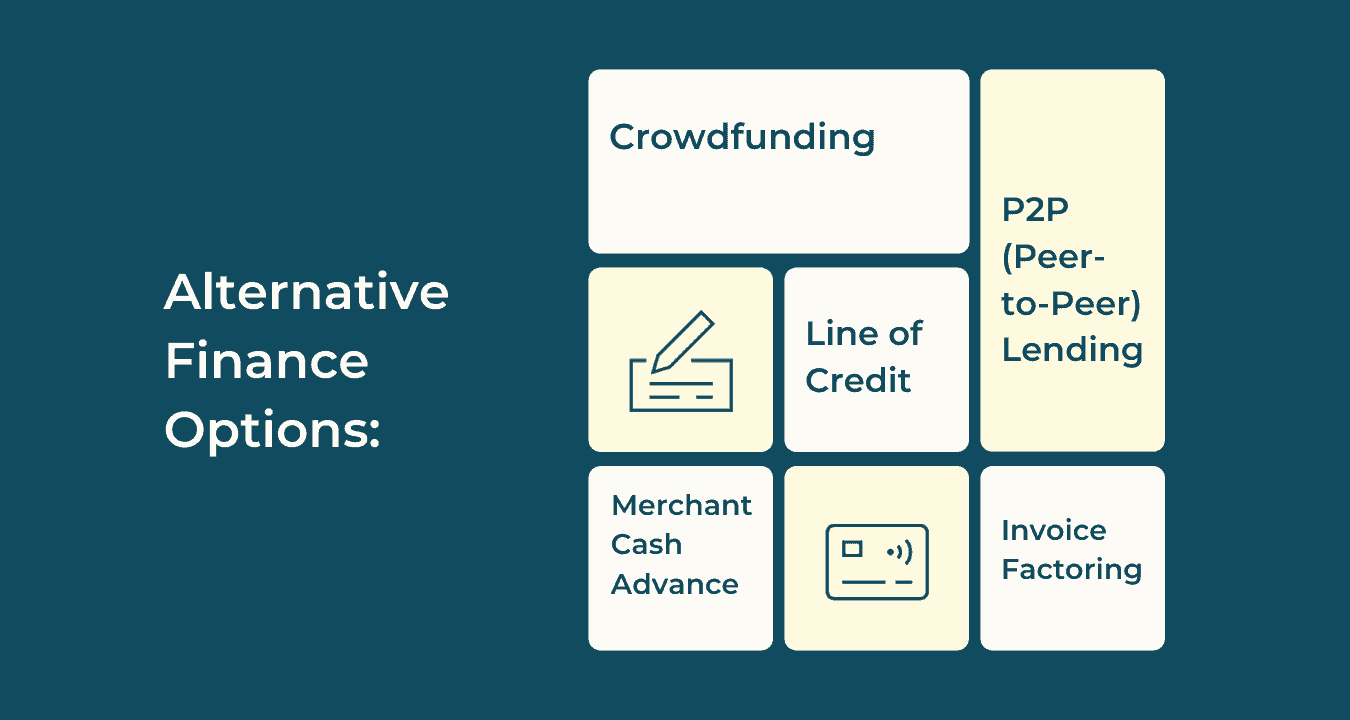

Peer-to-peer Lending

Peer-to-Peer (P2P) lending connects borrowers directly with individual lenders. This setup removes the middleman, often resulting in better terms for both parties. Platforms such as LendingClub and Prosper are well-known in this space.

Features:

- Direct connection between borrowers and lenders

- Competitive interest rates

- Quick approval process

Benefits:

- Lower interest rates compared to traditional banks

- Flexible loan amounts and terms

- Transparent fee structures

Crowdfunding

Crowdfunding platforms allow individuals to raise small amounts of money from a large number of people. This method is ideal for startups and creative projects. Websites like Kickstarter and Indiegogo are leaders in this field.

Features:

- Access to a wide audience

- Funding for various types of projects

- Rewards-based or equity-based funding models

Benefits:

- No need for traditional loan qualifications

- Opportunity to validate ideas with potential customers

- Builds a community around the project

Online Direct Lenders

Online direct lenders offer loans through their websites without involving traditional banks. These lenders often provide quick and easy access to funds. Examples include Upstart Personal Loans and Avant.

Features:

- Online application process

- Fast approval and funding

- Personalized loan offers

Benefits:

- Convenient and user-friendly application process

- Competitive rates and flexible terms

- Credit-building opportunities for borrowers

Microloans

Microloans are small loans usually offered to entrepreneurs and small businesses. Organizations like the Small Business Administration (SBA) and Accion provide these loans to help businesses grow.

Features:

- Small loan amounts

- Focus on underserved markets

- Support for business development

Benefits:

- Access to capital for small businesses

- Lower interest rates than traditional loans

- Flexible repayment options

Pricing And Affordability

Understanding the pricing and affordability of alternative lending options is crucial. It helps you make an informed decision. Below, we break down the key aspects of pricing and affordability for alternative lending.

Interest Rates Comparison

Interest rates can vary widely among different lenders. It is essential to compare these rates. Here is a table to illustrate the differences:

| Lender | Interest Rate |

|---|---|

| Upstart Personal Loans | 7.98% – 35.99% |

| Lender B | 5.99% – 29.99% |

| Lender C | 6.99% – 24.99% |

As shown, Upstart Personal Loans offers competitive rates. Always compare rates to find the best deal.

Fees And Hidden Costs

Fees and hidden costs can affect the overall cost of a loan. Here are some common fees to look out for:

- Origination Fees

- Late Payment Fees

- Prepayment Penalties

Always ask the lender for a detailed breakdown of all fees. Upstart Personal Loans are transparent about their fees, which helps in avoiding unexpected costs.

Repayment Terms And Conditions

Repayment terms and conditions vary by lender. Here are some key points to consider:

- Loan Term Length: Shorter terms usually mean higher monthly payments but lower overall interest.

- Flexibility: Some lenders offer flexible repayment options.

- Early Repayment: Check if there are penalties for paying off the loan early.

Understanding these terms helps you choose a loan that fits your financial situation. Upstart Personal Loans offer flexible terms, making them a good option for many borrowers.

Pros And Cons Of Alternative Lending

Alternative lending options offer a range of benefits and drawbacks. Understanding these can help you make informed decisions about borrowing. Let’s dive into the pros and cons of alternative lending.

Advantages: Speed, Accessibility, And Flexibility

Speed: Alternative lenders often provide faster approval processes. This means you can receive your funds quickly. Traditional banks may take weeks. Alternative lenders may approve your loan in just a few days.

Accessibility: These lenders have less strict requirements. They cater to individuals with lower credit scores. This makes borrowing more accessible. Many people who are denied by traditional banks turn to alternative lenders.

Flexibility: Alternative lending offers more flexible terms. You can find loans tailored to your specific needs. Whether you need a short-term loan or a long-term one, there are options available. This flexibility can be crucial for many borrowers.

Disadvantages: Higher Interest Rates And Risk

Higher Interest Rates: Alternative loans often come with higher interest rates. This is due to the increased risk lenders take on. Higher rates mean you’ll pay more over the life of the loan. Always calculate the total cost before borrowing.

Risk: There is a higher risk associated with alternative lending. Some lenders may have less transparent terms. It’s essential to read and understand all loan agreements. Be wary of hidden fees and penalties. Always do thorough research before committing.

| Advantages | Disadvantages |

|---|---|

| Fast approval process | Higher interest rates |

| Less strict requirements | Potential hidden fees |

| Flexible terms | Increased risk |

Ideal Users And Scenarios For Alternative Lending

Alternative lending offers flexible financing solutions tailored to diverse needs. Understanding the ideal users and scenarios can help determine if alternative lending is the right choice for you.

Small Business Owners

Small business owners often face challenges in securing traditional bank loans due to strict requirements. Alternative lending provides a viable solution.

- Quick Access to Funds: Business owners can obtain funds faster, ensuring cash flow stability.

- Less Stringent Requirements: Approval processes are more lenient compared to traditional banks.

- Tailored Repayment Plans: Flexible repayment options cater to the unique needs of small businesses.

Individuals With Poor Credit

Traditional lending institutions often deny loans to individuals with poor credit scores. Alternative lending offers an inclusive option for these individuals.

- Credit Score Flexibility: Lenders consider factors beyond credit scores, increasing approval chances.

- Opportunity for Credit Improvement: Timely repayments can help improve credit scores over time.

- Customized Loan Terms: Borrowers can negotiate terms that suit their financial situation.

Entrepreneurs And Startups

Startups and entrepreneurs frequently struggle to secure funding from traditional sources. Alternative lending provides the necessary capital to foster growth and innovation.

- Seed Capital: Entrepreneurs can access initial funding to kickstart their ventures.

- Growth and Expansion: Alternative loans support business scaling and expansion efforts.

- Faster Approval: Quick approval processes ensure that startups can capitalize on time-sensitive opportunities.

Conclusion: Unlocking Financial Freedom With Alternative Lending

Alternative lending options, like Upstart Personal Loans, offer new ways to gain financial freedom. They provide quick access to funds and are often more flexible than traditional loans. This flexibility can make a big difference for those with unique financial needs.

Summary Of Benefits

- Quick Access to Funds: Alternative lenders can approve loans faster than traditional banks.

- Flexible Terms: These loans often come with more flexible repayment terms.

- Accessible to More People: Individuals with lower credit scores may still qualify.

- Convenient Application Process: Applications are usually online and easy to complete.

- Lower Interest Rates: Some alternative lenders offer competitive interest rates.

Final Recommendations

Consider alternative lending options if you need funds quickly and have a lower credit score. Review the terms carefully and choose a lender that fits your financial needs. Upstart Personal Loans is one option to explore. Their easy online process and flexible terms could be beneficial.

Remember to compare different lenders. Look at interest rates, repayment terms, and any additional fees. Make sure you understand all the terms before agreeing to a loan.

By exploring alternative lending, you can find solutions that traditional banks might not offer. This can help you achieve financial freedom and meet your financial goals.

Frequently Asked Questions

What Is Alternative Lending?

Alternative lending refers to non-traditional lending methods, such as online platforms, peer-to-peer lending, and crowdfunding. These options provide more flexible terms compared to traditional banks.

How Does Peer-to-peer Lending Work?

Peer-to-peer lending connects borrowers directly with investors through online platforms. Borrowers get loans at competitive rates, while investors earn interest.

Are Alternative Lending Options Safe?

Alternative lending options are generally safe but carry some risks. It’s crucial to research the platform and understand the terms before borrowing or investing.

What Are The Benefits Of Alternative Lending?

Alternative lending offers flexible terms, faster approval, and access to funds for those who may not qualify for traditional loans.

Conclusion

Exploring alternative lending options can open up new opportunities. Consider Upstart Personal Loans for your financial needs. It offers flexible solutions with an easy application process. Learn more about Upstart here. Taking advantage of different lending options can help you make informed financial decisions. Always research and choose the best option for your situation. Good luck on your financial journey!