Affordable Credit Repair: Boost Your Credit Score Fast

Credit repair can seem overwhelming. But it doesn’t have to be expensive.

Many people think fixing their credit is costly. That’s not always the case. Affordable credit repair options exist for everyone. These solutions help you improve your credit score without breaking the bank. One such service is SoloSuit. This automated software aids users in debt disputes. It helps you respond to debt lawsuits and settle debts. SoloSuit offers professional attorney reviews and nationwide coverage. They have protected over $1.71 billion in debt and assisted 262 thousand people. Ready to learn more? Let’s explore how you can repair your credit affordably with SoloSuit. Check out more about SoloSuit here.

Introduction To Affordable Credit Repair

Struggling with poor credit can be overwhelming. Affordable credit repair services can help improve your credit score. Let’s explore how affordable credit repair works and its importance.

Understanding Credit Scores And Their Importance

Your credit score is a three-digit number. It ranges between 300 and 850. This score influences your ability to get loans and credit cards. Lenders use it to determine your creditworthiness.

A higher credit score means lower interest rates. It can save you money in the long run. Conversely, a low credit score can lead to higher interest rates. It can also make it harder to get approved for loans.

| Credit Score Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

What Is Credit Repair And Why Is It Necessary?

Credit repair involves fixing your credit to improve your credit score. It can include disputing errors on your credit report. It may also involve negotiating with creditors. Credit repair is necessary for several reasons:

- To correct errors on your credit report

- To improve your chances of getting approved for loans

- To reduce interest rates on existing debt

Errors on credit reports are common. They can significantly impact your credit score. Correcting these errors can improve your financial health.

Overview Of Affordable Credit Repair Solutions

Several affordable credit repair solutions are available. They vary in features and pricing. One notable option is Solo, an automated software designed to help with debt disputes.

- Reply to a Debt Lawsuit: Solo helps compile a response to debt lawsuits. It includes attorney review and filing.

- Settle a Debt: Solo facilitates negotiations with debt collectors. It aims to settle debts for less than the face value.

- Automated Assistance: Simplifies the process of responding to debt lawsuits and settling debts.

- Nationwide Coverage: Available in all 50 states.

Solo has helped over 262,000 people. It has protected over $1.71 billion in debt. This makes it a reliable and affordable option for credit repair.

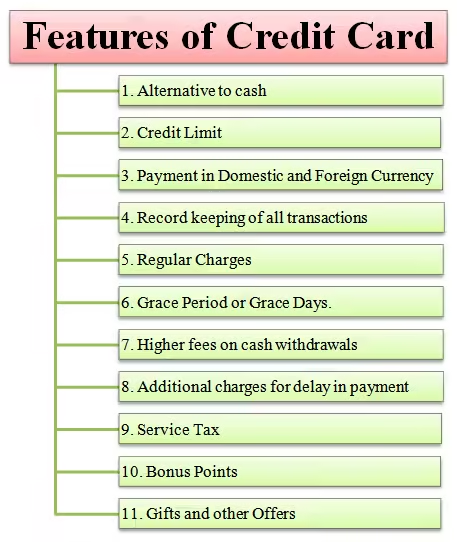

Key Features Of Affordable Credit Repair Services

Affordable credit repair services offer a range of features to help improve your credit score and manage debt effectively. Below are some key features to look for:

Personalized Credit Report Analysis

A thorough personalized credit report analysis is essential. Professionals review your credit history and identify inaccuracies. They pinpoint areas that need improvement and provide a tailored plan.

Dispute Resolution With Credit Bureaus

Effective dispute resolution with credit bureaus is a crucial service. The credit repair company will challenge any errors or inaccurate information on your credit report. They communicate directly with credit bureaus on your behalf, ensuring corrections are made promptly.

Credit Counseling And Education

Quality credit repair services offer credit counseling and education. They teach you how to manage your finances better and avoid future credit problems. Knowledge is power, and understanding credit can lead to better financial decisions.

Debt Management Assistance

Debt management assistance is another vital feature. These services help you create a manageable plan to pay off your debts. They can negotiate with creditors to lower interest rates or monthly payments, making debt repayment more feasible.

Monitoring And Follow-up Services

Continuous monitoring and follow-up services are essential to ensure lasting results. Regular updates on your credit status and ongoing support help maintain your improved credit score over time.

| Feature | Description |

|---|---|

| Personalized Credit Report Analysis | Tailored review of your credit history to identify and address inaccuracies. |

| Dispute Resolution with Credit Bureaus | Challenging errors and communicating with credit bureaus on your behalf. |

| Credit Counseling and Education | Providing knowledge and resources to manage your finances better. |

| Debt Management Assistance | Creating plans to repay debts and negotiating with creditors. |

| Monitoring and Follow-up Services | Regular updates and ongoing support to maintain improved credit. |

Pricing And Affordability Breakdown

Understanding the cost of credit repair services is crucial for those seeking to improve their financial health. This section delves into the various pricing models, compares popular services, and assesses the value for money.

Different Pricing Models In Credit Repair

Credit repair services offer various pricing models to cater to different needs and budgets. Some common models include:

- Monthly Subscriptions: Pay a monthly fee for ongoing services and support.

- Pay-Per-Deletion: Pay only for each negative item successfully removed from your credit report.

- One-Time Fee: A single payment for a comprehensive credit repair package.

Each model has its pros and cons. Monthly subscriptions provide continuous support, while pay-per-deletion ensures you pay only for results. One-time fees can be cost-effective for those needing extensive help.

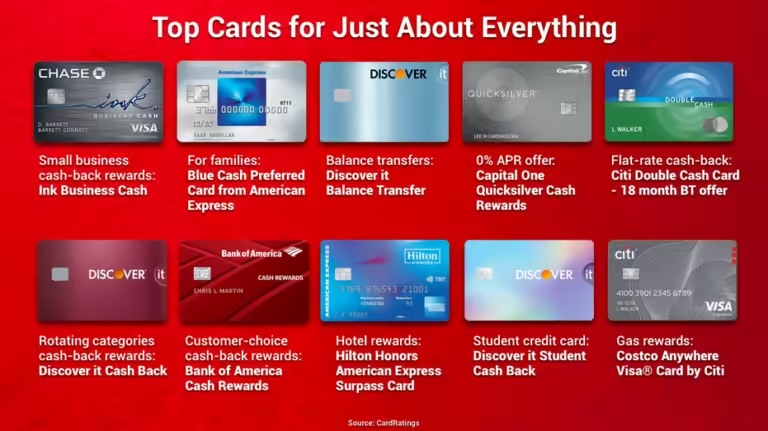

Cost Comparison Of Popular Credit Repair Services

| Service | Pricing Model | Cost |

|---|---|---|

| SoloSuit | Automated Software | Pricing details not provided |

| Lexington Law | Monthly Subscription | $89.95/month |

| CreditRepair.com | Monthly Subscription | $99.95/month |

| Sky Blue Credit | Monthly Subscription | $79/month |

Comparing prices helps you find a service that fits your budget and needs. SoloSuit offers automated assistance, focusing on debt disputes and settlements, but specific pricing details are not available.

Value For Money: What You Get For The Price

Understanding what you get for your money is essential. Here’s a breakdown of the value provided by different services:

- SoloSuit: Automated assistance with debt lawsuits and settlements, attorney review, and nationwide coverage.

- Lexington Law: Comprehensive credit repair, including credit monitoring and identity theft protection.

- CreditRepair.com: Personalized credit repair plans, regular progress reports, and credit score tracking.

- Sky Blue Credit: Fast dispute resolution, debt validation, and goodwill letters.

Choosing the right service depends on your specific needs and budget. SoloSuit provides a unique approach with its automated software, focusing on debt disputes and settlements.

Pros And Cons Of Using Affordable Credit Repair Services

Affordable credit repair services can offer significant benefits, but they also come with certain drawbacks. Understanding both sides can help you make an informed decision. Below, we delve into the advantages and disadvantages of these services.

Advantages: Quick Improvements And Expert Guidance

One of the main advantages of using affordable credit repair services is the potential for quick improvements in your credit score. Professionals in these services know how to identify and dispute errors on your credit report efficiently.

- Quick Improvements: Services can often achieve results faster than DIY methods.

- Expert Guidance: Experts can offer insights and strategies to improve your credit score.

- Stress Reduction: Professionals handle complex tasks, reducing your stress.

Additionally, these services provide expert guidance. They have experience and knowledge in dealing with credit issues, which can be invaluable. They can advise on how to maintain good credit habits and avoid future problems.

Disadvantages: Potential Risks And Limitations

Despite the benefits, there are some potential risks and limitations to consider. Not all credit repair services are legitimate, and some may engage in unethical practices.

- Potential Risks: Some services may be scams or use unethical methods.

- Costs: Even affordable services require an investment, which may not be feasible for everyone.

- Limitations: Not all credit issues can be resolved by repair services.

Another limitation is that not all credit problems can be fixed through repair services. Some issues require long-term financial habits changes rather than quick fixes.

Weighing The Benefits Against The Costs

When considering affordable credit repair services, it’s essential to weigh the benefits against the costs. Evaluate the potential for quick improvements and expert guidance against the risks and limitations.

| Benefits | Costs |

|---|---|

| Quick improvements in credit score | Potential financial investment |

| Expert guidance and advice | Risk of scams and unethical practices |

| Stress reduction | Limitations in resolving all credit issues |

By understanding both the pros and cons, you can make a more informed decision about using affordable credit repair services.

Specific Recommendations For Ideal Users

Affordable credit repair services can be a valuable tool for many individuals. By understanding who these services are best suited for, you can make an informed decision. Below are some specific recommendations for ideal users.

Who Should Consider Affordable Credit Repair Services?

Not everyone needs credit repair services. Here are some individuals who may benefit the most:

- Those with poor credit scores: If your credit score is below 650, credit repair can help.

- Victims of identity theft: If your credit report has errors due to identity theft, credit repair services can assist in correcting these issues.

- Individuals facing debt lawsuits: Services like Solo can help you respond to debt lawsuits and negotiate settlements.

Best Scenarios For Using Credit Repair: When And Why

Credit repair services are most effective in specific scenarios. Here are some of the best times to consider using these services:

- Before a major purchase: If you plan to buy a house or car, improving your credit score can help you secure better loan terms.

- When errors are found on your credit report: Correcting mistakes on your credit report can improve your score quickly.

- During financial hardship: If you’re struggling with debt, services like Solo can help you settle debts and avoid lawsuits.

Tips For Choosing The Right Credit Repair Service Provider

Selecting the right credit repair service is crucial. Here are some tips to help you make the best choice:

- Check for transparency: Look for providers that are clear about their fees and services.

- Read reviews: Customer reviews can offer insight into the effectiveness and reliability of the service.

- Consider professional oversight: Services like Solo that include attorney reviews can ensure your legal documents are accurate.

- Understand the scope: Ensure the service covers all aspects of credit repair, including error correction and debt settlement.

By following these tips, you can find a credit repair service that meets your needs and helps improve your financial situation.

Conclusion: Boost Your Credit Score Fast And Affordably

Improving your credit score does not have to be expensive or slow. With the right tools and approach, you can see significant improvements in a short time. Below, we summarize the key points and provide some final thoughts on affordable credit repair.

Recap Of Key Points

- Automated Assistance: Use tools like Solo to simplify debt disputes.

- Attorney Review: Ensure your responses are legally sound with professional reviews.

- Nationwide Coverage: Access these services anywhere in the United States.

- Proven Success: Over $1.71 billion in debt protected and 262,000 people helped.

Final Thoughts On Affordable Credit Repair

Affordable credit repair is within reach if you use the right resources. Solo provides an excellent option for those facing debt lawsuits. It offers automated help and attorney-reviewed responses, ensuring your efforts are legally sound.

Remember, consistent and informed actions make a difference. Using tools like Solo, you can handle debt disputes effectively and affordably.

Encouragement To Take Action And Improve Your Credit

Do not wait to start improving your credit score. Take the first step now. Consider using Solo for automated assistance with debt lawsuits and settlements. By taking action today, you can work towards a healthier financial future.

Visit SoloSuit to learn more and get started on your credit repair journey.

Frequently Asked Questions

What Is Credit Repair?

Credit repair involves improving your credit score by addressing errors on your credit report. This can include disputing inaccuracies, negotiating with creditors, and adopting better financial habits.

How Does Credit Repair Work?

Credit repair works by identifying and correcting errors on your credit report. This can involve disputing inaccuracies, negotiating with creditors, and implementing better financial habits.

How Long Does Credit Repair Take?

Credit repair typically takes three to six months. However, the exact time can vary based on individual circumstances and the complexity of the issues.

Can I Repair My Credit Myself?

Yes, you can repair your credit yourself. By understanding your credit report, disputing errors, and managing finances responsibly, you can improve your credit score.

Conclusion

Affordable credit repair is within your reach. SoloSuit can help you manage debt. This automated software assists with debt lawsuits and settlements. It’s user-friendly and available nationwide. SoloSuit has helped thousands and protected billions in debt. Simplify your debt disputes today with SoloSuit. Click here to learn more and start your journey to financial freedom.