Advanced Financial Analytics: Transform Your Business Strategy

In today’s fast-paced business world, understanding financial data is crucial. Advanced financial analytics can help you make smarter decisions.

Financial analytics goes beyond basic number-crunching. It involves using sophisticated tools and techniques to analyze data, predict trends, and make informed decisions. This is essential for freelancers, contractors, and small business owners who want to stay ahead. One such tool is Found, which offers a comprehensive financial management solution. Found integrates smart banking, bookkeeping, and tax tools into one platform. It simplifies financial management, helping you focus on growth and success. With features like real-time tax calculations and automatic expense tracking, Found can save you time and effort. Explore Found to streamline your financial tasks and enhance your business efficiency.

Introduction To Advanced Financial Analytics

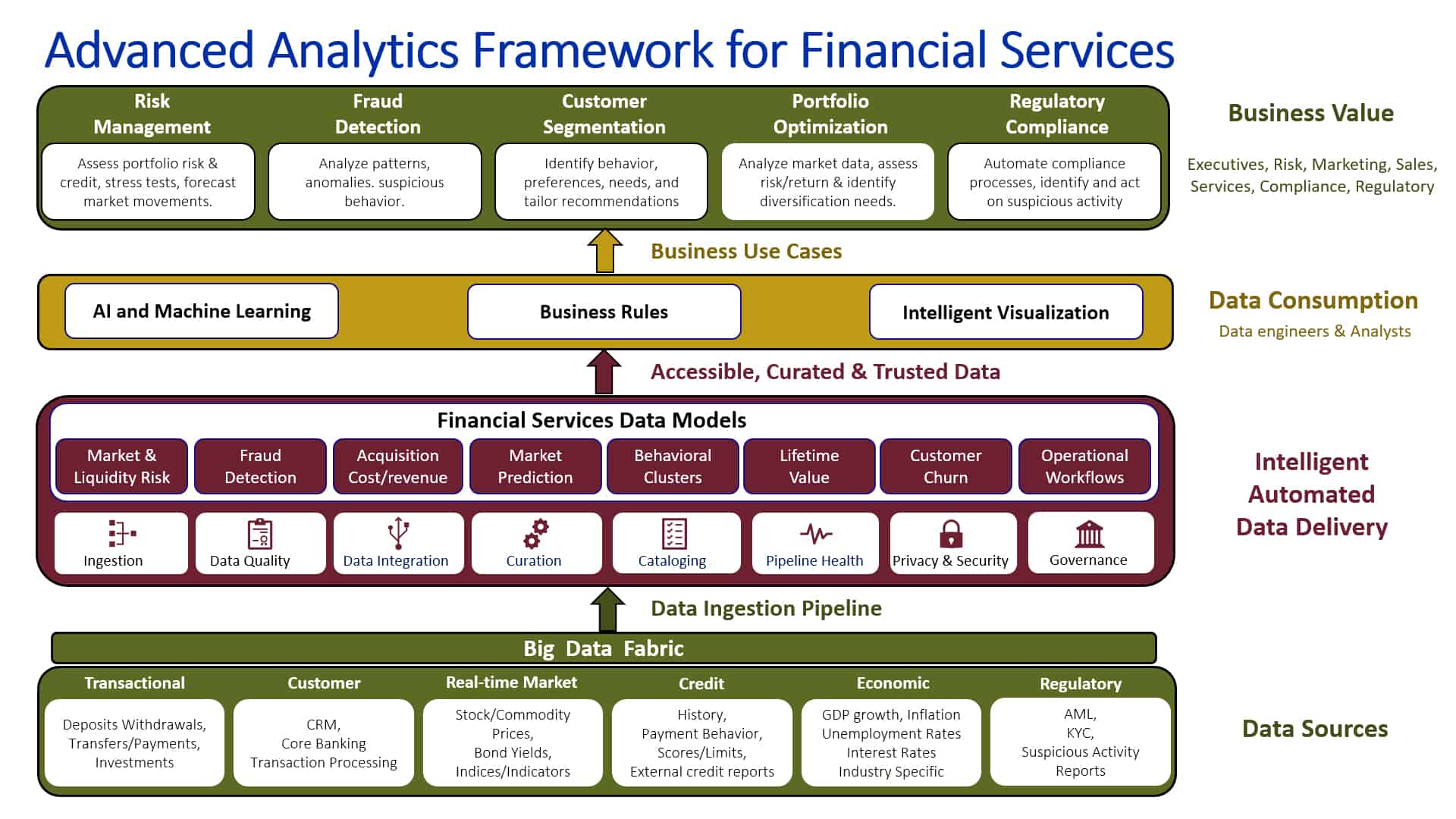

Advanced Financial Analytics plays a crucial role in modern business strategy. It involves the use of sophisticated tools and techniques to analyze financial data. This helps businesses make informed decisions, manage risks, and drive growth. Let’s dive deeper into what Advanced Financial Analytics is and its importance in business strategy.

What Is Advanced Financial Analytics?

Advanced Financial Analytics involves the use of advanced data analysis methods. It includes techniques such as predictive modeling, machine learning, and statistical analysis. These methods help in interpreting complex financial data. The goal is to gain insights that can improve financial decision-making.

Some common applications include:

- Predicting future financial performance

- Identifying trends and patterns in financial data

- Assessing risks and opportunities

By leveraging these techniques, businesses can stay ahead in a competitive market.

The Importance Of Financial Analytics In Business Strategy

Financial Analytics is vital for developing effective business strategies. Here are some key reasons:

- Informed Decision-Making: Provides accurate data analysis, leading to better decisions.

- Risk Management: Helps identify and mitigate financial risks.

- Performance Measurement: Tracks financial performance against goals.

- Cost Efficiency: Identifies areas to reduce costs and improve efficiency.

Using Financial Analytics, businesses can streamline operations and enhance profitability. This is where solutions like Found come into play. Found offers comprehensive financial management tools. These tools simplify banking, bookkeeping, and tax management for freelancers and small business owners.

With features like smart online banking, real-time tax calculation, and automatic expense tracking, Found helps businesses maintain financial organization. The platform also ensures data security with FDIC-insured funds, data encryption, and two-factor authentication.

By integrating Found into their financial strategy, businesses can save time, reduce costs, and focus on growth.

Key Features Of Advanced Financial Analytics

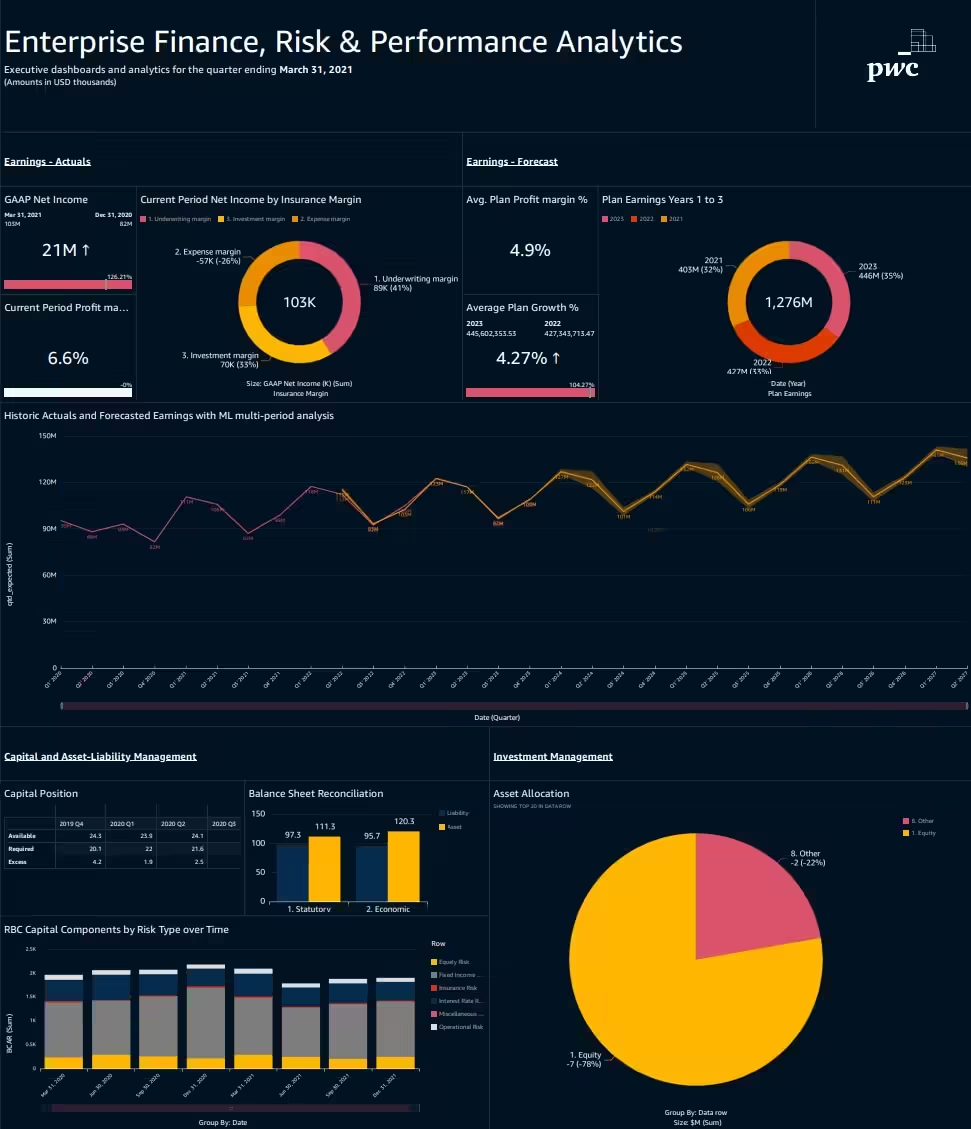

Advanced Financial Analytics is transforming the financial industry. It offers tools and insights to improve decision-making and efficiency. Below are the key features that set it apart.

Data Integration And Management

Advanced Financial Analytics integrates data from multiple sources. This ensures a holistic view of financial information. The platform handles data cleaning and transformation seamlessly. It supports various data formats and sources, including:

- ERP systems

- CRM platforms

- Financial databases

Effective data management leads to accurate and reliable insights.

Predictive Analytics And Forecasting

Predictive analytics uses historical data to forecast future trends. Advanced Financial Analytics employs sophisticated algorithms for this purpose. The platform can predict:

- Revenue growth

- Market trends

- Customer behavior

These insights help businesses make informed decisions and plan effectively.

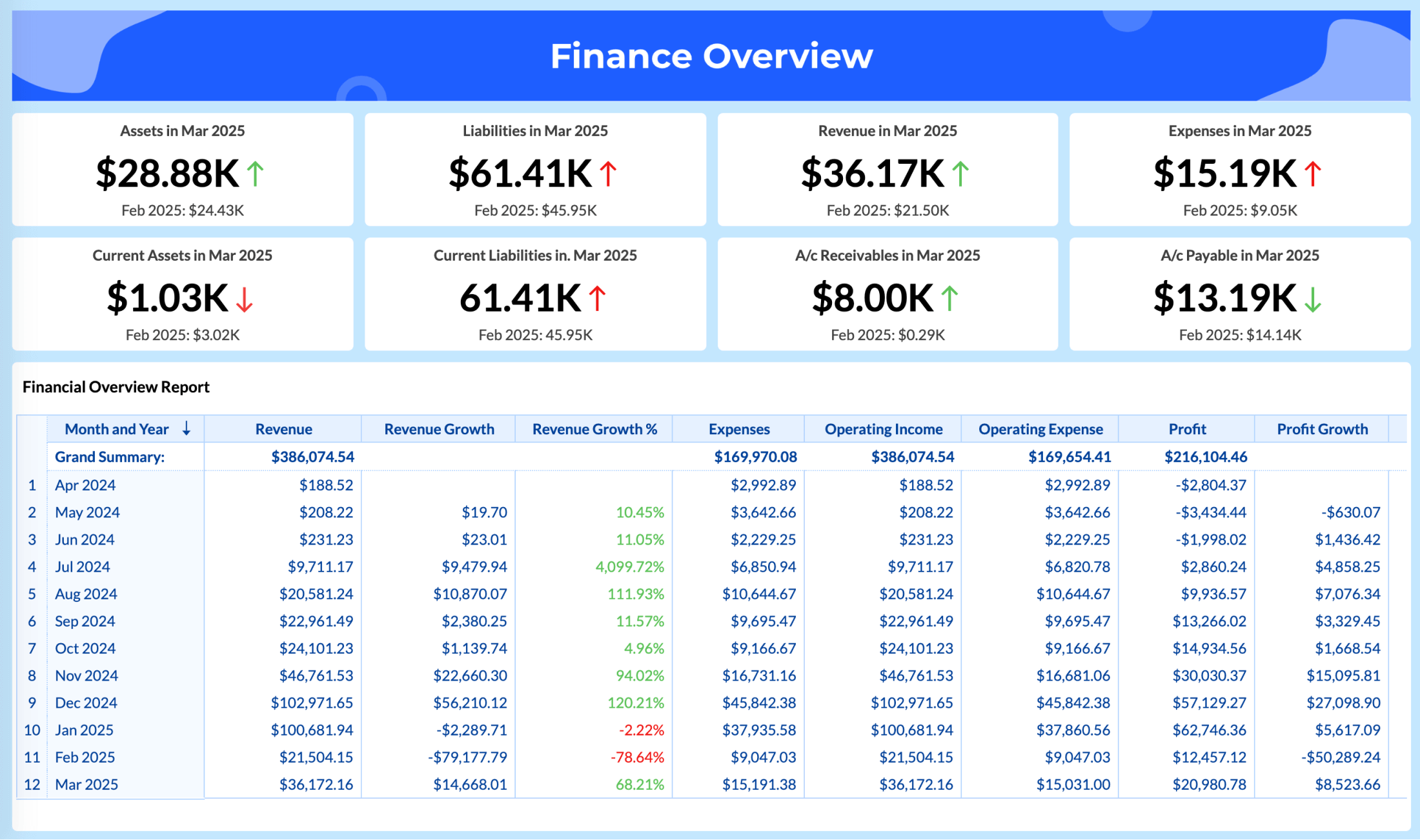

Real-time Financial Monitoring

Real-time monitoring provides up-to-date financial data. This feature is essential for quick decision-making. The platform offers:

- Live dashboards

- Instant alerts

- Continuous data updates

Businesses can respond promptly to any financial changes or anomalies.

Risk Management And Mitigation

Advanced Financial Analytics identifies potential risks. It assesses the impact and likelihood of various risk factors. The platform includes tools for:

- Risk scoring

- Scenario analysis

- Stress testing

Effective risk management ensures business stability and resilience.

Customized Reporting And Dashboards

The platform allows users to create tailored reports and dashboards. This ensures that relevant information is easily accessible. Features include:

- Drag-and-drop report builders

- Customizable templates

- Interactive visualizations

These tools help in presenting data in a clear and actionable manner.

Benefits Of Using Advanced Financial Analytics

Advanced Financial Analytics offers numerous benefits to businesses. It provides insights that can drive strategic decisions and improve overall performance. Here are some key benefits:

Enhanced Decision-making

Advanced Financial Analytics helps in making informed decisions. It uses data-driven insights to predict future trends. This allows businesses to plan better and make accurate decisions. The use of real-time data ensures that decisions are based on the most current information.

Improved Financial Performance

Using Advanced Financial Analytics can lead to better financial outcomes. It identifies areas of potential growth and cost savings. This helps in optimizing resources and increasing profitability. Businesses can track key performance indicators (KPIs) and adjust strategies as needed.

Increased Operational Efficiency

Advanced Financial Analytics streamlines operations by automating routine tasks. This reduces the time spent on manual processes. It allows employees to focus on more strategic activities. Efficiency gains translate into cost savings and better resource utilization.

Better Risk Management

Risk management is crucial for any business. Advanced Financial Analytics assesses potential risks accurately. It uses predictive models to forecast financial risks. This helps in preparing for uncertainties and mitigating potential losses. Businesses can develop more robust risk management strategies.

Strategic Planning And Competitive Advantage

Strategic planning is enhanced with Advanced Financial Analytics. It provides a comprehensive view of financial health. Businesses can identify trends and capitalize on opportunities. This leads to a competitive advantage in the market. Data-driven strategies are more effective and sustainable.

| Benefit | Description |

|---|---|

| Enhanced Decision-Making | Informed decisions based on data-driven insights. |

| Improved Financial Performance | Optimization of resources and increased profitability. |

| Increased Operational Efficiency | Automation of routine tasks and better resource utilization. |

| Better Risk Management | Accurate risk assessment and mitigation strategies. |

| Strategic Planning and Competitive Advantage | Comprehensive financial view and market opportunities. |

In summary, Advanced Financial Analytics is a powerful tool. It enhances decision-making, improves financial performance, and increases operational efficiency. It also provides better risk management and strategic planning. Businesses can gain a competitive edge by leveraging these benefits.

Pricing And Affordability Of Advanced Financial Analytics Tools

Understanding the pricing and affordability of advanced financial analytics tools is crucial. Many businesses seek to balance cost and benefits. This section explores different aspects of pricing to help you make an informed decision.

Cost Breakdown Of Popular Tools

Here’s a detailed look at the cost breakdown of popular financial analytics tools:

- Found: Free sign-up, no monthly account maintenance fees. Transactional fees apply for wires, instant transfers, and ATM transactions. Optional add-on bookkeeping software with Found Plus subscription.

- Tool B: Monthly subscription starting at $20. Additional charges for premium features.

- Tool C: One-time license fee of $500. Yearly support and maintenance fees at $100.

Each tool offers different pricing structures, catering to various business needs and budgets.

Value For Money: Roi And Long-term Savings

Investing in financial analytics tools can yield significant returns. Here are some key points:

- Time Savings: Automation in bookkeeping and tax calculations saves time, which can be redirected to other business activities.

- Cost Reduction: Consolidating banking, bookkeeping, and tax tools into one platform reduces the need for multiple subscriptions, leading to cost savings.

- Improved Accuracy: Real-time tax calculations and auto-categorization minimize errors, potentially saving money on corrections and penalties.

Overall, tools like Found provide value by integrating multiple financial functions, enhancing efficiency, and ensuring compliance.

Scalability And Flexibility In Pricing Plans

Scalability and flexibility are essential in pricing plans for growing businesses. Key aspects include:

- Found: Offers a free sign-up with no minimum balance requirement. Suitable for freelancers and small business owners. The optional Found Plus subscription provides additional features.

- Tool B: Multiple pricing tiers based on business size. Flexible monthly or annual payment options.

- Tool C: Customizable plans for enterprise solutions. Scalable based on user needs and business growth.

Choosing a tool with flexible pricing ensures it can grow with your business, avoiding the need for frequent changes or upgrades.

Pros And Cons Of Advanced Financial Analytics Tools

Advanced financial analytics tools are becoming crucial for businesses to stay competitive. These tools offer a variety of features that help in making informed decisions. However, they also come with some challenges.

Pros: Comprehensive Data Insights

Advanced financial analytics tools provide comprehensive data insights. They can process and analyze large datasets to uncover trends and patterns. This helps businesses to understand their financial health better. Using these tools, companies can identify areas where they can cut costs or invest more.

Pros: Enhanced Predictive Capabilities

These tools offer enhanced predictive capabilities. They use historical data to forecast future financial scenarios. This allows businesses to prepare for potential risks and opportunities. Predictive analytics can improve decision-making and strategic planning.

Pros: Real-time Monitoring And Alerts

Another significant advantage is real-time monitoring and alerts. These tools keep track of financial activities as they happen. If there are any irregularities, the system sends alerts immediately. This helps in preventing fraud and ensuring compliance.

Cons: High Initial Setup Costs

One of the downsides is the high initial setup costs. Implementing advanced financial analytics tools requires significant investment. This can be a barrier for small businesses or startups. The costs include purchasing the software, hardware, and training staff.

Cons: Complexity In Implementation

Another challenge is the complexity in implementation. These tools often require a steep learning curve. Companies need skilled professionals to manage and interpret the data. This can lead to additional costs and time for training.

Overall, while advanced financial analytics tools offer numerous benefits, they also come with certain challenges. Businesses need to weigh these pros and cons before making a decision.

Ideal Scenarios And Recommendations For Users

Advanced financial analytics can transform how businesses manage their finances. It helps large enterprises, small and medium-sized businesses, and various industries make data-driven decisions. Below are the ideal scenarios and recommendations for users considering advanced financial analytics.

Best Use Cases For Large Enterprises

Large enterprises can leverage advanced financial analytics to optimize their financial performance. Key use cases include:

- Cash Flow Management: Predict cash flow trends and manage liquidity efficiently.

- Risk Management: Identify and mitigate financial risks with real-time data.

- Budgeting and Forecasting: Enhance accuracy in budgeting and financial forecasts.

- Performance Analysis: Evaluate financial performance across different departments.

Benefits For Small And Medium-sized Businesses

Small and medium-sized businesses (SMBs) can gain several benefits from using advanced financial analytics:

- Cost Efficiency: Reduce operational costs with better financial insights.

- Improved Decision-Making: Make informed decisions with accurate financial data.

- Financial Planning: Plan future finances and investments effectively.

- Tax Management: Simplify tax calculations and compliance.

Industries That Can Benefit The Most

Advanced financial analytics is beneficial across various industries. Some of the key industries include:

- Retail: Optimize inventory and sales forecasting.

- Healthcare: Manage financial operations and reduce costs.

- Manufacturing: Improve production efficiency and cost management.

- Financial Services: Enhance risk assessment and compliance.

- Technology: Drive growth with better financial planning and analysis.

Recommendations For Selecting The Right Tool

Choosing the right financial analytics tool is crucial. Here are some recommendations:

- Identify Your Needs: Understand your business requirements and financial goals.

- Evaluate Features: Look for tools with comprehensive features like cash flow management, tax tools, and expense tracking.

- Consider User-Friendliness: Select a tool with an intuitive interface for ease of use.

- Check Integration: Ensure the tool integrates well with your existing systems.

- Assess Security: Choose a tool with robust security measures, such as data encryption and two-factor authentication.

For freelancers and small business owners, Found offers a complete financial management solution. It combines banking, bookkeeping, and tax tools in one platform. Visit Found for more information.

Frequently Asked Questions

What Is Advanced Financial Analytics?

Advanced financial analytics involves using complex algorithms and data models. It helps in predicting financial trends and making informed decisions.

Why Is Advanced Financial Analytics Important?

It provides deeper insights into financial data. This helps businesses make more accurate and strategic decisions.

How Does Advanced Financial Analytics Work?

It utilizes statistical models, machine learning, and big data. These tools analyze vast amounts of financial information for insights.

What Tools Are Used In Advanced Financial Analytics?

Common tools include Python, R, and specialized software like SAS. These tools help process and analyze financial data efficiently.

Conclusion

Advanced financial analytics can transform your business decision-making process. It offers insights and data-driven solutions. By leveraging these tools, you can optimize financial strategies. This can lead to better business outcomes. For freelancers and small business owners, managing finances efficiently is crucial. Consider using tools like Found for comprehensive financial management. Found simplifies banking, bookkeeping, and taxes. It helps you stay organized and compliant. With Found, you save time and effort, focusing more on growing your business. Embrace the power of advanced financial analytics today.