Square Online Payments: Simplify Your Business Transactions

Managing payments is crucial for any business. Square Online Payments makes this task easier.

Square offers a versatile platform to streamline operations and manage sales. Trusted by millions globally, it provides secure transactions and efficient team management. With features like POS systems, customer engagement tools, and advanced reporting, Square helps businesses thrive. Its tailored solutions cater to different industries like retail, restaurants, and beauty services. For more details, visit the official website here. Keep reading to learn how Square can transform your payment processes and boost your business efficiency.

Introduction To Square Online Payments

In today’s digital world, businesses need reliable and secure payment systems. Square Online Payments offers such a solution. This platform helps businesses of all sizes manage their sales and transactions effectively. It is a trusted choice for many businesses globally.

What Is Square Online Payments?

Square Online Payments is a part of the broader Square platform. It allows businesses to accept payments online securely and efficiently. The system integrates with various sales channels, providing flexibility and ease of use.

Purpose And Benefits For Businesses

The primary purpose of Square Online Payments is to streamline the payment process for businesses. Here are some key benefits:

- Secure Transactions: Ensures customer payments are processed safely.

- Versatile Sales Channels: Supports click and collect, online ordering, local delivery, and shipping options.

- Cash Flow Management: Offers instant transfers for a small fee or free next-business-day transfers.

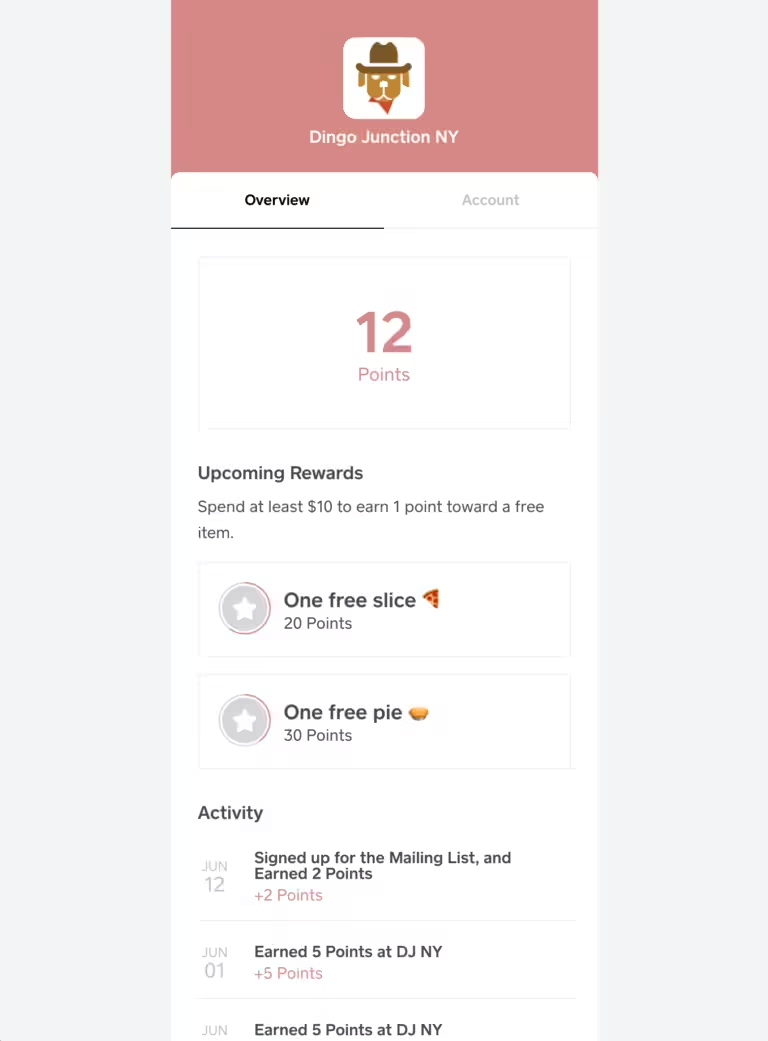

- Customer Engagement: Centralizes customer data to increase loyalty and value.

- Operational Efficiency: Helps manage and streamline operations across multiple locations and employees.

Square Online Payments not only improves payment processes but also enhances overall business efficiency. It supports various payment methods and integrates seamlessly with existing systems.

Table Of Key Features And Benefits

| Feature | Benefit |

|---|---|

| Secure Payments | Ensures safe transactions for customers. |

| Versatile Sales Channels | Supports multiple sales methods. |

| Cash Flow Management | Provides options for instant and next-day transfers. |

| Customer Engagement | Helps increase customer loyalty. |

| Operational Management | Streamlines operations across multiple locations. |

These features highlight the comprehensive nature of Square Online Payments. It is designed to meet the needs of modern businesses, providing the tools and support required to succeed.

Key Features Of Square Online Payments

Square Online Payments offers a robust platform for businesses to manage payments seamlessly. Here are the key features that make it a preferred choice for many:

Easy Integration With E-commerce Platforms

Square Online Payments integrates effortlessly with major e-commerce platforms like Shopify, WooCommerce, and BigCommerce. This ensures a smooth setup, allowing you to start accepting payments quickly. The integration process is user-friendly and requires minimal technical expertise.

Secure Payment Processing

Security is a top priority with Square Online Payments. It uses advanced encryption to safeguard transactions, ensuring the safety of both merchants and customers. Square complies with PCI DSS standards, providing peace of mind with every transaction.

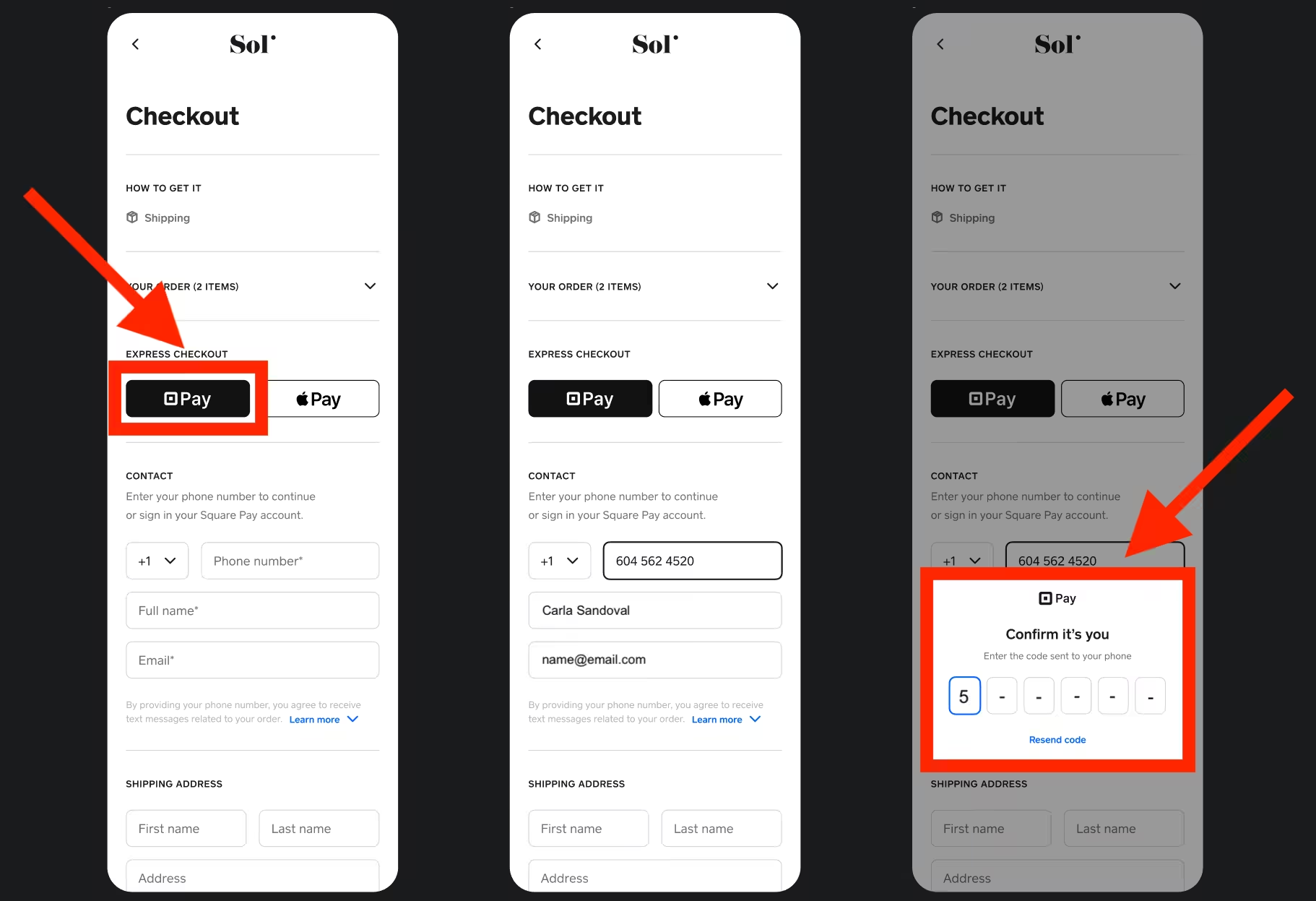

Multiple Payment Options

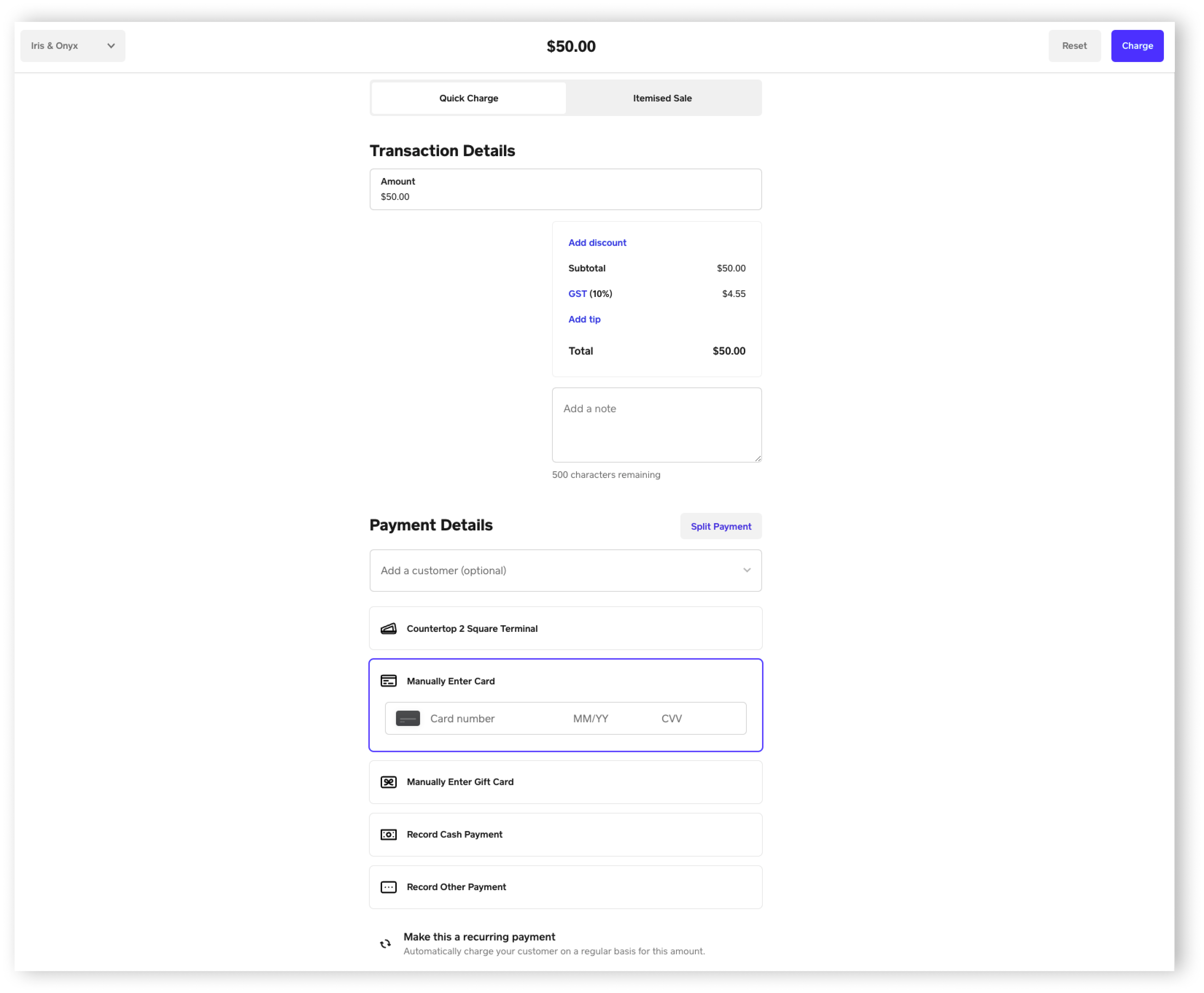

Square supports a wide range of payment methods, including credit and debit cards, digital wallets like Apple Pay and Google Pay, and even ACH bank transfers. This flexibility enables businesses to cater to different customer preferences, enhancing the overall shopping experience.

Real-time Analytics And Reporting

With Square Online Payments, you get access to real-time analytics and detailed reporting. The platform provides insights into sales performance, customer behavior, and transaction history. These insights help businesses make informed decisions and optimize their operations.

Mobile Payment Capabilities

Square’s mobile payment capabilities allow businesses to accept payments on the go. The Square Point of Sale app is compatible with iOS and Android devices, transforming your smartphone or tablet into a powerful payment terminal. This feature is perfect for businesses operating at events, markets, or on the move.

| Feature | Details |

|---|---|

| Easy Integration | Supports Shopify, WooCommerce, BigCommerce |

| Secure Processing | Advanced encryption, PCI DSS compliant |

| Payment Options | Credit/debit cards, Apple Pay, Google Pay, ACH transfers |

| Real-time Analytics | Insights on sales, customer behavior, transaction history |

| Mobile Payments | Compatible with iOS and Android, POS app available |

Square Online Payments provides a comprehensive solution for businesses to streamline their payment processes and enhance customer satisfaction.

Pricing And Affordability

Understanding the pricing and affordability of Square Online Payments is crucial for any business. Square offers transparent and competitive pricing plans, ensuring businesses of all sizes can manage their operations effectively. Below is a detailed look into Square’s pricing plans, transaction fees, and value for money.

Breakdown Of Pricing Plans

Square offers a variety of pricing plans tailored to different business needs. The plans include both hardware and software solutions to facilitate sales across various channels. Here’s a breakdown of the available pricing plans:

| Plan | Features | Cost |

|---|---|---|

| Basic | Basic POS and online payments | Free |

| Plus | Advanced POS, team management | $60/month |

| Premium | Custom solutions, advanced reporting | Custom Pricing |

Transaction Fees

Square has a straightforward transaction fee structure. This makes it easy for businesses to understand and manage their costs. Here’s a summary of the transaction fees:

- Card-present transactions: 2.6% + 10¢ per transaction

- Card-not-present transactions: 2.9% + 30¢ per transaction

- Instant transfers: 1.5% fee per transfer

- Next-business-day transfers: Free

Value For Money Comparison

Square provides significant value for money compared to other payment solutions. The competitive pricing, combined with robust features, makes Square a preferred choice for many businesses. Here’s a value comparison:

- Efficiency: Automates operations, saving time and resources.

- Growth: Supports new revenue streams with versatile sales channels.

- Data-Driven Decisions: Advanced reporting for better insights.

- Customer Loyalty: Enhances engagement with centralized data.

- Secure Transactions: Ensures secure payments across various channels.

With over 4 million sellers globally, Square’s trusted platform continues to support business growth and efficiency. For more information, visit Square’s official website.

Pros And Cons Of Using Square Online Payments

Square Online Payments offers a powerful platform for businesses to manage sales and transactions. Understanding its pros and cons can help you decide if it’s the right fit for your business needs.

Advantages Of Square Online Payments

- Secure Payments: Square ensures secure transactions for customers, no matter their location. This builds trust with your clients.

- Versatile Sales Channels: Supports various sales channels, including click and collect, online ordering, local delivery, and shipping. This flexibility caters to different business models.

- Instant and Free Transfers: Offers instant transfers for a small fee or free next-business-day transfers. This helps in managing cash flow efficiently.

- Comprehensive Hardware and POS Systems: Facilitates sales anywhere with its robust hardware and POS systems. This is ideal for businesses with physical and online stores.

- Operational Management: Helps manage operations across multiple locations and employees, streamlining your business processes.

- Customer Engagement: Centralized customer data and insights help in increasing customer loyalty and value.

- Advanced Reporting: Provides powerful data for confident decision-making. This is essential for strategic planning and growth.

- Revenue Diversification: Opens new revenue streams and helps manage inventory effectively. This supports business growth and sustainability.

Potential Drawbacks

- Transaction Fees: While the platform offers many features, transaction fees can add up, especially for small businesses.

- Complexity: The wide range of features can be overwhelming for new users. It may require a learning curve to fully utilize all the tools.

- Loan Terms: Loans are subject to approval, and there are specific terms and conditions. Minimum payments are required every 60 days, and full repayment is due within 18 months.

- Support Availability: While Square offers round-the-clock support, response times may vary, which can be a concern during critical times.

Overall, Square Online Payments provides a robust solution for managing sales and operations. Considering the advantages and potential drawbacks can help you determine if it aligns with your business goals.

Ideal Users And Scenarios

Square Online Payments offers a versatile solution for various business types. This includes small to medium-sized businesses, e-commerce stores, and service-based businesses. Explore how these user groups can benefit from Square’s features and functionalities.

Small To Medium-sized Businesses

Small to medium-sized businesses (SMBs) often face unique challenges. Square provides an all-in-one platform to help streamline operations and manage sales channels. Whether you run a retail store, restaurant, or beauty salon, Square’s custom-tailored suites cater to your specific needs.

- Hardware and POS Systems: Facilitate sales anywhere, from physical stores to outdoor markets.

- Operational Management: Manage multiple locations and employees with ease.

- Customer Engagement: Centralized customer data to enhance loyalty and value.

- Advanced Reporting: Make data-driven decisions for better business insights.

E-commerce Stores

Square is ideal for e-commerce stores looking to grow their online presence. It supports various sales channels and ensures secure transactions, no matter where your customers are located.

- Versatile Sales Channels: Supports click and collect, online ordering, local delivery, and shipping.

- Secure Payments: Ensures secure transactions, enhancing customer trust.

- Revenue Diversification: Open new revenue streams and manage inventory effectively.

- Custom Commerce Experiences: APIs and integrations for seamless operations.

Service-based Businesses

For service-based businesses, Square offers tools to manage appointments, optimize team shifts, and engage customers effectively.

- Team Management: Optimize team shifts and manage tasks securely.

- Customer Engagement: Use centralized data to increase loyalty and value.

- Cash Flow Management: Instant transfers for a small fee or free next-business-day transfers.

- Advanced Reporting: Provides powerful data for confident decision-making.

Frequently Asked Questions

What Is Square Online Payments?

Square Online Payments is a secure payment processing service. It allows businesses to accept payments online. It supports various payment methods, including credit cards and digital wallets.

How Does Square Online Payments Work?

Square Online Payments integrates with your website. Customers enter their payment details at checkout. The payment is processed securely, and funds are transferred to your account.

Is Square Online Payments Secure?

Yes, Square Online Payments is highly secure. It uses advanced encryption and fraud detection tools. These measures protect both businesses and customers from potential threats.

Can I Accept International Payments With Square?

Yes, you can accept international payments with Square. It supports multiple currencies and global payment methods. This makes it easy to sell to customers worldwide.

Conclusion

Square offers a robust platform to streamline business operations and secure payments. Its versatile sales channels and custom solutions make it ideal for various industries. Square’s efficient tools help manage teams, optimize cash flow, and enhance customer loyalty. Whether you need hardware, operational management, or advanced reporting, Square meets your needs. Trust by millions globally, Square is a reliable choice for your business. Discover more about Square’s offerings by visiting their official website.