Square Payment Security Features: Ultimate Protection for Your Business

Square Payment Security Features Square offers secure and versatile payment solutions for businesses. It ensures safe transactions, protecting both merchants and customers.

In today’s digital age, ensuring payment security is crucial for businesses. Square, a trusted name in the industry, provides robust security features that safeguard transactions. From secure hardware to advanced encryption, Square’s payment systems are designed to protect sensitive data. Whether you run a small retail shop or a large restaurant, understanding these security features can help you manage your business with peace of mind. Dive into the details of how Square keeps your transactions secure and learn why millions of businesses globally rely on it for their payment processing needs. Discover more about Square’s offerings by visiting their official site here.

Introduction To Square Payment Security Features

Ensuring payment security is crucial for any business. Square offers advanced security features to protect transactions and customer data. These features give peace of mind to business owners and customers alike.

What Is Square?

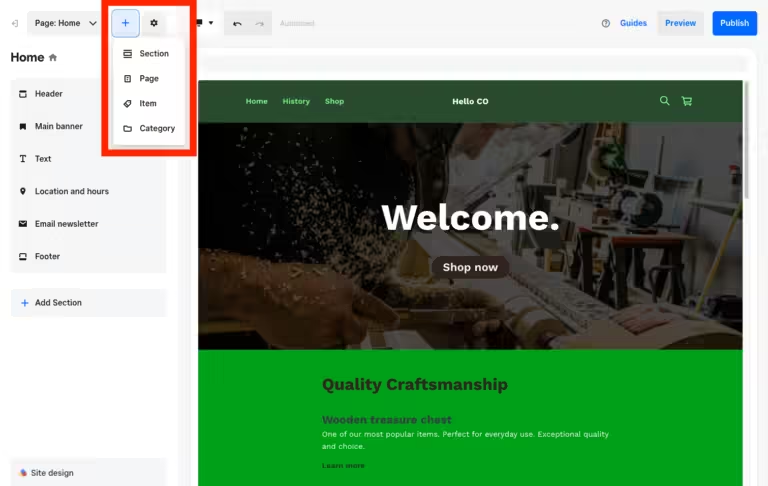

Square is a comprehensive software and hardware platform designed to streamline business operations. It automates tasks for efficiency and opens new revenue streams. Trusted by millions globally, Square supports various payment options including click and collect, online ordering, local delivery, and shipping.

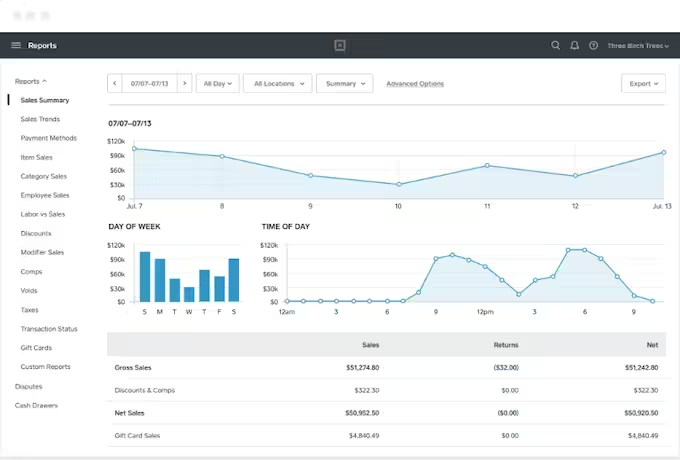

Square offers custom-tailored suites for restaurants, retail, and beauty businesses. It provides tools for operational management across multiple locations, sales channels, and employees. With advanced reporting, Square gives businesses the data needed for confident decision-making.

Purpose And Importance Of Payment Security

Payment security is essential in maintaining trust and protecting sensitive data. Square uses encryption and tokenization to secure transactions. This ensures that customer information is safe and reduces the risk of data breaches.

Secure payments support a variety of options. This includes hardware and POS systems designed to facilitate sales anywhere. With efficient cash flow management and team management features, businesses can optimize operations securely.

Square’s commitment to security is evident in its authorization by the Financial Conduct Authority. This provides an added layer of trust for users. With 24/7 support, Square ensures that businesses can always get help when needed.

End-to-end Encryption

End-to-End Encryption (E2EE) is a critical security feature of Square that ensures your payment data remains safe and secure throughout the entire transaction process. This means that from the moment a transaction is initiated to its completion, the data is protected from unauthorized access.

How It Works

Square’s End-to-End Encryption works by encrypting the payment information at the point of sale and keeping it encrypted until it reaches Square’s servers. This involves several steps:

- Data Encryption: When a customer swipes, dips, or taps their card, the payment data is immediately encrypted by the card reader.

- Secure Transmission: The encrypted data is transmitted over a secure network to Square’s servers.

- Decryption: Only Square’s secure servers can decrypt the data, ensuring that it remains protected at all times.

By following these steps, Square ensures that sensitive payment information is never exposed or vulnerable to interception during the transaction process.

Benefits Of End-to-end Encryption

Implementing End-to-End Encryption in Square offers numerous benefits, including:

- Enhanced Security: Protects sensitive payment data from cyber threats and unauthorized access.

- Customer Trust: Builds confidence among customers knowing their payment information is secure.

- Compliance: Helps businesses comply with industry standards and regulations for payment security.

- Reduced Fraud: Minimizes the risk of data breaches and fraudulent transactions.

End-to-End Encryption is a vital feature of Square, making it a reliable choice for secure payment processing.

Tokenization

Tokenization is a key security feature offered by Square. It ensures secure handling of sensitive payment information. This process converts sensitive data into a unique identifier called a token.

Definition Of Tokenization

Tokenization refers to the process of replacing sensitive payment details with a unique identifier, or token. This token has no exploitable value if breached. It can only be mapped back to the original data by Square’s secure systems.

Security Advantages Of Tokenization

Tokenization provides numerous security benefits. It minimizes the risk of sensitive data breaches. Here are the key advantages:

- Data Protection: Sensitive payment information is never stored on local devices. Only tokens are used for transactions.

- Reduced Fraud: Since tokens have no value outside Square’s system, they are useless to hackers.

- PCI Compliance: Tokenization helps businesses adhere to Payment Card Industry Data Security Standards (PCI DSS).

- Enhanced Security: Tokens are unique and cannot be reverse-engineered to retrieve original data.

Square’s tokenization system ensures that customer payment data is protected at all times. This makes transactions more secure and trustworthy for businesses and customers alike.

Pci Compliance

Ensuring payment security is crucial for any business. Square prioritizes protecting customer payment data by adhering to the Payment Card Industry Data Security Standard (PCI DSS). This compliance provides peace of mind to both businesses and their customers.

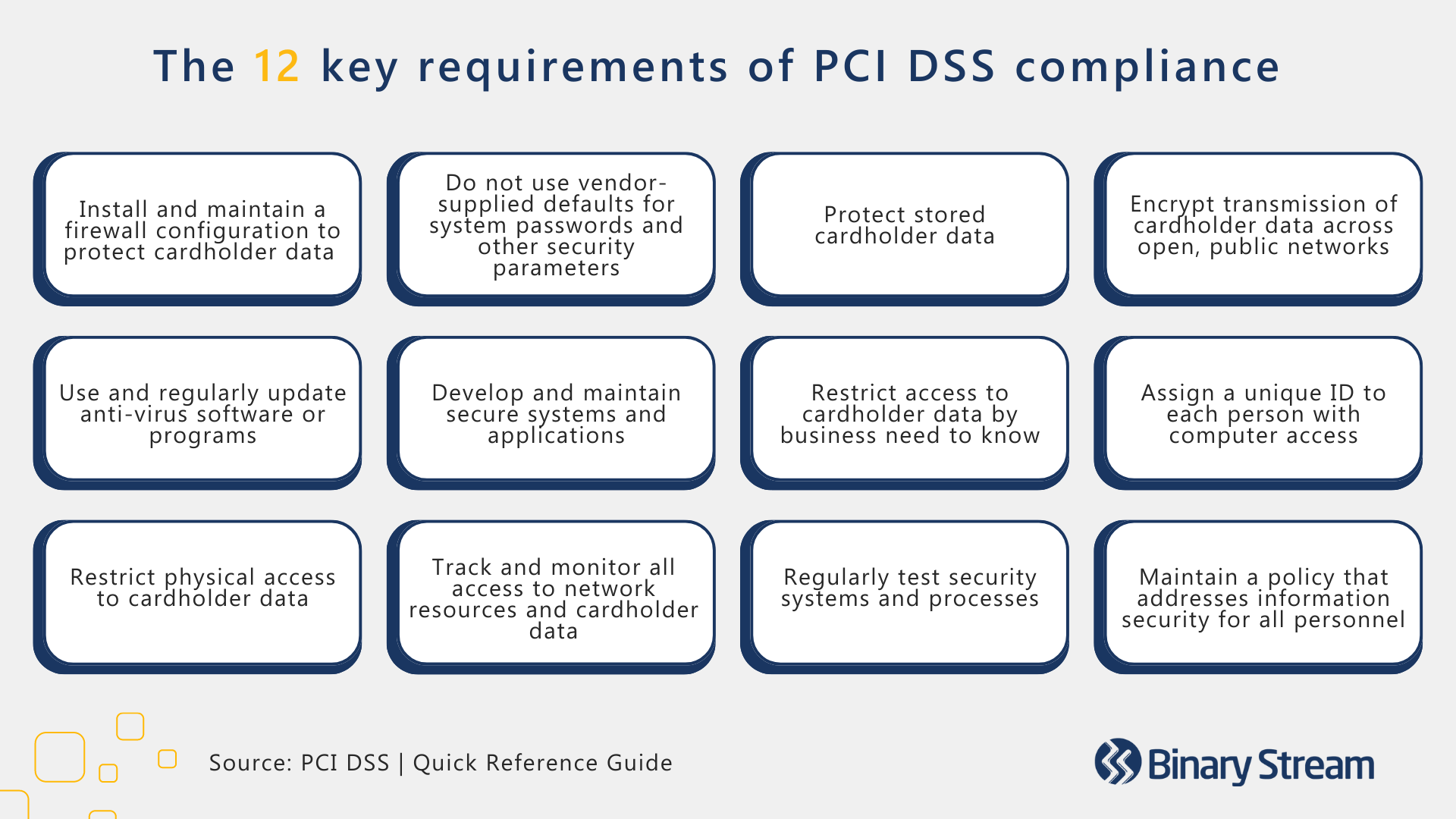

Understanding Pci Dss

PCI DSS is a set of security standards designed to ensure all companies that accept, process, store, or transmit credit card information maintain a secure environment. These standards are mandated by the major credit card companies and are essential for safeguarding sensitive cardholder data.

Businesses must follow 12 key requirements to comply with PCI DSS:

- Install and maintain a firewall to protect cardholder data.

- Do not use vendor-supplied defaults for system passwords and other security parameters.

- Protect stored cardholder data.

- Encrypt transmission of cardholder data across open, public networks.

- Use and regularly update anti-virus software.

- Develop and maintain secure systems and applications.

- Restrict access to cardholder data by business need-to-know.

- Assign a unique ID to each person with computer access.

- Restrict physical access to cardholder data.

- Track and monitor all access to network resources and cardholder data.

- Regularly test security systems and processes.

- Maintain a policy that addresses information security for all personnel.

Square’s Pci Compliance Measures

Square takes several measures to ensure compliance with PCI DSS, thereby securing customer payment data:

- Encryption: Square encrypts cardholder data during transmission and storage, protecting it from unauthorized access.

- Tokenization: Square uses tokenization to replace sensitive card information with a unique identifier, reducing the risk of data breaches.

- Regular Audits: Square conducts regular audits and assessments to ensure ongoing compliance with PCI DSS standards.

- Secure Infrastructure: Square maintains a secure infrastructure with firewalls, intrusion detection systems, and regularly updated anti-virus software.

- Employee Training: Square provides comprehensive training for employees on data security practices and PCI compliance requirements.

By implementing these measures, Square ensures that businesses can process payments securely and confidently. This commitment to security helps in building trust and loyalty among customers.

Fraud Detection And Prevention

Square offers robust fraud detection and prevention features to protect your business and customers. This section explores the advanced tools and real-time monitoring benefits provided by Square.

Advanced Fraud Detection Tools

Square uses advanced fraud detection tools to monitor transactions and prevent fraud. These tools analyze transaction patterns and flag suspicious activities. The system uses machine learning to improve detection accuracy over time.

- Analyzes transaction patterns

- Flags suspicious activities

- Machine learning improves accuracy

These tools help businesses stay one step ahead of potential fraudsters, ensuring every transaction is secure.

Real-time Monitoring Benefits

Square provides real-time monitoring of transactions. This feature allows businesses to detect and address fraudulent activities as they happen. Real-time alerts notify business owners of any suspicious transactions immediately.

Benefits of real-time monitoring include:

- Immediate detection of fraud

- Quick response to suspicious activities

- Enhanced security and peace of mind

With real-time monitoring, businesses can act swiftly to prevent financial losses and protect customer data.

Two-factor Authentication (2fa)

Security is a top priority for businesses, especially when handling payments. Square offers various security features, including Two-Factor Authentication (2FA), to protect your financial transactions. 2FA adds an extra layer of security to your account, ensuring that only authorized users can access sensitive information.

How 2fa Enhances Security

Two-Factor Authentication (2FA) significantly enhances security by requiring two forms of identification. This can be something you know, like a password, and something you have, like a phone. This dual-layer approach makes it much harder for unauthorized users to gain access.

| Factor | Description |

|---|---|

| Something You Know | Password or PIN |

| Something You Have | Phone or Hardware Token |

By combining these two factors, even if someone gets your password, they still need your phone to access your account. This makes it nearly impossible for unauthorized users to breach your security.

Implementing 2fa In Square

Implementing 2FA in Square is straightforward and adds a crucial layer of security. Follow these steps:

- Log in to your Square account.

- Go to the Security Settings.

- Select Two-Factor Authentication.

- Follow the prompts to link your phone number.

- Verify your phone with the code sent to you.

Once set up, you will receive a code on your phone each time you log in. Enter this code to gain access to your account. This ensures that only you can access your Square account, even if someone knows your password.

By implementing 2FA, you protect your business from unauthorized access. This keeps your financial data secure and builds trust with your customers.

Secure Data Storage

Square takes secure data storage seriously, ensuring your business and customer data is protected. They implement several robust security measures to safeguard sensitive information, both in transit and at rest.

Cloud Security Measures

Square leverages advanced cloud security measures to protect stored data. These measures include:

- Regular Security Audits: Frequent audits to ensure the highest security standards.

- Access Control: Strict controls to limit data access to authorized personnel only.

- Redundant Storage: Data is stored in multiple locations to prevent loss.

- Monitoring and Logging: Continuous monitoring and logging for suspicious activities.

These cloud security measures ensure that your data is always safe and accessible.

Data Encryption At Rest

Square uses data encryption at rest to protect stored data. This means that:

- Data is encrypted using industry-standard algorithms.

- Only authorized applications can decrypt and access the data.

- Encryption keys are managed securely, ensuring robust protection.

This encryption ensures that even if unauthorized access occurs, the data remains unreadable and secure.

Square’s commitment to secure data storage ensures that your business and customer information is always protected.

User Access Controls

Square ensures top-notch security by implementing robust User Access Controls. These controls are designed to safeguard sensitive data and streamline operations. By managing who can access what, businesses can protect themselves from unauthorized access and potential breaches.

Role-based Access Control

With Role-Based Access Control (RBAC), Square allows business owners to define roles and assign permissions accordingly. This means employees only access the information they need to perform their duties. RBAC helps in minimizing risks and maintaining data integrity.

For example, a cashier may only access the sales module, while a manager can view sales reports and customer data. This segregation of duties ensures that sensitive data remains protected and only accessible by authorized personnel.

| Role | Access Level |

|---|---|

| Cashier | Sales Module |

| Manager | Sales Reports, Customer Data |

| Admin | Full Access |

Benefits Of Restricting Access

Restricting access through RBAC brings numerous benefits. It enhances security by limiting exposure to sensitive information. This reduces the risk of data breaches.

Additionally, it improves operational efficiency. Employees focus on their roles without distractions. It also aids in compliance with data protection regulations, ensuring that only authorized personnel handle sensitive data.

- Enhanced Security: Protects sensitive data.

- Operational Efficiency: Employees focus on their specific tasks.

- Regulatory Compliance: Meets data protection standards.

By implementing User Access Controls, businesses using Square can operate more securely and efficiently. This feature is part of Square’s commitment to providing a secure and reliable platform for businesses of all sizes.

Pricing And Affordability

Square offers a range of security features that are designed to keep your transactions safe. Understanding the cost and value of these features is crucial for businesses. This section will detail the pricing and affordability of Square’s payment security features.

Cost Of Security Features

Square provides a variety of security features at competitive rates. Here’s a breakdown of the costs:

- Instant Transfers: A small fee applies for immediate cash outs; however, next-business-day transfers are free.

- Hardware and POS Systems: The cost varies based on the specific hardware and POS systems chosen. These are designed to facilitate secure sales anywhere.

- Custom-Tailored Suites: Available for different business types such as restaurants, retail, and beauty businesses. Pricing is customized based on the suite and the business needs.

These security features ensure that your business transactions remain secure without breaking the bank.

Value For Money Analysis

Square’s security features offer excellent value for money. Here’s why:

- Comprehensive Security: Square’s payment options, including click and collect, online ordering, local delivery, and shipping, are all secured.

- Efficient Cash Flow Management: With instant transfers available for a small fee and free next-business-day transfers, managing cash flow becomes more straightforward.

- 24/7 Support: Round-the-clock support ensures that any issues are resolved promptly, adding to the overall value.

Square’s pricing structure is designed to be affordable while delivering robust security features. This balance makes it a valuable choice for businesses looking for secure and cost-effective payment solutions.

For more detailed information on Square’s pricing and features, you can visit the Square website.

Frequently Asked Questions

What Are Square’s Key Payment Security Features?

Square’s key payment security features include encryption, tokenization, and fraud detection. These ensure safe transactions. Encryption protects data during transmission. Tokenization replaces card details with a unique identifier. Fraud detection tools monitor transactions for suspicious activity.

How Does Square Ensure Data Encryption?

Square ensures data encryption by using advanced security protocols. This protects sensitive information during transmission. All data is encrypted at the point of entry. This means your information is safe from hackers.

What Is Tokenization In Square Payments?

Tokenization in Square payments replaces sensitive card details with a unique identifier. This ensures that actual card data is never stored on devices. It adds an extra layer of security for every transaction.

How Does Square Detect Fraudulent Transactions?

Square detects fraudulent transactions using machine learning algorithms. These algorithms analyze transaction patterns for suspicious activity. The system flags and investigates potential fraud. This helps protect both businesses and customers from unauthorized transactions.

Conclusion

Square offers robust security features for seamless and safe transactions. Businesses can confidently accept payments knowing their data is protected. Square’s advanced tools help streamline operations and boost efficiency. Start using Square today and experience secure, reliable payment solutions. Explore more about Square here.