Square For Freelancers: Streamline Your Payments Effortlessly

Freelancers need efficient tools to manage their business. Square offers just that.

Square is a comprehensive platform designed to simplify business operations and boost revenue. It caters to various industries, including retail, restaurants, and beauty services. Freelancers can benefit from Square’s secure payment options, hardware and POS systems, and advanced management tools. With features like instant cash transfers, team management, and powerful data analytics, Square ensures you spend less time managing finances and more time growing your business. Whether you work from home or on the go, Square provides the flexibility to accept payments anywhere. Discover how Square can streamline your freelance business and enhance your financial management. Learn more about Square Business Solutions by visiting their official site: Square.

Introduction To Square For Freelancers

Square offers a versatile platform catering to the needs of freelancers. It combines efficient sales, secure payments, and advanced management tools. This section will guide you through the basics of Square, its benefits, and why it’s essential for freelancers.

What Is Square?

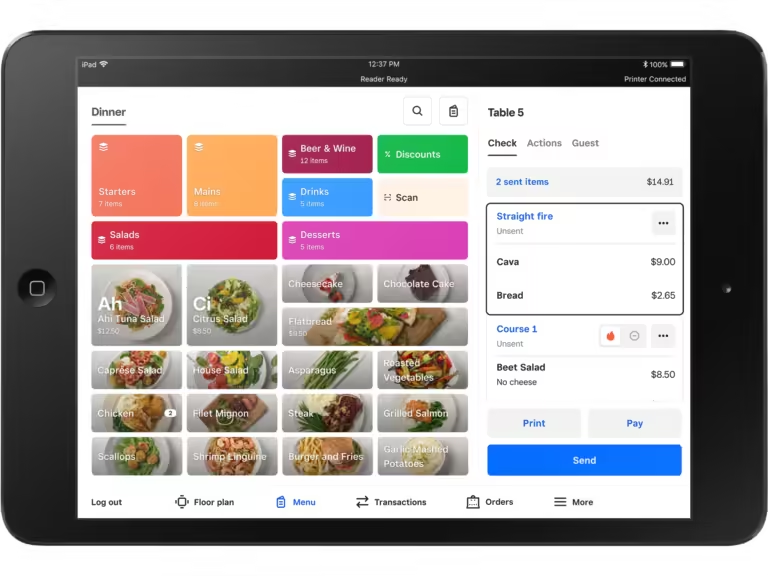

Square is a comprehensive software and hardware platform. It streamlines business operations and enhances revenue streams. Trusted by millions globally, Square facilitates efficient sales and secure payments. It offers advanced management tools across various industries including restaurants, retail, and beauty services.

Some of the main features of Square include:

- Hardware and POS Systems: Designed to facilitate sales anywhere.

- Payment Options: Secure payments, click and collect, online ordering, local delivery, and shipping.

- Custom-tailored Product Suites: Specific solutions for restaurants, retail, and beauty businesses.

- Operational Management: Tools to manage and streamline operations across multiple locations, sales channels, and employees.

- Cash Flow Management: Instant transfers for a small fee or free next-business-day transfers.

- Team Management: Optimized shift scheduling and secure team management.

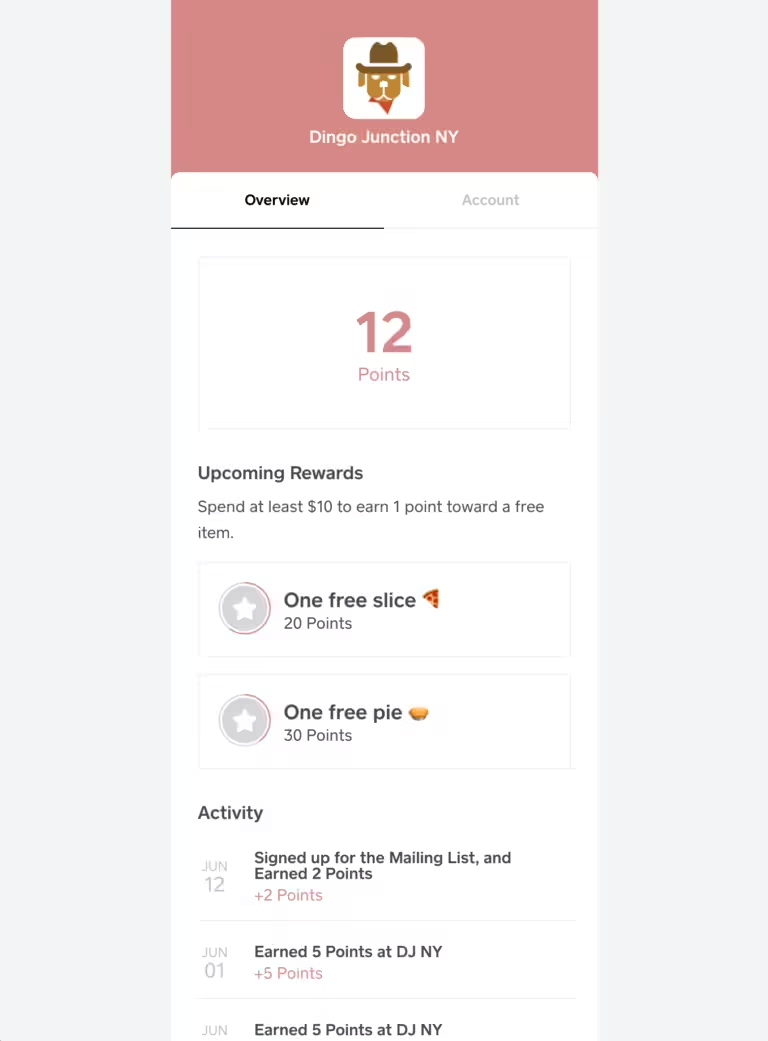

- Customer Engagement: Centralized customer data and insights to increase loyalty and value.

- Advanced Reporting: Powerful data analytics to support confident decision-making.

- Revenue Diversification: New revenue streams, inventory management, and online order capabilities.

- Custom Commerce Experiences: APIs for payments, commerce, customers, staff, and merchants.

Why Freelancers Need Square

Freelancers often juggle multiple roles. They manage sales, payments, and customer interactions. Square simplifies these tasks, allowing freelancers to focus on their core work. Here are some reasons why freelancers need Square:

- Efficiency: Automates business processes to save time and improve efficiency.

- Flexibility: Enables freelancers to sell and accept payments anywhere.

- Customer Retention: Enhanced customer engagement and loyalty through data insights.

- Scalability: Supports freelancers and small businesses alike.

- Financial Management: Easy cash flow management with instant and next-day transfers.

- Team Optimization: Streamlined team management and shift scheduling.

- Data-Driven Decisions: Advanced reporting features for insightful business decisions.

By using Square, freelancers can streamline their operations, manage payments effectively, and gain valuable insights into their business. This allows them to grow and succeed in their respective fields.

Key Features Of Square For Freelancers

Square offers a range of tools to help freelancers manage their business efficiently. From invoicing to expense tracking, Square provides solutions to ensure seamless financial management. Let’s explore the key features that make Square an ideal choice for freelancers.

Square simplifies the invoicing process for freelancers. Creating and sending invoices takes only a few clicks. You can customize your invoices with your logo and colors. Square also allows you to set automatic reminders for unpaid invoices. This ensures you get paid on time without any hassle.

Accepting payments is easy with Square. Freelancers can accept credit cards, debit cards, and digital wallets. Payments are processed securely, and funds are transferred quickly. Choose between instant transfers for a small fee or free next-business-day transfers. This flexibility helps manage cash flow effectively.

Keeping track of expenses is crucial for freelancers. Square provides tools to categorize and monitor all business expenses. You can upload receipts and attach them to specific transactions. This feature simplifies tax preparation and ensures accurate financial records.

Square offers advanced financial reporting features. Freelancers can generate detailed reports on income, expenses, and profits. Customizable reports help in understanding business performance and making informed decisions. Use these insights to optimize your business strategy.

Manage your business on the go with the Square mobile app. The app allows you to send invoices, accept payments, and track expenses from your smartphone. It provides real-time updates on your financial transactions. This ensures you stay connected with your business anytime, anywhere.

Easy Invoicing

Square offers freelancers an efficient way to manage their invoicing needs. This easy-to-use platform helps streamline the billing process, ensuring you get paid on time. With Square, you can create, send, and track invoices with just a few clicks. Let’s explore its features in detail.

Customizable Invoices

Square’s invoicing system allows you to create customizable invoices that reflect your brand. You can add your logo, choose the color scheme, and include personalized messages. Here’s a quick overview:

- Add your logo and brand colors.

- Include custom messages for a personal touch.

- Itemize services with descriptions and prices.

| Feature | Benefit |

|---|---|

| Custom Logo | Enhances brand recognition |

| Color Scheme | Maintains brand consistency |

| Personal Messages | Improves client relationships |

Automated Reminders

Square helps you ensure timely payments with automated reminders. This feature sends reminders to clients who have not yet paid, reducing the need for manual follow-ups. Key benefits include:

- Saves time with automatic follow-ups.

- Increases the likelihood of timely payments.

- Reduces the stress of chasing payments.

Set up reminders to be sent at intervals that suit your needs. This proactive approach keeps your cash flow steady and your business running smoothly.

Client Management

With Square, managing clients becomes a breeze. The client management feature keeps all client information in one place, making it easy to access and update. Here are some advantages:

- Store client contact details securely.

- Track invoice history and payment status.

- Send personalized communications based on client data.

Having a centralized client database helps you provide better service and maintain strong relationships. Square ensures you have all the tools needed to manage your freelance business effectively.

Seamless Payment Processing

Square offers freelancers a seamless payment processing experience. It provides a robust platform to manage payments efficiently and securely. From accepting various payment methods to ensuring swift deposits, Square covers all bases.

Multiple Payment Methods

Square allows freelancers to accept multiple payment methods, enhancing convenience for clients. You can process payments via:

- Credit and Debit Cards

- Mobile Payments (Apple Pay, Google Pay)

- Online Invoices

- eChecks

This flexibility ensures you never miss a payment, no matter the client’s preference.

Instant Deposits

Square offers the option for instant deposits for a small fee. This feature is vital for freelancers who need immediate access to funds. Alternatively, you can opt for free next-business-day transfers, ensuring you always have cash flow when needed.

| Deposit Type | Fee | Availability |

|---|---|---|

| Instant Deposit | Small Fee | Immediate |

| Next-Business-Day Transfer | Free | Next Business Day |

This flexibility provides peace of mind, knowing your earnings are always accessible.

Recurring Payments

Square simplifies the process of setting up recurring payments. This feature is essential for freelancers with subscription-based services or ongoing projects. You can automate invoices and ensure timely payments without manual intervention. Here’s how it works:

- Create a recurring invoice.

- Set the frequency (weekly, monthly, etc.).

- Send the invoice to your client.

- Get paid automatically.

This automation saves time and reduces the hassle of chasing payments. With Square, managing your finances becomes a breeze.

Expense Tracking

As a freelancer, keeping track of expenses is crucial. Square makes this process seamless and efficient. With Square for Freelancers, you can manage your expenses effortlessly. This feature helps you stay organized and prepared for tax season.

Receipt Capture

One of the standout features is Receipt Capture. You can snap a photo of your receipts and upload them directly to the Square app. This eliminates the need for paper receipts and reduces clutter.

Here’s a simple process to capture receipts:

- Open the Square app.

- Navigate to the expense section.

- Use the camera feature to take a photo of your receipt.

- Save and categorize the receipt.

Categorized Expenses

Square allows you to categorize your expenses. This helps in understanding where your money goes. You can create custom categories that fit your business needs. This ensures every expense is accounted for and makes financial tracking easier.

Categories you might use include:

- Office Supplies

- Travel Expenses

- Software Subscriptions

- Client Meetings

Tax Preparation

Tax season can be stressful, but Square simplifies it. With organized and categorized expenses, preparing your taxes becomes straightforward. Square generates reports that you can use or provide to your accountant. This saves time and reduces errors.

Key benefits include:

- Consolidated expense reports

- Accurate and up-to-date financial data

- Easy export of financial information

Square for Freelancers ensures you are always ready for tax season.

Financial Reporting

Freelancers need precise financial reporting to manage their business effectively. Square offers tools that help freelancers keep track of their finances and make informed decisions. Let’s dive into the financial reporting features provided by Square.

Detailed Reports

Square provides comprehensive and detailed reports that allow freelancers to monitor their business activities. These reports cover various aspects of the business, including sales, expenses, and customer transactions. Freelancers can easily generate these reports on demand, ensuring they always have up-to-date information.

Key features:

- Sales summary reports

- Expense tracking

- Customer purchase history

Cash Flow Management

Managing cash flow is crucial for freelancers to maintain their financial stability. Square offers tools that help freelancers track their incoming and outgoing funds. With options for instant transfers for a small fee or free next-business-day transfers, freelancers can manage their cash flow efficiently.

| Transfer Type | Fee |

|---|---|

| Instant Transfer | Small Fee |

| Next-Business-Day Transfer | Free |

Profit And Loss Statements

Understanding the profitability of their business is essential for freelancers. Square enables freelancers to generate profit and loss statements, which provide a clear picture of their financial performance. These statements help freelancers assess their revenue and expenses to determine their net profit.

With these financial reporting tools, freelancers can focus on growing their business while maintaining a clear understanding of their financial health.

Mobile App Accessibility

Square’s mobile app accessibility ensures that freelancers can manage their business operations seamlessly, even while on the move. The app empowers users with several key features, allowing for efficient financial management directly from their mobile devices.

On-the-go Invoicing

Freelancers can create and send invoices through Square’s mobile app. This feature eliminates the need for a desktop computer, making it convenient for those always on the move. The app allows users to customize invoices with their branding and track their status in real-time.

With Square, freelancers can:

- Generate professional invoices swiftly.

- Include details such as item descriptions and prices.

- Send invoices via email or SMS directly from the app.

On-the-go invoicing ensures timely billing and payments, enhancing cash flow management.

Real-time Notifications

The mobile app sends real-time notifications for various activities, keeping freelancers informed about their business status. These notifications can include:

- Payment confirmations

- Invoice views and payments

- Account updates

Real-time notifications help freelancers stay updated and respond quickly to any business needs.

Mobile Payment Acceptance

Square’s mobile app supports mobile payment acceptance, enabling freelancers to receive payments anywhere. This feature is crucial for those who meet clients in different locations or offer services on-site.

Key functionalities include:

- Accepting credit and debit card payments.

- Processing payments securely.

- Providing digital receipts to clients.

Mobile payment acceptance through Square ensures secure and flexible payment options for freelancers.

Pricing And Affordability

Square offers a range of affordable solutions for freelancers. Understanding the pricing structure is crucial. This section breaks down the costs associated with using Square, ensuring freelancers make informed decisions.

Subscription Plans

Square provides various subscription plans tailored to different business needs. Here’s a quick overview:

| Plan | Features | Cost |

|---|---|---|

| Free Plan | Basic POS features, secure payments, and online ordering | $0/month |

| Plus Plan | Advanced POS features, team management, and customer engagement | $29/month |

| Premium Plan | All features plus custom solutions and dedicated support | Custom pricing |

Transaction Fees

Square charges transaction fees based on the type of payment:

- In-Person Payments: 2.6% + 10¢ per transaction

- Online Payments: 2.9% + 30¢ per transaction

- Invoice Payments: 2.9% + 30¢ per transaction

These fees are competitive and transparent, ensuring freelancers know what to expect.

Cost-effectiveness For Freelancers

For freelancers, cost-effectiveness is a key consideration. Square’s pricing structure is designed with affordability in mind. Here are some reasons why:

- No Hidden Fees: Transparent pricing with no surprise charges.

- Flexible Plans: Options to scale as your business grows.

- Instant Transfers: Small fee for instant transfers, or free next-business-day transfers.

Square’s solutions are comprehensive yet affordable. This balance makes it an excellent choice for freelancers aiming to manage their finances effectively.

Pros And Cons Of Square For Freelancers

Square offers a range of tools for freelancers. These tools simplify payment processes and streamline operations. Below, we explore the pros and cons of using Square.

Pros

- Ease of Use: Square is easy to set up and use. Freelancers can start accepting payments quickly.

- Flexibility: Accept payments anywhere with Square’s POS systems and hardware. This is ideal for freelancers who work on-the-go.

- Secure Payments: Offers secure payment options, including credit cards and online payments. This ensures peace of mind for both freelancers and clients.

- Instant Transfers: Provides instant transfers for a small fee. Freelancers can also choose free next-business-day transfers.

- Advanced Reporting: Access to powerful data analytics. Helps freelancers make informed business decisions.

- Customer Engagement: Centralized customer data and insights. This can increase client loyalty and value.

Cons

- Transaction Fees: Square charges transaction fees. These fees can add up over time for freelancers with many transactions.

- Limited Customization: While versatile, Square may lack deep customization for some specific needs. Freelancers might need additional tools.

- Loan Repayment Terms: Loans are subject to approval and must be repaid within 18 months. This might be restrictive for some freelancers.

Overall, Square offers many benefits for freelancers. However, it is important to weigh these against potential drawbacks.

Specific Recommendations For Ideal Users

Square offers a range of tools and services tailored to various types of freelancers. Its comprehensive platform makes it easy to manage sales, payments, and operations efficiently. Below are specific recommendations for ideal users of Square.

Freelancers In Creative Industries

Creative freelancers such as graphic designers, photographers, and writers benefit greatly from Square’s features. The secure payment options ensure you get paid on time. Whether you’re selling prints online or invoicing for a design project, Square’s custom-tailored product suites offer flexibility.

- Invoicing and Payments: Send professional invoices and accept multiple payment methods.

- Client Management: Use centralized customer data to maintain strong client relationships.

- Advanced Reporting: Keep track of your earnings and expenses with powerful analytics.

Consultants And Coaches

Consultants and coaches need efficient tools to manage appointments, payments, and client data. Square’s operational management tools help streamline these processes. Team management features are also beneficial for those with support staff.

| Feature | Benefit |

|---|---|

| Appointment Scheduling | Simplifies the booking process for clients and reduces no-shows. |

| Instant Transfers | Manage cash flow with immediate access to funds for a small fee. |

| Customer Insights | Helps improve client engagement and loyalty through data-driven insights. |

Service-based Freelancers

Service-based freelancers like plumbers, electricians, and home cleaners can utilize Square to manage their operations smoothly. The POS systems facilitate easy payments on-site, while the advanced reporting tools help in tracking service efficiency.

- Mobile Payments: Accept payments anywhere with mobile POS systems.

- Efficient Scheduling: Organize your work calendar and team shifts effectively.

- Revenue Diversification: Add new revenue streams by offering online services or products.

Overall, Square’s versatile and robust platform is designed to meet the unique needs of different freelance professions.

Frequently Asked Questions

What Is Square For Freelancers?

Square for freelancers is a comprehensive tool that helps manage payments, invoicing, and financial tracking. It’s designed specifically for independent contractors and small business owners.

How Does Square Benefit Freelancers?

Square benefits freelancers by streamlining payment processing, offering easy invoicing, and providing detailed financial reports. It simplifies financial management.

Is Square Easy To Use For Freelancers?

Yes, Square is user-friendly and intuitive, making it easy for freelancers to manage their finances. It requires minimal setup.

Can Freelancers Use Square For Invoicing?

Yes, freelancers can use Square to create and send professional invoices. It also tracks payments and manages client billing.

Conclusion

Square is an excellent solution for freelancers. It simplifies payment processes and business management. With Square, you can handle payments securely and manage operations efficiently. Its tools help you stay organized and boost productivity. For more details, visit Square’s official website here. Embrace the ease and reliability that Square offers. Start enhancing your freelancing business today!