Square Credit Card Reader: Revolutionizing Small Business Payments

In the fast-paced world of business, efficient payment processing is crucial. The Square Credit Card Reader offers a reliable solution for secure and seamless transactions.

Square provides businesses with an all-in-one platform that enhances operations and boosts efficiency. From secure payments to advanced reporting, Square’s features cater to various business needs. Whether you run a restaurant, retail shop, or beauty salon, Square helps streamline your operations and manage your team effectively. With instant transfers and customized loan offers, Square also supports financial flexibility. Learn how the Square Credit Card Reader can transform your business operations and drive growth. For more information, visit the Square website.

Introduction To Square Credit Card Reader

The Square Credit Card Reader is an essential tool for small businesses. It allows them to accept payments quickly and securely. This device helps streamline business operations and improves efficiency.

What Is Square Credit Card Reader?

The Square Credit Card Reader is a compact device. It connects to your smartphone or tablet. This allows you to accept credit card payments on the go. The reader is part of the Square platform, which offers software and hardware solutions for businesses.

| Features | Description |

|---|---|

| Hardware and POS Systems | Seamless selling anywhere |

| Secure Payments | Accept payments securely from anywhere |

| Order Management | Options for click and collect, online ordering, local delivery, and shipping |

| Custom-Tailored Suites | Specific solutions for restaurants, retail, and beauty businesses |

Purpose And Importance For Small Businesses

For small businesses, the Square Credit Card Reader is invaluable. Here are a few reasons why:

- Instant Transfers: Get your funds in minutes for a small fee.

- Operational Efficiency: Streamline team management and operations.

- Customer Loyalty: Increase customer loyalty with centralized data.

- Revenue Growth: Diversify income streams and improve profit margins.

Using Square, small businesses can manage payments, inventory, and customer data. They can also create branded websites and sync inventory with their POS system. This integration helps in making data-driven decisions, thus boosting efficiency and growth.

For more information, visit Square’s official website.

Key Features Of Square Credit Card Reader

The Square Credit Card Reader is a powerful tool for businesses. It offers a range of features designed to simplify transactions and enhance efficiency. Below are the key features that make the Square Credit Card Reader a popular choice among business owners.

Ease Of Use And Quick Setup

Setting up the Square Credit Card Reader is simple and fast. The device connects easily to your smartphone or tablet. Follow the straightforward instructions to start accepting payments within minutes. No technical expertise is required, making it accessible for everyone.

Compatibility With Devices

The Square Credit Card Reader works with most smartphones and tablets. It is compatible with both iOS and Android devices. This versatility ensures that you can use it with the devices you already own.

Security Features

Security is a top priority for Square. The Square Credit Card Reader uses advanced encryption to protect customer data. This ensures that all transactions are secure and your customers can trust your business. Additionally, Square complies with industry standards for payment security.

Offline Mode

The Square Credit Card Reader offers an offline mode feature. This allows you to accept payments even when there is no internet connection. The transactions will automatically process once you are back online. This feature ensures that you never miss a sale.

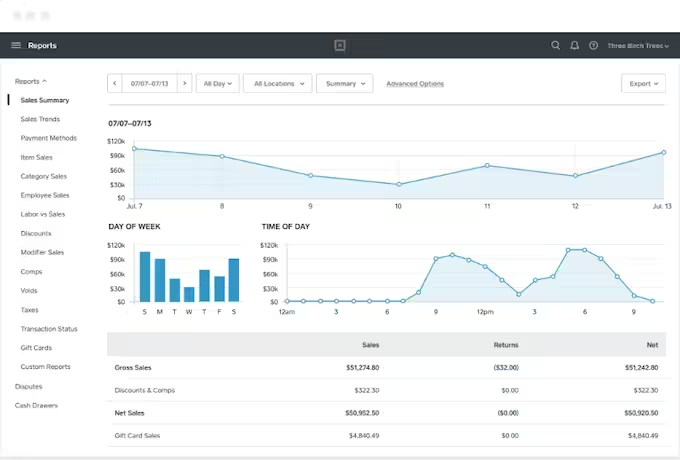

Analytics And Reporting

Square provides detailed analytics and reporting tools. These tools help you track your sales and understand your business performance. You can generate reports on sales trends, customer insights, and inventory management. The data-driven insights assist in making informed business decisions.

Pricing And Affordability

Understanding the pricing and affordability of the Square credit card reader is essential. Square offers a balance between cost and functionality, making it a popular choice for businesses of all sizes.

Cost Of The Device

The Square credit card reader is an affordable solution for businesses. The initial cost of the device is low, making it accessible for startups and small enterprises. Below is a table summarizing the costs:

| Device | Price |

|---|---|

| Square Reader for magstripe (with headset jack) | Free |

| Square Reader for magstripe (with Lightning connector) | $10 |

| Square Reader for contactless and chip | $49 |

| Square Stand for contactless and chip | $199 |

Transaction Fees

Square charges transaction fees for each payment processed. These fees are straightforward and easy to understand:

- Swipe, Dip, or Tap Transactions: 2.6% + 10¢ per transaction

- Keyed Transactions: 3.5% + 15¢ per transaction

- Online Transactions: 2.9% + 30¢ per transaction

These fees are competitive and align with industry standards.

Comparison With Competitors

Square’s pricing is competitive compared to other credit card readers. Here’s a comparison:

| Provider | Device Cost | Transaction Fees |

|---|---|---|

| Square | $0 – $199 | 2.6% + 10¢ |

| PayPal Here | $24.99 – $79.99 | 2.7% |

| Shopify POS | $49 | 2.7% + 0¢ |

| SumUp | $19 – $59 | 2.65% |

Value For Money

Square offers excellent value for money. The low cost of the device and competitive transaction fees make it an attractive option. It also provides robust features such as:

- Secure payments

- Order management

- Team management

- Customer insights

- Advanced reporting

These features enhance operational efficiency and support business growth. Square’s value is evident through its global trust and extensive user base.

Pros And Cons Of Square Credit Card Reader

The Square Credit Card Reader is a popular choice for small businesses. It offers many benefits but also has some limitations. Below, we explore the key advantages and drawbacks based on real-world usage.

Advantages Based On Real-world Usage

Square provides a comprehensive platform for business operations. The credit card reader is a standout feature, particularly for the following reasons:

- Ease of Use: The setup process is simple and quick, making it accessible for non-tech-savvy users.

- Secure Payments: Payments are processed securely, ensuring customer trust.

- Instant Transfers: Offers instant cash out for a small fee, with funds available in minutes.

- Custom-Tailored Suites: Solutions for different business types, such as restaurants and retail.

- Advanced Reporting: Detailed reports help in making informed business decisions.

Real-world users appreciate the hardware and POS systems designed for seamless selling anywhere. The options for order management including online ordering and local delivery are also highly valued.

Drawbacks And Limitations

While the Square Credit Card Reader offers many advantages, there are some limitations:

- Fees: Instant transfers come with a fee, which can add up for frequent users.

- Loan Terms: Custom loan offers have specific terms and conditions, requiring careful review.

- Support: No specific refund or return policies are mentioned, which may cause concerns.

- Integration: Though integration is easy, it may require technical knowledge for API use.

Users have noted that while customized loan offers can be beneficial, the terms need to be considered. Additionally, the lack of clear refund or return policies can be a drawback for some businesses.

For more details on the Square Credit Card Reader, visit the official Square website.

Recommendations For Ideal Users

The Square Credit Card Reader offers a versatile solution for many business types. Its user-friendly design and comprehensive features make it ideal for various scenarios and industries. Understanding who benefits most from this tool can help you decide if it’s the right fit for your business.

Best Scenarios For Using Square Credit Card Reader

The Square Credit Card Reader excels in several scenarios:

- Mobile Businesses: Ideal for food trucks, pop-up shops, and market stalls.

- Events and Festivals: Perfect for temporary setups needing quick and secure transactions.

- Service Providers: Great for freelancers, consultants, and home service providers needing on-the-go payment solutions.

Industries And Business Types That Benefit Most

The Square Credit Card Reader is particularly beneficial for the following industries:

| Industry | Benefits |

|---|---|

| Retail | Seamless POS integration and inventory management. |

| Restaurants | Custom solutions for order management and delivery. |

| Beauty and Wellness | Streamlined appointment scheduling and customer management. |

Tips For Maximizing Benefits

To get the most out of your Square Credit Card Reader:

- Leverage Advanced Reporting: Use in-depth data to make informed decisions.

- Integrate with Existing Systems: Utilize API integrations for seamless operations.

- Optimize Team Management: Manage shifts and staff efficiently with built-in tools.

- Encourage Customer Loyalty: Use centralized data to boost repeat business.

Frequently Asked Questions

What Is A Square Credit Card Reader?

A Square Credit Card Reader is a compact device that allows businesses to accept credit card payments easily.

How Does The Square Reader Work?

The Square Reader connects to your mobile device and processes payments via the Square app.

Is The Square Reader Secure?

Yes, the Square Reader is secure. It uses encryption to protect your customers’ payment information.

Can I Use Square Reader For Online Payments?

Yes, Square Reader can be used for online payments through Square’s integrated payment solutions.

Conclusion

Square Credit Card Reader is a reliable tool for businesses. It helps streamline payments and manage operations efficiently. With features like secure payments and advanced reporting, businesses can thrive. Its easy integration and customization cater to various business needs. Plus, instant transfers and loan options add convenience. Ready to enhance your business with Square? Explore more at Square’s official website.